ACCT221 Accounting Information Systems G5

advertisement

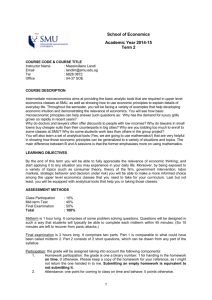

ACCT221 Accounting Information Systems G5 Course Outline 2012/2013 Term 1 A. Instructor and Contact Information Gary PAN Level 5 Room 5008, Dean’s Office School of Accountancy Singapore Management University Singapore 178900 Tel: (65) 6828-0983 Fax: (65) 6828-0600 Email: garypan@smu.edu.sg Consultation times: Anytime, but a courtesy email is appreciated. Teaching Assistant: Kenneth Lek (email: Kenneth.lek.2010@accountancy.smu.edu.sg) B. Course Prerequisites Students are allowed to take this course only after completing ACCT101/103/111 (Financial Accounting). C. Course Description This course provides knowledge about the analysis, design and use of accounting information systems. It addresses the following key concepts: role of internal control in an accounting system; documentation of accounting information systems; database management, business processes and modeling; internal controls; and the role of accounting information systems in major processes of the business cycle. D. Learning Goals, Course Objectives and Skill Developments This course contributes to the development of the following learning goals: • LO1.1 Our students can recognize, develop, measure, record, validate and communicate financial and other related information. • LO1.2 Our students can analyze, synthesize and evaluate financial and other related information for decision making in a management context. • LO1.3 Our students understand and can apply concepts relating to business processes, audit and assurance. • LO2.3 Our students can communicate effectively in a business context. • LO3.1 Our students understand and can apply the ethical principles relevant to accounting professionals. Students are expected to demonstrate the following technical accounting competencies upon successful completion of this course: 1. 2. 3. 4. Demonstrate systematic documentation and analysis of various business processes Obtain a broad understanding of database design and modeling Understand the role of internal control in an accounting system Identify the basic functions of revenue, expenditure and production cycles and their interactions with an accounting information system 5. Use an accounting software package to enter and process transactions, and produce accounting documents and reports 6. Obtain a broad understanding of technological and emerging practices that may impact on the design and management of an accounting information system ACCT221 – Accounting Information Systems G5 AY2012/2013 Term 1 Page 1 However, learning outcomes should be beyond just technical accounting competencies. In particular, this course seeks to develop your versatility, individual competencies and awareness of ethics and responsibilities through the various class and assessment activities: • Analytical skills: Analytical skills will be developed through cases and problems, including incomplete data and unstructured question sets. Class activities are also designed to train students’ analytical skills. • Communication: Students will be assessed on class participation and group presentation. • Team work: Students will be working in a team for their project in this course. In addition, students will be asked to work together in solving cases and problems in class. • Active learning: Students should be prepared to invest some time in self-learning tools such as Microsoft Visio and MYOB accounting software package. Classes consist of limited formal course materials presentation and the majority of the activities in class are designed for active learning. • Professional ethics: Ethical concepts and constructs are integrated throughout the course. E. Learning Approach The pedagogical approach to this course consists of three major facilitations: • Facilitating positive learning experience • Facilitating students’ learning of the subject matter (Theory) • Facilitating students’ learning of various issues related to the subject (Practice) Generally, the first learning outcome can be achieved by setting a conducive learning environment which enhances students’ learning experiences. This is done through collective learning, peer learning, and pleasant atmosphere but with rigor, and encouraging sharing of experiences and knowledge. Facilitating students’ learning of the subject matter is achieved via content-based education. This approach is crucial, because without solid theoretical groundings in the subject, students will find it difficult to appreciate the abstraction of some of the practical lessons learned. Students should prepare by pre-reading, analysing the materials/tasks/cases to be covered before coming to class and actively participate in class discussions. Students will learn a variety of AIS related issues and applications which may equip them with updated knowledge and skills so that they can effectively adapt to changing situations and remain valuable to their organizations in the future. F. Textbook Recommended Text: (1) Dull, Gelinas and Wheeler (2010), Accounting th Information Systems, 9 edition, South-Western Cengage Learning. Supplementary Text: (2) Romney and Steinbart (2012), Accounting Information Systems, 12th edition, Pearson. ACCT221 – Accounting Information Systems G5 AY2012/2013 Term 1 Page 2 G. Lesson Plan Class sessions are of 3-hour duration and will include a review of study materials, class discussions, software demonstration, and other learning activities where appropriate. Course materials will be published in SMU eLearn (https://elearn.smu.edu.sg/). A brief outline of course schedule is provided below: • Week 01: Overview of Accounting Information Systems and Business Processes • Week 02: System Analysis and Documentation: Data Flow Diagrams • Week 03: System Analysis and Documentation: System Flowcharts • Week 04: System Analysis and Documentation: System Flowcharts • Week 05: System Design: Database Management Systems • Week 06: System Design: Relational Databases • Week 07: Internal Controls • Week 08: Term Break • Week 09: System Implementation and Usage: Revenue Cycle • Week 10: System Implementation and Usage: Expenditure Cycle • Week 11: System Implementation and Usage: Production Cycle • Week 12: REA Data Model • Week 13: Emerging Issues in Accounting Information Systems • Week 14: Pre-exam break • Week 15: Examination The detailed course work plan will be announced in class. Note that this schedule is subject to change (administrative commitments, conferences, etc). Alternative times or activities will be arranged should they become necessary. H. Assessment To pass the course, a student is required to obtain a TOTAL mark of 50% or better. The assessment components are listed below: Class Learning and Participation Activities (20%), Progress Assessment (10%), Group Project Assignment (20%) and Final Examination (50%). 1. Class Learning and Participation Activities (20%) Class learning and participation means active participation and positive contribution during class. Participation can be in the form of the following, but not limited to: answering questions as posed by the instructor, contributing to class discussions and presentation. Please refer to Annex 1A and 1B for evaluation criteria of group presentation and class participation. Class participation is a continuous assessment throughout the term and students are reminded that they have to earn their class participation mark. 2. Progress Assessment (10%) There will be a mid-term test in Week 6 covering all topics that have been discussed up to Week 5. Details of the test will be advised later. 3. Group Project Assignment (20%) There are two group project learning activities for this course. You will be completing these in groups of (max) 5 students. These projects are designed to demonstrate system design and use of accounting information systems. Each project is expected to take no more than 10 hours of outside class time. Project 1 (10%, due in Week 5): You will be asked to document a business process using Data Flow Diagram and Flowcharting techniques. You will have to complete this project using a computerized drawing tool such as Microsoft Visio. Project 2 (10%, due in Week 10): You will be asked to create a simple database in Microsoft Access, complete with documentation based on a case scenario to be distributed in class. 4. Final Examination (50%) The final examination is a closed-book, of 3 (three) hours duration and covers the entire course. ACCT221 – Accounting Information Systems G5 AY2012/2013 Term 1 Page 3 Plagiarism All acts of academic dishonesty (including, but not limited to, plagiarism, cheating, fabrication, facilitation of acts of academic dishonesty by others, unauthorized possession of exam questions, or tampering with the academic work of other students) are serious offences. All work (whether oral or written) submitted for purposes of assessment must be the student’s own work. Penalties for violation of the policy range from zero marks for the component assessment to expulsion, depending on the nature of the offense. When in doubt, students should consult the instructors of the course. Details on the SMU Code of Academic Integrity may be accessed at http://www.smuscd.org/resources.html. Prepared by: Gary PAN, 12/7/2012 Approved by: Themin SUWARDY, 1 August 2012 ACCT221 – Accounting Information Systems G5 AY2012/2013 Term 1 Page 4 Annex 1A: Evaluation Criteria of Group Presentation (10%) Knowledge of subject area (including ability to answer questions) 5% Organization and clarity of presentation 3% Ability to engage the audience and draws active participation 2% Annex 1B: Evaluation Criteria of Class Participation (10%) Mark Range Comments 9-10 Outstanding Contributor. This student was well prepared and contributed actively to class discussion. His/her presence in the seminar significantly enhanced the learning experience for all students. 8 Good Contributor. This student was well prepared and contributed occasionally to class discussion, but was an active participant during in class small group learning 6-7 Average contributor. This student attempted the seminar exercise and participated in class, but to a lesser extent and/or of lower quality than outstanding and good contributors. 1-5 Poor contributor. This student had done minimal preparation and generally did not actively participate in class. 0 Unsatisfactory contributor. This student was unprepared and/or did not participate. ACCT221 – Accounting Information Systems G5 AY2012/2013 Term 1 Page 5