Supply chain coordination using optimal transfer pricing to

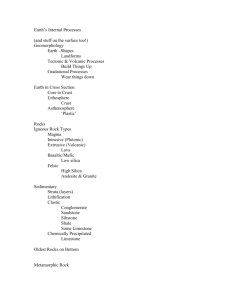

advertisement