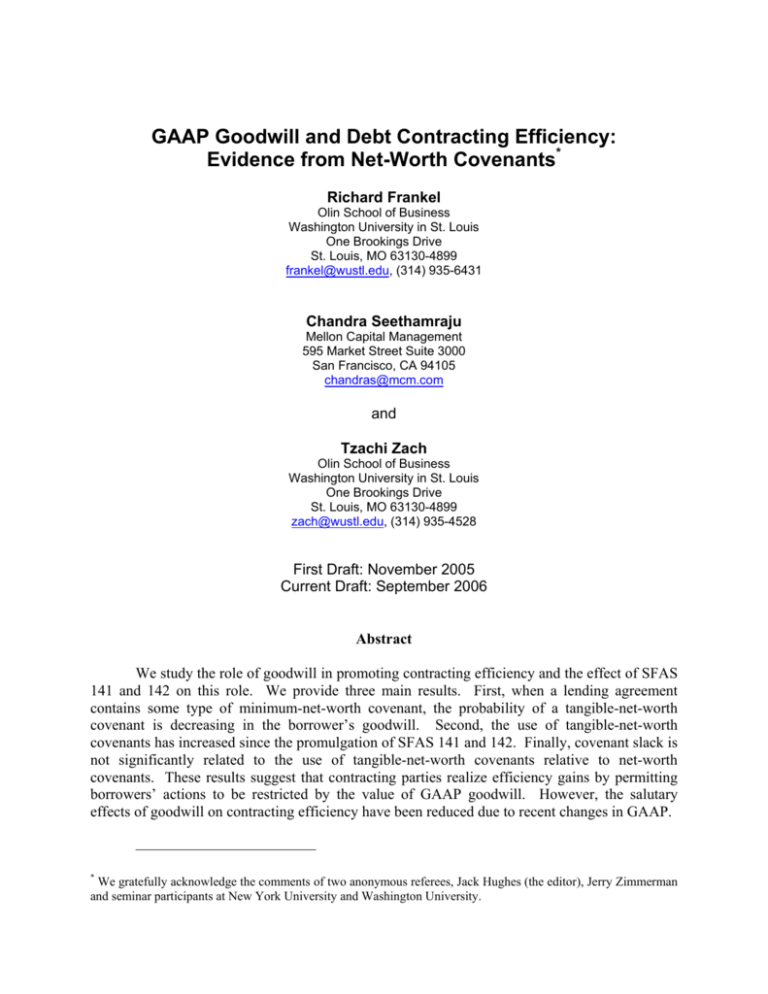

Evidence from Net-Worth Covenants

advertisement