October 24, 2013

California increases minimum wage, in two steps, to

$10 per hour

By Paul R. Lynd and Dale A. Hudson

For the first time in over five years, California employers must contend with an increase in the

state’s minimum wage. On September 25, 2013, California Governor Jerry Brown signed Assembly

Bill 10. The legislation increases California’s minimum wage in two steps. First, on July 1, 2014, the

minimum wage will increase to $9 per hour. Second, on January 1, 2016, it increases again to $10 an

hour.

Before passing the bill, the Legislature removed a provision that would have increased the

minimum automatically every year at the rate of inflation. California’s minimum wage last

increased to its current level of $8 per hour on January 1, 2008, after having risen in 2007. With this

latest increase, California’s minimum wage is among the highest in the nation. It is on track to be

perhaps the highest in the nation, depending on adjustments elsewhere that may happen before

2014. The federal minimum wage has been $7.25 since 2009. Employers must comply with the

highest applicable rate, which also may be a higher local rate.

In addition to complying with the new minimum wage for non-exempt employers, California

employers also need to be mindful that other minimum rates increase along with the state’s

minimum wage. California requires that overtime exempt employees be paid a minimum monthly

salary of at least twice the state’s minimum wage. The state’s commission pay exemption also

requires minimum pay for each hour of at least 1.5 times the state’s minimum wage, with at least

half of the employee’s earnings representing commissions. In addition, the state’s collective

bargaining exemption from daily overtime rules requires minimum hourly pay at least 30 percent

higher than the state’s minimum wage.

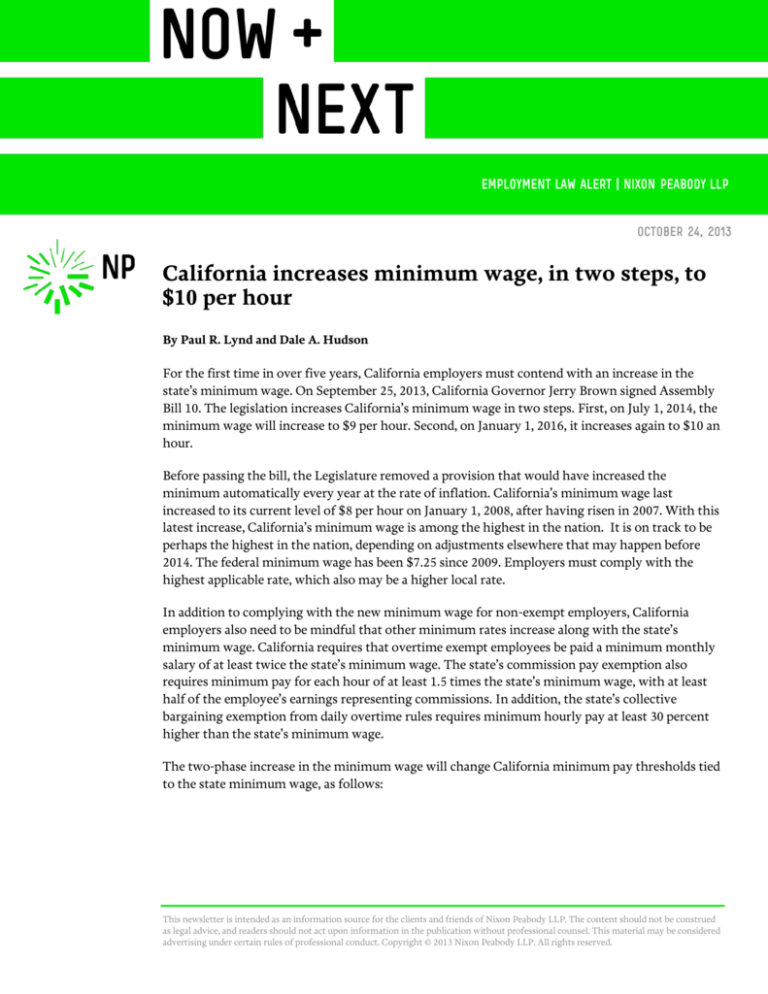

The two-phase increase in the minimum wage will change California minimum pay thresholds tied

to the state minimum wage, as follows:

This newsletter is intended as an information source for the clients and friends of Nixon Peabody LLP. The content should not be construed

as legal advice, and readers should not act upon information in the publication without professional counsel. This material may be considered

advertising under certain rules of professional conduct. Copyright © 2013 Nixon Peabody LLP. All rights reserved.

Minimum wage

Effective date

Minimum monthly salary for exempt

executive, administrative and

professional employees

Collective bargaining exemption

Split shift premium (if applicable)

$8.00

1/1/2008

$2,773.33

($33,280

per year)

$10.40/hour

$8.00

$9.00

7/1/2014

$3,120.00

($37,440 per

year)

$11.70/hour

$9.00

$10.00

1/1/2016

$3,466.67

($41,600 per

year)

$13.00/hour

$10.00

The minimum wage increase will not affect the pay thresholds for the computer software

professional exemption or the physician employee exemption. The state’s Department of Industrial

Relations adjusts these minimums annually based on the rate of inflation.

The higher pay thresholds will apply to all employees who are based in California. In addition,

pursuant to the California Supreme Court’s decision in Sullivan v. Oracle, these thresholds may

apply to out-of-state residents working temporarily in California.

What employers should do

Companies with employees in California will need to prepare to adjust compensation levels to

comply with these new thresholds. The greatest impact will certainly be on minimum wage

workers, who will be directly impacted by the new pay rates. In addition, employees currently just

above the minimum wage may also receive pay adjustments, as employers attempt to maintain the

appropriate relative pay levels with respect to employees possessing varying levels of skill and

experience.

Employers also need to review the minimum salary paid to employees classified as overtime

exempt under the executive, administrative, and professional exemptions. The minimum “salary”

required for these exemptions must be a fixed amount and guarantee that it meets at least the

minimum; other amounts paid would not count for the minimum if they are not guaranteed. If the

minimum salary rule is not met, an employee would not qualify as overtime exempt, regardless of

the employee’s duties.

Companies with employees who regularly travel to California should review carefully whether the

new California minimum wage, and possibly other California wage and hour requirements, applies

while those employees are working in California.

Watch out for higher local minimum wage requirements

Employers must also be careful to comply with any higher local minimum wage that may apply.

The state’s minimum wage law does not preempt local ordinances requiring payment of a higher

minimum wage. Currently, two California cities have minimum wages higher than the state

minimum wage for all employees. San Francisco’s minimum wage currently is $10.55 an hour, but

adjusts at the beginning of each year with the inflation rate. The San Francisco minimum wage

applies to time worked within the City and County of San Francisco, as long as an employee works

at least two hours a week in the City, even if he or she ordinarily works elsewhere.

San Jose’s current minimum wage is $10 per hour, thanks to an initiative approved by voters

effective January 1, 2013. On January 1, 2014, San Jose’s minimum will increase to $10.15 an hour.

Additionally, Long Beach, Los Angeles, and Emeryville have passed higher minimum wages for

some hotel employees. Other localities have “living wage” ordinances for some contractors.

For more information on the content of this alert, please contact your regular Nixon Peabody

attorney or:

— Paul R. Lynd at plynd@nixonpeabody.com or 415-984-8235

— Dale A. Hudson at dhudson@nixonpeabody.com or 213-629-6015