Memorandum of Law in Support of the Motion of Defendants Societe

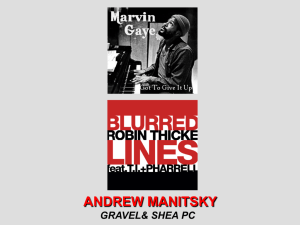

advertisement