SAMPLE CONSTRUCTION COMPANY FINANCIAL STATEMENT

SAMPLE CONSTRUCTION COMPANY

FINANCIAL STATEMENT AND

SUPPLENTARY INFORMANTION

For the Year Ended

December 31, 2011

The financial statement, prepared by an independent Certified

Public Accountant, is essential for bonding purposes. It should answer all of the surety’s questions regarding the financial health of the company, as well as disclose contingencies, guarantees, and other items that may not be reflected on the various statements. If the surety knows the CPA understands the construction industry, the financial statement will enhance the contractor’s bonding line due to the increased reliability of the information presented. The following is a financial statement prepared to maximize both bonding and banking lines.

TABLE OF CONTENTS

PAGES

Independent Accountant's Review Report on the Financial

Statements (The Representation of Management)..................1

Financial Statements

Balance Sheet................................................2

Statement of Operations and Retained Earnings................3

Statement of Cash Flows....................................4-5

Notes to the Financial Statements.........................6-16

Supplementary Data

Schedule 1-Summary of Construction Operations...............17

Schedule 2-Schedule of Completed Contracts..................18

Schedule 3-Schedule of Contracts in Process.................19

Schedule 4-Schedule of Revenues Earned......................20

Schedule 5-General and Administrative Expenses..............21

INDEPENDENT ACCOUNTANT’S REVIEW REPORT

The Shareholder and Board of Directors of Sample Construction Company

Phoenix, Arizona

I have reviewed the accompanying balance sheet of Sample Construction

Company as of December 31, 2011 and the related statements of operations and retained earnings and cash flows for the year then ended. A review includes primarily applying analytical procedures to management’s financial data and making inquiries of management. A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole.

Accordingly, I do not express such an opinion.

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America and for designing, implementing, and maintaining internal control relevant to the preparation and fair presentation of the financial statements.

My responsibility is to conduct the review in accordance with Statements on Standards for Accounting and Review Services issued by the American

Institute of Certified Public Accountants. Those standards require me to perform procedures to obtain limited assurance that there are no material modifications that should be made to the financial statements.

I believe that the results of my procedures provide a reasonable basis for my report.

Based on my review, I am not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in conformity with generally accepted accounting principles generally accepted in the United States of America.

My review was made for the purpose of expressing a conclusion that there are no material modifications that should be made to the financial statements in order for them to be in conformity with accounting principles generally accepted in the United States of America. The information included in the accompanying Schedules 1 through 5 is presented only for purposes of additional analysis and has been subjected to the inquiry and analytical procedures applied in the review of the basic financial statements, and I am not aware of any material modifications that should be made to such data.

THESE FINANCIAL STATEMENTS HAVE BEEN PREPARED ONLY FOR EDUCATIONAL

PURPOSES!!!

March 10, 2012

-1-

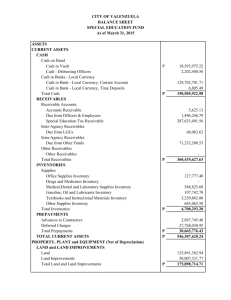

SAMPLE CONSTRUCTION COMPANY

BALANCE SHEET

(See Independent Accountant's Review Report)

December 31, 2011

ASSETS

Current assets (Note 1)

Cash and cash equivalents (Notes 1 and 2) $ 385,000

Contracts receivable (Notes 1, 2 and 3) 1,540,000

Costs and estimated earnings in excess

of billings on uncompleted contracts

(Notes 1 and 4) 15,000

Salary advances due from employees 4,000

Note receivable, shareholder (Note 7) 5,000

Prepaid items 31,000

Total current assets $ 1,980,000

Property and equipment, net of accumulated

depreciation and amortization (Notes 1 and 5) $ 250,000

Other assets

Note receivable, shareholder (Note 7) $ 57,000

Total assets $ 2,287,000

The Notes to the Financial Statements are an integral part of this

Statement.

LIABILITIES

Current liabilities (Note 1)

Accounts payable, including retention of

$45,000 $ 450,000

Billings in excess of costs and estimated

earnings on uncompleted contracts

(Notes 1 and 4) 150,000

Current portion of long-term debt (Note 9) 75,000

Accrued liabilities

Insurance payable 40,000

Bonuses and payroll taxes payable 90,000

Sales tax payable 35,000

Deferred income taxes payable (Notes 1 and 8) 87,000

Total current liabilities $ 927,000

Long-term debt (Note 9)

Note payable $ 300,000

Less current portion above -75,000

Total long-term debt $ 225,000

Deferred income taxes (Notes 1 and 8) $ 25,000

Total liabilities $ 1,177,000

Commitments (Note 6) $ -

STOCKHOLDER’S EQUITY

Capital stock

Authorized 1,000,000 shares of common stock,

no par value, 9,804 shares issued, 4,804

shares outstanding $ 50,000

Additional paid-in capital 110,000

Retained earnings 950,000

Total stockholder’s equity $ 1,110,000

Total liabilities and stockholder's equity $ 2,287,000

-2-

SAMPLE CONSTRUCTION COMPANY

STATEMENT OF OPERATIONS AND RETAINED EARNINGS

(See Independent Accountant’s Review Report)

For the Year Ended December 31, 2011

Contract revenues earned (Note 1) $ 11,000,000

Cost of revenues earned (Note 1) -9,300,000

Gross profit $ 1,700,000

General and administrative expenses (Note 1) -1,099,000

Income (-loss) from operations $ 601,000

Other income (-expense)

Interest income $ 20,000

Miscellaneous income 2,000

Interest expense -15,000

Total other income (-expense) $ 7,000

Net income (-loss) before (-provision) recovery

Income before income taxes $ 608,000

Provision for income taxes (Notes 1 and 8) -240,000

Net income (-loss) $ 368,000

Retained earnings, beginning of year 582,000

Retained earnings, end of year $ 950,000

The Notes to the Financial Statements are an integral part of this statement.

-3-

SAMPLE CONSTRUCTION COMPANY

STATEMENT OF CASH FLOWS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

Cash flows provided by operating

activities

Cash received from customers $ 10,300,000

Cash paid to suppliers and

employees -10,068,000

Interest received 20,000

Miscellaneous income 2,000

Interest paid -15,000

Net cash provided by operating

activities $ 239,000

Cash flows used by investing

activities

Capital expenditures $ -93,000

Net cash used by investing

activities -93,000

Cash flows used by financing

activities

Principal payments on

long-term debt $ -80,000

Proceeds from note receivable 4,000

Net cash used by financing

activities -76,000

Net increase in cash and cash

equivalents $ 70,000

Cash and cash equivalents,

beginning of period 315,000

Cash and cash equivalents,

end of period $ 385,000

The Notes to the Financial Statements are an integral part of this statement.

-4-

SAMPLE CONSTRUCTION COMPANY

STATEMENT OF CASH FLOWS (CONTINUED)

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

Reconciliation of Net Income to Net Cash

Provided by operating activities

Net income (-loss) $ 368,000

Adjustments to reconcile net

income to net cash provided by

operating activities

Depreciation $ 65,000

Change in assets and liabilities

Increase in contracts receivable -90,000

Decrease in costs and estimated

earnings in excess of billings

on uncompleted contracts 20,000

Increase in prepaid items -13,000

Increase in employee advances -1,000

Decrease in accounts payable -235,000

Increase in billings in excess of

costs and estimated earnings on

on uncompleted contracts 70,000

Decrease in bonuses and payroll

taxes payable -15,000

Increase in sales tax payable 11,000

Decrease in insurance payable -3,000

Increase in deferred income

taxes payable 62,000

Total adjustments -129,000

Net cash provided by operating

activities $ 239,000

The Notes to the Financial Statements are an integral part of this statement.

-5-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

Company formation and operating cycle.

Sample Construction Company is a corporation duly organized and operating under the laws of the State of Arizona. The Corporation was approved by the State of Arizona on March 6, 2008.

The length of the Company's contracts vary but is typically less than one year. Therefore, assets and liabilities are classified as current and non-current based on a one year operating cycle.

1. SIGNIFICANT ACCOUNTING POLICIES

Revenue and cost recognition. The accompanying financial statements are prepared according to the percentage of completion method, and therefore take into account the profit earned to date on contracts not yet completed.

The amount considered as earned under this method is that portion of the total contract price the contractor has a right to bill, based on that portion of the contract work actually completed. It is not related to the progress billings to customers. Completion percentage is measured by the relationship of cost expended to anticipated final total cost, based on current estimates of cost to complete the project.

Contract costs include all direct material and labor costs and those indirect costs related to contract performance, such as indirect insurance, miscellaneous expenses and depreciation costs. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined. Changes in job performance, job conditions, and estimated profitability, including those arising from contract penalty provisions, and final contract settlements may result in revisions to costs and income and are recognized in the period in which the revisions are determined.

The asset, "Costs and estimated earnings in excess of billings on uncompleted contracts," represents revenues recognized in excess of amounts billed. The liability, "Billings in excess of costs and estimated earnings on uncompleted contracts," represents billings in excess of revenues recognized.

Arizona, its counties and most of its cities impose a sales tax on the

Company’s sales when Sample Construction Company is acting in the capacity of a prime contractor. The Company collects the sales tax from its customers and remits the taxes to the applicable taxing authority.

The Company’s accounting policy is to include the sales tax collected and remitted in both revenue and cost of revenues earned. For the year

December 31, 2011, the sales tax collected and reflected in cost of revenues earned is $390,000.

-6-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

1. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Contract receivables. Contracts receivable represent the amounts billed but uncollected on completed construction contracts and construction contracts in process.

The Company uses the allowance method of recognizing uncollectible accounts receivable. The allowance method recognizes bad debt expense as a percentage of accounts receivable based on a review of the individual accounts outstanding and the Company's prior history of uncollectible accounts receivable. There was no change in the allowance from the prior year. At December 31, 2011, there is no allowance for bad debt established and in the opinion of management, all outstanding receivables at December 31, 2011 are considered fully collectible.

There not any change in the valuation allowance from the prior year.

Property, equipment, and depreciation. Property and equipment are recorded at cost. Maintenance and repairs are charged to operations when incurred. Betterments and renewals are capitalized when incurred.

Depreciation for all major classes of depreciable assets is provided for primarily on the straight-line method, taken over the useful lives of the assets.

Income taxes. The Company is taxed for federal and state purposes under the provisions of Subchapter C of the Internal Revenue Code.

For financial accounting purposes the Company reports income and expenses based on the percentage-of-completion method of accounting for long-term construction contracts. For tax accounting purposes the

Company reports income and expenses based on the completed contract method of accounting for long-term construction contracts.

The Company recognizes deferred income taxes according to the provisions of FASB Accounting Standards Codification 740-10-45-4 and 45-5. FASB

ASC 740 utilizes the liability method and deferred taxes are determined based on the estimated future tax effects of differences between the financial statement and tax bases of assets and liabilities given the provisions of enacted tax laws.

The Company accounts for tax penalties and interest in the provision for income taxes.

The Corporation adheres to accounting rules that prescribe when to recognize and how to measure the financial statement effects, if any, of income tax positions taken or expected to be taken on its income tax returns, including the position that the Corporation continues to qualify to be treated as a C Corporation for both federal and state

-7-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

1. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) income tax purposes. These rules require management to evaluate the likelihood that, upon examination by relevant taxing jurisdictions, those income tax positions would be sustained.

Based on that evaluation, if it were more than 50% probable that a material amount of income tax would be imposed at the entity level upon examination by the relevant taxing authorities, a liability would be recognized in the accompanying balance sheet along with any interest and penalties that would result from that assessment. Should any such penalties and interest be incurred, the Corporation’s policy would be to recognize them as operating expense.

Based on the results of management’s evaluation, adoption of the new rules did not have a material effect on the Corporation’s financial statements. Further, no interest or penalties have been accrued or charged to expense as of December 31, 2011 or for the year then ended.

The Corporation’s income tax returns are subject to examination by taxing authorities for a period of three years from the date they are filed. As of December 31, 2011, the tax following tax years are subject to examination:

Jurisdiction Open Years for Filed Returns Return to be filed in 2012

Federal December 31, 2008-2010 December 31, 2011

Arizona December 31, 2008-2010 December 31, 2011

General and administrative expenses. General and administrative expenses are charged to expense as incurred.

Cash equivalents. For purposes of the statement of cash flows, the

Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents.

Compensated absences. Compensated absences have not been accrued because the amount cannot be reasonably estimated.

Advertising costs. Advertising costs are charged to expense when incurred. For the year ended December 31, 2011, there is not any advertising expense.

2. CONCENTRATION OF CREDIT RISK

Company activities

Sample Construction Company is engaged in the construction industry as a

-8-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

2. CONCENTRATION OF CREDIT RISK (CONTINUED) general contractor, primarily on commercial projects in the greater

Phoenix, Arizona area. The work is performed under fixed-price contracts. These contracts are undertaken by the Company without joint ventures or partnerships.

Cash and Cash Equivalents

The Company maintains noninterest bearing cash balances in two financial institutions with various locations. The Federal Deposit Insurance

Corporation provides for unlimited insurance coverage of noninterestbearing accounts through December 31, 2012. The noninterest bearing accounts are separate from, and in addition to the insurance coverage provided to a depositor's other deposit accounts.

The Company has other deposit accounts at a financial institution with two different locations. The Federal Deposit Insurance Corporation insures $250,000 of deposits at each location. At December 31, 2011, the Company has uninsured cash in the aforesaid money markets accounts in the approximate amount of $15,000.

Effective July 31, 2010, the Dodd-Frank Wall Street Reform and Consumer

Protection Act permanently raises the current standard maximum deposit insurance amount to $250,000.

Major customers

During the year ended December 31, 2011, Sample Construction Company recognized sales to three major customers that exceeded 10% of total net sales. Sales to these customers were $3,750,000 (34.1%), $3,400,000

(30.9%) $2,900,000 (26.4%) of total net sales.

Contract receivables

It is the Company's policy to pre-lien all construction work performed.

Pre-liens enable a contractor to file a lien in the event the project owner fails to live up to the provisions of the contract.

In general, a construction contractor has a number of days, defined by statue, in which to file a lien in the event of non-payment of a contract receivable. The contractor then has six months to foreclose on the property. The foreclosure forces a sheriff's sale of the aforesaid property. The bank or mortgage holder has first rights, up to the mortgage amount, to any proceeds of the sale. Any proceeds in excess of the mortgage is received by the contractor.

-9-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

3. CONTRACT RECEIVABLES

Contract receivables

Completed contracts $ 270,000

Contracts in process 1,000,000

Unbilled receivables 20,000

Retention 250,000

Less allowance for doubtful accounts (Note 1) -

Total contract receivable $ 1,540,000

Unbilled receivables represent completed jobs for which a final billing had not been submitted as of December 31, 2011.

Historically, the Company's uncollectible contracts receivable, after direct write-offs, have been negligible. In the opinion of management, all contract receivables outstanding at December 31, 2011, are considered to be fully collectible, therefore at December 31, 2011, no doubtful account is established. Bad debt expense at December 31, 2011 is $20,000.

As of December 31, 2011, there is not any contract receivables aged greater than 90 days.

4. COSTS AND ESTIMATED EARNINGS ON UNCOMPLETED CONTRACTS

Costs incurred on uncompleted contracts $ 3,650,000

Estimated earnings 650,000

$ 4,300,000

Less: Billings to date -4,435,000

$ -135,000

Included in accompanying balance sheet

under the following captions:

Costs and estimated earnings in excess

of billings on uncompleted contracts $ 15,000

Billings in excess of costs and estimated

earnings on uncompleted contracts -150,000

$ -135,000

-10-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

5. PROPERTY AND EQUIPMENT

Assets

Building and land $ 150,000

Furniture and fixtures 50,000

Vehicles 350,000

Construction equipment 150,000

$ 700,000

Accumulated depreciation and amortization

Building $ 30,000

Furniture and fixtures 40,000

Vehicles 260,000

Construction equipment 120,000

$ 450,000

Net property and equipment $ 250,000

Total depreciation expense for the year ended December 31, 2011 is

$65,000.

6. COMMITMENTS

Performance and payment bonds

The Company, as a condition for entering into certain construction contracts, has outstanding surety bonds collateralized by contract receivables.

7. RELATED PARTY TRANSACTIONS

Note receivable from related party

On September 3, 2003, the Company sold its building and land to the

Company’s sole shareholder. As part of the sale, the Company signed a note receivable with it’s shareholder for $77,000. The note stipulates principal and interest payments of $700 per month, with a balloon payment, of approximately $20,000, due September, 2013. The note bears interest at 7.00% per annum. The balance due at December 31, 2011 is

$62,000. At December 31, 2011, $5,000 of the receivable is reflected as a current asset and the balance of $57,000 is recognized as a long-term asset.

Office and land lease

-11-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

7. RELATED PARTY TRANSACTIONS (CONTINUED)

The Company has a non-cancelable operating lease on the above land and office facilities with Sample Holdings, LLC. Sample Holdings, LLC is

100% owned by the Company’s sole shareholder. The operating agreement expires December 31, 2015. The base rent requires a monthly payment of

$4,000 including sales tax. Total rental expenses for year ended

December 31, 2011 is $48,000. The Company has an option to renew the lease for an additional five years.

As of December 31, 2011, a schedule of future minimum lease payments due under the non-cancelable operating lease agreements are as follows:

Period Ending

December 31, Amount

2012 $ 48,000

2013 48,000

2014 48,000

2015 48,000

$ 192,000

There were no contingencies, minimum rentals or subleases during the year ended December 31, 2011.

8. INCOME TAXES AND DEFERRED INCOME TAXES

For the year ended December 31, 2011 the provision of income taxes include the following:

Current $ 178,000

Provision for deferred income taxes 62,000

$ 240,000

Deferred taxes are determined based on the estimated future tax effects of differences between the financial statement and tax bases of assets and liabilities given the provisions of the enacted tax laws. However, some temporary differences cannot be identified with a particular asset or liability, such as differences between percentage-of-completion and completed contract methods for income recognition on long-term contracts. As of December 31, 2011, the net deferred tax liability is comprised of the following:

-12-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

8. INCOME TAXES AND DEFERRED INCOME TAXES (CONTINUED)

Federal State Total

Current deferred taxes

Gross liabilities $ 70,000 $ 17,000 $ 87,000

Non-current deferred taxes

Gross liabilities $ 19,000 $ 6,000 $ 25,000

Total deferred taxes $ 89,000 $ 23,000 $ 112,000

The tax effect of significant temporary differences representing deferred tax assets and liabilities are as follows:

Long-term contracts (cumulative

financial statement revenue

greater than tax basis revenue,

resulting in a current deferred

tax liability) $ 87,000

Depreciation (financial statement

net book value greater than tax

basis net book value, resulting in

a long-term deferred tax liability $ 25,000

Total deferred tax liabilities $ 112,000

For the year ended December 31, 2011, the Company's effective income tax rate is higher than what would be expected if the federal statutory rate were applied to income from continuing operations, primarily due to state taxes, net of federal income tax benefit.

9. LONG-TERM DEBT

At December 31, 2011, long-term consist of the following:

Note payable to finance company, collateralized by

a vehicle, principal and interest due in monthly

installments of $1,200. The note bears interest at

5.000 percent and is due in full by July, 2012. $ 20,000

Note payable to finance company, collateralized by

equipment, principal and interest due in monthly

installments of $1,800. The note bears interest at

5.500 percent and is due in full by December, 2014. 80,000

Note payable to finance company, collateralized

-13-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

9. LONG-TERM DEBT (CONTINUED)

Vehicles, principal payments due in monthly

installments of $5,000, plus interest on the

unpaid balance at the rate of 7.75% per annum,

also payable monthly. The note is due in full

February, 2014. 200,000

Total $ 300,000

Less current portion -75,000

Total long-term debt $ 225,000

A schedule of future minimum principal payments due on long-term debt outstanding at December 31, 2011, is as follows:

Year ending December 31,

2012 $ 75,000

2013 175,000

2014 50,000

Thereafter -

$ 300,000

The Company has a $400,000 line of credit commitment from XYZ Bank.

Borrowings under the line are secured by contract receivables, property, plant and equipment and the shareholder’s personal assets. The line accrues interest at the bank’s prime rate plus two percent. The prime rate at December 31, 2011 is 3.25%. There is not a balance outstanding under the line at December 31, 2011.

The Company shall timely perform and observe the following financial covenants: a. A minimum tangible net worth of $600,000. b. A maximum ratio of total liabilities to tangible net worth of 2.50 to 1. c. A minimum debt service coverage of 1.00: 1.

10. FINANCIAL INSTRUMENTS

The Companies financial assets are contract receivables, costs and estimated earnings in excess of billings on uncompleted contract, employee advances, note receivable, shareholder and pre-paid items. The

-14-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

10. FINANCIAL INSTRUMENTS (CONTINUED)

Company’s financial liabilities are trade payables, billings in excess of costs and estimated earnings on uncompleted contracts accrued liabilities and fixed rate loans. It is management’s opinion that the

Company is not exposed to significant interest rate risk or credit risk arising from any of the aforementioned instruments (long-term assets and debt's interest rate is fixed and reflect market rates). Unless otherwise noted the fair values of these financial instruments are deemed by management to approximate their carrying values.

11. STATEMENT OF CASH FLOW

Non-Cash Investing and Financing Activity

During the year ended December 31, 2011, the Company did not have any non-cash investing and financing activities that affected assets and liabilities:

12. ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The amount considered earned under the percentage of completion method on fixed price contracts is measured by the relationship of cost expended to anticipated final total cost, based on current estimates of cost to complete the project(s). That method is used because management considers total cost to be the best available measure of progress on the contracts. Because of the inherent uncertainties in estimating costs, it is reasonably possible that the Company's recorded estimate of cost to complete the project(s) may change in the near term.

13. BACKLOG

The following schedule shows a reconciliation of backlog representing signed contracts in existence at December 31, 2011:

Balance, December 31, 2010 $ 1,295,000

New contracts, 2010 10,705,000

$ 12,000,000

Less current revenue earned, 2011 -11,000,000

-15-

SAMPLE CONSTRUCTION COMPANY

NOTES TO THE FINANCIAL STATEMENTS

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

13. BACKLOG (CONTINUED)

Balance, December 31, 2011 $ 1,000,000

In addition, between January 1, 2012 and March 10, 2012, the Company enter into additional construction contracts in the amount of $7,800,00.

14. SUBSEQUENT EVENT CUT-OFF DATE

Management considered March 10, 2012 as the cut-off date regarding consideration of subsequent events analysis and disclosure. The date is the date the financial statements were available for issuance.

-16-

SAMPLE CONSTRUCTION COMPANY

SCHEDULE 1-SCHEDULE OF CONSTRUCTION OPERATIONS

(See Independent Accountant’s Review Report)

For the Year Ended December 31, 2011

Revenues

Earned

Cost of

Construction

Contracts completed during the year

Total revenue, costs & gross profit

Reflected in prior years

Recognized during current year

$ 11,200,000

-3,000,000

$ 8,200,000

$ 9,600,000

-2,550,000

$ 7,050,000

Gross

Profit

$ 1,600,000

-450,000

$ 1,150,000

Contracts in process at year end

Total revenue, costs & gross profit

Reflected in prior years

Recognized during current year

Totals

$ 4,300,000

-1,500,000

$ 3,650,000

-1,400,000

$ 650,000

-100,000

$ 2,800,000 $ 2,250,000 $ 550,000

$ 11,000,000

-17-

$ 9,300,000 $ 1,700,000

SAMPLE CONSTRUCTION COMPANY

SCHEDULE 2-SCHEDULE OF COMPLETED CONTRACTS

(See Independent Accountant’s Review Report)

For the Year Ended December 31, 2011

Adjusted

Contract Price

Cost of

Construction

Gross Profit

(Loss)

Gross Profit

(Loss)

In Prior Period

Current Gross

Profit (Loss)

Earned

Gross

Profit

(Loss)

Percent

Job

No.

Job Description

113 Chandler Office

115 Central Apts.

118 Rancho Market

119 Bell Towers

120 Strip Center

$ 1,700,000

1,800,000

1,400,000

2,900,000

3,400,000

$ 1,440,000

1,500,000

1,220,000

2,480,000

2,960,000

$ 260,000

300,000

180,000

420,000

440,000

$ 180,000

190,000

80,000

-

-

$ 80,000

110,000

100,000

420,000

440,000

15.3%

16.7

12.9

14.5

12.9

$ 11,200,000 $ 9,600,000 $ 1,600,000 $ 450,000 $ 1,150,000

-18-

SAMPLE CONSTRUCTION COMPANY

SCHEDULE 3-SCHEDULE OF CONTRACTS IN PROCESS

(See Independent Accountant’s Review Report)

For the Year Ended December 31, 2011

Job to Date

Job

No.

Job Name

121 Phoenix Office

122 Medical Center

Adjusted

Contract Price Amount Billed

Revenues

Earned

Cost of

Construction

Gross Profit

(Loss)

Gross Profit

(Loss) in Prior

Period

$ 1,550,000

3,750,000

$ 1,290,000

3,145,000

$ 1,305,000

2,995,000

$ 1,105,000

2,545,000

$ 200,000

450,000

$ 100,000

-

Totals $ 5,300,000 $ 4,435,000 $ 4,300,000 $ 3,650,000 $ 650,000 $ 100,000

Management Estimates

Current Gross

Profit (Loss)

Earned

Under-Billed

(Over-Billed)

Percent

Done

Work Load

Remaining

Cost to

Complete

Future Gross

Profit (Loss)

Final Estimated

Gross Profit

(Loss) G.P. %

$ 100,000

450,000

$ 15,000

(150,000)

84.2% $ 245,000

79.9% 755,000

$ 207,000 $ 38,000

640,000 115,000

$ 238,000

565,000

15,000

$ 550,000 $ -150,000 $ 1,000,000 $ 847,000 $ 153,000 $ 803,000

-19-

15.4%

15.1%

SAMPLE CONSTRUCTION COMPANY

SCHEDULE 4-SCHEDULE OF COST OF REVENUES EARNED

(See Independent Accountant’s Review Report)

For the Year Ended December 31, 2011

COST CATEGORY DOLLAR AMOUNT

Direct Cost:

Labor and overhead $ 400,000

Material 800,000

Subcontractors 6,800,000

Equipment rentals 100,000

Other direct cost 455,000

Total direct cost $ 8,555,000

Indirect cost:

Superintendents $ 250,000

Fringe benefits 30,000

Vehicle expense 60,000

Depreciation 25,000

Insurance 200,000

Repairs and maintenance 40,000

Travel 115,000

Small tools and supplies 25,000

Total indirect cost $ 745,000

TOTAL COST $ 9,300,000

-20-

SAMPLE CONSTRUCTION COMPANY

SCHEDULE 5-SCHEDULE OF GENERAL AND ADMINISTRATIVE EXPENSES

(See Independent Accountant's Review Report)

For the Year Ended December 31, 2011

Amount

Advertising and promotion $ 4,100

Bad debt expense 20,000

Contributions 8,700

Common area expense 2,500

Depreciation 40,000

Dues and subscriptions 18,000

Employee goodwill 10,000

Entertainment and meals 4,900

Insurance 24,000

Licenses and taxes 5,700

Miscellaneous expense 2,600

Office expenses 36,000

Office salaries 116,000

Officer's salary 636,500

Payroll taxes 43,000

Professional fees 28,000

Rent expense 48,000

Repairs and maintenance 6,000

Telephone and utilities 19,000

Travel expense 3,000

Vehicle expense 23,000

$ 1,099,000

-21-