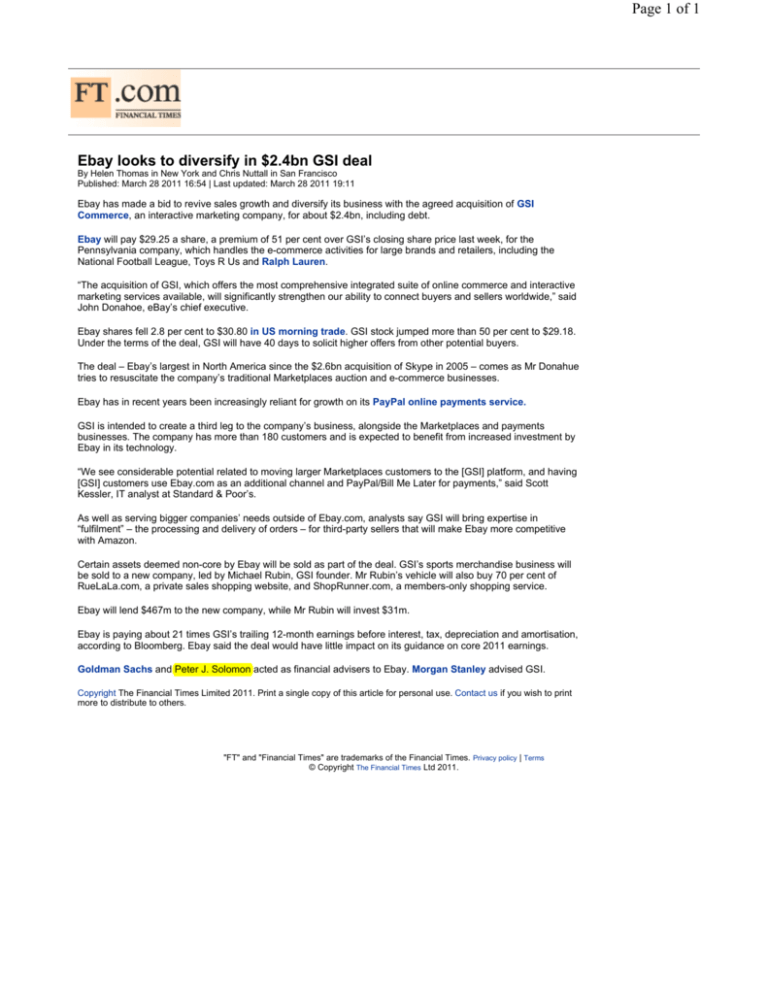

Ebay looks to diversify in $2.4bn GSI deal

advertisement

Page 1 of 1 Ebay looks to diversify in $2.4bn GSI deal By Helen Thomas in New York and Chris Nuttall in San Francisco Published: March 28 2011 16:54 | Last updated: March 28 2011 19:11 Ebay has made a bid to revive sales growth and diversify its business with the agreed acquisition of GSI Commerce, an interactive marketing company, for about $2.4bn, including debt. Ebay will pay $29.25 a share, a premium of 51 per cent over GSI’s closing share price last week, for the Pennsylvania company, which handles the e-commerce activities for large brands and retailers, including the National Football League, Toys R Us and Ralph Lauren. “The acquisition of GSI, which offers the most comprehensive integrated suite of online commerce and interactive marketing services available, will significantly strengthen our ability to connect buyers and sellers worldwide,” said John Donahoe, eBay’s chief executive. Ebay shares fell 2.8 per cent to $30.80 in US morning trade. GSI stock jumped more than 50 per cent to $29.18. Under the terms of the deal, GSI will have 40 days to solicit higher offers from other potential buyers. The deal – Ebay’s largest in North America since the $2.6bn acquisition of Skype in 2005 – comes as Mr Donahue tries to resuscitate the company’s traditional Marketplaces auction and e-commerce businesses. Ebay has in recent years been increasingly reliant for growth on its PayPal online payments service. GSI is intended to create a third leg to the company’s business, alongside the Marketplaces and payments businesses. The company has more than 180 customers and is expected to benefit from increased investment by Ebay in its technology. “We see considerable potential related to moving larger Marketplaces customers to the [GSI] platform, and having [GSI] customers use Ebay.com as an additional channel and PayPal/Bill Me Later for payments,” said Scott Kessler, IT analyst at Standard & Poor’s. As well as serving bigger companies’ needs outside of Ebay.com, analysts say GSI will bring expertise in “fulfilment” – the processing and delivery of orders – for third-party sellers that will make Ebay more competitive with Amazon. Certain assets deemed non-core by Ebay will be sold as part of the deal. GSI’s sports merchandise business will be sold to a new company, led by Michael Rubin, GSI founder. Mr Rubin’s vehicle will also buy 70 per cent of RueLaLa.com, a private sales shopping website, and ShopRunner.com, a members-only shopping service. Ebay will lend $467m to the new company, while Mr Rubin will invest $31m. Ebay is paying about 21 times GSI’s trailing 12-month earnings before interest, tax, depreciation and amortisation, according to Bloomberg. Ebay said the deal would have little impact on its guidance on core 2011 earnings. Goldman Sachs and Peter J. Solomon acted as financial advisers to Ebay. Morgan Stanley advised GSI. Copyright The Financial Times Limited 2011. Print a single copy of this article for personal use. Contact us if you wish to print more to distribute to others. "FT" and "Financial Times" are trademarks of the Financial Times. Privacy policy | Terms © Copyright The Financial Times Ltd 2011.