i

CRAFTING AND EXECUTING AN OPERATIONAL

STRATEGIC PLAN FOR A RETAIL PRODUCT LINE

Bradley Collins

Research report

presented in partial fulfilment

of the requirements for the degree of

Master of Business Administration

at the University of Stellenbosch

Supervisor: Professor Marius Ungerer

Degree of confidentiality: A

March 2009

ii

DECLARATION

By submitting this research report electronically, I declare that the entirety of the work

contained therein is my own, original work, that I am the owner of the copyright thereof

(unless to the extent explicitly otherwise stated) and that I have not previously in its entirety or

in part submitted it for obtaining any qualification.

_____________________________

B.J. Collins

31 January 2009

Copyright © 2008 Stellenbosch University

All rights reserved

iii

ACKNOWLEDGEMENTS

I would like to express my sincere thanks to everyone who assisted me in successfully

completing this research.

I would especially like to thank my wife and daughter for their support, assistance and patience.

Also, thanks to my parents, for their constant encouragement during the course of my studies. I

would also like to thank my sister, for her kind contribution.

My sincere thanks and gratitude to Professor Marius Ungerer, for his guidance and assistance.

Finally to God, for His strength.

iv

ABSTRACT

The following research report is titled “Crafting and executing an operational strategic plan for a

retail product line”. The report presents operational analysis which results in creating

operational strategy which is relevant to current trading conditions and which is clearly aligned

with both the organisation’s group and corporate strategic goals. The primary focus is therefore

not on the development of organisational strategy, but on strategic implications, interpretation

and operational execution.

The central research question is described as follows:

How can the current operational strategic planning process be improved in order to deliver

strategic plans which are aligned and clearly support the key strategic thrusts at group and

corporate level?

A literature study was conducted by consulting a vast number of books, articles and websites in

order to gain a comprehensive understanding of the latest management thinking pertaining to

the creation and implementation of strategy. Primary research, which took the form of informal

interviews with key personnel, was also conducted in order to ascertain the opinions and

insights of individuals who are directly affected by the operational strategic process.

The research resulted in a one year operational strategic framework which can be used as a

tool by all central buying teams when creating operational strategic plans. The framework

allows teams to follow a standardised process which results in concise summary populated with

key strategic points. Teams are thus guided by these points and are also prompted to

corrective action by ensuring that each strategic action has a measurable outcome. The

framework is also populated with group and corporate goals, which act as guiding principles to

team members.

v

The final recommendation is that teams allow for a degree of flexibility in the operational

strategic actions which were identified in their initial analysis. While key strategic points at group

and corporate level will most likely remain unchanged during the course of a financial year,

certain operational activities may have to be reconsidered should the micro and macro trading

environment change.

vi

OPSOMMING

Die titel van die volgende navorsingverslag is: “Crafting and executing an operational plan for a

retail product line”. Die verslag is ‘n weergawe van ‘n bedryfsontleding wat lei tot die ontwerp

van ‘n bedryfs-strategie wat van toepassing is op die huidige handelsmilieu. Die strategie is

verder in lyn met beide die organisasie se groep en korparatiewe doelwitte. Die verslag fokus

hoofsaaklik op strategiese implikasies, interpretasie en operasionele uitvoering en nie op

strategiese ontwikkeling nie.

Die sentrale navorsingskwessie word soos volg beskryf:

Watter verbeterings kan aangebring word aan die huidige bedryfs-strategiese beplannings

proses om sodoende strategiese planne op te lewer wat in lyn sal wees en ondersteuning sal

gee aan die sleutel strategiese dryfkrag op groep en korporatiewe vlak.

‘n Aantal sekondêre bronne –boeke,artikels and webwerwe- is nageslaan en ‘n letterkundige

studie is gedoen om ‘n omvattende begrip te kry van die nuutste bestuursdenke met betrekking

tot die ontwerp en implementering van strategie. Onderhoude is gevoer met sleutel personeel

wat gedien het as primere bronne. Sodoende is die opinies en insigte verkry van individue wat

direk betrokke is by die bedryfs-strategiese proses.

Die ondersoek het as gevolg ‘n bedryfs-strategiese raamwerk. Dit kan as instrument gebruik

word

deur alle sentrale aanskaffingspanne wanneer hulle bedryfs-strategiese planne

ontwerp.Die raamwerk maak voorsiening vir ‘n gestandardiseerde proses wat kulmineer in ‘n

een-bladsy opsomming wat strategiese punte bevat. Die opsomming gee dus rigting aan

spanne en hulle word aangespoor tot korrektiewe aksies elk met meetbare uitkomstes. Die

raamwerk bevat ook groeps- en korporatiewe doelwitte wat deur spanne as riglyne gebruik kan

word.

vii

‘n Finale voorstel is dat spanne voorsiening maak vir ‘n mate van plooibaarheid in die bedryfsstrategiese aksies wat aanvanklik in hul ontledings geidentifiseer was.Sekere strategiese punte

sal waarskynlik op groep en korporatiewe vlak onveranderd bly na afloop van die finansieele

jaar terwyl sekere bedryfsaktiwiteite heroorweeg sal moet word na gelang van veranderinge in

die mikro en makro handelsmileu.

viii

TABLE OF CONTENTS

Page

Declaration.....................................................................................................................................ii

Acknowledgements ...................................................................................................................... iii

Abstract .........................................................................................................................................iv

Opsomming ..................................................................................................................................vi

List of tables................................................................................................................................. xii

List of figures .............................................................................................................................. xiii

List of appendices ....................................................................................................................... xiv

List of abbreviations and acronyms ............................................................................................ xv

CHAPTER ONE: INTRODUCTION AND STATEMENT OF THE PROBLEM .......................... 1

1.1

Introduction ...................................................................................................................... 1

1.2

Statement of the problem and research question ........................................................... 3

1.3

Assumptions and delimitations ........................................................................................ 4

1.4

Subsequent chapters of the report .................................................................................. 7

CHAPTER TWO: RESEARCH DESIGN AND METHODOLOGY ............................................. 9

2.1

Introduction ...................................................................................................................... 9

2.2

Primary data .................................................................................................................. 11

2.3

Secondary data ............................................................................................................. 13

2.4

Conclusion ..................................................................................................................... 13

ix

Page

CHAPTER 3: REVIEW OF RELATED LITERATURE ............................................................. 14

3.1

Introduction .................................................................................................................... 14

3.2

A definition of strategy ................................................................................................... 14

3.3

Levels of strategy .......................................................................................................... 16

3.4

The benefits and risks of strategic planning .................................................................. 18

3.5

The steps in the strategic planning process .................................................................. 20

3.5.1

Developing a strategic vision ......................................................................................... 20

3.5.2

Setting objectives .......................................................................................................... 22

3.5.3

Crafting strategy to achieve the objectives and vision .................................................. 24

3.5.3.1 Porter’s five forces ......................................................................................................... 26

3.5.3.2 SWOT analysis .............................................................................................................. 32

3.5.3.3 Ansoff’s product/market mix .......................................................................................... 34

3.5.4

Strategic implementation ............................................................................................... 37

3.5.5

Initiating corrective action .............................................................................................. 42

3.6

Strategic alignment ........................................................................................................ 43

3.7

Conclusion ..................................................................................................................... 44

CHAPTER 4:

CRAFTING AND EXECUTING AN OPERATIONAL STRATEGIC PLAN

FOR LONG LIFE DAIRY ................................................................................. 45

4.1

Introduction .................................................................................................................... 45

4.2

Summary of information obtained from interviews ........................................................ 45

4.3

The operational strategic framework and strategic planning process........................... 48

4.3.1

The operational strategic framework ............................................................................. 48

4.3.2

The operational strategic planning process .................................................................. 49

4.4

Operational strategic analysis ....................................................................................... 52

4.4.1

Porter’s five forces ......................................................................................................... 52

4.4.2

Ansoff’s product/market matrix ...................................................................................... 61

4.4.3

Analysis of internal reports ............................................................................................ 63

x

Page

4.4.4

SWOT analysis for Long Life Dairy ............................................................................... 64

4.4.5

Summary of strategic action points from Ansoff, SWOT and internal reports .............. 65

4.4.5.1 Marketing and sales ...................................................................................................... 65

4.4.5.2 Product features ............................................................................................................ 65

4.4.5.3 Staff competence building ............................................................................................. 65

4.4.5.4 Supply chain and product display ................................................................................. 65

4.5

Populate the operational strategic framework ............................................................... 66

4.6

Conclusions and recommendations .............................................................................. 69

CHAPTER 5:

IMPLEMENTING THE OPERATIONAL STRATEGIC FRAMEWORK

IN TWO OTHER DEPARTMENTS .................................................................. 70

5.1

Introduction .................................................................................................................... 70

5.2

Operational strategic analysis for Organic Dairy ........................................................... 70

5.2.1

Porter’s five forces ......................................................................................................... 70

5.2.2

Ansoff’s product/market matrix for Organic Dairy ......................................................... 78

5.2.3

Analysis of internal reports for Organic Dairy ................................................................ 79

5.2.4

SWOT analysis for Organic Dairy ................................................................................. 80

5.2.5

Summary of strategic action points from Ansoff, SWOT and internal reports .............. 81

5.2.5.1 Marketing and sales ...................................................................................................... 81

5.2.5.2 Product features ............................................................................................................ 81

5.2.5.3 Staff competence building ............................................................................................. 81

5.2.5.4 Supply chain and product display ................................................................................. 82

5.2.6

Populate the operational strategic framework for Organic Dairy .................................. 82

5.3

Operational strategic analysis for Short Life Dairy ........................................................ 85

5.3.1

Porter’s five forces for Short Life Dairy.......................................................................... 85

5.3.2

Ansoff’s product/market matrix for Short Life Dairy....................................................... 93

5.3.3

Analysis of internal reports for Short Life Dairy ............................................................. 94

5.3.4

SWOT analysis for Short Life Dairy............................................................................... 96

xi

Page

5.3.5

Summary of strategic action points from Ansoff, SWOT and internal reports .............. 97

5.3.5.1 Marketing and sales ...................................................................................................... 97

5.3.5.2 Product features ............................................................................................................ 97

5.3.5.3 Staff competence building ............................................................................................. 97

5.3.5.4 Supply chain and product display ................................................................................. 97

5.3.6

Populate the operational strategic framework for Short Life Dairy ............................... 98

5.4

Conclusion…………………………………………………………………………………..100

CHAPTER 6:

SUMMARY, CONCLUSIONS AND RECCOMMENDATIONS ..................... 101

6.1

Summary and conclusions ............................................................................................ 101

6.2

Recommendations ......................................................................................................... 102

LIST OF SOURCES ................................................................................................................. 104

APPENDICES .......................................................................................................................... 108

xii

LIST OF TABLES

Page

Table 1.1:

List of Long Life Dairy subclasses...................................................................... 6

Table 2.1:

List of employees interviewed .......................................................................... 11

Table 3.1:

Financial versus strategic objectives ................................................................ 24

Table 3.2:

What to look for in identifying a company’s strengths, weaknesses,

opportunities and threats .................................................................................. 33

Table 4.1:

Summary of responses from employees interviewed ...................................... 46

Table 4.2:

Ansoff’s product/market matrix for Long Life Dairy .......................................... 62

Table 4.3:

Summary of key financial indicators for Long Life Dairy .................................. 63

Table 4.4:

The operational strategic framework for Long Life Dairy 2009/2010 ............... 67

Table 5.1:

Ansoff’s product/market matrix for Organic Dairy ............................................ 79

Table 5.2:

Summary of financial indicators for Organic Dairy ........................................... 80

Table 5.3:

The operational strategic framework for Organic Dairy 2009/2010 ................. 83

Table 5.4:

Ansoff’s product/market matrix for Short Life Dairy ......................................... 94

Table 5.5:

Summary of key financial indicators for Short Life Dairy ................................. 95

Table 5.6:

The operational strategic framework for Short Life Dairy 2009/2010 .............. 98

xiii

LIST OF FIGURES

Page

Figure 1.1:

Trend cycle of retail trade sales (at constant 2000) prices ................................ 1

Figure 1.2:

The firm’s product hierarchy ............................................................................... 5

Figure 3.1:

A company’s strategy making hierarchy .......................................................... 17

Figure 3.2:

The strategy-making, strategy-executing process ........................................ 21

Figure 3.3:

The components of a company’s microenvironment ....................................... 25

Figure 3.4:

Porter’s five forces model ................................................................................. 27

Figure 3.5:

The relationship between SWOT and the environmental analysis ................. 32

Figure 3.6:

The Ansoff product/market matrix .................................................................... 35

Figure 4.1:

The operational strategic planning process .................................................... 51

Figure 4.2:

Porter’s five forces of competitive position for Long Life Dairy ........................ 60

Figure 5.1:

Porter’s five forces of competitive position for Organic Dairy .......................... 77

Figure 5.2:

Porter’s five forces of competitive position for Short Life Dairy........................ 92

xiv

LIST OF APPENDICES

Page

Appendix A:

Questions used in the informal interviews...................................................... 108

xv

LIST OF ABBREVIATIONS AND ACRONYMS

BEE

:

black economic empowerment

CEO

:

chief executive officer

KPI

:

key performance indicator

QC

:

quality control

SWOT

:

strengths, weaknesses, opportunities and threats

1

CHAPTER 1

INTRODUCTION AND STATEMENT OF THE PROBLEM

1.1

INTRODUCTION

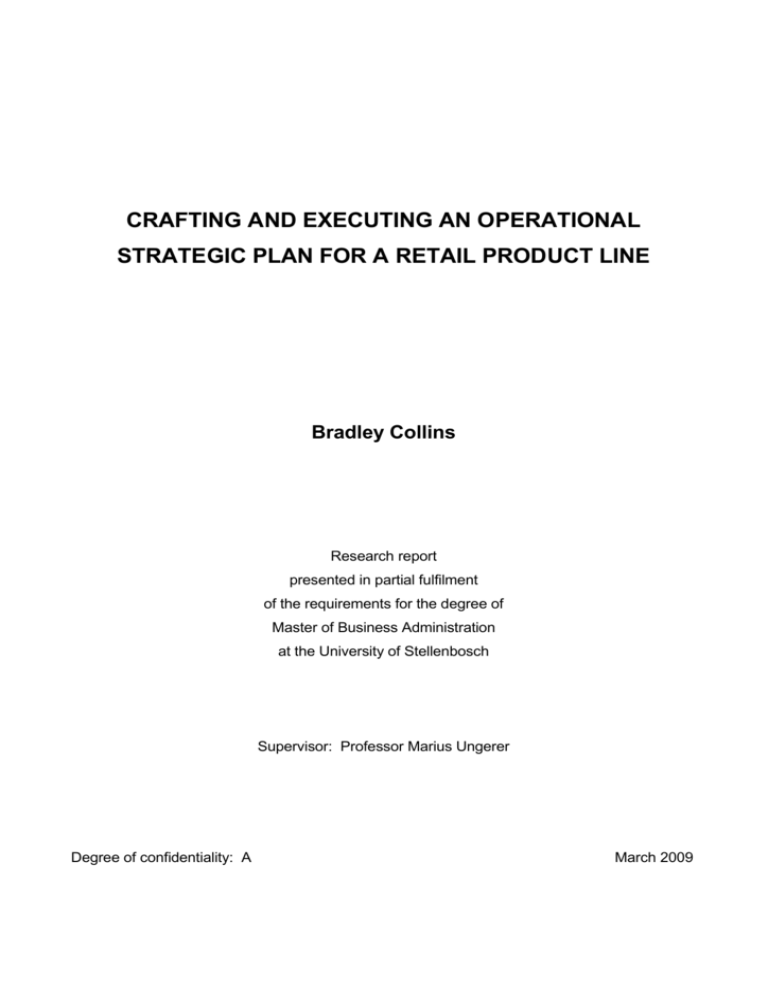

The period 2004 to mid 2007 was categorised by excellent growth for the retail industry in

South Africa. Figure 1.1 indicates the upward trend experienced in the sector during this time

frame. During this period disposable income was less affected by inflationary prices and

spiralling interest rates.

Figure 1.1: Trend cycle of retail trade sales (at constant 2000) prices

Source: Statistics South Africa retail trade sales, 2008: 4

2

In May 2008, Statistics SA released retail trade sales data showing a decrease of 3.6% for May

2008 to May 2007. The figures showed a decline of 0.4% for the first five months of 2008

versus 2007, while the growth for the same period of 2007 versus 2006 was almost 9%. The

poor sales environment has resulted in retailers intensifying their efforts to grow market share

by modifying their offers most notably in terms of price on key value items. Retailers do this in

order to attract customers in a sustained manner.

The strategy adopted by the retailer is vital for attracting new and current customers. “A retail

strategy describes the comprehensive plan that a retailer follows to differentiate itself from

competitors and to create and deliver value to its customers. To arrive at this comprehensive or

strategic retail plan, the retailer must embark on a process of strategic planning” (Terblanche,

1998:84-85).

Strategic planning allows the retailer to better understand the threats and

opportunities in its environment. The resultant strategic plan enables the retailer to achieve a

strategic fit between the retailer’s present and future capabilities and the present and future

opportunities.

The focus of this research will be to develop an operational strategic planning framework which

can be utilised by the trading departments in the foods group of a large retail concern. The

framework is designed in a manner which makes it simple and clear for trading departments to

craft and execute a strategic plan which is linked to, and clearly supports the broader group and

corporate strategic goals. The current strategic planning process at this level is not inadequate,

as it does deliver success for the business. However, the latest management thinking is often

not incorporated into the strategic decisions and also a uniform approach is not used across the

entire trading group. This results in various strategies being presented which are often not

aligned with the overriding strategy of the group and corporate entity.

The framework will incorporate tools and processes based on sound theoretical principles and

the latest management thinking, as well as information gleaned from interviews with key

3

stakeholders in the organisation. The strategy framework must provide an operational strategy

which is executable and measurable, and which provides sound guidelines for the buying

teams to consider when making decisions during the course of the year.

1.2

STATEMENT OF THE PROBLEM AND RESEARCH QUESTION

The strategic plans which are formulated at department level in the foods group of a major

retailer are not aligned with the group and corporate strategy. The primary reason for this is

that each department formulates their plan using a different process, and it is often done

without consulting the broader strategic objectives at group and corporate level. Senior

management often criticises these plans which result in teams having to go back to the drawing

board and therefore spending a large amount of precious time reworking the document.

“Competition occurs at business unit level. Diversified companies do not compete; only their

business units do. Unless a corporate strategy places primary attention on nurturing the

success of each unit, the strategy will fail, no matter how elegantly constructed” (Porter, 2001:

46). A direct relationship therefore exists between corporate, group and business unit strategic

plans which emphasises the importance of having these plans aligned.

The research conducted will result in a framework which can be used to formulate strategy

across the foods group at department level. The framework will provide central buying teams

with the tools to conduct strategic analysis, formulate strategic plans which are relevant and

which will enable the foods group to continue to prosper well into the future. The primary focus

is therefore not on the development of strategy, but on strategic implications, interpretation and

operational execution.

The central research question can be summarised as follows:

4

How can the current operational strategic planning process be improved in order to

deliver strategic plans which are aligned and clearly support the key strategic thrusts at

group and corporate level?

1.3

ASSUMPTIONS AND DELIMITATIONS

The report does not attempt to cover all the theory on strategy. Certain theories may be

adapted to best suit the nature of the business for which a strategic framework is being

developed.

The report also assumes that the current business environment is flexible enough to conduct

this type of research as a means toward improving current business processes.

The research is being conducted by an internal employee with access to company data, as well

as the support of management.

The research occurs at department level of the foods group. The group product hierarchy in

Figure 1.2 depicts the different levels in the organisation. Strategy formulation occurs at each

level and it is important that the guiding principles are reflected in the detail of the strategic

initiatives at each of these levels.

5

Corporate

Clothing, home, beauty,

connect

Foods Group

Produce & horticulture

Sales & new stores, communication,

space & range, store

Speciality, wine, beverages &

impulse

Prepared, deli, bakery, dessert &

frozens

Grocery & non-foods

Meat, poultry, seafood & dairy

Meat, poultry, seafood

Organic Dairy

Short Life Dairy

Figure 1.2: Foods product hierarchy

Long Life Dairy

6

Table 1.1 shows a list of subclasses which constitute the Long Life Dairy department. These

are used to classify products in reporting and display. Long Life Dairy is highlighted, because

the development of the operational strategic framework baseline was done in this department.

Table 1.1: List of Long Life Dairy subclasses

Department

Long Life Dairy

Subclass

Gouda

Subclass

Cheddar

Subclass

Mature cheddar

Subclass

White cheese

Subclass

Feta

Subclass

Cream cheese

Subclass

Cottage cheese

Subclass

Fresh cheese

Subclass

Speciality hard cheese

Subclass

Speciality semi hard cheese

Subclass

Speciality soft cheese

Subclass

Speciality blue cheese

7

1.4

SUBSEQUENT CHAPTERS OF THE REPORT

Chapter Two: Research design and methodology

This chapter outlines the design and methodological approach to this research report, using

primary and secondary research techniques.

Chapter Three: Review of related literature

This chapter reviews relevant literature on crafting and executing strategy. The literature

reviewed was obtained from books, journals, articles and websites. It defines strategy in more

detail and also describes key processes and concepts required for producing an excellent

strategic plan.

Chapter Four: The development of an operational strategic plan

Chapter four involves developing the framework for crafting and implementing strategy while

simultaneously populating the framework with an actual plan for a specific department. All the

required analysis and interpretation will be conducted in this chapter.

Chapter Five:

Practical utilisation of the operational strategic framework in two other

departments

In order to provide validity to the report, two other departments within the foods group were

selected. The departments are Short Life Dairy and Organic Dairy, and are at the same level in

8

the hierarchy as Long Life Dairy. The framework was applied to these two departments in order

to show the applicability of the proposed framework.

Chapter Six: Summary, conclusions and recommendations

This chapter concludes the research report with a summary of the key findings encountered

from the research. Also presented here are conclusions and recommendations based on the

research that was done.

9

CHAPTER 2

RESEARCH DESIGN AND METHOGOLOGY

2.1

INTRODUCTION

Research design refers to the outline, plan or strategy that specifies the procedure that will be

used in seeking an answer to the research question. Furthermore, it is a set of guidelines and

instructions to be followed in addressing the research problem, and differs from project to

project. The rationale for a research design is to plan and structure a research project in such a

way that the eventual validity of the research findings is maximised through either minimising

or, where possible, eliminating error (Mouton, 1996:107-109).

Qualitative research uses a naturalistic approach that seeks to understand phenomena in

context-specific settings, such as "real world setting where the researcher does not attempt to

manipulate the phenomenon of interest" (Patton, 2001:39). Qualitative research, broadly

defined, means "any kind of research that produces findings not arrived at by means of

statistical procedures or other means of quantification" (Strauss and Corbin, 1990:17) and

instead, the kind of research that produces findings arrived from real-world settings where the

"phenomenon of interest unfold naturally" (Patton, 2001:39). Unlike quantitative researchers

who seek causal determination, prediction, and generalisation of findings, qualitative

researchers seek instead illumination, understanding, and extrapolation to similar situations.

This report will follow a qualitative research process by interpreting and applying information

obtained in the literature review and from interviews conducted with key stakeholders in the

business. The findings will be presented in a manner that will result in an operational strategic

framework that will add value and can be easily implemented in other trading departments.

10

Guba and Lincoln (1981) propose four criteria for evaluating qualitative findings and increasing

trustworthiness. These being credibility, transferability, dependability and confirmability.

Credibility is the believability of the research findings from the perspective of the report

participants. The credibility of this report will be increased by incorporating the views of the

people being interviewed as key stakeholders in the operational strategic framework.

Transferability is the degree to which findings can be generalised to other settings or contexts.

The framework is available for utilisation in the firm by other departments also crafting

operational strategic plans. Transferability will be enhanced by the practical application of the

strategic framework in two other chosen areas, all related to the same context, namely the

foods group.

Dependability is related to the importance of the researcher describing the changing contexts

and circumstances that are vital in qualitative research. The context of the research is the

current strategic plan of the firm, and this will be described as part of the operational plan

baseline.

Confirmability refers to the extent that findings can be corroborated by others. The framework

will be applicable within the firm, but not outside. The intent is to create a framework for the

operationalisation of strategy in the case report firm, not to create a universal strategic

operational tool.

Whilst research design focuses on the end product – what kind of report is being planned and

what kind of result is aimed at – research methodology focuses on the research process and

the kinds of tools and procedures to be used (Mouton, 2001:56). The research methodology

that has been used in this research report is a combination of primary and secondary research.

Primary data is that which has been collected for the express purpose of the research being

11

undertaken, whereas secondary data is that which has been collected for purposes other than

the research objectives (Parasuraman, 1986:165).

2.2

Primary data

Primary research was conducted amongst key decision makers across the foods group in order

to determine the effectiveness of the current strategic plans. Information obtained from these

sources was used to populate various strategy making tools in order to help formulate the

strategic plan. The primary research took the form of qualitative research, personal interviews

were conducted in a semi-structured interview format. It was felt that, for the purposes of this

report, it was not necessary to conduct complex, quantitative research in the form of a

structured and comprehensive research questionnaire. Table 2.1 provides a summary of people

interviewed. The majority of the participants interviewed had more than 10 years experience;

all were older than 30 years and were men.

Table 2.1: List of employees interviewed

Number

Name

Surname

Position

Number of

years

experience

Age

Gender

1

Denzil

Greentree

Senior buyer

12

35

Male

2

Giscard

Heradien

Sales manager

12

33

Male

3

Clynton

Louw

Inventory manager

14

33

Male

4

Rian

Marren

Senior technologist

4

34

Male

5

Chan

Pillay

Trading head

15

36

Male

12

The research was conducted in a more investigative, journalistic and descriptive approach in

order to find the answers to the research problem. A purposive or judgmental sampling

technique was used to identify the group of people who were subsequently interviewed.

Judgmental sampling is defined as a procedure in which the researcher exerts some effort in

selecting the sample that he feels is most appropriate (Parasuraman, 1986: 501). This is an

example of non-probability sampling that Mason and Lind (1996: 298) define as a sampling

method in which not all items or people have a chance of being included in the sample. In

contrast to this, probability sampling is defined as a sample selected in such a way that each

item or person in the population being studied has a known likelihood of being included in the

sample (Mason & Lind, 1996: 298).

The sample was selected from a wide range of management positions in the foods hierarchy.

Personal interviews were conducted with the aid of a Discussion Guide (refer to appendix).

Each interview was a semi-formal discussion relating to the respondent’s experience and

opinions of how operational strategy is crafted and executed in the foods business.

Discussions from these interviews have been used to formulate the findings of the primary

research. The use of a qualitative, discussion technique in the interviews provided the freedom

to ask respondents questions relating to their specific areas of expertise and experience, and to

probe into deeper issues where appropriate. The personal interviews were conducted during

October 2008. The input of those interviewed was especially useful in applying the theory and

concepts of crafting and executing strategy in the retail industry. The author assumes full

responsibility for his interpretation of the data presented.

13

2.3

Secondary data

The secondary data has been obtained by conducting an extensive literature review on relevant

and related topics to provide a thorough understanding of strategy and how it can best be

crafted and implemented in the chosen area. A wide variety of journals, books, and internet

websites was consulted.

2.4

Conclusion

This chapter has provided an overview of the research design and methodology for this

research report. The methods used to find relevant information have been described as well as

how the trustworthiness of data will be established. The chapter is followed by a review of the

related literature on the area of crafting and executing strategy.

14

CHAPTER 3

REVIEW OF RELATED LITERATURE

3.1

INTRODUCTION

The literature review aims to provide insight into the area crafting and executing strategy. The

areas which are covered provide explanations of the theory that will be employed in answering

the research problem. Numerous texts, journals, articles and websites were consulted for the

purposes of the literature review.

3.2

A DEFINITION OF STRATEGY

“A company’s strategy is management’s game plan for growing the business, staking out a

market position, attracting and pleasing customers, competing successfully, conducting

operations, and achieving targeted objectives.” (Thompson, Strickland & Gamble, 2005:3).

Strategy serves as a unifying theme that guides actions and decisions by individuals in the

organisation. An organisation has a strategic advantage when it does similar tasks to that of

rivals in a different way or performing different activities which clearly set it apart from its rivals.

In defining a business strategic direction management must address the following three

questions:

Where are we now?

Where do we want to go?

How will we get there?

15

The strategy of an organisation can be intended or proactive, where management intentionally

does certain things that have been working well for the business. Alternatively there is a portion

of the strategy which is reactive or adaptive to conditions and events which are unforeseen or

beyond the control of the organisations’ management.

The strategy for any business could be viewed as a work in progress. Managers must not feel

bound to stick to a strategic plan where it is clearly not delivering success for the business. In

certain circumstances it may be necessary to make significant changes in the current game

plan; other circumstances may only require tweaking and fine tuning. The strategy of an

organisation will evolve over time, and a degree of change is inevitable.

The successful retailer must ensure that it has a sound strategic plan, one which sets it apart

from its competitors. The dynamic nature of the retail business and the intense rivalry amongst

competitors requires that the strategy be flexible and allows for change at the operational level.

Changes at this level are often required in order to react to threats and other market conditions

which may lead to loss of market share should the organisation remain unresponsive. “A

retailer’s long term performance is largely determined by its strategy. A strategy coordinates

employees’ activities and communicates the direction the retailer plans to take” (Levy & Weitz,

2007:153). The components of the strategic plan, like price, promotions and product range may

thus change at an operational level on a more regular basis, but the long term overriding

strategic principles remain in tact in order to guide the organisation in its activities.

16

3.3

Levels of strategy

Strategy is formulated and implemented at different levels in an organisations structure. The

role players at each level will differ, with some role players applying themselves across various

levels depending on their position within the organisation.

Thompson, et al. (2005:34-37), identifies four levels of strategy. Figure 3.1 depicts a summary

of these levels of strategy as well as the interrelationships at various levels.

“Corporate strategy for multi-business retailers includes developing the overall mission for the

corporation, specifying the objectives to be achieved, and managing the individual businesses

that comprise the corporation” (Mason & Mayer, 1990:54). The role players at this level will

include the CEO and other key executives. The strategic guiding principles will be established

at this level, as well as ways of creating synergies which result in competitive advantage.

The level, called business strategy, is largely derived by general managers and heads of

business units. At this level it is established how each of the businesses will operate within their

competitive environment in order to achieve the mission and objectives of the corporate entity.

Functional strategy specifies how the overall objectives of the business strategy will be

achieved. This area of strategy is crafted by the functional managers for approval by the

business head. The functional strategy will typically encompass decisions around new product

development, product distribution strategy, the procurement strategy, the planning strategy and

the technical strategy.

17

Figure 3.1: A company’s strategy making hierarchy

Source: Thompson, Strickland & Gamble, 2005: 35

18

The importance of the operational strategy level must not be underestimated because it falls at

the bottom of the strategy making hierarchy. Execution at this level is a vital component to

achieving the goals at the levels above. “Operating strategies, while of lesser scope than the

higher levels of strategy-making, add relevant detail and completeness to the overall business

plan. Lead responsibility for operating strategies is usually delegated to operating-level

managers, subject to review and approval by higher level managers” (Thompson & Strickland,

1992:39).

3.4

THE BENEFITS AND RISKS OF STRATEGIC PLANNING

Strategic planning leads to improved profitability and turnover in businesses that use the tool

correctly. A good strategic plan allows a business to better utilise scarce resources which result

in increased productivity and therefore increased competitive advantage.

“Through effective strategic management, all employees tend to understand the goals and

objectives of the organisation so much better and this directly leads to better and more effective

communication” (Ehlers & Lazenby, 2007:8). The improved understanding which is a result of

improved communication allows employees to own the strategy which is being implemented

and makes them more committed to driving the change.

Employees can become empowered by the process of strategic planning. A common error by

senior management is that strategic plans are forced on lower level employees without having

them involved in the formulation of these plans. Involving employees in the formulation of

strategic plans allows them to take ownership of the plans, and they are thus empowered to

implement these plans successfully.

19

Strategic planning improves the sense of responsibility to the management team of the

organisation. The team involved in the planning process is held accountable for the detail and

implementation of the plan. Their actions are guided by corporate governance which ensures

that activities are executed in a controlled and disciplined manner.

Time management can be vastly improved by good strategic management. Strategic planning

requires that various timelines are adhered to for a plan to be relevant and effect the desired

change. “The whole strategic process is therefore broken down into more specific timeframes,

giving all employees involved a better idea of their own time management” (Ehlers & Lazenby,

2007:8).

The strategic management process does not always allow for all parties to be involved in the

process. This will result in unrealistic expiations form both management and employees which

will eventually undermine the intended strategic changes. Additionally, organisations encounter

an unclear chain of implementation when strategic plans are handed down from the upper

levels of the organisation.

The concept of strategic management must be embraced at every level of the organisation. As

it inevitably involves change it is vital that it be managed accordingly and with minimum

disruption to the running of the business. A negative perception of strategic management must

not be allowed to foster itself among employees.

“Probably the most important criticism of strategic management is the fact that management

does not know whether strategies have been implemented effectively or not. In other words,

there are frequently no measurement tools to see whether the organisation is better off or not

after implementing the strategies” (Ehlers & Lazenby, 2007:9-10).

20

3.5

THE STEPS IN THE STRATEGIC PLANNING PROCESS

Thompson Strickland and Gamble (2005:17) identifies five managerial processes in the

crafting and execution of an organisation’s strategy. These five phases are:

1.

Developing a strategic vision

2.

Setting strategic objectives

3.

Crafting strategy which achieves the vision and objectives

4.

strategy implementation and execution

5.

Monitoring, evaluating and corrective action.

Figure 3.2 below graphically depicts the Strategy-Making, Strategy-Executing Process.

3.5.1 Developing a strategic vision

The strategic vision gives direction, unifies efforts and provides a sense of identification. An

effective strategic vision must have the following characteristics:

Realistic: A vision must be based in reality to be meaningful for an organisation.

Credible: A vision must be believable to be relevant. It must be credible to the employees

or members of the organisation. If the members of the organisation do not find the vision

credible, it will not be meaningful or serve a useful purpose. One of the purposes of a

vision is to inspire those in the organisation to achieve a level of excellence, and to

provide purpose and direction for the work of those employees. A vision which is not

credible will accomplish neither of these ends.

21

Figure 3.2: The strategy-making, strategy-executing process

Source: Thompson, Strickland & Gamble, 2005: 35

22

Attractive: If a vision is going to inspire and motivate those in the organisation, it must be

attractive. People must want to be part of this future which is envisioned for the

organisation.

Future: A vision is not in the present, it is in the future. A vision is not where you are now;

it's where you want to be in the future.

“The vision statement answers the question: ‘What do we want to become?’ and serves as the

roadmap of the organisation. A vision statement is a dream that focuses on a desirable future

and is often referred to as being as an enduring promise” (Ehlers & Lazenby, 2007: 63).

The vision must be effectively communicated, it must serve to inspire and motivate employees

at all levels. The strategic vision is usually encapsulated in a slogan which summarises the

essence of where the company would like to strategically find itself in the future.

3.5.2 Setting objectives

Phase 2 of the strategy making process is to set objectives. The objectives have the role of

applying specific measurable targets which help achieve the strategic vision. Objectives start to

narrow the focus for managers on which activities need to be executed and forces creative

thinking in order to tackle complex problems. The organisation which sets realistic yet

challenging objectives will ensure that all employees are clear on what is required, and will

therefore have the drive and will to complete the tasks at hand.

Objectives need to be set for both the short and the long-term. Short-term objectives provide

focus on what must occur immediately. “The most important situation in which short-range

objectives differ from long-range objectives occurs when managers are trying to elevate

23

organisational performance and cannot reach the long-range target in just one year”

(Thompson, Strickland & Gamble, 2005:29).

As strategy formulation occurs at different levels in the organisation it is imperative that

objectives are set at each level. The corporate objectives must be cascaded to the lower levels

of the organisation where objectives must be set in a manner which allows all corporate goals

to be achieved. According to Dunne and Lusch (2005:38), retailers generally divide their

objectives into two dimensions. Firstly, that of market performance, which allows a retailer to

compare itself against its competitors, and secondly, financial performance, which analyses the

organisations ability to generate wealth for its shareholders and continue operations.

Thompson, Strickland and Gamble (2005: 46) argue that performance must be measured in

terms of financial and strategic objectives. Examples of these types of objectives are

summarised in Table 3.1 below.

24

Table 3.1: Financial versus strategic objectives

Financial objectives

Achieve revenue growth of 10%

per year

Strategic objectives

Increased market share

Quicker design-to-market ls

Reduce waste by 3%

Higher product quality than rivals

Increase margin by 5%

Lower costs relative to key competitors

Increase product availability by

Broader product line

4%

A stronger reputation with customers

Improve stock turn by 3%

Stable earnings during periods of

economic downturn

Sufficient internal cash flows to

fund new investment

than rivals

Better customer service

Recognition as a leader in technology

Wider geographic coverage than rivals

More innovative products

Source: Thompson, Strickland & Gamble, 2005: 27

3.5.3

Crafting strategy to achieve the objectives and vision

The formulation of strategy requires detailed analysis of both the internal and eternal

environment in which the organisation operates. “After developing a mission statement and

setting objectives, the next step in the strategic planning process is to conduct a situation audit,

an analysis of the opportunities and threats in the retail environment and the strengths and

weaknesses of the retail business relative to its competitors” (Levy & Weitz, 2007:146). Figure

3.3 depicts the elements of the macro environment in which an organisation conducts its

25

operations. The greatest influence on an organisation’s strategy comes from the inner circle or

what Figure 3.3 refers to as the “immediate industry and competitive environment”.

Figure 3.3: The components of a company’s micro-environment

Source: Thompson, Strickland & Gamble, 2005: 47

Strategic analysis tools are available which assist in the strategy formulation process. Three

strategic analysis tools have been chosen for this report which is most relevant to the retail

environment in which this business finds itself. These three tools are Porter’s five forces, SWOT

analysis; and Ansoff’s growth matrix.

26

3.5.3.1 Porter’s five forces

The competitive environment does not only consist of direct rivals of the organisation. “Rather,

competition in an industry is rooted in its underlying economics, and competitive forces exist

that go well beyond the established combatants in a particular industry. Customers, suppliers,

potential entrants and substitute products are all competitors that may be more or less

prominent or active, depending on the industry” (Porter, 1980:34).

The goal is to position the business in such a manner that the effect of these forces can easily

be defended by the organisation. Greater attention must be given to those forces which affect

the profitability of an industry. These may differ from industry to industry depending on the

nature of the business. In the retail industry the threat of a low cost substitute could pose a

substantial threat which needs to be addressed.

In order to deal with these forces it is important to understand how they work within a given

industry and how they the affect the organisation. The information gained form this analysis is

vital for the strategic plan of action, and it results in much broader analysis of the competitive

environment. Figure 3.4 shows the Five Forces Model of competitive forces for industry

analysis.

27

Figure 3.4: Porter’s five forces model

Source: Ehlers & Lazenby, 2007: 113

Threat of entry occurs when a new player enters or attempts to enter an existing industry. The

new competitor threatens to lower the profits of those already in the industry by taking away

their market share. New entrants into an industry are hesitant to do so if they barriers to entry

28

are high and if expected retaliation from existing players is high. Porter (1980:37) identifies six

sources of barriers to entry. These are:

Economies of scale. This is achieved by the ability to increase production over a given

time period and thereby lower the costs per unit manufactured as the costs are now

spread over a larger amount of units. Organisations are therefore able to increase profits

by keeping prices constant. New entrants are forced to enter the market by manufacturing

large volumes, or accepting a cost disadvantage. The concept can also be applied to

other parts of a business, like distribution and the utilisation of a sales force.

Product differentiation. New entrants must spend large sums of money in order to

overcome customer brand loyalty.

Capital requirements. Money spent on high capital investment act as a barrier to entry.

Big corporations do however have the capability to enter almost any market as they have

an abundance of resources.

Cost disadvantages independent of size. Companies entrenched in the industry have

certain cost advantages irrespective of size. These cost advantages originate from the

learning and experience curve, access to the best raw materials, assets bought at lower

prices, technology and government subsidies.

Access to distribution channels. The new product must present itself to the market but

this may be difficult and expensive if existing operators have tied up these distribution

channels. In some instances it may be so difficult to displace entrenched brands that

organisations resort to finding new ways of presenting their offer to the market.

29

Government policy. Government regulations can restrict entry to an industry by issuing

licence requirements which limits access to raw materials.

Existing players in the industry may however have access to a large amount of resources with

which they may fight back if new entrants attempt take market share. Price cuts are often used

as a weapon for impeding the growth of a new entrant in the market.

Suppliers are organisations that offer as their product inputs into production like raw material,

machinery and labour. They exert bargaining power over competitors in an industry by raising

prices or reducing the quality of purchased goods and services. Suppliers may have the power

to diminish the profitability in an industry such that competitors are unable to recover the cost of

the raw material input. The power of a supplier group is powerful under the following conditions:

The industry is dominated by a few large organisations and is more concentrated than the

industry it supplies.

Very little or no substitutes are available.

The customer base of the supplier group spans several industries and therefore a group in

a certain industry may not be very meaningful.

Buyers have no option but to take the goods from the supplier as it is critical to the

success of the buyer.

The cost of switching is high due to supplier efficiency or differentiated products.

The supplier is able integrate forward and thus becomes its own buyer of products or

services.

Buyers are the customers of organisations in an industry. This group is constantly bargaining

for higher quality goods and services which reduce their costs. Buyers with a high degree of

bargaining power can drive down prices and have the ability to play competitors against each

other in order to find the best deal. Buyers are powerful under the following conditions:

30

Buyers are meaningful to the organisations from which they purchase. The buyer

purchases large volumes from the supplier and is therefore responsible for a substantial

percentage of the suppliers’ turnover.

Switching costs are low and the buyer is able to move to another supplier with relative

ease.

The current supplier is responsible for a high percentage of a buyers’ cost. This will

prompt the buyer to seek alternative supply.

Products in the industry are undifferentiated or standardised. Buyers are thus able to

obtain several prices and compare.

The products that buyers purchase are not vital to the quality of the buyers’ products.

Information about the market is freely available to buyers.

The buyer is able to apply backward integration. The buyer is then able to become its own

supplier.

“Consumers tend to be more price-sensitive if they are purchasing products that are

undifferentiated, expensive relative to their incomes and of a sort where quality is not

particularly important. The buying power of retailers is determined by the same rules, with one

important addition. Retailers can gain significant bargaining power over manufacturers when

they can influence consumers' purchasing decisions, as they do in audio components,

jewellery, appliances, sporting goods and other goods” (Porter, 1980:43).

Substitute products or services are able to limit the potential in an industry by capping prices.

These products pose a strong threat to an organisation when the switching costs for customers

are low. The threat is intensified when a substitute product has a low price or it is able to

compete with the other product in terms of quality and performance. According to Porter (1980:

44), substitute products that deserve the most attention strategically are those that (a) are

subject to trends improving their price performance trade-off with the industry's product, or (b)

are produced by industries earning high profits. Substitutes often come rapidly into play if

31

some development increases competition in their industries and causes price reduction or

performance improvement.

Ehlers and Lazenby (2007:117) cite rivalry amongst competitors as the strongest of the five

forces. The actions taken by direct competitors will require a response in order to remain in

business. Competitive advantage can only be gained by differentiating the organisation’s offer

in the mind of the customer. This can be done in such a manner that the customer perceives as

value, and is usually based on dimensions such as price, quality and innovation. Rivalry among

competitors is intensified under the following conditions:

Many competitors exist in the industry with approximately the same size and power.

The industry growth is slow and results in fights for increased market share.

In an attempt to minimise the impact of fixed costs origination engage in high production

runs. This results in high inventories and storage costs. Customers are incentivised to buy

more products by lowering prices and other special discounts.

The products in the industry have a lack of differentiation and low switching costs. The

demand for undifferentiated products is largely based on price and service. Under such

condition rivalry can be very intense. Also low switching costs imply that it is easier for

competitors to lure customers away from existing suppliers.

The exit barriers are high.

Once this analysis has been completed it should become apparent where the organisation is

positioned in the competitive environment. The organisation is then able to develop plans which

can position the company where it is best able to fend off rivals, influence the balance of the

forces through strategic moves and is able to best exploit shifts in the competitive environment

before competing firms.

32

3.5.3.2 SWOT analysis

The SWOT analysis is considered one of the more popular techniques for analysing the internal

and external environment of the organisation. The acronym SWOT stands for strengths,

weaknesses, opportunities and threats. Figure 3.5 shows the elements of the SWOT technique

with their relationship to the internal and external environment.

SWOT ANALYSIS

Strengths

Internal Analysis

External Analysis

D

D

i i

h

Weaknesses

Opportunities

i i

h

Threats

Figure 3.5: The relationship between SWOT and the environmental analysis

Source: Ehlers & Lazenby, 2007: 82

33

Strength is a resource or capability which is a distinctive competence for the organisation and

offers a competitive advantage. A weakness is something which is lacking in the organisation

relative to that of a competitor. A weakness prevents the organisation form developing a

competitive position in the industry. An opportunity is some favourable situation which can be

exploited in the organisations external environment, while a threat is an unfavourable one.

Table3.2 summarises a few of the concepts to consider when identifying the organisation’s

strengths, weaknesses, opportunities and threats.

Table 3.2:

What to look for in identifying a company’s strengths, weaknesses,

opportunities and threats

SWOT Analysis - What to Look For

Potential Resource

Strengths

Potential Resource

Weaknesses

• Powerful strategy

• Strong financial

condition

• Strong brand name

image/reputation

• Widely recognized

market leader

• Proprietary

technology

• Cost advantages

• No clear strategic

direction

• Obsolete facilities

• Weak balance sheet;

excess debt

• Higher overall costs

than rivals

• Missing some key

skills/competencies

• Subpar profits

• Strong advertising

• Product innovation

skills

• Good customer

service

• Internal operating

problems . . .

• Falling behind in

R&D

• Too narrow product

line

• Weak marketing

skills

• Better product

quality

• Alliances

• An attractive

customer base

Potential Company

Opportunities

• Serving additional

customer groups

• Expanding to new

geographic areas

• Expanding product

line

• Transferring skills to

new products

• Vertical integration

• Take market share

from rivals

• Acquisition of rivals

• Alliances or JVs to

expand coverage

• Openings to exploit

new technologies

• Openings to extend

brand name/image

Potential External

Threats

• Entry of potent new

competitors

• Loss of sales to

substitutes

• Slowing market growth

• Adverse shifts in

exchange rates & trade

policies

• Costly new regulations

• Vulnerability to

business cycle

• Growing leverage of

customers or suppliers

• Reduced buyer needs

for product

• Demographic changes

262

Source: Thompson, Strickland & Gamble, 2005: 95

34

Once the SWOT listings have been constructed, the process of identifying key strategic issues

from these lists must be followed. Management must act on the conclusions it draws from the

SWOT in order to match the company’s strategy to its resource strengths and market

opportunities. Understanding the organisations’ resource strength is vital for future prosperity.

Managers must build strategy around these resource strengths in order to best create a

competitive advantage. Resource strengths that are unable to serve as the foundation for the

organisation’s strategy must be revaluated and possibly upgraded by the organisation.

3.5.3.3 Ansoff’s product/market matrix

The organisation needs to have a good understanding of the products they currently offer and

should offer, as well as the markets they currently serve and should serve in order to ensure

profitable growth. The Ansoff product/market matrix is a tool which helps organisations to

decide which product and market growth strategy they should follow. The matrix suggests that

businesses will find growth from new or existing products in new or existing markets. There are

four quadrants which suggest a different growth strategy depending on where the organisation

is currently positioned. Organisations use this analysis tool in order understand a series of

growth strategies which will help determine the strategic direction of the business. The four

strategies which the organisation can adopt are market penetration, product development,

market development and diversification. Figure 3.6 depicts Ansoff’s product/market matrix.

35

Figure 3.6: The Ansoff product/market matrix

Source: http://tutor2u.net/business/strategy/ansoff_matrix.htm

36

An organisation adopts the strategy of market penetration when it decides to sell existing

products into existing markets. Adopting a strategy of market penetration achieves the following

objectives:

The market share of current products is maintained or increased. This strategy is typically

driven by aggressive lower prices, promotions, increased personnel selling and

advertising.

By penetrating the market the organisation is able to ensure that it is the dominant player

especially in the case where the market is growing profitably.

Alternatively in a mature market this strategy can be employed in order to drive out

competitors. Organisations are able to do this by adopting a pricing strategy which makes

the market unattractive for competitors.

Organisations can also increase usage by existing customers through the introduction of

loyalty programmes.

A market penetration strategy is not very disruptive to the daily operations of the business and

does not require a large amount of investment in new market research.

The organisation adopts a strategy of market development when is seeks to sell its existing

products into new markets. Globalisation has played a major role in opening up new markets to

organisations that were previously unreachable. The percentage of exports to different

geographical areas can be increased in order to foster new growth and gain better economies

of scale. Also introducing different packaging and dimensions can open up new markets which

require the product for different uses. The organisation may decide to use distributing channels

which were previously off limits are not viable in the past. Tiering pricing can also open up new

markets to lower, middle or higher income brackets depending on where the organisation is

currently trading.

37

Organisations may choose to introduce new products into existing markets. In this case, the

business adopts a strategy of product development. This strategy requires speed to market and

a high degree of innovation which may require the development of new competencies. In the

case of the retailer, this strategy is widely used at the operational level where an innovative

product range is used as the point of difference for attracting customers.

Diversification is the name given to the growth strategy where the organisation decides to

market new products to new markets. The risks associated with adopting this strategy are high,

as the business will have very little knowledge or experience in this arena. It is important that

good market research is done, which may be costly, and that the risks have been carefully

assessed.

“Typically, retailers have the greatest competitive advantage in opportunities that are similar to

their present retail strategy. Thus retailers would be most successful in engaging in market

penetration opportunities that don’t involve entering new, unfamiliar markets or operating new

unfamiliar retail formats” (Levy & Weitz, 2004: 162). Therefore, once the strategic analysis has

been conducted, the retail strategy employed must be the one best suited to the current profile

of the retailer that will enable a sustainable competitive advantage. The salient strategic points

derived from each analysis need to be summarised and presented in a format that clearly

indicates the strategic direction for the retailer.

3.5.4

Strategic implementation

“Strategy implementation can be defined as the process that turns strategic plans into a series

of tasks, and ensures that these tasks are executed in such a way that the objectives of the

strategic plan have been achieved” (Ehlers & Lazenby, 2007:212). The success of strategy

implementation also relies on the information obtained in the strategic analysis. This is

38

important information as the organisation must be sure that it is implementing the correct

strategy.

The following are required to successfully implement strategy:

The allocation of appropriate resources in order to fulfil the requirements of the strategy.

This relates to staffing, systems, finance, plant and equipment.

The culture and structure of the organisation must also be redefined in order to support

the proposed strategy.

A process on internal change must be considered through the mechanism of change

management.

“The implementation stage in the process often sees a shift in the responsibility, from the

strategic level down to the divisional or functional managers. This transfer may also act as a

barrier to the implementation of the desired strategy as the responsibility is shifting from the few

to the many” (Campbell, Stonehouse & Houston, 2004: 93-194).

The successful implementation of strategy can be deterred by the following:

Differing interpretations of the strategy at each new business level.

Inadequate planning and communication.

Lack of support from the design team.

Failure to take account of internal issues that do not facilitate the adoption of the strategy.

The amount of resources allocated to the proposed strategy will depend on the amount change

that the strategy will effect. A small change may require only modest financing or training of

only a few employees. However, a strategy advocating few changes may also require that

resources be streamlined. Conversely, a strategy requiring a big change will require an

39

increase in the resource base. In order to facilitate this type of change, it may become

necessary to reallocate the current organisational resources, as well as to procure new

resources from the organisations external environment.

The suitability of an organisation’s culture must be assessed in order to implement a chosen

strategy. This will help determine the readiness of the organisation for the change to come, as

well as how this change will be embraced. According to Miles and Snow (1978), four culture

types exist in organisations based on how they will approach strategy. These are:

Defender cultures, which work best in well-defined markets and the adopted strategy, are

similar to that of market penetration. This type of culture is uncomfortable with exploring

new markets, is diversifying and prefers to operate in a known arena.

Protector cultures seek out new markets and opportunities. This type of culture

propagates change and enjoys doing things differently. The prospector culture is more

likely to embrace change and fresh ideas.

The analyser culture can be defined as a hybrid of the defender and prospector culture.

This type of culture can thrive in both stable and unstable environments.

Reactor cultures tend to deal with change after it has happened, they may lack strategic

focus and therefore seem directionless. This type of culture tends to adopt strategies of

successful competitors and is therefore a follower not a leader.

Understanding the culture is therefore extremely relevant when implementing strategic change.

The strategy may require a complete turnaround in how business is currently conducted, which

may leave certain organisations in turmoil depending on their culture classification at the time.

“An organisational structure is the framework within which the strategic process must operate to

achieve the organisation’s objectives” (Ehlers & Lazenby, 2007:247). Organisational structure

can be used as a competitive advantage if it supports the strategic process, is difficult to copy

40

and makes it easy for customers to conduct business. It is therefore in their best interests to

ensure that the organisational structure is optimised in order for the strategy to deliver the best

possible results. The following organisational structures can be identified:

Entrepreneurial structure.

This is simple structure consisting of the owner and his

employees. The owner is involved in all daily operations and communicates frequently

with workers – usually in an informal fashion. As the organisation grows, it may form

entrepreneurial to functional structure.

Functional structure.

This structure is characterised by categorising tasks such as

marketing, human resources research and development, operations and finance into

separate areas. The structure typically has a CEO and some senior managers. These

structures have the ability to create economies of scale and optimise resource allocation

and budgeting, as they usually have a single or very narrow product line. As the

organisation continues to grow, it will move from a functional structure to a divisional

structure.

Divisional structure.

A divisional structure is represented by clusters of similar

businesses. The clustering may take place by means of geographical area, product or

service, customer or business process. Divisional structures are good where the

organisation needs to adopt the characteristics or culture of the customers in a particular

geographical area. As the organisation grows, the span of control may become too wide in

a divisional structure and strategy implementation will become more complex. At this

point, organisations may opt for the strategic business unit structure.

Strategic business unit structure. Similar divisions are grouped together into strategic

business units and the accountability is assigned to a senior executive who reports

directly to the CEO. Certain functions may be centralised into a central head office. This

41

structure places strategy formulation and implementation closer to each business unit’s

competitive environment.

The matrix structure. A matrix structure is characterised by its dual lines of authority. It

allows several competencies to be combined, which allows for improved problem-solving

and innovation.

Network structures. Network structures are composed of different teams that band

together for a project. The structure can easily be dropped once the project has been

completed. Network structures are beneficial in that they are able to make decisions

quickly and can react innovatively to customers’ demands.

The organisational structure will therefore change as the organisations choice of strategy