Understanding Wealth Management

Your Objectives Come First

How Wealth Management

Works

Implementing The Wealth

Management Approach

n Determining your net worth

Our approach integrates your objectives

into a personalized plan that can be

updated as life changes occur. We combine

sophisticated investment planning tools

with professional resources to help match

your objectives with customized solutions.

The process includes:

n Analyzing your asset allocation

n Understanding Your Financial

Using this process, you and your

financial advisor integrate your

objectives into a personalized,

regularly-monitored plan that helps

us make sure you stay the course. No

financial objective is too simple or too

complicated for Wealth Management —

it is simply a way of making sure you are

satisfied. Only after understanding your

objectives will we use our knowledge,

experience and access to financial

professionals to deliver the solutions

needed to help reach your objectives.

Our first priority is to help you

achieve your financial objectives.

Our disciplined approach to wealth

management is designed to identify

strategies to accumulate, protect, convert

and transfer your wealth based on your

financial goals, which may include:

n Planning for retirement

n Funding an education

n Maintaining or enhancing your lifestyle

n Preparing for a major purchase

n Protecting your family or income

n Creating a legacy

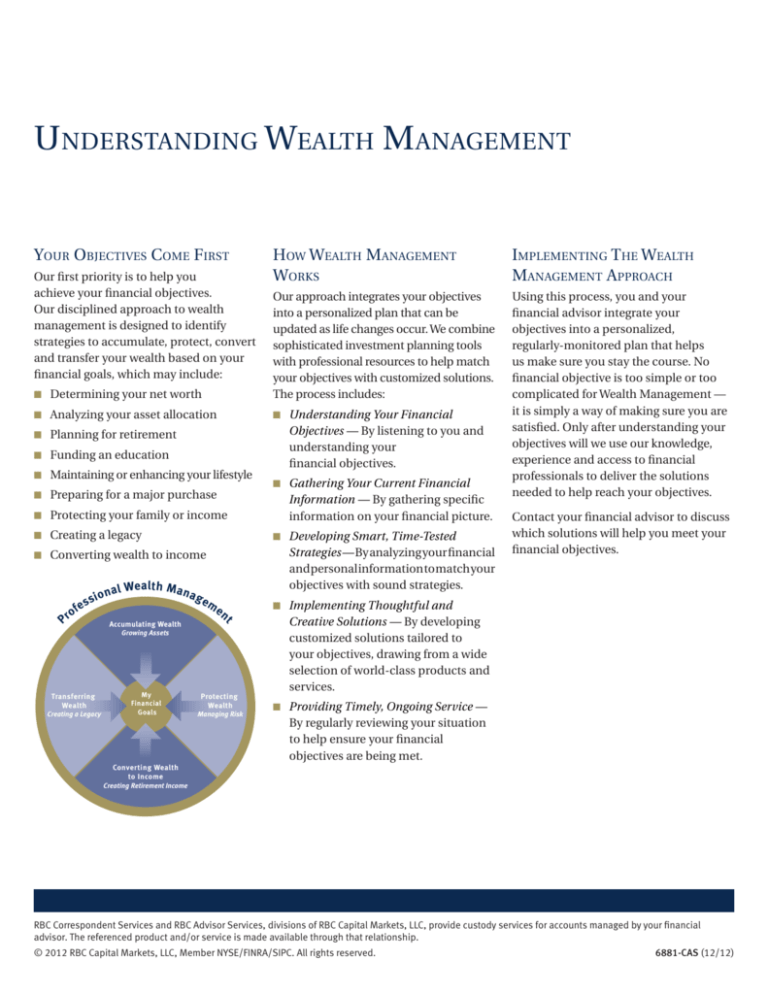

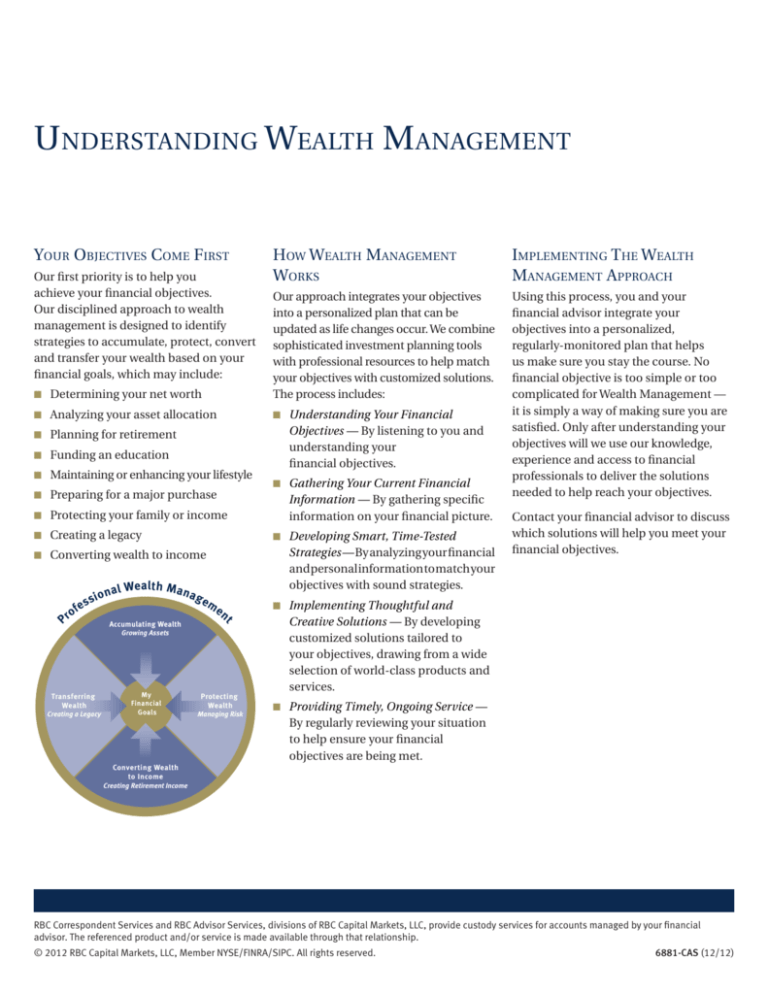

P

ro

o na

l We a l t h M a n a

Accumulating Wealth

Transferring

Wealth

My

Financial

Goals

Information — By gathering specific

information on your financial picture.

Strategies — By analyzing your financial

and personal information to match your

objectives with sound strategies.

ge

me

nt

Growing Assets

Creating a Legacy

n Gathering Your Current Financial

n Developing Smart, Time-Tested

n Converting wealth to income

si

fe s

Objectives — By listening to you and

understanding your

financial objectives.

Protecting

Wealth

Managing Risk

Contact your financial advisor to discuss

which solutions will help you meet your

financial objectives.

n Implementing Thoughtful and

Creative Solutions — By developing

customized solutions tailored to

your objectives, drawing from a wide

selection of world-class products and

services.

n Providing Timely, Ongoing Service —

By regularly reviewing your situation

to help ensure your financial

objectives are being met.

Converting Wealth

to Income

Creating Retirement Income

RBC Correspondent Services and RBC Advisor Services, divisions of RBC Capital Markets, LLC, provide custody services for accounts managed by your financial

advisor. The referenced product and/or service is made available through that relationship.

© 2012 RBC Capital Markets, LLC, Member NYSE/FINRA/SIPC. All rights reserved.

6881-CAS (12/12)