Financial report - Bouygues Construction

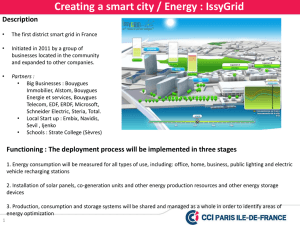

advertisement