EXPERT INSIGHTS

advertisement

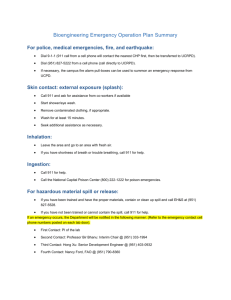

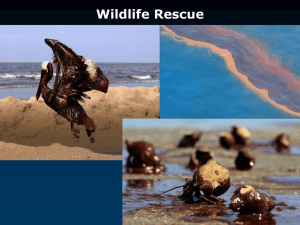

EXPERT INSIGHTS analysis • research • planning Trade-Offs in Designing Mass Tort Settlement Structures: The Gulf Coast Claims Facility Experience Authored by In April 2010, the Deep Water Horizon drilling rig explosion and ensuing oil spill resulted in multiple deaths, closed areas to fishing and harvesting of shrimp, oysters and Thomas Vasquez, PhD other seafood and significantly disrupted the economy of the Gulf region. This Partner unprecedented oil spill disaster played out as live headline news night after night on local, national and international media. Individuals, business owners, local officials Ilan Guedj, PhD and politicians representing their constituents were becoming increasingly frustrated Managing Director and vocal about the need for immediate financial and environmental relief. Clean-up activities and programs to compensate victims were established by BP Plc and Federal and State agencies were working toward providing relief and preventing further damage. One key component of BP’s effort was the funding of the Gulf Coast Claims Facility (GCCF) that was established to compensate victims of the disaster. The GCCF was funded with $20 billion to begin compensating the thousands of businesses and individuals throughout the Gulf Coast region from Texas to Florida who were negatively affected by the oil spill. It was immediately clear that the GCCF would need to address what has now been labeled the “trilema” - the three contradictory goals faced by all mass torts: 1. The amount paid is reasonably precise in the calculation of damages and there is a reasonable level of proof that the alleged damages were caused by the oil spill; 2. Payments to claimants are timely, and 3. The payment and resolution of claims is completed in a cost effective manner. The conflict is clear. A structure that requires no proof of causality and relies solely on the damage alleged by the plaintiff minimizes transaction costs, provides funds to injured parties quickly, but has little (if any) precision in estimating damages and proving causality. A structure that emphasizes precision in estimating damages and proving causality requires documentation and proof and likely litigation which increases transaction costs and lengthens the time to paying injured parties. A structure that minimizes transaction costs likely shortens time to payment, but provides little precision. The appropriate balance among the three goals varies by the specific characteristics of the mass tort. The resolution structure is generally dictated by the size of the tort (e.g. number of claims and estimated damage), the type of injury (e.g. bodily injury vs. solely financial damage), funds available to claimants relative to the total amount of damage, and the type of defendant (e.g. high asset private company, government fund, insurance coverage). 1220 19TH STREET, NW SUITE 700 WASHINGTON, DC 20036 PHONE 202 797 1111 FAX 202 797 3619 ARPC.COM The GCCF Experience It was immediately clear that damages from the oil spill were massive and that it was likely that hundreds of thousands of individuals and businesses were affected by the oil spill. Indeed, while the GCCF operated for less than two years, over one million claims were filed by approximately 580,000 claimants and approximately $6.5 billion were paid to approximately 230,000 claimants. The GCCF decided to balance the contradictory goals by implementing a number of disparate programs and techniques: • Implementation of a three month program to provide emergency relief. A program that required less than complete proof of damage or causality and did not affect the claimants ability to pursue further compensation; • Implementation of a program to limit causality proof for the overwhelming number of claimants (over 95% of claimants); • Development of an algorithm to facilitate the early resolution of claims. Emergency Advanced Payments It was very clear that claimants were facing severe hardship and needed compensation immediately. The GCCF provided funds under its Emergency Advanced Payment (EAP) program that was started in August 2010 and lasted for 90 days. Under the program, 170,000 claimants (or approximately 75% of paid claimants) were paid approximately $2.6 billion. The program provided for a payment to individuals and businesses equal to six months of losses due to the oil spill. Any and all claimants with documented proof would be paid without the requirement of signing a release – and would be able to petition for even more compensation later. However, because of the emergency nature of these payments and that they were not final amounts; the EAP causality and proof of damage requirements were not as rigorous as the eventual final payment scheme. The EAP was primarily a mechanism to get compensation to entities – there were limited requirements to receive payment and claimants were not required to abandon any rights to future claims against BP. The EAP was viewed as a partial, advanced payment, not a full resolution of the claim. Final Payments That Demanded Little Documentation Faced with resolving the claims of more than a half million entities, the GCCF provided for a de minimis final payment – the Quick Pay program. Under the program, individual claimants were offered $5,000 and business claimants were offered $25,000. The claimants were not required to submit any further documentation to the GCCF in support of their claim, but were required to sign a release. Approximately 135,000 claimants elected this alternative and were paid approximately $1.4 billion dollars. ARPC.COM Final Payments That Required Documentation The Quick Pay program provided only a very limited solution to the overwhelming problem of the sheer number of claimants. At the time the GCCF was closed, there were approximately 180,000 claims still open. It was still not possible (or desirable) to subject all the remaining (and yet to be filed) claimants to rigorous discovery to establish their claim. In response, the GCCF developed a procedure to limit proof of causality for the majority of claimants and developed an algorithm to approximate past and estimated future damages for the majority of claimants. Determination of Causality The GCCF split the claimant population into two parts – (1) fishermen and (2) the rest of the economy. There was little controversy over whether the damage incurred by fishermen was caused by the oil spill – fishing was precluded for a significant time in vast areas of the Gulf and oysters, oyster beds, shrimp, crabs, clams and other seafood was severely affected by the oil spill. There was a great deal of controversy over the causation of damage for claimants in the general economy. It was clear that the oil spill affected tourism, but who is affected by tourism? Hotels on the beach are likely affected, but what if the hotel is inland or in a major city that caters to business conventions, not tourism? Restaurants near the beach are likely affected (especially if their menu is focused on Gulf seafood), but what if the restaurant caters to locals and is a steak house? Personal service companies, employees of tourism based businesses; souvenir shops all have the same or similar issues. Is the lost revenue due to the oil spill or the lingering recession? Is the job loss due to the oil spill or incompetence of the worker? Documenting and litigating these issues would take years. Instead, the GCCF adopted a set of presumptive rules that dramatically limited the required proof of causality. Claimants were categorized into one of three groups, each with a different “presumption” about causality and therefore a different level of proof of causality. The three groups were defined geographically: • Category 1: Businesses with addresses in zip codes (and individuals working for such businesses) directly on the Gulf. Claimants in Category 1 were not required to provide proof that their damage resulted from the oil spill. The GCCF presumed that if an entity was in that geographical region that its damage was from the oil spill. • Category 2: Businesses with addresses in counties adjacent to the Gulf (and individuals working for such businesses), but not in Category 1. The GCCF did not impose any presumption of the cause of damage to the claimant. The claimant was required to satisfy a simple financial test – the claimant’s income had to have significantly deteriorated after April 10, 2010 the date of the Deep Water Horizon explosion and oil spill. • Category 3: All other businesses and individuals. The GCCF presumed that damage incurred by claimants in this category was not caused by the oil spill. To be eligible for payment, these claimants had to satisfy the financial test for Category 2, but also had to provide additional proof in the form of cancelled contracts, invoices or other documentation linking their damage to the oil spill. ARPC.COM The establishment of presumed causality for Category 1 and the simple financial test for Category 2 was very important. Approximately 95% of all payments were made to claimants in these two categories. The overwhelming percent of claimants were not required to submit documented evidence of causality. Estimation of Damages The GCCF was intent on resolving all valid claims within a few years. As such, the GCCF could not simply observe historical losses since losses were likely to continue into the future – losses would continue until tourism rebounded and the economy fully recovered. To resolve claims now, the GCCF had to make an offer that included two components: (1) actual damages from the date of the oil spill to the end of 2010 and (2) estimated post 2010 damages (future damages). The first component certainly involved a number of complex issues – given the recession and the usual volatility of year over year income estimating the “but for the oil spill” income of the claimant may be very problematic. But these problems were solvable. The effect of the recession could be separated by looking the other geographic areas that had similar characteristics (reliance on tourism, beach areas, similar mix of visitor characteristics, etc.) but were at a great enough distance from the oil spill that their economy would be unaffected. Estimating future losses was more difficult. The GCCF relied on the experience of other areas to estimate the pace of the recovery of tourism in the Gulf region. The economic recovery after events such as the September 11 attacks in New York, the recovery rate from natural disasters such as tsunamis and other events showed similar recovery periods. On average these other events showed that future losses are expected to be approximately equal to actual losses in the first nine months after the event. Summary Conclusions The work of the Gulf Coast Claims Facility provides a modern paradigm for organizing and delivering financial relief to economic victims of extraordinary environmental disasters. In these situations, acting quickly offers the benefits of: • Getting relief to victims before their situations become worse • Settling claims for reasonable sums and avoiding long-term litigation costs • Demonstrating leadership in a highly-charged situation The tradeoffs of speed can of course include issues of making payments for illegitimate claims, or paying more than necessary on any given claim. Differentiating the claims based on characteristics that help achieve the goal of speed while also providing for the ability to address significant variations in the underlying facts of the claims is key to achieving the right level of precision with respect to damages and causality. The payment algorithms developed by GCCF provided for quick payments to settle the vast majority of smaller but legitimate claims, emergency advanced payments to bring short term relief to injured parties while further assessment of damages and causality are made, and final payments to settle these claims on the basis of more traditional evaluations of the merits of each claim. ARPC.COM The specific application of the payment algorithms developed in the GCCF case can be applied as a framework for other similar situations, and they offer the flexibility to alter the relationship between speed and precision based on the specific circumstances of the event. Contacts: About ARPC For further information and questions, please contact the authors ARPC — Analysis, Research, Planning Corporation — is an expert services and business advisory firm dedicated to providing world-class analytical expertise and guidance to clients facing complex legal and business challenges. For over 40 years, ARPC’s consultants have assisted law firms, corporations, governments and nonprofit organizations in addressing their economic and financial concerns in the courtroom, board room and marketplace. The firm is based in Washington, D.C. Telephone: 1 (202) 797-1111 ARPC 1220 19th Street, NW Washington, D.C. 20036 About the Authors Thomas Vasquez, PhD, a Partner with ARPC, is a pioneer in the development of quantitative and economic models aimed at solving complex business and legal issues. He has provided expert testimony and analytical support for a broad spectrum of issues and industries. Dr. Vasquez has consulted on such cases as National Gypsum, Fireboard Corporation, Reynolds Tobacco, CSX Inc., Owens Corning, Tyson Foods, Halliburton, AstraZeneca, Foster Wheeler, Gulf Coast Claims Facility, and Oracle. t.vasquez@arpc.com Ilan Guedj, PhD, a Managing Director at ARPC, has provided expert consulting and testimony in securities class actions, investment management, and valuation disputes. Dr. Guedj consults with clients and supports experts in a wide range of finance and economics cases. He is an expert in corporate finance, securities, and the securities industry, and has provided testimony regarding financial analysis, financial statements, and financial securities. He has also participated in large class action lawsuits that involved various financial securities, mutual funds, ETFs, and structured products. i.guedj@arpc.com The opinions expressed herein do not necessarily represent the views of ARPC or any other ARPC consultant. Please do not cite without explicit permission from the author. ARPC.COM