Personal Management - Overland Trails Council

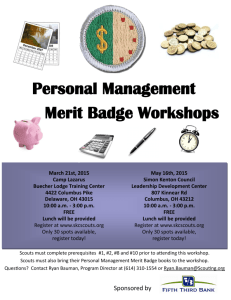

advertisement

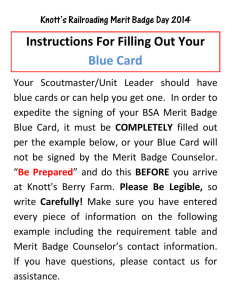

2010 PERSONAL MANAGEMENT PROGRAM OVERVIEW & WORKBOOK CENTRAL COMMUNITY COLLEGE MERIT BADGE UNIVERSITY OVERLAND TRAILS COUNCIL 7/31/2010 TABLE OF CONTENTS PROGRAM OVERVIEW MERIT BADGE REQUIREMENTS (PRE-REQUISITE REQUIREMENTS IN BOLD RED UNDERLINED ITALICS) WORKBOOK PART ONE (COMPLETE BEFORE ATTENDING MBU) WORKBOOK PART TWO (WILL BE COMPLETED DURING CLASS) APPLICATION for MERIT BADGE (MUST HAVE UNIT LEADER SIGNATURE PRIOR TO CLASS) FEBRUARY 2010 Information in this booklet was accurate at the time of publishing. Boy Scouts Requirements 2010, Copyrighted Boy Scouts of America Program Overview & Workbook was reviewed by MBU Staff/Committee. PERSONAL MANAGEMENT PROGRAM OVERVIEW COUNSELOR: tba C/O: Overland Trails Council PO Box 1361 Grand Island, NE 68802-1361 LOCATION: Central Community College TRANSPORTATION: N/A ADDITIONAL COSTS: None CLASS SIZE: 10 BRING TO CLASS: Personal Management merit badge pamphlet. Personal Management merit badge workbook, part one & part two Signed “Application for Merit Badge”, found at the end of the merit badge workbook. (This will be your only record of work completed on this merit badge.) If your Council requires the official “blue card”, you must bring one with you to class. PRE-REQUISITES: Complete Part One of the workbook before class (requirements 1, 2, 8, 9, & 10). Complete information on the “Application for Merit Badge” including Scoutmasters signature. CURRICULUM: Requirements 3, 4, 5, 6, & 7 will be completed during class (part two of the workbook). Pre-requisites will also be reviewed during class. PERSONAL MANAGEMENT Boy Scouts Requirements 2010 PRE-REQUISITE REQUIREMENTS ARE PRINTED IN BOLD UNDERLINED RED ITALICS & MUST BE COMPLETED BEFORE CLASS. 1. Do the following: a) Choose an item that your family might want to purchase that is considered a major expense. b) Write a plan that tells how your family would save money for the purchase identified in requirement 1a. 1) Discuss the plan with your merit badge counselor. 2) Discuss the plan with your family 3) Discuss how other family needs must be considered in this plan. c) Develop a written shopping strategy for the purchase identified in requirement 1a. 1) Determine the quality of the item or service (using consumer publications or ratings systems). 2) Comparison shop for the item. Find out where you can buy the item for the best price. (Provide prices from at least two different price sources.) Call around; study ads. Look for a sale or discount coupon. Consider alternatives. Can you buy the item used? Should you wait for a sale? 2. Do the following: a) Prepare a budget reflecting your expected income (allowance, gifts, wages), expenses, and savings. Track your actual income, expenses, and savings for 13 consecutive weeks. (You may use the forms provided in the merit badge pamphlet, devise your own, or use a computer-generated version.) when complete, present the results to your merit badge counselor. b) Compare expected income with expected expenses. 1) If expenses exceed income, determine steps to balance your budget. 2) If income exceeds expenses, state how you would use the excess money (new goal, savings). 3. Discuss with your merit badge counselor FIVE of the following concepts: a) The emotions you feel when you receive money. b) Your understanding of how the amount of money you have with you affects your spending habits. c) Your thoughts when you buy something new and your thoughts about the same item three months later. Explain the concept of buyer’s remorse. d) How hunger affects you when shopping for food items (snacks, groceries). e) Your experience of an item you have purchased after seeing or hearing advertisements for it. Did the item work as well as advertised? f) Your understanding of what happens when you put money into a savings account. 4. 5. 6. 7. 8. g) Charitable giving. Explain its purpose and your thoughts about it. h) What you can do to better manage your money. Explain the following to your merit badge counselor: a) The differences between saving and investing, including reasons for using one over the other. b) The concepts of return on investment and risk. c) The concepts of simple interest and compound interest and how these affected the results of your investment exercise. Select five publicly traded stocks from the business section of the newspaper. Explain to your merit badge counselor the importance of the following information for each stock: a) Current price b) How much the price changed from the previous day c) The 52-week high and the 52-week low prices Pretend you have $1,000 to save, invest, and help prepare yourself for the future. Explain to your merit badge counselor the advantages or disadvantages of saving or investing in each of the following: a) Common stocks b) Mutual funds c) Life insurance d) A certificate of deposit (CD) e) A savings account or U.S. savings bond Explain to your merit badge counselor the following: a) What a loan is, what interest is and how the annual percentage rate (ARP) measures the true cost of a loan. b) The different ways to borrow money. c) The differences between a charge card, debit card, and credit card. What are the costs and pitfalls of using these financial tools? Explain why it is unwise to make only the minimum payment on your credit card. d) Credit reports and how personal responsibility can affect your credit report. e) Ways to reduce or eliminate debt. Demonstrate to your merit badge counselor your understanding of time management by doing the following: a) Write a “to do” list of tasks or activities, such as homework assignments, chores, and personal projects, that must be done in the coming week. List these in order of importance to you. b) Make a seven-day calendar or schedule. Put in your set activities, such as school classes, sports practices or games, jobs or chores, and/or Scout or church or club meetings, then plan when you will do all the tasks from your “to do” list between your set activities. c) Follow the one-week schedule you planned. Keep a daily diary or journal during each of the seven days of this week’s activities, writing down when you completed each of the tasks on your “to do” list compared to when you scheduled them. d) Review your “to do” list, one-week schedule, and diary/journal to understand when your schedule worked and when it did not work. With your merit badge counselor, discuss and understand what you learned from this requirement and what you might do differently the next time. 9. Prepare a written project plan demonstrating the steps below, including the desired outcome. This is a project on paper, not a real-life project. Examples could include planning a camping trip, developing a community service project or a school or religious event, or creating an annual patrol plan with additional activities not already included in the troop annual plan. Discuss your completed project plan with your merit badge counselor. a) Define the project. What is your goal? b) Develop a time line for your project that shows the steps you must take from beginning to completion. c) Describe your project. d) Develop a list of resources. Identify how these resources will help you achieve your goal. e) If necessary, develop a budget for your project. 10. Do the following: a) Choose a career you might want to enter after high school or college graduation. b) Research the limitations of your anticipated career and discuss with your merit badge counselor what you have learned about qualifications such as education, skills, and experience. PERSONAL MANAGEMENT WORKBOOK PART ONE, PRE-REQUSITIES Name Unit # Council District Part One of the workbook must be completed before class. Bring the entire workbook (part one and part two) with you to class. Also bring the “Application for Merit Badge” signed by your scoutmaster (included at the end of the workbook). 1. Do the following: a) Choose an item that your family might want to purchase that is considered a major expense. An item that your family might want to purchase: b) Write a plan that tells how your family would save money for the purchase identified in requirement 1a. Write a plan: 1) Discuss the plan with your merit badge counselor. Discuss the plan: 2) Discuss the plan with your family Discuss the plan with your family: PERSONAL MANAGEMENT WORKBOOK, PART ONE, p.2 Name 1. b) continued 3) Discuss how other family needs must be considered in this plan. Discuss how other family needs: c) Develop a written shopping strategy for the purchase identified in requirement 1a. Develop a written shopping strategy: 1) Determine the quality of the item or service (using consumer publications or ratings systems). Quality of the item or service: 2) Comparison shop for the item. Find out where you can buy the item for the best price. (Provide prices from at least two different price sources.) Call around; study ads. Look for a sale or discount coupon. Consider alternatives. Can you buy the item used? Should you wait for a sale? Comparison shop: The best price: (provide at least two different price sources) PERSONAL MANAGEMENT WORKBOOK, PART ONE, p.3 Name 1. c) 2. Continued Consider alternatives: Can you buy the item used: Should you wait for a sale: 2. Do the following: a) Prepare a budget reflecting your expected income (allowance, gifts, wages), expenses, and savings. Track your actual income, expenses, and savings for 13 consecutive weeks. (You may use the forms provided in the merit badge pamphlet, devise your own, or use a computer-generated version.) when complete, present the results to your merit badge counselor. To help you complete this requirement the “Basic Living Expenses” & “Personal Budget Sheet” is included at the end of this workbook. b) Compare expected income with expected expenses. 1) If expenses exceed income, determine steps to balance your budget. Determine steps to balance your budget: 2) If income exceeds expenses, state how you would use the excess money (new goal, savings). How you would use the excess money: PERSONAL MANAGEMENT WORKBOOK, PART ONE, p.4 Name 8. Demonstrate to your merit badge counselor your understanding of time management by doing the following: a) Write a “to do” list of tasks or activities, such as homework assignments, chores, and personal projects, that must be done in the coming week. List these in order of importance to you. To help you complete this requirement a “To Do” List is included at the end of this workbook. b) Make a seven-day calendar or schedule. Put in your set activities, such as school classes, sports practices or games, jobs or chores, and/or Scout or church or club meetings, then plan when you will do all the tasks from your “to do” list between your set activities. To help you complete this requirement a “Weekly Planner” is included at the end of this workbook. c) Follow the one-week schedule you planned. Keep a daily diary or journal during each of the seven days of this week’s activities, writing down when you completed each of the tasks on your “to do” list compared to when you scheduled them. To help you complete this requirement a “Daily Journal” is included at the end of this workbook. d) Review your “to do” list, one-week schedule, and diary/journal to understand when your schedule worked and when it did not work. With your merit badge counselor, discuss and understand what you learned from this requirement and what you might do differently the next time. Review and discuss what you learned: What might you do differently next time: PERSONAL MANAGEMENT WORKBOOK, PART ONE, p.5 Name 9. Prepare a written project plan demonstrating the steps below, including the desired outcome. This is a project on paper, not a real-life project. Examples could include planning a camping trip, developing a community service project or a school or religious event, or creating an annual patrol plan with additional activities not already included in the troop annual plan. Discuss your completed project plan with your merit badge counselor. a) Define the project. What is your goal? Define: Goal: b) Develop a time line for your project that shows the steps you must take from beginning to completion. Time line: c) Describe your project. Describe your project: PERSONAL MANAGEMENT WORKBOOK, PART ONE, p.6 Name 9. continued d) Develop a list of resources. Identify how these resources will help you achieve your goal. Resources: Identify how resources will help: e) If necessary, develop a budget for your project. To help you complete this requirement a “Budget Worksheet” is included at the end of this workbook. PERSONAL MANAGEMENT WORKBOOK, PART ONE, p.7 Name 10. Do the following: a) Choose a career you might want to enter after high school or college graduation. Choose a career: b) Research the limitations of your anticipated career and discuss with your merit badge counselor what you have learned about qualifications such as education, skills, and experience. Limitations of career: Career qualifications: Education: Skills: Experience: PERSONAL MANAGEMENT WORKBOOK PART TWO, CLASS CURRICULUM Name Unit # Council District Part Two of the workbook will be completed during class. 3. Discuss with your merit badge counselor FIVE of the following concepts: a) The emotions you feel when you receive money. Emotions you feel: b) Your understanding of how the amount of money you have with you affects your spending habits. How the amount of money affects your spending habits: c) Your thoughts when you buy something new and your thoughts about the same item three months later. Explain the concept of buyer’s remorse. Thoughts when buying something new and three months later: Concept of buyer’s remorse: d) How hunger affects you when shopping for food items (snacks, groceries). How hunger affects you: PERSONAL MANAGEMENT WORKBOOK, PART TWO, p.2 Name 3. continued e) Your experience of an item you have purchased after seeing or hearing advertisements for it. Did the item work as well as advertised? Your experience of an item you have purchased: Work as well as advertised: f) Your understanding of what happens when you put money into a savings account. Putting money into a savings account: g) Charitable giving. Explain its purpose and your thoughts about it. Charitable giving: h) What you can do to better manage your money. Better manage your money: PERSONAL MANAGEMENT WORKBOOK, PART TWO, p.3 Name 4. Explain the following to your merit badge counselor: a) The differences between saving and investing, including reasons for using one over the other. Differences between saving and investing: Reasons for using one over the other: b) The concepts of return on investment and risk. Concepts of return on investment and risk: c) The concepts of simple interest and compound interest and how these affected the results of your investment exercise. Concept of simple interest: Compound interest: How these affected the results of your investment exercise: PERSONAL MANAGEMENT WORKBOOK, PART TWO, p.4 Name 5. Select five publicly traded stocks from the business section of the newspaper. Explain to your merit badge counselor the importance of the following information for each stock: a) Current price Importance of current price for each stock: Stock Current Price 1 2 3 4 5 b) How much the price changed from the previous day Importance of price change from previous day: Stock How much price change from previous day 1 2 3 4 5 c) The 52-week high and the 52-week low prices Importance of 52-week high and low prices: Stock 1 2 3 4 5 52-week High 52-week Low PERSONAL MANAGEMENT WORKBOOK, PART TWO, p.5 Name 6. Pretend you have $1,000 to save, invest, and help prepare yourself for the future. Explain to your merit badge counselor the advantages or disadvantages of saving or investing in each of the following: a) Common stocks Advantages b) Mutual funds Advantages Disadvantages d) A certificate of deposit (CD) Advantages Disadvantages c) Life insurance Advantages Disadvantages Disadvantages e) A savings account or U.S. savings bond Advantages Disadvantages PERSONAL MANAGEMENT WORKBOOK, PART TWO, p.6 Name 7. Explain to your merit badge counselor the following: a) What a loan is, what interest is and how the annual percentage rate (ARP) measures the true cost of a loan. Explain what a loan is: What interest is: How the annual percentage rate (ARP) measures the true cost of a loan: b) The different ways to borrow money. Ways to borrow money: c) The differences between a charge card, debit card, and credit card. What are the costs and pitfalls of using these financial tools? Explain why it is unwise to make only the minimum payment on your credit card. Differences between: Charge card Debit card Credit card PERSONAL MANAGEMENT WORKBOOK, PART TWO, p.7 Name 7. continued d) Credit reports and how personal responsibility can affect your credit report. Explain credit reports: How personal responsibility can affect your credit report: e) Ways to reduce or eliminate debt. Explain ways to reduce or eliminate debt: PERSONAL MANAGEMENT WORKBOOK Notes APPLICATION FOR MERIT BADGE Name: Address: City: State: Is a registered Boy Scout, Varsity Scout, Venturer, of No. MERIT BADGE UNIVERISTY Merit Badge: Personal Management Counselor: Address: Overland Trails Council PO Box 1361 2808 O’Flannagan Grand Island, NE 68802-1361 Phone: 308-382-3717 Troop, team, crew, ship District: Council: email: mbuotc@yahoo.com and is qualified to begin working for this merit badge and has completed the following pre-requisite requirements: PRE-REQUISITE REQUIREMENTS Requirement No. and letter Date of Approval Counselor Initial 1 2 8 9 Requirement No. and letter Date of Approval Counselor Initial 10 The applicant has personally appeared before me and demonstrated to my satisfaction that he has met all prerequisites requirements for the above stated merit badge and is ready to attend his assigned MBU class. Signature of Unit Leader APPLICANTS RECORD Requirement No. and letter Date of Approval Date Counselor Initial Requirement No. and letter Date of Approval Counselor Initial 3 4 5 6 7 The applicant has personally appeared before me and demonstrated to my satisfaction that he has completed all requirements above for the Merit Badge: Personal Management Name of Counselor: Signature of Counselor Date SCOUT INSTRUCTIONS Complete your name, address, city, unit type & number, district, & council on the Application for Merit Badge. Your unit leader must sign the Application for Merit Badge before attending class. All other information is already printed on the Application for Merit Badge; please make sure all information is correct. The merit badge counselor is registered & approved for this merit badge and is on the MBU Counselor’s List. Read the merit badge pamphlet. Attend the merit badge class. Always meet with your counselor along with a buddy (a Scout, friend, or parent) Have your merit badge worksheet with you when you attend class. If the merit badge pre-requisites are not completed before class, you will not be able to complete the merit badge during this weekend event, you will have to follow up with your Unit’s Advancement Chair when you return home PLEASE BE AWARE THAT SOME COUNSELORS WILL NOT ALLOW YOU TO ATTEND THEIR CLASS WITHOUT PRE-REQUISITES COMPLETED—CLASS CURRICULUM IS DEPENDENT ON PRE-REQUISITE WORK BEING COMPLETED! COUNSELOR INSTRUCTIONS Never meet alone with a Scout. Verify all information & merit badge name on Application for Merit Badge is correct. Sign your name on the line at the bottom of “SECTION B APPLICANTS RECORD”. Name Income Week 1 Planned Actual Week 2 Planned Actual Week 3 Planned Actual Week 4 Planned Actual Week 5 Planned Actual Week 6 Planned Actual Week 7 Planned Actual Week 5 Planned Actual Week 6 Planned Actual Week 7 Planned Actual Allowance Job Gifts Other Totals Expenses Week 1 Planned Actual Savings Hobbies Scout Expenses Snacks Gifts Entertainment Miscellaneous Totals Week 2 Planned Actual Week 3 Planned Actual Week 4 Planned Actual Name Income Week 8 Planned Actual Week 9 Planned Actual Week 10 Planned Actual Week 11 Planned Actual Week 12 Planned Actual Week 13 Planned Actual Total Planned Actual Week 12 Planned Actual Week 13 Planned Actual Total Planned Actual Allowance Job Gifts Other Totals Expenses Week 8 Planned Actual Week 9 Planned Actual Week 10 Planned Actual Week 11 Planned Actual Savings Hobbies Scout Expenses Snacks Gifts Entertainment Miscellaneous Totals Personal Management Merit Badge Pamphlet, Boy Scouts of America, 2009 Printing Basic Living Expenses Name: Expense Savings Rent Groceries Eating out Utilities Telephone Personal grooming Car/transportation (gas, license, parking, Bus fare, insurance, maintenance) Clothing/laundry Insurance Medical care Charities Entertainment (cable TV, movies, dating) CDs, DVDs, video games, etc. Recreation Sports/hobbies Vacations Books, magazines Gifts Miscellaneous (items not covered by Other categories) Total monthly expenses Amount $ $ $ Personal Management Merit Badge Pamphlet, Boy Scouts of America, 2009 Printing PROJECT BUDGET Name of Project: Budget Prepared By: Date: INCOME Total Income (net) Loan Donations Fundraising Other Frequency Amount Total Total Income EXPENSES Expenses/Spending Amount Rental Fees Transportation Insurance Meals/Food Meals/Food Admission Fees/Park Permits Other Total Expenses Total “To Do” List Name: 1 2 3 4 5 6 7 8 9 10 Week of: Notes Weekly Planner Name: Set Activities: Week of: To do list: Set Activities: To do list: Set Activities: To do list: Set Activities: To do list: Set Activities: To do list: Set Activities: To do list: Set Activities: To do list: Daily Journal Name: Date: Tasks completed from your “to do” list: Tasks completed from your “to do” list: Tasks completed from your “to do” list: Tasks completed from your “to do” list: Continued Tasks completed from your “to do” list: Tasks completed from your “to do” list: Tasks completed from your “to do” list: