NET EXPORTS AND CAPITAL FLOWS

advertisement

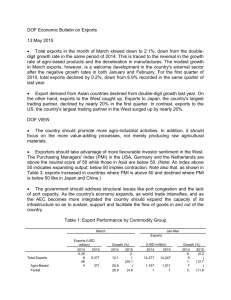

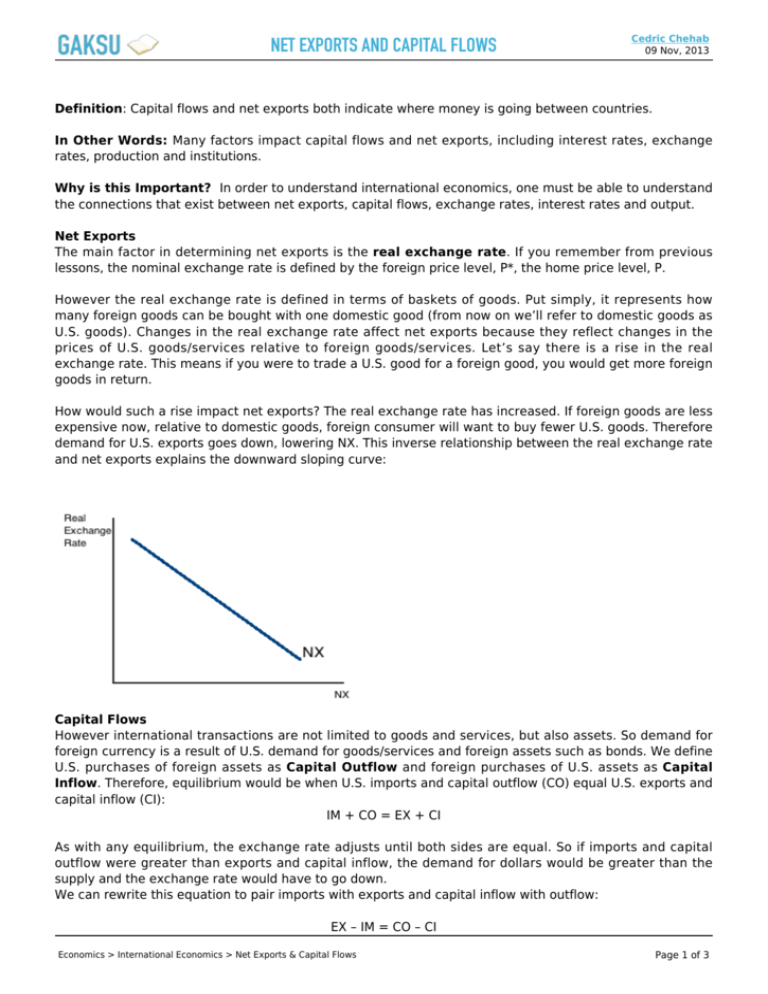

NET EXPORTS AND CAPITAL FLOWS Cedric Chehab 09 Nov, 2013 Definition: Capital flows and net exports both indicate where money is going between countries. In Other Words: Many factors impact capital flows and net exports, including interest rates, exchange rates, production and institutions. Why is this Important? In order to understand international economics, one must be able to understand the connections that exist between net exports, capital flows, exchange rates, interest rates and output. Net Exports The main factor in determining net exports is the real exchange rate. If you remember from previous lessons, the nominal exchange rate is defined by the foreign price level, P*, the home price level, P. However the real exchange rate is defined in terms of baskets of goods. Put simply, it represents how many foreign goods can be bought with one domestic good (from now on we’ll refer to domestic goods as U.S. goods). Changes in the real exchange rate affect net exports because they reflect changes in the prices of U.S. goods/services relative to foreign goods/services. Let’s say there is a rise in the real exchange rate. This means if you were to trade a U.S. good for a foreign good, you would get more foreign goods in return. How would such a rise impact net exports? The real exchange rate has increased. If foreign goods are less expensive now, relative to domestic goods, foreign consumer will want to buy fewer U.S. goods. Therefore demand for U.S. exports goes down, lowering NX. This inverse relationship between the real exchange rate and net exports explains the downward sloping curve: Capital Flows However international transactions are not limited to goods and services, but also assets. So demand for foreign currency is a result of U.S. demand for goods/services and foreign assets such as bonds. We define U.S. purchases of foreign assets as Capital Outflow and foreign purchases of U.S. assets as Capital Inflow. Therefore, equilibrium would be when U.S. imports and capital outflow (CO) equal U.S. exports and capital inflow (CI): IM + CO = EX + CI As with any equilibrium, the exchange rate adjusts until both sides are equal. So if imports and capital outflow were greater than exports and capital inflow, the demand for dollars would be greater than the supply and the exchange rate would have to go down. We can rewrite this equation to pair imports with exports and capital inflow with outflow: EX – IM = CO – CI Economics > International Economics > Net Exports & Capital Flows Page 1 of 3 NET EXPORTS AND CAPITAL FLOWS Cedric Chehab 09 Nov, 2013 Which simplifies to net exports equals net capital flow: NX = CF Now that capital flows are a factor in determining the exchange rate, we also introduce the impact of the real interest rate. If there is a high interest rate in the U.S., then more people will want to put their money in U.S. banks, so capital outflows goes down and inflows go up and CF falls (CF=CO-CI). So there is an inverse relationship between CF and the real interest rate (r). MP-IS Curves Now that we’ve introduced the interest rate, a crucial component in our understanding of NX and CF is the MP-IS relationship. The IS curve shows the relationship between the real interest rate and output. It relates to the planned expenditure curve, which you may have learned about in macroeconomics. That curve consists of E= C + I + G, so any changes in C,I or G affect the IS curve. There is an inverse relationship between IS and r because an increase in r reduces investment, thus output falls. MP stands for Monetary Policy; this curve shows how the central bank (in the U.S., the federal reserve) uses monetary policy in reaction to changes in output. When output rises, the fed worries the economy is growing too fast so slows it down by raising the real interest rate, which encourages people to put their money in the bank instead of spending it. When output falls, the fed lowers the rate to encourage people to spend money. Thus we get the following relationship which determines the real interest rate: Economics > International Economics > Net Exports & Capital Flows Page 2 of 3 NET EXPORTS AND CAPITAL FLOWS Economics > International Economics > Net Exports & Capital Flows Cedric Chehab 09 Nov, 2013 Page 3 of 3