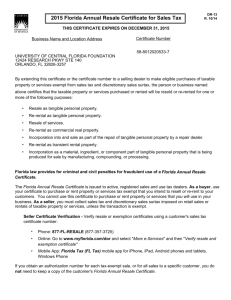

Business Owner's Guide - Florida Department of Revenue

advertisement