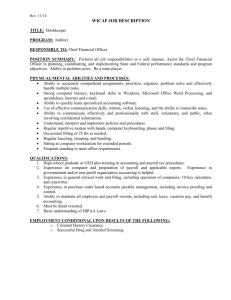

Payroll - Help Centers

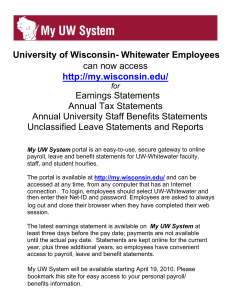

advertisement