November 2011 - Virginia State Bar

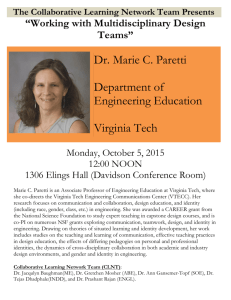

advertisement