Function Regression Project In this project you will research the

advertisement

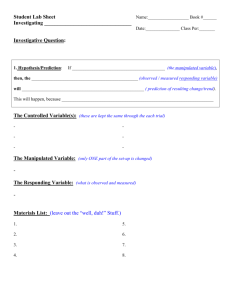

Name:________________________ Period: ____ Function Regression Project In this project you will research the stock price for a company throughout 2012. You will graph the prices and develop an equation that best fits the data. From this equation you will predict the price of the company’s stock on December 1. After December 1, you will compare your prediction to the actual stock price and write a one-page essay of what you feel influenced the stock’s price changes over the year. Step One Develop a list of three choices for a company that you are interested in for this project. Think about products that you buy and the companies that own the products. You can Google a product and find the company that owns it. For example, if you like Cheerios cereal, you can Google “Who owns cheerios” and will find that General Mills owns Cheerios. Not all companies are public and sell stock. So you will have to look up companies and their stock symbols together to narrow down your list. Along with the three company names, you need to find the companies’ stock symbols. Go to Mrs. Milleson’s web page on the JHS website – click Algebra II and under Stock Project select Yahoo Finance Website (finance.yahoo.com). Enter the company name in the Get Quotes box at the top of the window. Please choose a company on the NYSE (New York Stock Exchange) or NASDAQ (National Association of Securities Dealers Automated Quotations). You will see either NYSE or NASDAQ to the right of the company name and stock symbol in the list from the Get Quotes box. List your three company choices (full names) and their stock symbols in your order of preference. Submit them on Mrs. Milleson with the Enter Choices for Company link under Stock Project on the Algebra II page of Mrs. Milleson’s web page on the JHS website. Choices must be submitted by Friday, October 12 at 3pm. Mrs. Milleson will compile the list and let you know which company you will use for your project on Monday, October 15. Record the company name and stock symbol on the Stock Information sheet. Step Two Research stock prices for your company over the last year and record them in the chart on the Stock Information sheet. Be consistent in finding the prices, for example, chose the first business day of each month and record the price. Stock prices can be found at finance.yahoo.com or Yahoo Finance Website on Mrs. Milleson’s web page on the JHS website on the Algebra II page under Stock Project Enter your company’s stock symbol in the Get Quote box. Click Get Quotes. Click Historical Prices on the left. In the Set Date Range section you can select the time frame you are researching o Start Date: January 1, 2012 to End Date: October 7, 2012. o Select Monthly. o Click Get Prices. o Use the stock price in the Close column. That is the price the stock was at the end of the business day on the specific date. Enter your stock price information in the chart on the Stock Information sheet. Name:________________________ Period: ____ Step Three Graph your stock price data as a scatter plot. Decide what scale to use for your y-axis (stock price). You may use the attached Stock Price Graph or Microsoft Excel. Decide if your data follows a linear, quadratic or exponential trend. (You may need/choose to use a section of your data as opposed to all of the data if some data points are outliers. Use a minimum of six data points when finding your regression function.) Enter the data for the points you want to use for your regression function in your calculator per the Function Regression instructions and create an equation (regression function) for your data. Graph this regression function on your graph (either manually or using Excel). Use the regression function to predict the price of your company’s stock on December 1, 2012. Record your prediction on the Stock Information sheet. Part I (Stock Information sheet, scatter plot of prices, graph of regression function and prediction price) of the Project is Due Friday, October 26, 2012 at the beginning of class. Step Four On November 28, you will get your Stock Information sheet back. At the end of the day on November 30 (since December 1 is on a Saturday) you will check your company’s stock price and record it on the Stock Information Sheet. Write a one to two-page, typed and double-spaced essay detailing the following: 1st paragraph: Introduce your company, it’s stock symbol, its products and why you chose it. 2nd paragraph: Explain why you chose the type of function you used for the regression function and state your regression function. State your prediction and the actual price of the stock on December 1 and how you came up with that prediction. Explain if you think your prediction was close to or way off the actual stock price for December 1. 3rd paragraph: Describe some general factors that influence the stock market. Describe what factors influence your stock price and if they had a positive or negative effect on your prediction. 4th paragraph: Conclude with an explanation of whether you would purchase this stock or not. Final Essay Due: Friday, December 7, 2012 at the beginning of class. Name:________________________ Period: ____ Company: Stock Symbol: Exchange: NYSE or NASDAQ circle one Stock Prices at close of business on the first day of the month, 2012. Month Jan (1) Feb (2) Mar (3) Apr (4) May (5) Jun (6) Jul (7) Aug (8) Sept (9) Oct (10) The data looks like a Price linear / quadratic / exponential curve. circle one Regression Function: Prediction of stock price at close of business on December 1, 2012: Stock Information sheet and graph are due Friday, October 26 at the beginning of class. TO BE COMPLETED AFTER November 30, 2012 Actual stock price at close of business on December 1, 2012: *Attach a separate sheet for essay analysis of your prediction vs. the actual price and what influences the stock prices. Stock Information sheet with actual stock price and essay due Friday, December 7, 2012 at the beginning of class. Name:________________________ Period: ____ Company: Stock Symbol: Exchange: NYSE or NASDAQ circle one Stock Prices Jan Feb Mar Apr May Jun Jul Aug Sep Oct Name:________________________ Period: ____ Total Points 48-41 40-31 30-21 20-11 10-0 Stock Analysis Function Regression Project Grading RUBRIC CATEGORY/ POINTS 8 6 4 2 Company Choices Three company choices submitted electronically or on paper by due date. Three company choices submitted electronically or on paper within three days of due date. Company choices incomplete (less than three) but submitted electronically or on paper within three days of due date. Company choices incomplete (less than three) and/or submitted four or more days after due date. Data Collection Data collected is accurate and complete. Data collected is accurate but incomplete. Prediction Equation Price axis scale is consistent. All data points are plotted correctly. Function choice fits the data well. Prediction equation is graphed correctly. Price axis scale is inconsistent. All data points are plotted correctly. Function choice fits the data well. Prediction equation is graphed incorrectly. Data collected is inaccurate but complete. Price axis scale is inconsistent. Most data points are plotted correctly. Function choice does not fit the data. Prediction equation is graphed correctly. Data collected is inaccurate and incomplete. Price axis scale is inconsistent. Most data points are not plotted correctly. Function choice does not fit the data. Prediction equation is graphed incorrectly. Prediction Price Prediction price is correctly calculated. Prediction price is incorrectly calculated. Essay is not typed, double-spaced and/or either less than 1 page or over 2 pages long. Information from two of the paragraphs is either missing or incomplete. Company, stock symbol, products and why you chose it. Why you chose the type of regression function, state the regression function, your prediction and actual price for Dec. 1 – describe how you calculated the prediction. Explanation why prediction was close/away from actual price. General factors that influence the stock market - factors that influence your stock price (positive or negative effect on your prediction) Explain why you would or would not purchase this stock Essay is not typed, double-spaced and/or either less than 1 page or over 2 pages long. Information from three of the paragraphs is either missing or incomplete. Company, stock symbol, products and why you chose it. Why you chose the type of regression function, state the regression function, your prediction and actual price for Dec. 1 – describe how you calculated the prediction. Explanation why prediction was close/away from actual price. General factors that influence the stock market - factors that influence your stock price (positive or negative effect on your prediction) Explain why you would or would not purchase this stock Accuracy of Plot Analysis Essay Essay is typed, double-spaced and between 1 and 2 pages long. The following is contained in the four paragraphs: Company, stock symbol, products and why you chose it. Why you chose the type of regression function, state the regression function, your prediction and actual price for Dec. 1 – describe how you calculated the prediction. Explanation why prediction was close/away from actual price. General factors that influence the stock market - factors that influence your stock price (positive or negative effect on your prediction) Explain why you would or would not purchase this stock Essay is not typed, double-spaced and/or either less than 1 page or over 2 pages long. Information from one of the paragraphs is either missing or incomplete. Company, stock symbol, products and why you chose it. Why you chose the type of regression function, state the regression function, your prediction and actual price for Dec. 1 – describe how you calculated the prediction. Explanation why prediction was close/away from actual price. General factors that influence the stock market - factors that influence your stock price (positive or negative effect on your prediction) Explain why you would or would not purchase this stock Grade A B C D F Final Grade 1 Company choices never submitted. Data was not collected. Graph was not completed. Prediction equation was not calculated or graphed. Prediction price is missing. Essay is missing or is not typed, double-spaced and/or either less than 1 page or over 2 pages long. Information from all of the paragraphs is either missing or incomplete. Company, stock symbol, products and why you chose it. Why you chose the type of regression function, state the regression function, your prediction and actual price for Dec. 1 – describe how you calculated the prediction. Explanation why prediction was close/away from actual price. General factors that influence the stock market - factors that influence your stock price (positive or negative effect on your prediction) Explain why you would or would not purchase this stock Name:________________________ Period: ____