Grants Aging Receivable Procedure

advertisement

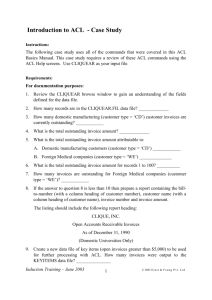

Finance and Planning Financial Services Grants Aging Receivable Procedure Table of Contents 01. Process Overview ....................................................................................................................... 2 02. Process Description .................................................................................................................... 2 03. Process Flow .............................................................................................................................. 3 Invoices Less than 60 Days Outstanding ................................................................................ 3 Invoices Between 61 – 90 Days Outstanding .......................................................................... 3 Invoices Between 91-120 Days Outstanding ........................................................................... 3 Invoices Between 121-180 Days Outstanding ......................................................................... 3 Invoices Over 180 Days Outstanding ...................................................................................... 3 04. Reasons for Outstanding Payments ........................................................................................... 4 05. Aging Report and Sample Invoice Log ....................................................................................... 5 06. Accounts Receivable Process Flow Chart ................................................................................. 6 Last Changed: September 7, 2010 Page 1 1 of 6 Draft – For Discussion Purposes Only Finance and Planning Financial Services 01. Process Overview This Accounts Receivable procedure describes the steps that are necessary to monitor and pursue the collection of payments from sponsors where payments are past due. On a regular basis, Finance and Planning Grant Accountants will review and document the status of open receivables in their specific populations. Grant Accountants will identify outstanding invoices with potential problems and resolve them through the collections process. There are numerous reasons for non-payment of an invoice. The source of the problem may be associated with the invoicing process, a difficulty on the sponsor’s end, or a technical/contractual problem with the Primary Investigator (PI). When reviewing outstanding invoices, the Grant Accountant will take appropriate follow-up action which, in time, will escalate to leadership and/or legal council depending on the number of days outstanding and number of unsuccessful follow-up attempts. Examples of possible follow-up action are letters, emails, and phone calls. The Grant Accountant must document all actions taken to resolve outstanding invoices in the MS Access Grants Database. A copy of any correspondence or dunning letter should also go in the award file and stored in the appropriate grant folder on the shared drive. Since outstanding payments will always be due from sponsoring agencies, this is considered a cyclical process needing constant monitoring throughout the year. 02. Process Description At the beginning of each month, Grant Accountants will review their population of accounts to confirm that payments have been received. Following this review, each Grant Accountant will meet individually with the Grants Manager to review their accounts and also to discuss any Accounts Receivable issues. At these meetings, the Grants Manager will review the comments and prioritize work for the following month with each Grant Accountant. Additionally, Grant Accountants will identify each invoice for which they are responsible that is older than 120 days. In the prioritization meeting, it will be decided if additional action is needed for these invoices. In addition to the meeting, each accountant is required to conduct Accounts Receivable follow-up commensurate with the Accounts Receivable process flow, unless circumstances require different action as deemed by the Grants Manager. Last Changed: September 7, 2010 Page 2 2 of 6 Draft – For Discussion Purposes Only Finance and Planning Financial Services 03. Process Flow Details of this process flow are as follows: Invoices Less than 60 Days Outstanding 1. No action required Invoices Between 61 – 90 Days Outstanding 1. Prepare and send a signed dunning letter with a copy of the invoice attached. 2. File a copy of the signed dunning letter and the invoice copy in the award file folder. 3. Scan and store the signed dunning letter and invoice copy in the grant’s folder under the \\fsstor\departments\grantsandcontracts directory. 4. Add comment to the invoice notes section of the MS Access Grants Database. Invoices Between 91-120 Days Outstanding 1. Contact the sponsor by telephone about the outstanding invoice and document this conversation. 2. Send a follow-up signed dunning letter with a summary of the conversation. 3. Provide a copy of the signed follow-up dunning letter to the PI. 4. File a copy of the conversation notes and follow-up dunning letter in the award file folder. 5. Scan and store the conversation notes and follow-up dunning letter copy in the grant’s folder under the \\fsstor\departments\grantsandcontracts directory. 6. Add comment to the invoice notes section of the MS Access Grants Database. Invoices Between 121-180 Days Outstanding 1. Grant Accountants share query with Grants Manager of all invoices greater than 120 days old. 2. Contact the sponsor by telephone about the outstanding invoice and document this conversation. 3. Send a follow-up dunning letter, signed by the Grants Manager, with a summary of the conversation. The tone of the letter will be changed, mentioning legal consequences if the invoice is not paid. 4. Provide a copy of the follow-up dunning letter to the Budget Representative and PI. 5. File a copy of the conversation notes and follow-up dunning letter in the award file folder. 6. Scan and store the conversation notes and follow-up dunning letter in the grant’s folder under the \\fsstor\departments\grantsandcontracts directory. 7. Document the history of all actions taken in the invoice notes section of the MS Access Grants Database. Invoices Over 180 Days Outstanding 1. Grant Accountants share query with Grants Manager of all invoices greater than 180 days old. 2. The Grants Manager will determine if the matter needs to be referred to legal council. 3. If referred to legal council, provide the legal council with a copy of the dunning letters and conversation notes, and a list of invoices over 180 days, and update the history in the invoice notes section of the MS Access Grants Database.. 4. If not referred to legal council, follow steps 2-6 for 121-180 Days Aging. Last Changed: September 7, 2010 Page 3 3 of 6 Draft – For Discussion Purposes Only Finance and Planning Financial Services 04. Reasons for Outstanding Payments Even with strict adherence to the steps documented in this procedure, there will always be special circumstances for each sponsor on why an invoice may not have been paid. Some of those reasons include: The sponsor: o is insolvent or bankrupt; o disencumbered the funds prior to paying the final invoice; o is a slow-payer. Their invoices typically are late being paid; o only remitted a partial payment; o moved and failed to provide proper forwarding information; o skipped the payment as a result of losing or misplacing the invoice; o paid the invoice, but failed to identify the invoice or award number on their payment, and Pace has not been able to apply the payment, thus it is in the cash clearing account awaiting application; o returned the invoice to Pace because: the invoice was issued late (sent after the due date per the contract); the invoice was in the wrong format, and/or had the wrong dates of service, fund year, contract dates, or other information, the expenses were not incurred according to budget, were unapproved, inappropriate, or not sufficiently described; financial backup data was not provided where demanded by the sponsor; the billed expense exceeded the authorized budget (total budget or line item budget), and the sponsor short-paid the invoice by this amount plus any indirect costs. The invoice was sent to the wrong address, person, or is undeliverable; The PI did not submit the required deliverables or resigned before completing the work. Last Changed: September 7, 2010 Page 4 4 of 6 Draft – For Discussion Purposes Only Finance and Planning Financial Services 05. Aging Report and Sample Invoice Log Sponsor: City of White Plains, Public Safety Department Banner Numbers Index Fund Org Advantage Number Payment Type # L6590 F05602 LW6590 2000-383-7170 Invoice Date Mailed Page 5 5 of 6 Outstanding 2 1/1/2004 $32,869.74 $2.75 3 1/1/2004 $29,945.10 $0.03 4 7/20/2005 $46,582.43 $100.45 8 2/2/2006 $33,107.62 $33,107.62 10 2/2/2006 $26,106.87 $26,106.87 11 2/2/2006 $6,582.36 $6,582.36 $175,194.12 $65,900.08 Total: Last Changed: September 7, 2010 Invoice Amount Draft – For Discussion Purposes Only Finance and Planning Financial Services 06. Accounts Receivable Process Flow Chart End of the billing process After month-end close, Grants Manager (“GM”) schedules a meeting with Grant Accountants (“GA”) GA run the “Invoices to be Paid” report in the MS Access Grants Database GA meet with GM by the 10th of the month to review the Invoices report and prioritize work for the current month GM identifies any AR issues No. Days Outstanding (“O/S”)? < 60 Days O/S 61 < 90 Days O/S 91 < 120 Days O/S 121 < 180 Days O/S > 180 Days O/S No Action Required GA prepares dunning letters for accounts w/ outstanding invoices; a copy of the invoice(s) will be included GA contacts the sponsor via phone for accounts w/ outstanding invoices over 90 days GA refers any invoices 120+ days outstanding to the GM GA prepares & submits a report of outstanding invoices over 180 days to the GM File a copy of the dunning letter in the award file folder Sign and issue a follow up dunning letter to sponsor with summary of the conversation GM contacts the sponsors directly (via phone) for accounts w/ o/s invoices over 120 days GM will determine if matter needs to be referred to legal council Provide a copy of dunning letter to PI Prepare a follow up dunning letter to sponsor with summary of the conversation and legal consequences No Store the signed dunning letter and invoice copy in the computer folder for the grant Refer to legal council? Yes Add comment in MS Access Grants Database File a copy of the dunning letter in the award file folder Provide a copy of the dunning letter to Budget Representative and PI Provide a copy of correspondence history with detail summary to legal council Store the signed dunning letter, invoice copy, and conversation notes in the computer folder for the grant File a copy of the dunning letter in award file folder Add comment in MS Access Grants Database Add comment in MS Access Grants Database Store the signed dunning letter, invoice copy, and conversation notes in the computer folder for the grant Start of the billing process (A/R process starts over) Last Changed: September 7, 2010 Add comment in MS Access Grants Database Page 6 6 of 6 Draft – For Discussion Purposes Only