CAREERS IN ACCOUNTING –

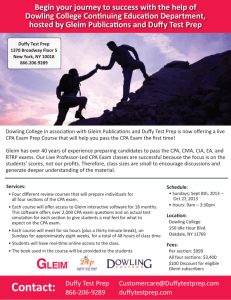

advertisement

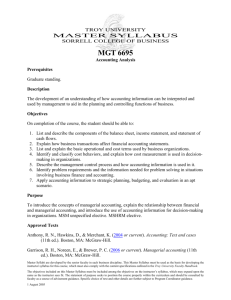

1 CAREERS IN ACCOUNTING – WE MAKE SUCCESS EASY! How to Study for Success in School and Professional Accounting .... Planning Your Curriculum . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Master’s Degree? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Importance of Grades . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Student Activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Preparing for Exam Success . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Your Cognitive Processes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Study Suggestions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Exam Questions and Explanations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Certification of Accountants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Overview of Accounting Certification Programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Rationale for Accounting Certification Programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Examination Content . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . How to Pass the CIA Exam . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . How to Pass the CMA Exam . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Steps to Become a CPA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Improve Your Grades! . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Order Form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . TO: FROM: 2 2 3 3 3 4 5 7 10 12 12 12 13 15 17 19 20 23 Accounting Students Irvin N. Gleim, Ph.D., CPA, CIA, CMA, CFII This booklet was developed to encourage you to think about learning and understanding in contrast to short-term memorization. Your future--subsequent classes, certification examinations, professional practices, etc.--is the focus: ● ● ● ● You invested in your future by going to college after high school. You invested further by majoring in accounting, a profession that provides exceptional career opportunities. In spite of your success up to this point, your study methods are probably not as efficient as they could be. Many students experience false success based on short-term memorization. We are inviting and urging you to invest even further to improve the effectiveness of your study time by learning and understanding, rather than memorizing, to earn better grades, pass courses, obtain a degree, and get a job. You need professional competency to 1. 2. 3. ● ● Pass the CIA (Certified Internal Auditor), CMA (Certified Management Accountant), CPA (Certified Public Accountant), and/or EA (IRS Enrolled Agent) exams. Practice professional accounting. Work your way up to an executive position and succeed! Please read this booklet carefully to gain a competitive advantage. Order Gleim Exam Questions and Explanations books and EQE Test Prep CD-Rom to help you 1. 2. 3. Improve control of your study effort. Learn and understand more in less time. Earn higher grades. 2 Careers in Accounting – We Make Success Easy! A MILLION THANKS TO GLEIM CONTRIBUTORS FOR THE MOST EFFECTIVE, EASIEST-TO-USE, AND LEAST EXPENSIVE STUDY MATERIALS Literally millions of accounting students; CPA, CIA, CMA, and EA candidates; and others have used Gleim Exam Questions & Explanations books and CD-Rom and Gleim certification review materials during the past 30 years. More importantly, tens of thousands of Gleim users have submitted questions, comments, suggestions, etc., about our products. THANK YOU GLEIM USERS for helping develop the most relevant and useful accounting study materials. In addition to the Gleim users, we also recognize and thank the hundreds of employees, consultants, and accounting professors who have provided editorial content, comments, and suggestions. Finally, many thanks to our dedicated co-authors who have enjoyed helping students throughout their careers: William A. Collins, Professor of Business and Economics at the University of North Carolina Dale L. Flesher, Professor at the School of Accountancy at the University of Mississippi James R. Hasselback, Professor of Taxation at Florida State University William A. Hillison, Professor of Accounting at Florida State University Jordan B. Ray, Professor Emeritus at the University of Florida HOW TO STUDY FOR SUCCESS IN SCHOOL AND PROFESSIONAL ACCOUNTING The central theme of this booklet is control: establish plans, perform effectively, evaluate your performance, understand shortcomings, and follow through with an improved strategy. This is an executive approach that will work for you, especially if you aspire to be an executive. You should because you will have the opportunity. Planning Your Curriculum Begin by chronologically listing all of your courses to date by semester (or quarter). Put credits and grades to the right. Underneath this listing, organize a desirable schedule of remaining courses and credits. After spending 10 minutes on this exercise, consult your university catalog, college and departmental advisement sheets, and any other relevant materials. Make sure you will meet all the requirements to graduate. Have you planned your courses in the proper sequence in terms of prerequisites? After you have thought through your schedule, review it with an appropriate administrator or counselor. Confirm that it satisfies the requirements for your graduation. What is your objective? Presumably, it is to earn a degree in accounting and subsequently sit for the CIA, CMA, CPA, and/or EA exams. Why? The prospects of employment are good and starting salaries are high. What then? What will you be doing in 5 years? 10 years? 15 years? No one knows for sure, but to the extent that you improve your study program, i.e., learn more and become more qualified, you will brighten your prospects. Thus, you want to train not only to be a professional accountant but also to be able to go on to bigger and better opportunities. Careers in Accounting – We Make Success Easy! 3 Master’s Degree? Just as your bachelor’s degree is an investment in your future, so too is a master’s (MA, MS, or MBA). Initially, a master’s in accounting translates to about a 10% - 20% premium in starting salary. The primary advantage of having a master’s degree is that your employer will have higher expectations as a result of your additional training. This usually translates into more opportunities, more responsibility, faster promotion, and higher compensation. Look at The Wall Street Journal on Tuesdays, when the employment ads are most numerous. Listed positions frequently require a master’s; the CPA, CMA, and/or CIA designation; and several years of experience for accounting executive positions, such as controller or treasurer. Adding the EA designation will show your proficiency in tax matters. The amount and availability of financial support is usually an impediment to continued schooling, but borrowing funds is generally a prudent financial decision, especially since student spending is limited relative to that of the career professional. In the business world, the accounting professional will incur additional spending for items such as clothes, cars, housing, entertainment expenses, etc. Avoid planning to return to school after you have saved enough money. Once you are working and enjoying the lifestyle provided by a good salary, resuming the role of a student is not easy. Stay in school until your educational goals have been met. A part-time job will also help defray some of your costs. Education is the best investment you will make! Many professionals attend graduate school on a part-time basis (evenings, weekends). These programs offer a chance to interact with your peers who have similar interests and aspirations. An added benefit of attending graduate school part-time is learning from the work experience of classmates with various backgrounds, which significantly enriches class discussion. Importance of Grades Grades are important. Usually, a “B” average or higher is necessary to enter graduate and/or law school. Some CPA firms and other employers restrict their hiring to individuals with a “B” average or better. Conversely, many students with “C” or “C+” GPAs are extremely successful once out of school. If your GPA is currently below an “A” average, this booklet is particularly relevant to you. You must do your best in each course, especially those pertaining to your career. Other courses are important because they affect your overall GPA and help make you a better-rounded person. Your employer will be interested in you as a whole person, not just as an accounting technician. Student Activities To their detriment, some students overemphasize grades. You also need to develop your “people” skills. Join your accounting club or society and the honorary accounting fraternity, Beta Alpha Psi, if your school is a member of the American Association of Collegiate Schools of Business. To develop leadership skills, volunteer to serve as an officer. Balance your academic efforts with other activities, such as community service, intramural sports, student government, or pursuit of personal interests. Almost all prospective employers are interested in your leadership, communication, and social skills. 4 Careers in Accounting – We Make Success Easy! Preparing for Exam Success The Preparation Process – In order to be successful on examinations, you need to 1. Understand the exam, including coverage, content, format, administration, and grading. Virtually all certification programs, admission tests, and other established exams have information books developed by those responsible for the examination. Also, review manuals and “test prep” books usually exist to help you with the exam. The better you understand the process, the better you will perform. In college courses, ask your professor for clarification of the exam process publicly in class and privately in his/her office, talk to former students, and attempt to review exams from prior terms. 2. Learn and understand the subject matter tested. Obtain content specification outlines for established exams. Outline recommended reference books. Confirm coverage by looking at past examinations (if available) and/or review manuals. In college courses, confirm text and study unit coverage with your professor. Also, to what extent are class lectures, examples, handouts, etc., tested? 3. Practice answering recent exam questions to perfect your exam question-answering techniques. Answering recent exam questions helps you understand the standards to which you will be held. It also helps you learn and understand the material tested -- see “Exam Questions and Explanations” on page 10. 4. Plan and practice exam execution. Anticipate the exam environment and prepare a plan including your arrival time, your manner of dress, the appropriate exam supplies, the expected number of questions and the format, the order in which you will answer questions, and the time you will spend on each question. Expect the unexpected and adjust! Remember that your sole objective when taking an examination is to maximize your score. Most examinations are “curved,” and you must outperform your peers. 5. Most importantly, develop confidence and assure success with a controlled preparation program followed by confident execution during the examination. Control – You have to be in control to be successful during exam preparation and execution. Control can also contribute greatly to your personal and other professional goals. Control is a process whereby you 1. 2. 3. 4. 5. 6. 7. Develop expectations, standards, budgets, and plans. Undertake activity, production, study, and learning. Measure the activity, production, output, and knowledge. Compare actual activity with expected or budgeted activity. Modify the activity, behavior, or production to better achieve the desired outcome. Revise expectations and standards in light of actual experience. Continue the process. The objective is to be confident that the best possible performance is being generated. Most accountants study this process in relation to standard costs, i.e., establish cost standards and compute cost variances. Consider the following simple example: Every day you rely on control systems implicitly. When you brush or comb your hair, you have expectations about the desired appearance of your hair and the time required to style it. You monitor your progress and make adjustments as appropriate, e.g., brush it a different way or speed up. Careers in Accounting – We Make Success Easy! 5 Develop and enforce standards in all of your endeavors. Exercise control, implicitly or explicitly. Most endeavors will improve with explicit control. This is particularly true with certification examinations and other academic tests. 1. Practice your question-answering techniques (and develop control) as you prepare answers/solutions to practice questions/problems during your study program. 2. Develop explicit control over your study programs based on the control process discussed on the previous page. 3. Think about using more explicit control systems over any and all of your endeavors. 4. Seek continuous improvement to meet your needs given a particular situation or constraint. Additional practice will result in further efficiencies. Your Cognitive Processes Which mental processes do you use for learning? How do you internalize assignments? How do you process facts and concepts to complete assignments and take tests? If, by better understanding how you “study” and how you can be more efficient and effective, you improve your study processes 20%, you might change 80% scores to 96% scores and reduce 30 hours per week in the library to 24 hours. Your Learning Process1 Learning in the broad sense is the change in behavior or knowledge as a result of experience, practice, effort, etc. We are particularly interested in the narrower definition, i.e., knowledge (in particular, accounting-related knowledge), in contrast to other behaviors and skills, like riding a bicycle, or vocational skills, like cutting hair. Psychologists have defined many categories of learning, such as classical conditioning, trial-and-error earning, sensorimotor learning, verbal learning, concept learning, and rule learning. Accountants focus on concept learning and rule learning. Most accounting and business concepts are multidimensional; therefore, they can be better understood by examining their multiple aspects. For example, you might view a financial accounting transaction in light of 1. 2. 3. 4. 5. Journal entry(ies) required Impact on the financial statements Consequences of the transaction for the business Motivation of all parties to enter into the transaction Behavioral implications to employees, customers, competitors, etc. This multidimensionality describes understanding, i.e., relating many concepts, rules, and relationships. The above list is an abbreviated example; take a minute to pencil in a few additional dimensions in the margin. Train yourself to consider the implications of the underlying business transactions for all accounting procedures you study. For example, what effect will a given procedure have on ● ● ● ● 1 Purchasing power? Cash flows? Financial ratios? Other areas? Two texts relied on in preparing the following discussions on learning process and cognitive ability are Bloom’s Taxonomy of Educational Objectives, copyright © 1956 by David McKay Company, Inc., and Arthur Wingfield, Human Learning and Memory: An Introduction, copyright © 1979 by Harper & Row. 6 Careers in Accounting – We Make Success Easy! Levels of Cognitive Ability In ascending order of complexity, one categorization (Bloom) of the levels of knowledge is 1. 2. 3. 4. 5. 6. Recall knowledge Understanding to interpret Application of knowledge to solve problems Analytical skills Synthesis Ability to evaluate The levels above “recall knowledge” tend to be cumulative. They constitute building blocks of cognitive processes. To interpret, you need some recall knowledge; to solve problems, you must understand to interpret, etc. 1. Recall knowledge. The first level is recall knowledge, e.g., definitions of technical terms and sources of information. Objective questions often test this kind of knowledge, which is the most fundamental since it entails basic memorization. EXAMPLE: According to Statement on Financial Accounting Concepts No. 2, the two primary decision-specific qualitative characteristics of accounting information are reliability and relevance. This requires little mental processing beyond simple recall. 2. Understanding to interpret. The second level of knowledge is the understanding and interpretation of written and quantitative data. Questions at this level test understanding of concepts, including interrelationships within data. This level of knowledge is also called comprehension. EXAMPLE: SFAC 2 defines reliability as the “quality of information that provides assurance that the information is reasonably free from error and bias and faithfully represents what it purports to represent.” What does this mean? Do you understand? Can you explain it to someone else? The ability to explain it to someone else is a very good indicator of your comprehension. 3. Application of knowledge to solve problems. The third level of knowledge is problem solving. Questions at this level examine practical applications of concepts to solve a problem. Unfortunately, some problem solving is based only on recall knowledge. EXAMPLE: Memorizing the cost of goods sold formula (CGS = BI + Pur – EI) is mere recall. Instead you should understand that CGS equals purchases adjusted for the change in inventory. For example, an increase in inventory means that not all of purchases were sold. Conversely, a decrease in inventory means all of purchases plus some inventory were sold. Given BI, Pur, and EI, most students can solve for CGS by plugging numbers into the formula. But an interpretive understanding of the relationship of the change in inventory level to CGS permits solving more complex problems, e.g., effect of inventory errors. 4. Analytical skills. The fourth level of knowledge is analytical ability, including identification of cause-and-effect relationships, internal inconsistencies or consistencies, relevant and irrelevant items, and underlying assumptions. The following question requires analysis and interrelation of a number of variables to reach a conclusion. EXAMPLE: Would you accept a customer’s order at a lower-than-usual price? Variables to consider include contribution margin generated, available production capacity, and psychological and economic effects on other customers. Careers in Accounting – We Make Success Easy! 5. 7 Synthesis. The fifth level is the ability to put parts together to form a new whole. EXAMPLE: The development of the FASB’s major pension pronouncement (SFAS 87, Employers’ Accounting for Pensions) illustrates the synthesis of existing elements. It retains such aspects of prior pension accounting as delayed recognition of certain events, reporting net cost, and offsetting liabilities and assets. SFAS 87 combines them with applications of the existing principles of accrual accounting, full disclosure, and comparability to develop a new approach to pension accounting. 6. Ability to evaluate. The sixth level is evaluative ability. What is the best (most effective) method (alternative)? Evaluation has in common with analysis and synthesis the consideration of qualitative as well as quantitative variables. Qualitative variables are usually multidimensional and thus cannot be meaningfully quantified or measured. For example, multiple-choice questions consist of a series of either true or false statements with one exception (the correct answer); if the question is evaluative, all of the answer choices will be true or false, but one answer will be better than the others. EXAMPLE: “The most important nonfinancial issue that a company should consider is...” requires evaluation of qualitative variables. Undergraduate accounting courses generally emphasize the first three levels: recall, interpretation, and problem solving. Your career in professional accounting, however, will require and emphasize the last three levels: analysis, synthesis, and evaluation. Gleim products will help you reach these higher levels. Put another way, the first three levels are required to prepare financial data. The second three are necessary to use financial data and exercise professional judgment. How does accounting differ from bookkeeping? Professional judgment. Yes, in your study of accounting, you must go well beyond recall and memorization. Many accountants move on to executive positions after beginning their professional career as an “accountant.” Even those who remain in accounting exercise more and more judgment and rely less and less on rote memory as they take on and exercise more responsibility. Study Suggestions Where to Study Study where you study best. Some study best at home. Others study best at the library. Some prefer to study at different locations at various times in the day and/or on different days. Still others study at only one location. The issue is effective study. You must seek out the study locations that provide you with the most effective environment for concentration, which means avoiding or blocking out distractions, which are most often produced by people you know. Try out-of-the-way places where other accounting majors/friends do not study, e.g., the English library or fine arts library. When to Study Study on a regular basis, 7 days a week to the extent possible. Stay ahead of all assigned material. Do not wait to study before exams and assignment due dates. This emphasizes rote memorization, which does not result in learning and understanding. You will improve your grade point average and increase the amount learned by investing several hours on each class at the very beginning of each term (see the next section, “Course Overview”). Are you a morning person? Do you study effectively first thing in the morning or in the evening? Experiment with different study times to determine when you are most effective and schedule your time accordingly. 8 Careers in Accounting – We Make Success Easy! Remember, the important point is that you must study regularly to stay ahead. Class lectures »» and discussion are much more meaningful and beneficial when you have studied the assignment prior to attending class. A good rule to follow is, “You are behind if you are not ahead.” Stay ahead of all of your classes by following a regular study schedule. Course Overview At the very beginning of the term, as soon as you have your text and syllabus, you should obtain an executive overview of each course. Begin by writing down the study unit titles. What is the course about? How does its content relate to courses you have already taken and to courses you plan to take in the future? Given this brief study unit listing and perhaps also a course description provided in the syllabus, you are in a position to survey the individual study units in the text. You began with a one-line listing of study units. Now skim each study unit, reading the introduction and summary/conclusion. Your objective is to gain more insight into each study unit’s content and approach than that provided by the study unit title. Document your effort with a short paragraph and/or summary outline of each study unit. After you have completed your study unit-by-study unit analysis, examine the entire course overview. Has your executive overview of the course changed and become more focused as a result of your study unit-by-study unit analysis? The entire process will probably take 2 to 4 hours. Spend half a day at the library and do a thorough job for each course. This initial investment of time will pay dividends because at this point you have a basis for understanding how the study units and their parts fit into the overall course. Now you will be able to put individual definitions and concepts into the context of the entire course. Through the exercise of control, you will be more efficient and effective and thus will be better prepared to attain the analytical, synthesis, and evaluative levels of knowledge. How to Study a Study Unit Before reading a study unit, gain a general understanding of the study unit contents. The following seven steps should precede actual study: 1. Skim through the study unit. What is it about? 2. Read the study unit summary. 3. Look at the requirements of the exercises and problems to see what is expected. 4. Try to answer the discussion questions at the back of the study unit to see if you can provide answers based upon your present knowledge and common sense. If possible, relate real life (business world) examples to the discussion questions or requirements to help your understanding. 5. Obtain and use the appropriate Gleim Exam Questions and Explanations book and EQE Test Prep CD-Rom: AUDITING & SYSTEMS • FEDERAL TAX • FINANCIAL ACCOUNTING BUSINESS LAW/LEGAL STUDIES • COST/MANAGERIAL ACCOUNTING Each Gleim product is thoroughly cross-referenced to textbooks used at universities throughout the U.S. Accordingly, you can identify specific areas in the Gleim book for each study unit in your textbook and answer 5 to 10 questions to determine the standards to which you will be held. Gleim’s EQE Test Prep CD-Rom allows you to study, self-test, and measure your progress. Please see our presentation on the inside front cover of this booklet. Careers in Accounting – We Make Success Easy! 6. Outline the study unit based on the headings. Rewrite them in your own words. ● 7. 9 Do not recopy phrases from the textbook. Put concepts into your own words so you understand, rather than memorize. Now that you have an overview of the study unit and have thought about what is in it, you can begin studying, rather than simply reading. Studying means understanding. What is the author saying? Do you agree? How does each concept fit into the study unit? »» Remember, the objective is not to read the study unit and complete an assignment. The objective is to understand the material well enough to be able to explain it to someone else. To this end, you need to be sufficiently conversant with the material in each study unit so that you can confidently discuss it, question it, and/or critique it with your professor, as well as assimilate it with class lectures and notes. Ask at least one question during each class session. There is not always enough time for everyone to ask questions in class, but do not use that as an excuse for your failure to participate. Engage your professor in discussion about a topic, procedure, or principle that you do not understand. Many accounting students are introverts, sit passively in class, and only receive information. This approach is inefficient because these students simply write down formulas, definitions, etc., for later regurgitation without understanding the concepts. While introverts are frequently attracted to accounting, practicing accountants are expected to be extroverts and demonstrate effective communication skills. Accountants are in the communication business and must be good communicators. Stay ahead of your professor, answer all questions asked (usually to yourself) and look ahead during lectures. Anticipate what will be next. Preclass preparation permits you to learn in class. The poor alternative (both inefficient and ineffective) is to play “catch-up,” i.e., attempt to memorize lists, definitions, etc., out of context after class is over. Remember, you have Gleim Exam Questions and Explanations products to supplement your study and significantly improve your preparation. Attempt to relate your current course material to that covered in previous courses. A thorough understanding of the material in previous courses makes it feasible to tie the contents of all your courses together. A potential weakness of undergraduate accounting programs is that one course is taken at a time, without the “integration” of the individual courses into an entire program that usually occurs in graduate programs. Make notes in the margins of your books; they are your study vehicle. Just as you should ask questions and discuss topics with your professor, you need to understand your text. Critique your text as you study! How could it be improved? How would you organize and present the material? Highlighters and underlining: Do not become completely dependent on them! Yes, many students highlight and underline, but using short-term memory to become familiar with the concepts, facts, and definitions is not a satisfactory method to complete courses. You are in school to learn and understand with the objective of a successful career, not just to get a diploma. How to Complete Homework Assignments Most accounting course assignments consist of computational problems. They are largely similar to the examples and illustrations in your study units. Thus, most of your homework problems are susceptible to “cookbooking,” or copying from the study unit illustration, step-by-step. Barely more than rote memorization is required to achieve false success. Do not cookbook! 10 Careers in Accounting – We Make Success Easy! You are adequately prepared to complete your homework assignments under exam conditions (time pressure and no reference back to the study unit) because you have previously accomplished the necessary building blocks in your individualized control process: establishing where and when to study, surveying the course, studying your textbook, answering multiple-choice questions in the Gleim Exam Questions and Explanations book and EQE Test Prep CD-Rom, and participating in class. Scan the exercise or problem and set a 5-, 10-, or 15-minute time limit. With a watch before you, see how much you can accomplish within the time limit. As you get each problem under control, note the issues you need to research after you have substantially completed the problem. Put yourself in a frame of mind to be highly productive during homework preparation. Effective time management is very important to successful exam performance. Do your best! No one can ask for more. Develop and use your question answering techniques on each homework assignment. These systematic methods of problem solving should be executive in nature. Before you start, determine what has to be done, how it has to be done, the sequence of procedures, etc. It is the same general approach recommended for course overviews, studying a study unit, taking an exam, etc. Exam Questions and Explanations Experts on testing increasingly favor multiple-choice questions as a valid means of examining various levels of knowledge. The ACT, SAT, GMAT, and other entrance examinations consist entirely of multiple-choice questions. The CIA, CMA, and EA exams are now 100% multiple-choice questions. The percentage of objective questions on the CPA exam has also increased. Using objective questions to study for undergraduate examinations is an important tool not only for obtaining good grades, but also for long-range preparation for certification and other examinations. The following suggestions can help you study in conjunction with each Gleim Exam Questions and Explanations product: 1. Locate the study unit that contains questions on the topic you are currently studying. Each Exam Questions and Explanations book and EQE Test Prep CD-Rom contains crossreferences to the tables of contents of most textbooks. 2. Work through a series of questions, selecting the answers you think are correct. 3. If you are using the Gleim book, do not consult the answer or answer explanations on the right side of each page until after you have chosen and written down an answer. ● 4. It is crucial that you cover the answer explanations and intellectually commit yourself to an answer. A bookmark is provided at the back of each Gleim book for this purpose. This method will help you understand the concept much better, even if you answered the question incorrectly. EQE Test Prep CD-Rom automates this process for you. Study the explanations to each question you answered incorrectly. In addition to learning and understanding the concept tested, analyze why you missed the question. Did you misread the question? Misread the requirement? Make a math error? Not know the concept tested? Identify your weaknesses and take corrective action (before you take a test). ● Studying the important concepts that we provide in our answer explanations will help you understand the principles to the point that you can answer that question (or any other like it) successfully. 11 Careers in Accounting – We Make Success Easy! 5. Prepare a summary analysis of your work on each subunit (topic). If you have EQE Test Prep CD-Rom, simply view your performance analysis information. Some sample column headings could be: Date Subunit Time to Complete Questions Answered Avg. Time per Question Questions Correct Percent Correct The analysis will show your weaknesses (areas needing more study) and also your strengths (areas of improvement). You can improve your performance on objective questions both by increasing your percentage of correct answers and by decreasing the time spent per question. SUCCESSFUL ACCOUNTING STUDENTS STUDY WITH THE GLEIM SERIES (see inside front cover) “The Gleim books helped me because they test you on all subjects covered in class and better prepare you for exams. A lot of exam questions are modeled after the Gleim questions, especially when the professor recommends the book in class. The study guides have also been useful because they simplify some of the language found in traditional books and provide examples to supplement one’s learning. I only wish I had known the software was available as a study tool sooner!” Kirk Khan, accounting graduate student A ccounting is competitive (academically and professionally). The Gleim Series provides a competitive advantage by improving the effectiveness of your study time through learning and understanding. Gleim will help you to: ● Learn and understand more in less time ● Improve your test scores and earn higher grades ● Practice answering CPA exam questions now ● Propel yourself into a career in accounting After graduation, you will compete with graduates from schools across the country in the accounting job market. Make sure you measure up to standards that are as demanding as the standards of your counterparts at other schools. These standards will be tested on professional certification exams. The Gleim Series works! Each book is a comprehensive source of multiple-choice questions with thorough explanations of each correct and incorrect answer. You learn from our explanations regardless of your answers to the questions. Pretest before class to see if you are strong or weak in the assigned area. Retest after class and before each exam or quiz to be certain you really understand the material. The questions in these books cover virtually all topics in your courses. Rarely will you encounter questions for which you are not well prepared. Each Gleim book is cross-referenced to the primary textbook used in your class. To maximize your study, use Gleim’s Exam Questions and Explanations Test Prep CD-Rom – details on inside front cover! The student next to you has the exam questions – do you? See what might be on the exam before you take it! Use Gleim’s Exam Questions and Explanations books and EQE Test Prep CD-Rom to master the material in your courses and learn how to succeed on exams – almost 9,000 questions with detailed discussions covering every accounting, tax, business law, and auditing topic! 12 Careers in Accounting – We Make Success Easy! CERTIFICATION OF ACCOUNTANTS Overview of Accounting Certification Programs The CPA (Certified Public Accountant) exam is the grandparent of all the professional accounting examinations. Its origin was in the 1896 public accounting legislation of New York. In 1917, the American Institute of CPAs (AICPA) began to prepare and grade a uniform CPA exam. It is currently used to measure the technical competence of those applying to be licensed as CPAs in all 50 states, Guam, Puerto Rico, the Virgin Islands, and the District of Columbia. During the first year of computerbased testing, April 2004 - April 2005, over 50,000 candidates sat for at least one section of the CPA exam. The CIA (Certified Internal Auditor) and CMA (Certified Management Accountant) examinations are relatively new certification programs compared to the CPA. The CMA exam was first administered in 1972, and the first CIA exam in 1974. Why were these certification programs begun? Generally, the requirements of the CPA designation instituted by the boards of accountancy, especially the necessity for public accounting experience, led to the development of the CIA and CMA programs. The IRS Enrolled Agent (EA) certification is available for persons specializing in tax. Certification is important to professional accountants because it provides 1. 2. 3. 4. 5. Participation in a recognized professional group An improved professional training program arising out of the certification program Recognition among peers for attaining the professional designation An extra credential for the employment market/career ladder The personal satisfaction of attaining a recognized degree of competency These reasons hold particularly true in the accounting field due to wide recognition of the CPA designation. Accountants and accounting students are often asked if they are CPAs when people learn they are accountants. Thus, there is considerable pressure for accountants to become certified. A new development is multiple certifications, which is important for the same reasons as initial certification. Accounting students and recent graduates should look ahead and obtain multiple certifications to broaden their career opportunities. The table of selected CIA, CMA, and CPA examination data on the opposite page provides an overview of these accounting examinations. Additional information about the IRS enrolled agent (EA) exam is available at www.gleim.com/accounting/ea/. Use Gleim to pass each of these certification exams. Rationale for Accounting Certification Programs The primary purpose of professional examinations is to measure the technical competence of candidates. Competence includes technical knowledge, ability to apply such knowledge with good judgment, and comprehension of professional responsibility. Additionally, the nature of these examinations (low pass rate, broad and rigorous coverage, etc.) has several very important effects. 1. Candidates are forced to learn all of the material that should have been presented and learned in a good accounting educational program. 2. Relatedly, candidates must integrate the topics and concepts that are presented in individual courses in accounting education programs. 3. The content of each examination provides direction to accounting education programs; i.e., what is tested on the examinations will be taught to accounting students. 13 Careers in Accounting – We Make Success Easy! Examination Content The content of certification examinations is specified by the respective governing boards with lists of topics to be tested. In the Gleim review manuals – CIA Review, CMA Review, CPA Review, and EA Review – the material tested is divided into subtopics we call study units. A study unit is a more manageable undertaking than an overall part of each exam. The listings of study units on pages 14, 16, and 18 provide an overview of the content of these exams. CIA, CMA, CPA EXAMINATION SUMMARY CIA CMA CPA Sponsoring Organization Institute of Internal Auditors 247 Maitland Avenue Altamonte Springs, FL 32701 (407) 937-1100 www.theiia.org Institute of Management Accountants 10 Paragon Drive Montvale, NJ 07645-1718 (201) 573-9000 (800) 638-4427 www.imanet.org American Institute of Certified Public Accountants Harborside Financial Center 201 Plaza Three Jersey City, NJ 07311-3881 (201) 938-3750 www.aicpa.org Passing Score 75% 70% 75% Average Pass Rate by Exam Part 35%-40% 55% 40%-45% Cost $380 (50% student discount) $460 (50% student discount; requires IMA membership) $500-$800 (varies by state) Year Examination Was First Administered 1974 1972 1917 I. Internal Audit Role in Governance, Risk, and Control (3-1/2 hours) 1. Business Analysis (3 hours) 1. Business Environment & Concepts (2-1/2 hours) II. Conducting the Internal Audit Engagement (3-1/2 hours) 2. Management Accounting and Reporting (4 hours) 2. Auditing & Attestation (4-1/2 hours) III. Business Analysis and Information Technology (3-1/2 hours) 3. Strategic Management (3 hours) 3. Regulation (3 hours) IV. Business Management Skills (3-1/2 hours) 4. Business Applications (3 hours) 4. Financial Accounting & Reporting (4 hours) Length of Exam 14 hours 13 hours 14 hours When Administered Mid-May and Mid-Nov On Demand Jan-Feb Apr-May July-Aug Oct-Nov Candidates Sitting for Exam: Total number of candidates sitting for two examinations; many are repeaters. Major Exam Sections and Length 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 4,363 4,547 4,961 5,103 4,557 4,649 4,646 5,169 7,972 11,724 15,912 19,451 26,147 31,539 30,634 4,839 6,404 7,464 7,879 8,259 8,675 8,679 *5,456 *5,276 *4,950 *4,823 *5,791 *5,100 *5,200 *6,644 143,572 140,042 136,541 140,100 131,000 126,000 122,232 121,437 116,906 126,770 115,423 106,079 108,900 108,700 **100,000 *Does not include double-counting which occurred in previous years. **Exam parts, not candidates for three calendar quarters, which is about a 50% drop from 2000 and 2003 levels. Other professional accounting-related designations include CBA (Certified Bank Auditor), CDP (Certificate in Data Processing), CFA (Chartered Financial Analyst), CFE (Certified Fraud Examiner), CISA (Certified Information Systems Auditor), Enrolled Agent (one enrolled to practice before the IRS). 14 Careers in Accounting – We Make Success Easy! LISTING OF CIA REVIEW STUDY UNITS Part I: Internal Audit Role in Governance, Risk, and Control 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Standards and Proficiency Charter, Independence, and Objectivity Internal Audit Roles I Internal Audit Roles II Control I Control II Planning and Supervising the Engagement Managing the Internal Audit Activity I Managing the Internal Audit Activity II Engagement Procedures and Fraud Part II: Conducting the Internal Audit Engagement 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Engagement Information Communicating Results and Monitoring Progress Specific Engagements I Specific Engagements II Information Technology I Information Technology II Specific IT Engagements Statistics and Sampling Other Engagement Tools Ethics and Fraud Part III: Business Analysis and Information Technology 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Business Performance Managing Resources and Pricing Financial Accounting I Financial Accounting II Finance Managerial Accounting Regulatory, Legal, and Economic Issues Information Technology I Information Technology II Information Technology III Part IV: Business Management Skills* 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Structural Analysis and Strategies Industry and Market Analysis Industry Environments Strategic Decisions Global Business Issues Motivation and Communications Organizational Structure and Effectiveness Managing Groups Influence and Leadership Time Management, Conflict and Negotiation *Persons who have passed the CPA or CMA exams (and many other professional exams) are not required to take Part IV of the CIA exam. The explosive growth in the number of candidates sitting for the CIA exam (see page 13) is certainly the result of a combination of factors including the Sarbanes-Oxley legislation and the Enron/ WorldCom scandals. Management cannot personally observe the functioning of all officers, employees, and specialized functions (finance, marketing, operations, etc.). Each has a unique perspective. Only internal auditing is in a position to take a total company point of view, and firms are increasingly enlisting the ranks of certified professionals. The CIA exam is a two-day exam. Each of the four parts consists of 125 multiple-choice questions and is 3 1/2 hours in length (8:30 a.m. - 12:00 p.m. and 1:30 p.m. - 5:00 p.m.). Thus, you will budget 1.5 minutes per question, leaving 20 minutes of “extra” time. The first two parts of the CIA exam focus on the theory and practice of internal auditing. The body of knowledge of internal auditing and the auditing skills to be tested consist of 1. The typical undergraduate auditing class (as represented by auditing texts, e.g., Arens and Loebbecke, Taylor and Glezen, etc.) 2. Internal auditing textbooks (e.g., Sawyer and Sumners, The Practice of Modern Internal Auditing, and Atkisson, Brink, and Witt, Modern Internal Auditing) 3. Various IIA (Institute of Internal Auditors) pronouncements (e.g., The IIA Code of Ethics, Standards for the Professional Practice of Internal Auditing, and Statement of Responsibilities of Internal Auditing) 4. Reasoning ability, communications, and problem-solving skills, and dealing with auditees within an audit context (i.e., the questions will cover audit topics, but test audit skills) The remaining 50% of the exam, Parts III and IV, assures that internal auditors are conversant with topics, methodologies, and techniques ranging from individual and organizational behavior to economics and information technology. Careers in Accounting – We Make Success Easy! 15 How to Pass the CIA Exam 1. Make the decision and the commitment to take the CIA exam. 2. Register for the CIA program and apply to take Parts I, II, III, and/or IV. The cost for IIA members is $60 for registration and $85 per part. Students receive a 50% discount. Application deadlines are 3/31 and 9/30 for the May and November exams, respectively. Registration/application forms are available at www.theiia.org. 3. Commit to a thorough preparation program using the complete Gleim system (see inside back cover). Mail or fax an order form (pp. 23-24). Alternatively, call (800) 874-5346 or go to www.gleim.com/CIA/. a. b. Your first order of business after you receive Gleim CIA Review is to carefully read and understand the Introduction, which explains the examination process, content, grading, etc. Do not underestimate the value of expertise in exam administration vs. jumping into the study of testable material. The expertise you attain will pay dividends when you are at the exam site. Next, you need to establish and maintain your study schedule. Each exam part is covered by 10 study units in our review materials. For each CIA Review study unit, we recommend the following steps: In the online course, complete multiple-choice quiz #1 before studying each study unit. This is essential to develop your question-answering skills for questions that you do NOT know the answer. After the initial 20-question test, use the online audiovisual presentation for an overview of the study unit. The audio CDs can be substituted for the audiovisual presentation. Complete the 30-question true/false quiz in the online course. Study the Knowledge Transfer Outline, especially the troublesome areas identified in the diagnostic multiple-choice and true/false quizzes. You can use the online course or the book to study the outline. Complete multiple-choice quiz #2 in the online course and review the answer explanations. Complete two 20-question quizzes in the Test Prep CD-Rom while in test mode. After EACH test session, immediately switch to study mode and select “questions missed in last session” so you can reanswer these questions AND analyze why you answered each question incorrectly. It is imperative that you complete your predetermined number of study units per week so you can review your progress and realize how attainable a comprehensive CIA review program is when using the combination of Gleim’s books, Test Prep CD-Rom, audios, and online course. Remember to meet or beat your schedule to give yourself confidence. After you complete each quiz, ALWAYS review the questions you missed. FOCUS on why you selected the incorrect answer, NOT the correct answer. You want to learn from your mistakes while you are studying so you avoid mistakes on the exam. 16 Careers in Accounting – We Make Success Easy! LISTING OF GLEIM CMA REVIEW STUDY UNITS* Part 1: Business Analysis 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Factors Affecting the Firm Consumption and Production Market Structures Macroeconomic Issues, Measures, and Cycles Government Participation in the Economy Comparative Advantage and Free Trade Trade Barriers and Agreements Foreign Exchange Other Global Business Topics Risk Assessment and Controls Internal Auditing Systems Controls and Security Measures Forecasting Linear Programming and Network Analysis Probability, Decision Trees, and Other Techniques The Development of Accounting Standards Financial Statement Assurance Liquidity, Capital Structure, and Solvency Return on Investment, Profitability, and Earnings Other Analytical Issues Part 2: Management Accounting and Reporting 1. Budgeting 2. Cost Management Terminology and Concepts 3. Job-Order Costing, Overhead Costs, and Service Department Allocation 4. Process Costing and Other Cost Accumulation Systems 5. Overview of Information Systems and Systems Development and Design 6. Technology of Information Systems 7. Electronic Commerce and Other Topics 8. Cost and Variance Measures 9. Responsibility Accounting and Financial Measures 10. The Balanced Scorecard and Quality Considerations 11. Overview of External Financial Reporting 12. Overview of Financial Statements 13. Cash and Receivables 14. Inventories and Investments 15. Long-Lived Assets 16. Liabilities 17. Equity and Revenue Recognition 18. Other Income Statement Items 19. Business Combinations and Derivatives 20. SEC Requirements and the Annual Report *WARNING!!! About 30% of CMA test questions will require mathematical calculations. Practice computational questions to prepare for exam success! Part 3: Strategic Management 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Strategic and Tactical Planning Manufacturing Paradigms Business Process Performance Marketing’s Strategic Role within the Firm Marketing Information and Market Segmentation Other Marketing Topics Risk and Return Financial Instruments Cost of Capital Managing Current Assets Financing Current Assets The Decision Process Data Concepts Relevant to Decision Making Cost-Volume-Profit Analysis Marginal Analysis Cost-Based Pricing The Capital Budgeting Process Discounted Cash Flow and Payback Ranking Investment Projects Risk Analysis and Real Options Part 4: Business Applications 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Organization Structures Jobs and Teams Leadership Styles and Sources of Power Motivational Theories and Diversity Issues Organization Communication Behavior – Alignment of Organizational Goals Behavior – Budgeting and Standard Setting Behavior – Reporting and Performance Evaluation Ethics as Tested on the CMA Exam Part 1 Review – Business Economics and Global Business Part 1 Review – Internal Controls and Quantitative Methods Part 1 Review – Financial Statement Analysis Part 2 Review – Budget Preparation and Cost Management Part 2 Review – Information Management and Performance Measurement Part 2 Review – External Financial Reporting I Part 2 Review – External Financial Reporting II Part 3 Review – Strategic Planning and Strategic Marketing Part 3 Review – Corporate Finance Part 3 Review – Decision Analysis Part 3 Review – Investment Decisions The CMA exam has broader coverage than the CPA exam in several areas. For example: 1. CMA topics like risk management, finance, management, and marketing are covered lightly, if at all, on the CPA exam. 2. The CMA exam tests internal auditing to a greater degree than does the CPA exam. 3. The CMA exam tests business ethics, but not business law. CMA questions are generally more analysis-oriented than CPA questions. On the CPA exam, the typical requirement is the solution of an accounting problem, e.g., consolidated worksheet, funds statement, etc. Careers in Accounting – We Make Success Easy! 17 How to Pass the CMA Exam 1. 2. 3. 4. Purchase the Gleim/Flesher complete system, including the books, Test Prep CD-Rom, audios, and Gleim Online. Apply for membership in the IMA and register to take the desired exam parts. You can do this online at www.imanet.org/. Student membership is $37/year. Take one part at a time. When you register and pay $130 for a part ($165 for exams at most international sites), you have 120 days to take the part. Upon receipt of authorization to take the exam, call Prometric to schedule your test. Plan your preparation process. It’s easy. Complete one study unit at a time. Use the 6-step process on page 15, i.e., use the same study steps as for the CIA exam. Orderly, controlled preparation builds confidence, reduces anxiety, and produces success! PASS THE EXAMINATION at your Prometric Testing Center. a. You have 180 minutes to answer 110 questions, i.e., 1.6 minutes per question. (Part 2 is 240 minutes to answer 140 questions, and Part 4 is entirely essays.) We suggest you attempt to answer eight questions every 10 minutes, which is 1.25 minutes per question. This would leave you with 40-60 minutes to revisit questions that you have marked for review. 1) b. c. On your Prometric computer screen, the time remaining appears at the upper right of your screen. 2) Remember, Gleim’s CMA Test Prep CD-Rom and Gleim Online emulate the Prometric computer screens and testing process. This provides you with a distinct, head-start advantage since you will not have to expend any valuable time or energy familiarizing yourself with how to use Prometric’s exam software. Answer the questions in chronological order. 1) Do not agonize over any one question. Stay within your time budget. Read each question carefully to determine the precise requirement. 1) Focusing on what is required enables you to ignore extraneous information and to proceed directly to determining the precise requirement. a) 2) Be especially careful to note when the requirement is an exception; e.g., “All of the following statements regarding a company’s internal rate of return are true except:” Determine the correct answer before reading the answer choices. The objective is to avoid allowing the answer choices to affect your reading of the question. a) Read each answer choice with close attention. i) 3) Even if answer (A) appears to be the correct choice, do not skip the remaining answer choices. Answer (B), (C), or (D) may be better. ii) Treat each answer choice as a true/false question. Select the best answer. The answer is selected by either pressing the answer letter on your keyboard or by using your mouse. Select the most likely or best answer choice. If you are uncertain, make an educated guess. Your score is determined by the number of correct responses: answer every question. a) d. As you answer a question, you can mark it by pressing “M” or unmark a marked question by pressing “M.” b) It is not necessary to “mark unanswered questions. Prometric provides options to review both unanswered questions and marked questions. After you have answered, marked, or looked at and not answered all 110 questions, you will be presented with a summary screen that shows how many questions you did not answer and how many you marked. First revisit and answer all of the unanswered questions, then the “marked” questions. 18 Careers in Accounting – We Make Success Easy! Listing of CPA REVIEW Study Units Business Environment and Concepts Regulation 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 1. 2. 3. 4. 5. 6. 7. Proprietorships and General Partnerships Noncorporate Limited Liability Entities Corporations: Formation, Powers, and Financing Corporations: Governance and Fundamental Changes Economic Concepts I Economic Concepts II Working Capital Policy and Management Long-Term Capital Financing Financial Statement Analysis Risk Management IT and Business Information Systems IT Controls Hardware, Software, and Data Processing Modes, Databases, and Networks E-Commerce Planning and Budgeting Business Performance Cost Behavior and Definitions Product Costing and Related Topics Standard Costs and Variance Analysis Auditing and Attestation 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Engagement Responsibilities Risk Assessment Strategic Planning Issues Internal Control Concepts and Information Technology Internal Control – Sales-Receivables-Cash Receipts Cycle Internal Control – Purchases-Payables-Cash Disbursements Cycle Internal Control – Payroll and Other Cycles Tests of Controls Internal Control Communications Evidence – Objectives and Nature Evidence – The Sales-Receivables-Cash Cycle Evidence – The Purchases-Payables-Inventory Cycle Evidence – Other Assets, Liabilities, and Equities Evidence – Key Considerations Evidence – Sampling Reports – Standard, Qualified, Adverse, and Disclaimer Reports – Other Modifications Review, Compilation, and Special Reports Related Reporting Topics Governmental Audits 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. AICPA Ethics CPAs and the Law Agency Contracts Debtor-Creditor Relationships Government Regulation of Business Negotiable Instruments, Bank Transactions, and Related Topics Sales Secured Transactions Real Property and Insurance Gross Income Deductions Tax Computations and Tax Procedures Property Transactions Corporate Taxable Income Corporate Tax Computations Corporate Tax Special Topics S Corporations Partnerships Estates and Trusts Financial Accounting and Reporting 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Concepts and Standards Financial Statements Income Statement Items Financial Statement Disclosure Cash and Investments Receivables Inventories Property, Plant, and Equipment Intangibles and Other Assets Payables and Taxes Employee Benefits Long-Term Liabilities Leases and Contingencies Equity Business Combinations Foreign Currency Issues and Other Topics Governmental Concepts Fund Accounting and Reporting Not-for-Profit Concepts Not-for-Profit Accounting and Reporting Computer Administered CPA Exam (effective April 2004) The CPA exam is an on-demand test administered at hundreds of Prometric testing centers throughout the United States. The quality, integrity, and prestige of the CPA exam increased AND the exam became easier for candidates to prepare for and pass. Computerization of the CPA exam is a win-win development. Basic requirement: Pass all 4 sections of the CPA exam within 18 months. 1. If you don’t pass all 4 sections in 18 months, you lose credit for any section passed more than 18 months prior to the current date. 2. The exam sections are: Auditing & Attestation (AUD) Financial Accounting & Reporting (FAR) Regulation (REG) Business Environment & Concepts (BEC) 4.5 hours 4.0 hours 3.0 hours 2.5 hours Careers in Accounting – We Make Success Easy! a. b. 19 Multiple-choice “testlets”: There will be 3 groups of 30 multiple-choice questions given as testlets on each section of the exam, except Regulation where there will be 24 instead of 30 multiple-choice questions. Simulation “testlets”: Auditing, Financial and Regulation will each have 2 simulations or case study testlets. These two simulations will account for 30% of the grade in each exam section. Each simulation will begin with directions and an explanation of the “situation.” Thereafter there will be a series of requirements using the following testing formats: 1) 2) 3) 4) 5) Drop-down boxes Check boxes Forms (Regulation tax questions only) Communication Research 3. The CPA exam is administered at Prometric Testing Centers, and is composed of a series of testlets. The testlet sequence is predetermined. You will have 3 multiple-choice testlets followed by 2 simulation testlets in Auditing, Financial, and Regulation (Business has only 3 testlets of multiple choice). 4. Each testlet will be completed separately. Once you complete a testlet, you cannot return to it. You may take breaks between testlets to stretch or go to the bathroom, but the time remaining in the exam continues to run during breaks. 5. Cost to take the CPA exam will be about $500 - $800 as determined by individual State Boards. Before individual State Board fees are added to obtain total cost, NASBA-AICPA-Prometric costs are about $470. Steps to Become a CPA 1. Make the commitment to become a CPA. It’s a big step but well worth it. 2. Decide when you are going to take the CPA exam (the sooner, the better!). 3. Determine the state board to which you will apply to sit for the CPA exam. If you are not going to practice public accounting, you may wish to become certified in a state that issues a CPA certificate separate from a license to practice. To check individual State Board requirements, go to www.gleim.com/accounting/CPA/requirements.php or www.nasba.org. 4. Obtain, complete, and submit your application form, including transcripts, pay fees, etc. and you will receive a Notice To Schedule (NTS) from NASBA. 5. Commit to thorough, systematic preparation for the exam using Gleim’s complete system to guarantee your success. a. b. c. d. CPA Review books (Auditing, Financial, Regulation, and Business) CPA Test Prep CD-Rom: nearly 7,000 CPA questions, all updated to current tax law, FASB Statements, etc. CPA Audio Review available on CDs. Complete, comprehensive CPA Review Online and Simulation Wizard courses. 6. Schedule your test with Prometric (online, national 800#, or call your local Prometric testing site). 7. Take and PASS the CPA exam while you are in control using the Gleim Time Control System. Gleim will make it easy. Call (800) 874-5346 and ask to speak to a CPA exam personal counselor (students welcome!), or visit www.gleim.com/CPA/ for more information. 20 Careers in Accounting – We Make Success Easy! IMPROVE YOUR GRADES! Use these objective question books to ensure your understanding of each topic you study in your accounting and business law courses. Access the largest bank of exam questions (including thousands from past certification exams) that is widely used by professors. Get immediate feedback on your study effort, while you take your “practice” tests. AUDITING & SYSTEMS EXAM QUESTIONS AND EXPLANATIONS (Thirteenth Edition) Introduction 1. External Auditing Standards and Professional Responsibilities 2. Audit Planning and Risk Assessment 3. Internal Control 4. Audit Evidence and Procedures 5. Information Systems 6. Statistical Sampling 7. Audit Reports 8. Special Reports and Other Reporting Issues 9. Internal Auditing FINANCIAL ACCOUNTING EXAM QUESTIONS AND EXPLANATIONS (Twelfth Edition) Introduction 1. Conceptual Framework 2. The Accounting Process 3. Comprehensive Income and the Statement of Income 4. Present Value and Future Value 5. Current Assets, Cash, Accounts Receivable, and Short-Term Notes Receivable 6. Inventory 7. Property, Plant, and Equipment 8. Depreciation and Depletion 9. Intangible Assets and Research and Development Costs 10. Investments in Debt Securities, Equity Securities, and Derivatives 11. Current Liabilities, Compensated Absences, and Contingencies 12. Long-Term Liabilities 13. Pensions, Other Postretirement Benefits, and Postemployment Benefits 14. Leases 15. Corporate Equity 16. EPS and Share-Based Payment 17. Accounting for Income Taxes 18. Accounting Changes and Error Corrections 19. Statement of Cash Flows 20. Accounting for Changing Prices 21. Financial Statement Disclosures 22. Long-Term Construction-Type Contracts, Installment Sales, and Consignments 23. Financial Statement Analysis Based on Percentage Relationships 24. GAAP Accounting for Partnerships 25. Business Combinations, Consolidations, and Branch Accounting 26. Interim Financial Reporting 27. Foreign Currency Translation and Transactions 28. Accounting for State and Local Government Entities 29. Not-for-Profit Organizations 30. Specialized Accounting Issues COST/MANAGERIAL ACCOUNTING EXAM QUESTIONS AND EXPLANATIONS (Seventh Edition) Introduction 1. Overview and Terminology 2. Activity-Based Costing 3. Job-Order Costing 4. Process Costing 5. Quality 6. Cost Allocation: Support Costs and Joint Costs 7. Absorption and Variable Costing 8. Cost-Volume-Profit Analysis 9. Budgeting 10. Standard Costs and Variances 11. Responsibility Accounting, Performance Measurement, and Transfer Pricing 12. Nonroutine Decisions 13. Capital Budgeting 14. Inventory Management: Traditional and Modern Approaches 15. Probability and Statistics 16. Regression Analysis 17. Linear Programming 18. Other Quantitative Approaches FEDERAL TAX EXAM QUESTIONS AND EXPLANATIONS (Sixteenth Edition) Introduction Individual 1. Gross Income 2. Exclusions from Gross Income 3. Business Expenses and Losses 4. Limitations on Losses 5. Other Deductions for Adjusted Gross Income 6. Deductions from AGI 7. Individual Tax Computations 8. Credits Property 9. Basis 10. Depreciation, Amortization, and Depletion 11. Capital Gains and Losses 12. Sale of Business Property 13. Nontaxable Property Transactions Other Entities 14. Partnerships: Formation and Operation 15. Partnerships: Distributions, Sales, and Exchanges 16. Corporate Formations and Operations 17. Advanced Corporate Topics 18. Income Taxation of Estates, Trusts, and Tax-Exempt Organizations Other Topics 19. Accounting Methods 20. Employment Taxes and Withholding 21. Wealth Transfer Taxes 22. Preparer Rules 23. Federal Tax Process and Procedure BUSINESS LAW/LEGAL STUDIES EXAM QUESTIONS AND EXPLANATIONS (Sixth Edition) Introduction 1. The American Legal System 2. The American Court System 3. Civil Litigation and Procedure 4. Constitutional Law 5. Administrative Law 6. Criminal Law and Procedure 7. Tort Law 8. Contracts: The Agreement 9. Contracts: Consideration 10. Contracts: Capacity, Legality, Mutuality, and Statute of Frauds 11. Contracts: Interpretation, Conditions, Discharge, and Remedies 12. Contracts: Third-Party Rights and Duties 13. Sale of Goods: The Sales Contract, Interpretation, and Risk of Loss 14. Sale of Goods: Performance, Remedies, and Warranties 15. Negotiable Instruments: Types, Negotiation, and Holder in Due Course 16. Negotiable Instruments: Liability, Bank Transactions, and Electronic Fund Transfers 17. Negotiable Instruments: Documents of Title and Letters of Credit 18. Secured Transactions 19. Suretyship 20. Bankruptcy 21. Personal Property and Bailments 22. Computers and the Law 23. Real Property: Interests and Rights 24. Real Property: Transactions 25. Mortgages 26. Creditor Law and Liens 27. Landlord and Tenant 28. Wills, Estate Administration, and Trusts 29. Agency 30. Partnerships and Other Entities 31. Corporations: Nature, Formation, and Financing 32. Corporations: Operations and Management 33. Federal Securities Regulation 34. Insurance 35. Environmental Law 36. Antitrust 37. Consumer Protection 38. Employment Regulation 39. International Business Law 40. Accountants’ Legal Responsibilities 21 GLEIM Professor-Led Review • LIVE weekly study sessions • Leadership of a Professor • Interactive Online Community • Gleim's proven self-study materials Contact GLEIM for the location nearest you. gleim.com • 800.874.5346 22 EXAM SUCCESS GUARANTEED! CPA • CMA/CFM • CIA • EA Complete Review Systems gleim.com • (800) 874-5346 23 COMPLETE GLEIM CPA SYSTEM All 4 sections, including Gleim Online, books*, Test Prep CD-Rom, audio cds, plus bonus book bag. $989.95 Also available by exam section @ $274.95 (does not include book bag). *Fifth book: CPA Review: A System for Success $ COMPLETE GLEIM CMA/CFM SYSTEM for the UNCHANGED EXAM Includes: Gleim Online, books, Test Prep CD-Rom, audio cds, plus bonus book bag. CMA $681.95 $340.98 CMA/CFM $781.90 $440.93 $ Also available by exam part @ $198.95 (does not include book bag). COMPLETE GLEIM CMA SYSTEM for the “REORGANIZED” EXAM Includes: Gleim Online, books, Test Prep CD-Rom, audio cds, plus bonus book bag. CMA $739.95 CMA/CFM $839.90 $ Also available by exam part @ $213.95 (does not include book bag). COMPLETE GLEIM CIA SYSTEM Includes: Gleim Online, books, Test Prep CD-Rom, audio cds, plus bonus book bag. Also available by exam part @ $224.95 (does not include book bag). $824.95 $ GLEIM EA REVIEW SYSTEM Includes: Gleim Online, books, and Test Prep CD-Rom. Also available by exam part @ $185.95 (does not include book bag). $529.95 $ “THE GLEIM SERIES” EXAM QUESTIONS AND EXPLANATIONS Includes: 5 books and Test Prep CD-Rom. Also available by part @ $29.95. $112.25 GLEIM Paper and Pencil CPE $200 each Financial Acctg Auditing Federal Tax Visit gleim.com/CPE for Online CPE courses and course catalog. Contact GLEIM PUBLICATIONS for further assistance: gleim.com (800) 874-5346 sales@gleim.com $ SUBTOTAL $ Complete your order on the next page 24 (888) 874-5346 (352) 375-0772 (888) 375-6940 (toll free) gleim.com sales@gleim.com 25.00 1. We process and ship orders daily, within one business day over 98.8% of the time. Call by 3:00 pm for same day service. 09/12/06