constructive partnerships: when alliances between private

advertisement

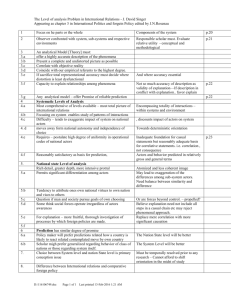

姝 Academy of Management Review 2006, Vol. 31, No. 3, 738–751. CONSTRUCTIVE PARTNERSHIPS: WHEN ALLIANCES BETWEEN PRIVATE FIRMS AND PUBLIC ACTORS CAN ENABLE CREATIVE STRATEGIES SUBRAMANIAN RANGAN RAMINA SAMII LUK N. VAN WASSENHOVE INSEAD Drawing on transaction cost economics and externalities theory, we argue that privatepublic partnerships will be necessary when economic opportunity realization (1) calls for industry-specific competencies but entails significant positive externalities (i.e., implies specialized private actions with significant public benefits), (2) is shrouded by high uncertainty for the private actors, and (3) necessitates for private actors high governance costs for contracting, coordinating, and enforcing. Thus, specialized resources, positive externalities, uncertainty, and governance costs are all jointly implicated in our theory. other drug companies and employers like Anglo American and De Beers) and public actors (such as national governments in Africa and specialized United Nations agencies). “We need to build up the level of resources through a larger coalition” (Gilmartin, quoted in Lamont, 2002: 6). The hope appears to be that a constructive partnership—an alliance between private and public actors—will enable creative and effective responses to tackle the economic and social crisis being wrought in Africa by AIDS. While one can understand the CEO of a major pharmaceutical company speaking about AIDS, it is less easy to comprehend the call for a larger coalition, especially one including public actors. After all, drug firms don’t call for such coalitions to sell headache remedies in Africa. Why this organization? As Williamson (1991) argues, the optimality of organization is often better understood through comparative analysis. In this illustration the question then is why is Merck not going it alone, or with a multiparty alliance among private firms? Alternatively, why is the Botswana government not going it alone (as it might in the case of primary health or child vaccination programs)? Why a privatepublic partnership in this instance? More generally, under what circumstances— that is, when—will only such constructive partnerships be effective and efficient? Why, in those circumstances, won’t conventional ar- Ronald Coase (1937), in his article “The Nature of the Firm,” introduced the notion of firm as a governance mode rather than a production function. Williamson (1975, 1985, 1991), building on Coase (1937), Stigler (1951), Richardson (1972), and others, specified the conditions under which transactions are carried out within markets, firms, and alliances. Transaction cost theory and institutional theory (Powell, 1990) have made important contributions to our understanding of organization. However, the alternatives they contemplate don’t say much about the contribution of public actors to private economic activity. Yet there are situations where pockets of private economic opportunity cannot be realized effectively and efficiently without the operative participation of public actors. Consider the following illustration of “uncommon associations” being called for to foster “creative strategies.” Speaking in Botswana on the massive and urgent challenge of HIV/AIDS in Africa (and, implicitly, on the legitimacy of the pharmaceutical industry that has, relatedly, been called into question), Ray Gilmartin, former CEO of Merck, called for a “constructive partnership” among private actors (including We thank Thomas D’Aunno, Antonio Fatas, Javier Gimeno, William Lazonick, Mary O’Sullivan, Peter Ring, Timothy Van Zandt, guest editor Arvind Parkhe, and the anonymous reviewers for helpful comments on this research. 738 2006 Rangan, Samii, and Van Wassenhove rangements (viz. markets, interfirm alliances, internalization, or nationalization) work as well? That is, why can’t firms or public actors go it alone? Last, when, in these cases, can the public actor be a government, and when does a multilateral organization have to be involved? These are the questions we address in this paper. In brief, drawing on transaction cost economics and the theory of externalities, we argue that when the realization of economic opportunity (1) calls for industry-specific competencies but entails significant positive externalities (i.e., implies specialized private actions with significant public benefits), (2) is shrouded by high uncertainty for the private actors, and (3) necessitates for private actors high governance costs for contracting, coordinating, and enforcing, then private-public alliances— constructive partnerships—will be necessary for realizing the economic potential. Thus, specialized resources, positive externalities, uncertainty, and governance costs are all jointly implicated in our proposed theory. Before proceeding, we should point out that our arguments are strictly economic in orientation. While we acknowledge that principles of justice and liberty (as indicated in Bryson & Ring, 1990) are important, our focus here is on efficiency and effectiveness. Likewise, politics, power, and institutionalism—in their own right important explanations of organization (see Moe, 1990; Myer & Rowan, 1977; Perrow, 1981)— are set aside in this initial theorizing. In turn, we cannot and do not claim to explain all reality, which, after all, is frequently shaped by politics and history. Still, in a world in which actors are becoming less buffered from “selection pressures,” the economic approach can be a powerful starting point. We organize the remainder of our article as follows. In the next section, drawing primarily on transaction cost economics, we review base concepts and traditional modes of organizational exchange. In the section after that, we widen the analysis and draw on the theory of externalities to bring in public actors. We delineate the general circumstances in which private-public partnerships will be optimal. Subsequently, we discuss when and why multilateral organizations (rather than just governments) might participate in constructive partnerships. We then instantiate our theory with real-world illustrations drawn from a variety of settings. We con- 739 clude with a summary and a discussion of implications for future research. CORE AND COMPLEMENTARY VALUES: RESOURCES AND GOVERNANCE Every economic transaction involves a dyad composed, on the one hand, of resources and, on the other, of governance. Resources refer to the core values (viz. investment, know-how, time, materials, etc.) that are the objects of the exchange, while governance refers to the complementary values (viz. the ex ante searching, negotiating, and contracting and the ex post coordinating, monitoring, and enforcing) that are necessary to enable and ensure satisfactory exchange. It is generally accepted that markets economize on resource costs, while firms economize on governance costs (Coase, 1937; Hayek, 1945; Williamson, 1975). Networks, the focus of this special topic forum, are viewed as hybrids that are adopted in circumstances in which markets or firms alone are unsatisfactory (see Richardson, 1972, for an early treatise on the topic). Because we use this conventional wisdom as a point of departure, in the paragraphs below we review its basic form and substance. Resources—that is, the objects of exchange— are seldom costless. Unit resource costs tend to be (1) positive, (2) not constant or bounded, and (3) varying across actors. Some actors, by virtue of scale, experience, and expertise, can deliver given resources at lower unit costs than others who are not so specialized. We can therefore expect actor capabilities to affect resource costs. In particular, if resources required are industry specific, then industry-specific actors can be expected to have lower resource costs than other actors. Resource costs can also vary across circumstances. In circumstances where volumes are sufficiently sizable and stable or growing, unit resource costs might, by virtue of scale economies, be expected to be lower. Thus, actor capabilities, a factor on the supply side, and volumes, a factor on the demand side, can both influence unit resource costs. Governance, the enabler of the exchange, is typically not costless either. Both ex ante and ex post governance costs also vary across circumstances and actors (see Parkhe, 1993). In circumstances where resources are made specific (to exchange partners, industry, or location), gover- 740 Academy of Management Review nance costs are expected to be higher. In circumstances where there is high and uninsurable uncertainty on volumes (and, hence, prices), governance costs (especially related to renegotiation) can be expected to be higher. Likewise, governance costs can be expected to be high when high and uninsurable uncertainty is perceived in the future behavior of transaction partners (regarding their explicit and implicit obligations in the transaction). A corollary is that as the number of actors involved rises, governance costs can be expected to rise as well. It is also well established that the nature and identity of actors can influence governance costs. Actors can vary in their knowledge of and connectedness to other actors. Thus, actor position and status can influence governance costs. Certain actors can weaken partners’ legitimacy or block their access to scarce resources. Such actors can be expected to face lower governance costs. Actors can also be from the same or different industries. Governance costs can be expected to be higher if collaborating actors are from different industries. Last but not least, actors can vary in their authority and credibility. Lower governance costs, especially in terms of July monitoring and enforcing, attach to actors endowed with greater authority and credibility. TRADITIONAL EXCHANGE MODES Juxtaposing (1) resource losses to a focal actor from adopting a “make” option and (2) governance losses to the same focal actor from adopting a “buy” option, we can depict, as in Figure 1, the three traditional exchange modes that have been widely discussed in the existing literature (e.g., Williamson, 1991). To be clear, our purpose here is not to develop logic but simply to categorize the known exchange modes. Thus, when the governance losses of buying are not high but the resource losses of making exceed the governance losses of buying, then markets are expected to hold sway. Indeed, the area in Figure 1 allocated to markets is consistent with the view that they economize on resource costs. Further, when the resource losses of making are not high but the governance losses of buying exceed the resource losses of making, then firms are expected to hold sway. Thus, the area in Figure 1 allocated to firms is consistent with the view that they economize on governance costs. Last, when the resource FIGURE 1 Relative Resource and Governance Losses to a Focal Actor and Expected Transaction Governance Mode 2006 Rangan, Samii, and Van Wassenhove losses of making and the governance losses of buying are both perceived to be high, then alliances (hybrids) are expected to hold sway. Thus, the area in Figure 1 allocated to alliances is consistent with the view that they are a compromise indicated when the resource losses of making and governance costs of buying are both high. PUBLIC ACTORS AND PUBLIC BENEFITS As important and useful as the traditional organizational apparatus is, it does not help address the issues we raised at the beginning of the paper. Indeed, there is no mention of public actors, and, further, there is no mention of nationalization, which, after all, has been and still remains a widely used organizational arrangement in certain spheres of the economy (e.g., general postal services). To see when nationalization might emerge as an organizational arrangement, it is necessary to lift certain assumptions that are implicit in the preceding analysis. First, although not stated explicitly, it is assumed that the benefits generated by transactions in Figure 1 accrue mainly to the parties bearing the resource and governance costs in the transaction. This, of course, is not always the case. Certain private transactions bring benefits to third parties that are not directly (or immediately) part of the transaction. These transactions, in economic terminology, have positive externalities—that is, the potential to create significant “public benefits.”1 When this is the case, a wedge can exist between the amount of private benefit that accrues to the cost-bearing actors and the public (or total social) benefits that accrue to all actors affected. Now it is well known that because of individual rationality (oriented toward maximum private benefits at minimum private costs) and the nontrivial governance costs of collective action (i.e., fair allocation of costs over all potential beneficiaries and enforcement of sanctions against free riders), public “goods” tend to be underprovided (and public “bads” tend to be overprovided2). After all, private actors will tend to be reluctant to participate in economic trans- 741 actions in which expected public benefits far exceed expected private benefits, especially if the latter are not expected to exceed private costs. Two things now become clear. First, the traditional apparatus focuses on resources and governance costs but does not explicitly discuss benefits. It is driven, therefore, by a logic of minimization (an apparent feature of Williamsonian transaction cost theory critiqued in Ghoshal and Moran [1996]). Second, the traditional apparatus does not address public benefits from private transactions—that is, it does not address positive externalities. As noted, public benefits are the benefits accruing to all private actors from the (costly) actions of some private actors. Taking these factors into account allows us to consider wider economic organization. Accordingly, in Figure 2 we introduce public actors and public benefits into the analysis. (For simplicity, we discuss only governments and multilateral organizations as public actors.) Like private actors, public actors, too, have limited resources and varying levels of capability and credibility. They differ, however, from private actors in two important ways. First, they differ in terms of objectives. While private actors strive to maximize private benefits (indicated, say, as firm-level economic profits and long-term independent survival), public actors strive to maximize public benefits (indicated, say, as region-level GDP per capita and sustainable development) for their constituents. Second, public actors tend to possess greater authority and legitimacy. Authority inheres in public actors, especially governments, because they have a monopoly on rule making, its application, and enforcement (see Moe, 1990, and Zerbe & McCurdy, 1999). Public actor legitimacy can be controversial; still, especially for multilateral organizations, it tends to be higher than that of private actors because objectives are explicitly public spirited rather than private. To be clear, the pursuit of private benefits (selfinterest) is legitimate, yet, as a generalization, the pursuit of public benefits (other interest) enjoys prima facie greater legitimacy. This greater legitimacy translates into greater credibility, because professed motives are not only well regarded but are also more accepted as true ones. 1 Coarsely, in utility terms, if U2(A2, A1) is an increasing function of A1, then A1 has positive externalities. 2 Overproduction of public “bads” imposes negative externalities (recall “the tragedy of the commons”), which, typ- ically, are the object of regulation—a topic beyond the scope of this paper. 742 Academy of Management Review July FIGURE 2 Expected Actors and Transaction Modes Based on Public Versus Private Benefits, Relative Resource Costs, and Private Actors’ Uncertainty and Governance Costs Returning to Figure 2, the vertical axis of the main framework on the left contrasts public and private benefits for a given transaction (or set of transactions). The horizontal axis of the same framework contrasts public versus private actor resource costs pertaining to the same transaction (or set of transactions). As we suggest in that framework, when (1) public actor resource costs are higher than those for private actors (i.e., private actors are more efficient), and (2) public benefits do not much exceed private actor benefits (i.e., the public-private wedge is small), then private actors will undertake transactions they regard as beneficial (and will do so within one or another of the three traditional modes sketched in Figure 1). We therefore allocate the south-southeast area of the main framework in Figure 2 to private actors (i.e., markets, firms, and interfirm alliances). However, when (1) public benefits significantly exceed private benefits (whatever the reason), and (2) public actor resource costs are not relatively higher (and perhaps are even lower) than private actor costs (i.e., public actors are not less efficient), then public actors will themselves undertake transactions they regard as beneficial (and will tend to do so via nationaliza- tion or its equivalents). We therefore allocate the west-northwest area of the main framework in Figure 2 to public actors (and nationalization). As before, a third area remains in the figure. When (1) public benefits significantly exceed private actor benefits (i.e., the public-private wedge is large), but (2) public actor resource costs in the activities contemplated are far higher than private actor costs (i.e., private actors are more efficient), then there is scope for collaboration between private and public actors. Public actors will want to get involved because of positive externalities (and the large public benefits), but they will be loath to go it alone, because the effectiveness and efficiency implications indicate otherwise. Private actors will be reluctant, by themselves, to undertake transactions in this northeast quadrant, because while they might have resource (i.e., cost) advantages, they do not have the governance advantages required to close the public-private wedge and reap adequately positive net benefits. They will therefore be hard pressed to justify to their stakeholders the allocation of (presumably scarce) private resources to the creation of (dubious) benefits that are not fully, or, worse, sufficiently, privately appropriable. 2006 Rangan, Samii, and Van Wassenhove It is in this northeast quadrant of the main framework in Figure 2 that we can expect to see constructive partnerships—that is, active alliances between private and public actors. Here, right away, we must make two important clarifications. First, for the same transaction, the parameter values of public and private benefits can and do vary across place and time. The valid calculus depends on the presence, breadth, and quality of the ambient institutions of governance—including norms and laws on private property, courts, enforcement units such as the police, and, not least, markets—as perceived by the private actors contemplating the focal transaction. In a place or time where ambient institutions of governance are not well developed, private appropriability will be perceived as low and the public-private wedge will, in general, be perceived as large. Of course, even in contexts where ambient institutions of governance are well developed, there will be certain transactions for which private appropriability is still perceived as low and the publicprivate wedge as unacceptably large. In sum, to be explicit, assessments of the parameter values on the vertical axis in Figure 2 depend not only on the transaction but, importantly, on the ambient institutions of governance.3 In turn, this means that the full and meaningful unit of analysis for the question at hand is transaction, as well as place and time. The second clarification involves immediately acknowledging that the private-public collaboration indicated in the northeast area in Figure 2 can and often does take place in “contract” mode. In this mode, government (the public actor) simply contracts with private actors to undertake, in return for financial consideration, certain transactions. Today, transactions such as waste collection, highway construction, and design and assembly of defense aircraft tend, in many places, to be undertaken in this mode. Here, the public actor uses its delegated authority and solves the collective action problem on the demand side (by, for instance, taxing citizens) and at the transaction level presents the private actor an acceptably low level of uncertainty regarding private net benefits (see Forster, 1999). Alternatively, if uncertainty still ex- 3 For pointing out this “nested logic,” we thank an anonymous reviewer. 743 ists, it must be the case that private actor governance costs are sufficiently low to contract, monitor, renegotiate, and enforce obligations according to the circumstances that actually exist. That is, if private actors have efficient access to effective mechanisms to deal with uncertainty (e.g., access to courts and court enforceable government contracts with, say, satisfactory cancellation clauses), then the contract mode of private-public collaboration will tend to prevail, even under uncertainty. It is when private actors perceive high uncertainty in terms of their expected net benefits and when they perceive high governance costs of contracting, coordinating, renegotiating, and enforcing (to mitigate or react to the uncertainty) that constructive partnerships will be necessary. Private actors will be willing to contribute their specialized resources to transactions that generate positive externalities (i.e., public benefits), but their participation will be conditioned on the satisfactory externalization of governance. Here, multiple actors on the demand and supply sides might need to be coordinated, and contracts might be perceived as impractical and offering limited relief. (Recall the HIV/AIDS effort in Botswana.) Public actors come in because they are uniquely placed to take on the governance (coordination and enforcement) function.4 As reasoned above, public actors are endowed asymmetrically with more authority and legitimacy, both of which are key currencies for efficient and effective governance. Accordingly, if suitable public actors exist, and if they are persuaded to step in to supply satisfactory external governance, then the economic (and social) opportunity can be realized. The satisfactoriness of external governance will be indicated in the extent to which it lowers private actors’ uncertainty in terms of expected net benefits accruing to them. These, then, are the circumstances in which constructive partnerships will be necessary. We 4 Notice, today, at least in economically developed nations, that public actors don’t tend to have factories (i.e., they are not much engaged in transforming inputs into outputs); they are staffed largely with planners, program managers, and administrators (i.e., bureaucrats and technocrats). A notable exception is governments’ direct involvement in science, especially basic and future science. It would appear that the fact that science can contribute to public benefit, but is often not commercially exploitable, has something to do with this pattern. 744 Academy of Management Review portray this last set of arguments by telescoping out the northeast quadrant of the main framework in Figure 2 and delineating there the contract and constructive partnership modes. To recap, public actors enter the transaction because of significant positive externalities (public benefits to constituents). They do not go it alone because of resource cost disadvantages (which hurt efficiency and effectiveness). Private actors possessing specialized resources enter the transaction to reap positive private net benefits (profits and long-term independent survival). They do not go it alone because of uncertainty and governance cost disadvantages (which cast doubts on value creation and appropriation). Of course, all this holds only where suitable private and public actors exist. Assuming this, and based on the preceding, we offer the following. Proposition 1: When the realization of economic opportunity (1) calls for industry-specific competencies but entails significant positive externalities (i.e., implies specialized private actions with significant public benefits), (2) is shrouded by high uncertainty for the private actors, and (3) necessitates for private actors high governance costs for contracting, coordinating, and enforcing, then private-public alliances— constructive partnerships— will be necessary for realizing the economic potential. GOVERNMENTS AND MULTILATERAL ORGANIZATIONS Having specified when private-public alliances— constructive partnerships—will be necessary, we turn now to the question of when the public actor in the partnership might be a (local or national) government and when the public actor might be a multilateral organization. In general, private-public alliances are likely to involve governments. Governments are, as noted above, uniquely endowed with authority. Moreover, government actors in economically advanced nations are perceived by private actors as generally capable and credible partners in private-public alliances. In the United States, for instance, the National Institutes of Health is a major sponsor and overseer of basic and “orphan drug” research (both activities with uncer- July tain private payoffs), often conducted in conjunction with and within private drug companies. In general, then, constructive partnership involves private firms and government actors. Although governments are endowed with exceptional authority, scholars have highlighted the political nature of their actions (Moe, 1990; Spiller, 1999). We identify at least two other factors beyond political motives (and unethical diversion of resources) that can undermine the effectiveness of governments as partners in the provision of public benefits. First, a government may not be a viable partner owing to the absence of adequate human, financial, and institutional capability. Second, it may lack credibility because of an unsatisfactory history of achievements, relationships, and behavior. Lack of credibility can prevent it from being regarded as a viable partner, because governance effectiveness of public actors is a function of their perceived credibility (see Delmas & Heiman, 2001). When private actors perceive the capability or credibility of potential public partners as inadequate, they will tend to shy away from the economic opportunity (see Parkhe, 1993). It is in these situations that multilateral organizations, where suitable ones exist, can be optimally involved. A multilateral organization is a not-forprofit economic, judiciary, social, or cultural organization with a specific or broad mandate that transcends national and firm boundaries, authority, and interests. Created, governed, and funded by its member states, it has no legal claim to ownership of the goods and services it creates or strengthens. Yet multilateral organizations (such as the United Nations Development Program, the World Health Organization, and the International Monetary Fund) often possess greater organizational capabilities and credibility than many governments (especially in the developing world). Thus, in a recent commentary, Jeffrey Sachs (2002) argued that specialized United Nations agencies have more organizational expertise and hands-on experience than many organizations worldwide, including bilateral donor agencies. Importantly, he notes, they have a wide operational presence that enables them to organize and oversee activities even in the most difficult settings. The role of the multilateral organization in a constructive partnership may be as varied as the catalyst, coordinator, administrator, and moral watchdog. As a catalyst, it brings together 2006 Rangan, Samii, and Van Wassenhove actors for the achievement of a common goal. Through a negotiation process, it coordinates the establishment of a framework for cooperative relations and the initiative (roles and responsibilities of individual economic and political partners, nature of the problem to be addressed, modalities, etc.). Incurring high sunk costs, it pulls together all the necessary resources (financial, human, and technical) and accepts accountability for their utilization. It can relieve the actors from the administrative and implementation burden as it takes on responsibility for the delivery of the deliverables. As a moral watchdog, it acts as an acceptable intermediary between the market, government, and the corporate world. It tries to ensure the accomplishment of system goals (through a process of goals and expectations management and harmonization). Proposition 2: When a constructive partnership is indicated in the context of an economic opportunity, but local or national governments are not perceived by the relevant private actors to possess adequate capability or credibility, then the participation of a suitable multilateral organization will be necessary for realizing the economic potential. Before turning to real-world illustrations to instantiate the theory we have outlined, we would like to make two further points. First, beyond a very general mention of profits and longterm independent survival, we have offered no discussion of specific “reasons” for the participation of firms in private-public partnerships. In particular, some observers have rightly pointed out that, in some of these cases (as in the Merck example mentioned earlier), private actors might be maneuvering for legitimacy. This is valid, but legitimacy enhances long-term survival, which is the broader end under which we subsume this specific reason. More important, reasons (such as legitimacy) are distinct from “circumstances,” and scrutinizing reasons rather than circumstances does not help us discriminate among organizational forms. There are, after all, many organizational forms through which private actors might obtain legitimacy (see Meyer & Rowan, 1977), but there is a specific set of circumstances in which privatepublic partnerships are optimal and, hence, can be expected. This is why we focus on circum- 745 stances rather than reasons. (For a useful categorization of reasons that motivate interorganizational relationships, see Oliver [1990]). Second, we have said little about negative externalities. Consider the improper disposal of industrial waste, or the corrupt business practices of some firms. Such actions of some private actors bring public disbenefits. As a generalization, however, negative externalities tend not be addressed via private-public partnerships; rather, like other “bads,” they tend to be the object of regulation. There is a public disbenefit, and, hence, a public actor, typically a government, is involved, but specialized resources are not usually called for, so the matter is handled largely by public actors. However, consistent with what we argued above, we would venture that in the cases where the containment of negative externalities calls for industry-specific competencies (e.g., optimal regulation of business practices—related to security, privacy, and content— on the internet [see Baird, 2002]), public actors will engage with private actors in preregulatory consultation and exchange. REAL-WORLD EXAMPLES In the paragraphs below, we briefly discuss several real-world examples drawn from a variety of settings and position them within the framework of Figure 2. To be clear, our purpose here is instantiation, not substantiation. Consider first the north-northwest (public actors) area of the main framework in Figure 2. We could position public libraries here. For reference materials, the private cost-benefit analysis is such that they seldom find their way onto private book shelves. Still, public benefits of making such materials widely accessible can be considerable, and the public costs can scarcely be greater than private costs—ergo, public libraries. Another example we would position here is the U.S. space exploration program pursued through NASA. Space exploration can be regarded as an activity with potentially enormous future benefits. Currently, however, uncertainty shrouds both scientific discovery and especially commercially attractive applications in that realm. This means that the wedge between public and private benefits is perceived as large. Also, given the exploratory nature of the space “business,” few private actors possess resource 746 Academy of Management Review advantages (experience and expertise) over public actors (government and university labs). Furthermore, given their different time horizons and “discount rates,” the projected net present value is higher (less negative?) for public actors compared to private actors. Therefore, today, consistent with the logic sketched above, this set of activities is pursued, for the most part, by public actors. In the future, in this domain, if the private supply curve and (private or public) demand curve shift enough so that they intersect, then space research and exploration could be privatized in contract mode or even operate altogether privately. An example we would place in the southsoutheast (private actors) area of Figure 2 is the (interfirm) alliance formed by America Online, Microsoft, and Yahoo! to address the email “spam” problem (estimated to account for 40 percent of all email traffic and “$8 billion to $10 billion in costs to business a year’’ [Krim, 2003: A6]. At this time, the three firms are estimated to have more than 200 million email account holders, which, it would appear, gives them sufficient private incentive to move to address the spam issue. Thus, here, the net private benefits are strong, the concerned private actors are few in number, and those actors possess distinct resource advantages (technical expertise) to address the issue. Hence, as would be indicated by the proposed framework, this set of activities is undertaken and organized by private actors.5 Above, in instantiating our theory, we described purely public and purely private actor transactions. In passing, we also already mentioned contract relations between public and private actors; recall road construction and procurement of defense aircraft. In the paragraphs below we turn to examples of constructive partnerships involving private and public actors. The call by the CEO of Merck for a constructive partnership—among industry peers, government, and specialized multilateral organizations—to address the HIV/AIDS crisis in Botswana is the first example we noted. The set of life-saving medicines to fight this disease is, 5 To be sure, consistent with our comment about negative externalities being addressed via regulation, the U.S. Federal Trade Commission recently held in Washington a threeday forum on spam, and U.S. law makers are tabling several bills, including one proposing “a bounty” for tracking down spammers (Krim, 2003: A6). July today at least, a “specialized resource,” implying that, currently, only industry-specific private actors (specialist pharmaceutical firms in this case) possess the expertise to effectively and efficiently fabricate the indicated drugs. However, the treatment is complex in nature and must be complemented by an adequate health infrastructure: trained physicians and nurses, diagnostic and treatment facilities, community distribution channels, and so forth. Ability to pay, moreover, is a critical issue and calls for serious collective action. The implementation of such a system implies high coordination, monitoring, and enforcement costs. Because government capabilities (and in some cases credibility) might be inadequate, specialized multilateral actors (e.g., UNAIDS, WHO) have been called in. These latter actors bring legitimacy and expert authority to their role as project administrators and coordinators. Thus, they lower coordination and enforcement costs to the private actors and also mitigate the fear of misuse and neglect by government (and other complementary actors). While the government is keen on the initiative for obvious public benefit reasons, the multilateral organizations view this as an opportunity to fulfill their mandate. For their part, the private actors require such a constructive partnership if their efforts (in making the drugs available at subsidized prices) are actually to bear fruit (in this case, prevent the spread of AIDS). Success in this endeavor can repair firms’ legitimacy, which has eroded subsequent to their initial traditional responses. In terms of longer-term private benefits, Merck CEO Gilmartin bluntly points out: Corporations must view these issues from the perspective of a long-term investor. The ability to maintain and extend markets from the developed world to emerging markets . . . will be impossible unless we create the foundation of political and economic stability that can only come by addressing the economic and social needs of the world’s poorest nations (2003: 177). Another example of constructive partnerships relates to developing country project finance for power plants, ports, petroleum pipelines, and so on. Here again, potential economic opportunity is realized and transactions consummated through constructive partnerships between private and public actors. High-sunk-cost, longterm, illiquid infrastructure projects in develop- 2006 Rangan, Samii, and Van Wassenhove ing countries face both high country and project risk. In these countries the governance mechanisms (contracts, legal infrastructure) to mitigate such uncertainties are often not adequately developed (see Klein, So, & Shin, 1996). Therefore, although private actors (construction companies and commercial banks) see the opportunity and possess industry-specific knowhow—in infrastructure engineering, capital allocation, and risk management—they are deterred from going it alone. However, through a constructive partnership with two sets of public actors— host governments and multilateral development banks—these private actors may pursue such infrastructure projects. As a third example, consider MPEG (the Moving Picture Expert Group)—the body that works out and establishes technical standards for compressing digital video and audio information. This is a constructive partnership where private actors come together under the auspices of a public actor, the International Organization for Standardization (ISO). The private actors (such as Fujitsu, Lucent, Matsushita, Philips, Scientific Atlanta, and others) have a resource advantage (e.g., technical expertise), but they are too numerous and heterogeneous in terms of the industries they come from. The costs of coordination among these computer, electronics, and telecommunications firms can be considerable. Still, the public benefits from agreement on digital information compression standards are considerable too. (Just think of the public benefits to all users and merchants from the standardization of credit card physical sizes and data formats—an activity that also occurred under the auspices of ISO.) Thus, in MPEG, private actors want to participate because there is potential private benefit (viz. current and future profit from sales, patent royalties, and the right allocation of research resources). Yet they face not only a coordination challenge but also uncertainty in terms of net benefits. If not enough firms join and comply with the consortium, then there can be costly factionalization (which has happened in the U.S. mobile phone arena). With the participation of one or more credible public actors, this factionalization can be avoided (as in the governmentaided setting of the single GSM telecommunications standard in Europe). Hence, consistent with the model we have proposed, the MPEG involves public actors (the ISO 747 and the International Electrotechnical Commission [IEC]). The website of the ISO notes that the technical work of ISO is highly decentralized, carried out in a hierarchy of some 2,850 technical committees, subcommittees and working groups. In these committees, qualified representatives of industry, research institutes, government authorities, consumer bodies, and international organizations from all over the world come together as equal partners in the resolution of global standardization problems. Some 30,000 experts participate in meetings each year (ISO, 2003).6 A fourth example is manifested in a problem we refer to as the infrastructure gap—a challenge in developing countries faced by multinational enterprises (MNEs) that operate in linkage-intensive industries. It is useful to bear in mind, as background, that despite market potential in developing countries, those nations receive less than a third of world foreign direct investment (United Nations Conference on Trade and Development, 2001). Adaptation for foreign investors in linkageintensive industries consists of the establishment of backward and forward linkages within the host economy. The financial success of an MNE’s investment often depends on this. In developed markets (such as Britain and the United States), market uncertainty is relatively low and basic infrastructure sound enough that multinationals can make it on their own. But in developing countries, a focal multinational often faces market uncertainty and the absence of a precompetitive supply platform. As a result, it must determine a strategy to overcome this infrastructure gap in the short and long term. The firm can pursue at least four different strategies: internalization through vertical integration, reliance on market mechanisms, traditional creation of local on-site capability, or risk diversification and externalization through a constructive partnership. Internalization is a high-risk strategy, given the uncertainties on the demand side and the 6 We should note that in certain technical arenas the speed of public actors might be perceived as unacceptably slow, and private actors might view the window of economic opportunity as fleeting. In such cases, some private actors might well come together in an attempt to create de facto standards. In this private coordination the larger public might lose, which, however, does not automatically imply that government intervention would have been better. For more on optimal standard setting, see Farrell and Saloner (1988). 748 Academy of Management Review high sunk costs involved in developing specialized and industry-specific resources ex novo. As Ohmae has asserted, “You can do everything yourself—with enough time, money, and luck. But all three are in short supply” (1989; 197). To maintain quality levels in supply, firms may resort to a fast and reliable route: the market mechanism of imports. While this can be an effective strategy in the short run, its long-term competitiveness implications are not enticing because of changing exchange rates and tariffs on imports. That is, firms pursuing this strategy forego the predictability and cost effectiveness they could realize with a local supply chain. The decision of an MNE to source locally depends on the local suppliers’ capability and performance (competitive cost structure, quality, reliability, and flexibility). When performance is below acceptable standards, MNEs engage in one-to-one company-specific vendor development programs. The objective is to create specialized capability and upgrade key and strategic suppliers capable of absorbing new technologies and management practices. However, given cost and private appropriation concerns, in an economy characterized by market size uncertainties and incomplete contracts (i.e., costly governance), it is unlikely that individual firms will singly indulge in the development of a public benefit—namely, a precompetitive supply platform. An alternative to the above is the development of the supply platform through a constructive partnership with other industry members and public actors. Government, multilaterals, and private actors have an interest in the collective action. In this vein, Samii, Van Wassenhove, and Bhattacharya (2002) document the constructive partnership between the United Nations Industrial Development Organization (UNIDO), the multinational firms Fiat and Magnetti Marelli, and the host government of India, in the development of an automotive industry supply platform in the western region of the country. Viewed by all parties as a pilot case, the project aimed to upgrade industry-specific capability of the Indian suppliers. While governance was externalized to UNIDO, the private actors—Fiat and others—provided both funding and expertise. The government provided funding and authority to the whole initiative, while the Indian industry associations provided local resources and knowledge. July This constructive partnership was viewed by all parties, including the Indian automotive component suppliers, as successful on two fronts: as a governance mode per se, and as a creative and effective strategy to address the infrastructure gap and unlock economic potential. Like those discussed earlier, this case too illustrates (1) how firms working alone might fail to capitalize on pockets of private economic opportunity, (2) how governments working alone would be unable to close the gaps and advance the public benefit, and (3) how a constructive partnership can alleviate the problem. The examples cited above are consistent with the model we have proposed. Notwithstanding, our theorizing should be seen not as positive (i.e., what is) but rather as normative (i.e., what should be). By setting aside history and politics, as we have done, we also set aside claims of explaining all governance in the real world. Indeed, we already speculated that superior outcomes could have been expected had U.S. mobile phone standards been determined via a constructive partnership (as opposed to a market melee). Likewise, we would venture, today, that the health care systems in the United States, Britain, and continental Europe seem perplexingly unsatisfactory. We would argue that governance in this arena is well-suited to a constructive partnership. Yet (for reasons that lie outside our model) the system is largely marketized in the United States (with large swaths of the population undercovered and in questionable health) and nationalized in Europe and the United Kingdom (with apparently inefficient and unsatisfactory outcomes there). We agree that history and politics probably play a great role in explaining the current governance arrangements in health care. Among other malaligned governance arrangements we would add pharmaceutical pricing, and also perhaps the continuation in Western nations of government-supported radio and television stations (witness the debate on the forced public sponsorship of the British Broadcasting Corporation). CONCLUSION As extensive as the literature on networks and alliances is (see Contractor & Lorange, 2002), it has focused largely on private actors—namely, firms. Little has been said about the role of public actors. Yet, as we argued above, only alli- 2006 Rangan, Samii, and Van Wassenhove ances between private firms and public actors can enable creative strategies in certain spheres of economic activity. We have specified the circumstances under which such constructive partnerships will be effective and efficient. We have explained why, in those circumstances, conventional arrangements (viz. markets, interfirm alliances, internalization, or nationalization) cannot be expected to work as well. Last, we have also specified when, in these cases, the public actor can be a government and when a multilateral organization will have to be involved. Through this paper we have attempted to make three contributions. First, we have explicitly and jointly discussed both resource and governance costs. In most of the organization literature (on trust and social networks), resources are taken as given and governance receives sole focus, or, alternatively, governance is taken as given and resources receive sole focus. Second, we have shown that only by joining both of these latter costs with public benefits and the concept of positive externalities can we identify when constructive partnerships will be necessary. While this explicit joining of positive externalities and transaction costs might not be novel in the worlds of positive political theory and public policy, it has received little attention in the management literature. (In most economics the resolution of externalities has been sought via appropriate pricing mechanisms, but transaction costs are usually set aside there.) Third, and most important, we have shed explicit light on the potential role of public actors in building effective private networks. By highlighting the role of (especially multilateral) public actors, we hope we have shown that alliance governance can be externalized to a specialized actor. The alliance literature has implicitly assumed that governance should be endogenous to the core players. This, as we have shown, can be severely limiting. In the confines of one paper we have not been able to explore the dynamics implied in our model. What is clear, however, is that boundaries between the state and the firm have changed over time, especially during the past two decades. We would submit that several developments jointly explain these shifts. Most important, perhaps, has been the growing budgetary pressures on all actors, but especially public actors. For a variety of reasons (comparative growth rates being among them, and also the 749 mobility of technology, capital, and skilled labor), small government ideology and a preference for market ordering have captivated policy circles and become the conventional wisdom. Citizens, partly perhaps as a reaction, look more to the private sector to fill in spaces left open by government (witness the emergence of corporate social responsibility). Thus, the legitimacy standards of government have evolved more along an economic dimension (making public efficiency and errors of commission more salient), while those of private actors have evolved more along a social and ethical dimension (making private actor errors of omission more salient). Belief and growth in competition, we speculate, are root causes of both developments. Alongside these broad developments, market growth and specialization have shifted the boundaries of the firm (and made interorganizational relations more salient). In some sectors (such as civil aviation, which historically was typically nationalized), there has been a marked upward shift in demand, which has made marketization feasible and sensible. In other words, private demand curves have risen to now intersect private supply curves. In other sectors, technologies have advanced (e.g., color TV, internet), with roughly the same effect. In still other cases, the ambient institutions of governance have evolved (e.g., on intellectual property, human rights) and new actors have emerged (e.g., nongovernmental organizations, such as Médecins Sans Frontières). Whatever their origins, these developments influence and shift the values of the parameters in our model. They do not, however, negate the parameters themselves or the logic underlying them. In this sense, the model we have advanced can accommodate changes not only in transaction but also in place and time. If shifts along one or more of those three dimensions cause sufficient changes in parameter values, then the model signals changes in governance arrangements. We expect that the ideas sketched above will be of some interest to managers in the private and public realm. One implication for private managers is that, in complicated situations of unlocking economic potential, if they can demonstrate genuinely that their firms’ private actions can bring considerable public benefits, they might be able to call and count on effective and efficient governance from authority- and 750 Academy of Management Review credibility-endowed public actors. While this division of labor might not have been pondered by Adam Smith, it would appear to hold important promise today (and, for this reason, perhaps even meet with Smith’s approval). In the words of another economist, Governments realize that firms [private actors] are peculiarly well equipped to be wealth [and, we would add, health] creators. At the same time, they acknowledge their responsibility to provide the . . . institutional . . . framework so that firms can fulfil this function efficiently and with the minimum transaction costs (Dunning, 1993: 328). In terms of future research, it will no doubt be necessary to refine and deepen the early ideas we have sketched here. The issues of time horizon, repeat interactions, opportunity costs, and other ideas from game theoretic approaches to interorganizational cooperation (as elegantly treated in Parkhe, 1993) could be promising avenues. We hope the question we have framed and the theory we have proposed will provoke this sort of interest. Likewise, it will be important to study how constructive partnerships get initiated. This is an issue about which we have said little. Last but not least, it will be instructive to attempt an empirical operationalization of the framework we have proposed.7 Before concluding, we would be remiss not to acknowledge a “fig leaf” hypothesis on constructive partnerships. At least some of the illustrations we have sketched (e.g., the one involving Merck in Botswana) raise the specter of firms posturing for pure private gain: using partnerships to cover up or deflect attention away from serious inadequacies and defects. Similar motives could be attributed to governments (politicians) and even multilateral organizations. Disturbingly, as has been pointed out to us, the seeming rationality of economics can hide political choices while legitimating often arbitrary and purely self-interested arrangements.8 Obvi7 The empirical approaches in Dubin and Navarro (1988), Ferris and Graddy (1990), and Parkhe (1993) provide helpful models. 8 We credit a judicious reviewer for helping us confront and acknowledge this awkward reality. At the same time, we maintain that testability, not only parsimony and generalizability, is a hallmark of useful theory. On that score the fig leaf hypothesis is problematic, not to mention it could not easily explain constructive partnerships in such cases as the infrastructure projects (the pipeline and auto parts examples we described) or the MPEG. July ously, our intentions here are not such, and we leave to future research the task of grappling with empirical evidence and apportioning explanatory power among economic and political factors. In a world that is increasingly specialized and interdependent, successful responses to new goals and challenges will call for more understanding of how to orchestrate complementary activities. We hope, in responding to this special issue on unusual partnerships enabling creative strategies, we have made a contribution in this direction. REFERENCES Baird, Z. 2002. Governing the internet: Engaging government, business, and nonprofits. Foreign Affairs, 81(6): 15–20. Bryson, J. M., & Ring, P. S. 1990. A transaction-based approach to policy intervention. Policy Sciences, 23: 205– 229. Coase, R. 1937. The nature of the firm. Economica, 4: 386 – 405. Contractor, F. J., & Lorange, P. (Eds.). 2002. Cooperative strategies and alliances. Oxford: Elsevier Science. Delmas, M., & Heiman, B. 2001. Government credible commitment to the French and American nuclear power industries. Journal of Policy Analysis and Management, 20: 433– 456. Dubin, J. A., & Navarro, P. 1988. How markets for impure public goods organize: The case of household refuse collection. Journal of Law, Economics, and Organization, 4(2): 217–242. Dunning, J. H. 1993. Governments, hierarchies and markets: Toward a new balance? In J. H. Dunning (Ed.), The globalization of business: 315–329. London: Routledge. Farrell, J., & Saloner, G. 1988. Coordination through committees and markets. Rand Journal of Economics, 19: 235– 252. Ferris, J. M., & Graddy, E. 1994. Organizational choices for public service supply. Journal of Law, Economics, and Organization, 10(1): 126 –141. Forster, J. 1999. The creation, maintenance and governance of public goods and free goods. Public Management, 1: 313–327. Ghoshal, S., & Moran, P. 1996. Bad for practice: A critique of the transaction cost theory. Academy of Management Review, 21: 13– 47. Gilmartin, R. 2003. What business can and must do to boost health. Global Agenda, 2003: 177–178. Hayek, F. 1945. The use of knowledge in society. American Economic Review, 35: 519 –530. International Organization for Standardization (ISO). 2003. Who does the work? http://www.iso.org/iso/en/stdsdevelopment/whowhenhow/who.html. Klein, M., So, J., & Shin, B. 1996. Transactions costs in private 2006 Rangan, Samii, and Van Wassenhove 751 infrastructure projects—Are they too high? Viewpoint. Note No. 95. Washington, DC: World Bank Group. Richardson, G. B. 1972. The organization of industry. Economic Journal, 82: 883– 896. Krim, J. 2003. Big U.S. providers of e-mail join forces to fight spammers. Wall Street Journal Europe, April 29: A6. Sachs, J. 2002. Weapons of mass salvation. The Economist, October 26: 81– 82. Lamont, J. 2002. Merck seeks wider private-sector coalition on Aids. Financial Times, September 13: 6. Samii, R., Van Wassenhove, L. N., & Bhattacharya, S. 2002. An innovative public-private partnership: New approach to development. World Development, 30: 991–1008. Meyer, J. W., & Rowan, B. 1977. Institutional organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83: 340 –360. Moe, T. M. 1990. Political institutions: The neglected side of the story. Journal of Law, Economics, and Organization, 6(Special Issue): 213–253. Ohmae, K. 1989. The global logic of strategic alliances. Harvard Business Review, 67(2): 143–154. Oliver, C. 1990. Determinants of interorganizational relationships: Integration and future directions. Academy of Management Review, 15: 241–265. Spiller, P. 1999. Institutions and commitment. In G. R. Carroll & D. J. Teece (Eds.), Firms, markets, and hierarchies: 279 –310. New York: Oxford University Press. Stigler, G. J. 1951. The division of labor is limited by the extent of the market. Journal of Political Economy, 59: 185–193. United Nations Conference on Trade and Development (UNCTAD). 2001. World investment report. Geneva: United Nations. Williamson, O. E. 1975. Markets and hierarchies. London: Free Press. Parkhe, A. 1993. Strategic alliance structuring: A game theoretic and transaction cost examination of interfirm cooperation. Academy of Management Journal, 36: 794 – 829. Williamson, O. E. 1985. The economic institutions of capitalism. New York: Free Press. Perrow, C. 1981. Markets, hierarchies and hegemony. In A. H. Van de Ven & W. F. Joyce (Eds.), Perspectives on organization design and behavior: 371–386. New York: Wiley. Williamson, O. E. 1991. Comparative economic organization: The analysis of discrete structural alternatives. Administrative Science Quarterly, 36: 269 –296. Powell, W. W. 1990. Neither market nor hierarchy: Network forms of organization. Research in Organizational Behavior, 12: 295–336. Zerbe, R. O., Jr., & McCurdy, H. E. 1999. The failure of market failure. Journal of Policy Analysis and Management, 18: 558 –578. Subramanian Rangan (subramanian.rangan@insead.edu) is associate professor of strategy and management at INSEAD. He received his Ph.D. in political economy and government from Harvard University. His current research focuses on competition among multinational firms in foreign host markets and on cooperation across geographic boundaries within multinational firms. Ramina Samii (Ramina.samii@insead.edu) holds a laurea degree in economics and business administration from the University of Rome. She currently works as a private sector officer at the OPEC Fund for International Development. She holds a visiting researcher status at INSEAD. Her current research interests revolve around development and disaster management. Luk N. Van Wassenhove (Luk.van-wassenhove@insead.edu) is the Henry Ford Chaired Professor of Manufacturing at INSEAD. He received his Ph.D. in industrial management from the Katholieke Universiteit Leuven, Belgium. His current research includes global supply chain management, risk, and bottom-line performance. He works with companies and humanitarian organizations to improve disaster response.