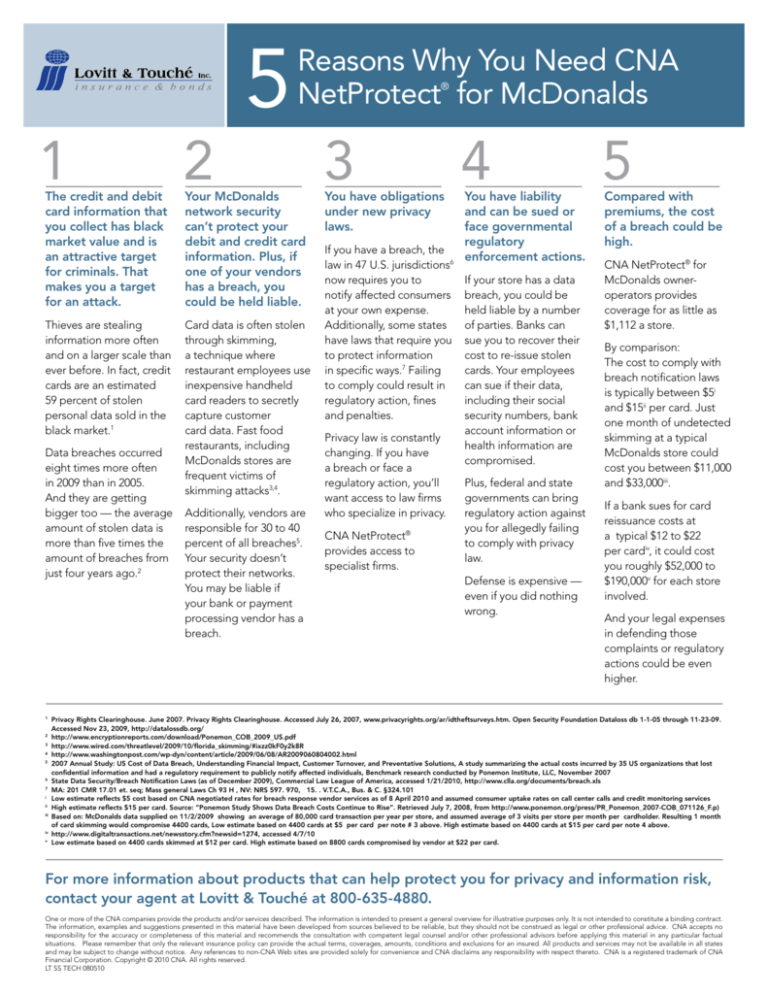

5

1

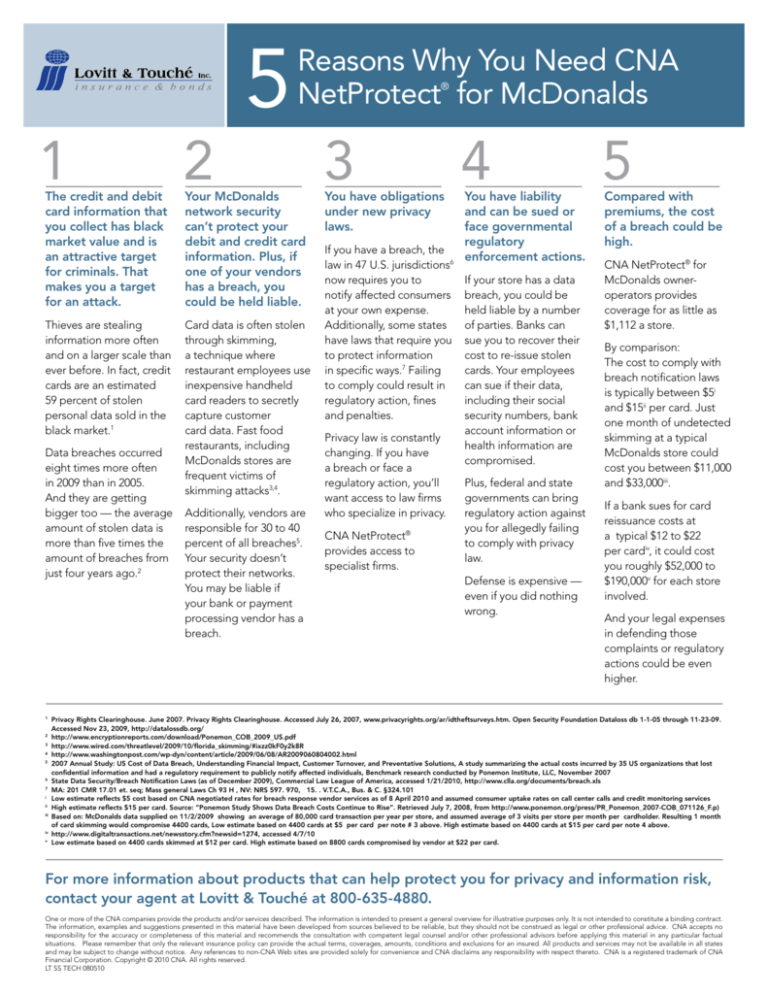

The credit and debit

card information that

you collect has black

market value and is

an attractive target

for criminals. That

makes you a target

for an attack.

Thieves are stealing

information more often

and on a larger scale than

ever before. In fact, credit

cards are an estimated

59 percent of stolen

personal data sold in the

black market.1

Data breaches occurred

eight times more often

in 2009 than in 2005.

And they are getting

bigger too ­— the average

amount of stolen data is

more than five times the

amount of breaches from

just four years ago.2

Reasons Why You Need CNA

NetProtect for McDonalds

2

Your McDonalds

network security

can’t protect your

debit and credit card

information. Plus, if

one of your vendors

has a breach, you

could be held liable.

Card data is often stolen

through skimming,

a technique where

restaurant employees use

inexpensive handheld

card readers to secretly

capture customer

card data. Fast food

restaurants, including

McDonalds stores are

frequent victims of

skimming attacks3,4.

Additionally, vendors are

responsible for 30 to 40

percent of all breaches5.

Your security doesn’t

protect their networks.

You may be liable if

your bank or payment

processing vendor has a

breach.

®

3

You have obligations

under new privacy

laws.

If you have a breach, the

law in 47 U.S. jurisdictions6

now requires you to

notify affected consumers

at your own expense.

Additionally, some states

have laws that require you

to protect information

in specific ways.7 Failing

to comply could result in

regulatory action, fines

and penalties.

Privacy law is constantly

changing. If you have

a breach or face a

regulatory action, you’ll

want access to law firms

who specialize in privacy.

CNA NetProtect®

provides access to

specialist firms.

4

You have liability

and can be sued or

face governmental

regulatory

enforcement actions.

If your store has a data

breach, you could be

held liable by a number

of parties. Banks can

sue you to recover their

cost to re-issue stolen

cards. Your employees

can sue if their data,

including their social

security numbers, bank

account information or

health information are

compromised.

Plus, federal and state

governments can bring

regulatory action against

you for allegedly failing

to comply with privacy

law.

Defense is expensive —

even if you did nothing

wrong.

5

Compared with

premiums, the cost

of a breach could be

high.

CNA NetProtect® for

McDonalds owneroperators provides

coverage for as little as

$1,112 a store.

By comparison:

The cost to comply with

breach notification laws

is typically between $5i

and $15ii per card. Just

one month of undetected

skimming at a typical

McDonalds store could

cost you between $11,000

and $33,000iii.

If a bank sues for card

reissuance costs at

a typical $12 to $22

per cardiv, it could cost

you roughly $52,000 to

$190,000v for each store

involved.

And your legal expenses

in defending those

complaints or regulatory

actions could be even

higher.

Privacy Rights Clearinghouse. June 2007. Privacy Rights Clearinghouse. Accessed July 26, 2007, www.privacyrights.org/ar/idtheftsurveys.htm. Open Security Foundation Dataloss db 1-1-05 through 11-23-09.

Accessed Nov 23, 2009, http://datalossdb.org/

http://www.encryptionreports.com/download/Ponemon_COB_2009_US.pdf

3

http://www.wired.com/threatlevel/2009/10/florida_skimming/#ixzz0kF0y2k8R

4

http://www.washingtonpost.com/wp-dyn/content/article/2009/06/08/AR2009060804002.html

5

2007 Annual Study: US Cost of Data Breach, Understanding Financial Impact, Customer Turnover, and Preventative Solutions, A study summarizing the actual costs incurred by 35 US organizations that lost

confidential information and had a regulatory requirement to publicly notify affected individuals, Benchmark research conducted by Ponemon Institute, LLC, November 2007

6

State Data Security/Breach Notification Laws (as of December 2009), Commercial Law League of America, accessed 1/21/2010, http://www.clla.org/documents/breach.xls

7

MA: 201 CMR 17.01 et. seq; Mass general Laws Ch 93 H , NV: NRS 597. 970, 15. . V.T.C.A., Bus. & C. §324.101

i

Low estimate reflects $5 cost based on CNA negotiated rates for breach response vendor services as of 8 April 2010 and assumed consumer uptake rates on call center calls and credit monitoring services

ii

High estimate reflects $15 per card. Source: “Ponemon Study Shows Data Breach Costs Continue to Rise”. Retrieved July 7, 2008, from http://www.ponemon.org/press/PR_Ponemon_2007-COB_071126_F.p)

iii

Based on: McDonalds data supplied on 11/2/2009 showing an average of 80,000 card transaction per year per store, and assumed average of 3 visits per store per month per cardholder. Resulting 1 month

of card skimming would compromise 4400 cards, Low estimate based on 4400 cards at $5 per card per note # 3 above. High estimate based on 4400 cards at $15 per card per note 4 above.

iv

http://www.digitaltransactions.net/newsstory.cfm?newsid=1274, accessed 4/7/10

v

Low estimate based on 4400 cards skimmed at $12 per card. High estimate based on 8800 cards compromised by vendor at $22 per card.

1

2

For more information about products that can help protect you for privacy and information risk,

contact your agent at Lovitt & Touché at 800-635-4880.

One or more of the CNA companies provide the products and/or services described. The information is intended to present a general overview for illustrative purposes only. It is not intended to constitute a binding contract.

The information, examples and suggestions presented in this material have been developed from sources believed to be reliable, but they should not be construed as legal or other professional advice. CNA accepts no

responsibility for the accuracy or completeness of this material and recommends the consultation with competent legal counsel and/or other professional advisors before applying this material in any particular factual

situations. Please remember that only the relevant insurance policy can provide the actual terms, coverages, amounts, conditions and exclusions for an insured. All products and services may not be available in all states

and may be subject to change without notice. Any references to non-CNA Web sites are provided solely for convenience and CNA disclaims any responsibility with respect thereto. CNA is a registered trademark of CNA

Financial Corporation. Copyright © 2010 CNA. All rights reserved.

LT SS TECH 080510