Chapter 20 Forward-looking expectations under uncertainty

advertisement

Chapter 20

Forward-looking expectations

under uncertainty

In this chapter we consider how to solve models where current expectations

of a future value of an endogenous variable have an influence on the current

value of this variable. Under the hypothesis of rational expectations this

leads to expectational difference equations. These are important for many

topics in macroeconomics, including the theory of asset price bubbles. Both

at the formal level and in substance the framework departs from the simpler framework where only past expectations of current and future variables

influence current variables, which was considered in the preceding chapter.

In order to put things clearly in relief, we start by comparing the two types

of frameworks. Then, in Section 20.2 the method of repeated forward substitution is presented. The set of solutions to linear expectational difference

equations, in the “normal case”, is studied in Section 20.3 and illustrated

by simple economic examples. The complementary case is briefly treated in

Section 20.4. Finally, Section 20.5 concludes. Some of the technical aspects

are dealt with in the appendix.

20.1

Expectational difference equations

In the preceding chapter we studied stochastic models where rational expectations entered in one of the following ways:

yt = α E(yt |It−1 ) + γ xt , or

yt = α E(yt |It−1 ) + βE(yt+1 |It−1 ) + γ xt ,

t = 0, 1, 2, ....

Here α, β, and γ are given coefficients, xt is an exogenous stochastic variable,

and E(yt |It−1 ) and E(yt+1 |It−1 ) are the “true”, mathematical expectations

615

616

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

conditional on information available at the end of period t−1, of the values of

y in period t and period t + 1, respectively.1 The distinctive feature is that yt

depends only on agents’ expectations formed in the preceding period. These

models are called models with past expectations affecting current endogenous

variables.

In many macroeconomic problems, however, there is an important role

for agents’ current expectations of future values of the endogenous variables.

Even in the previous chapter, where small stochastic AD-AS models were

considered, we had to drastically simplify by assuming money demand is

independent of the interest rate. In reality money demand depends on the

nominal interest rate. When this is taken into account, output in an AD-AS

model depends on the expected real interest rate, which in turn depends on

expected inflation between the current and the next period. This gives rise

to a model of the form

yt = aE(yt+1 |It ) + c xt ,

t = 0, 1, 2, ...,

where a 6= 0 (otherwise the model is uninteresting) and E(yt+1 |It ) is the

mathematical expectation of yt+1 conditional on information available at the

end of period t.2 Here the expectation of a future value of an endogenous

variable has an impact on the current value of this variable. We call this a

model with current expectations of future values or, for short, a model with

forward-looking expectations. Thinking of an appropriate AD-AS model, it

will have investment demand (and therefore also aggregate demand) depending on both the expected real interest rate and expected future aggregate

demand, two forward-looking variables. Or we might think of equity shares.

Their market value today will depend on the expectations, formed today, of

the market value tomorrow.

The conditioning information, It , is assumed to contain knowledge of the

realized values of y and x up until and including period t. The hypothesis is

that the “generally held” subjective expectation conditional on It coincides

with the objective conditional expectation based on the model (including

knowledge of the exact values of the parameters a and c and knowledge of

the stochastic process which xt follows). As we discussed in Chapter 19,

the assumption of rational expectations should generally be seen as just a

simplification which may lead to useful approximative conclusions. Assuming

1

In this and the following chapters, as is common in economic writings, the logarithms

of variables are denoted by lower case letters and so the same letter may sometimes denote

a stochastic variable and sometimes a specific value this variable may take. The meaning

should be clear from the context.

2

As in Chapter 19, we imagine that all agents have the same information, hence also

the same rational expectation.

Christian Groth, 2009

20.1. Expectational difference equations

617

rational expectations implies that the results which emerge from the model

cannot depend on systematic expectation errors from the economic agents’

side.

For ease of exposition we will use the notation Et yt+1 ≡ E(yt+1 |It ) and

thus write

yt = aEt yt+1 + c xt ,

t = 0, 1, 2, ....

(20.1)

A stochastic difference equation of this form is called a linear expectational

difference equation of first order with constant coefficient a.3 A solution is

a specified stochastic process {yt } which satisfies (20.1), given the stochastic

process followed by xt . In the economic applications usually no initial value,

y0 , is given. On the contrary, the interpretation is that yt depends, for all

t, on expectations about the future. Indeed, yt is considered to be a jumpvariable and can immediately shift its value in response to the emergence

of new information about the future x’s. For example, a share price may

immediately jump to a new value when the accounts of the firm become

publicly known (sometimes even before, due to rumors).4

Due to the lack of an initial condition for yt , there can easily be infinitely

many processes for yt satisfying our expectational difference equation. We

have an infinite forward-looking “regress”, where a variable’s value today depends on its expected value tomorrow, this value depending on the expected

value the day after tomorrow and so on. Then usually there are infinitely

many expected sequences which can be self-fulfilling in the sense that if only

the agents expect that particular sequence, then the aggregate outcome of

their behavior will be that the sequence is realized. It “bites its own tail”

so to speak. Yet, when an equation like (20.1) is part of a larger model,

there will often (but not always) be conditions that allow us to select one

of the many solutions to (20.1) as the only economically relevant one. For

example, transversality conditions and general equilibrium conditions may

rule out divergent solutions and leave a unique convergent solution as the

final solution.

3

Later we allow the coefficients a and c to be time-dependent.

We said that yt “depends on” the expectation of yt+1 , because it would be inaccurate to say that yt is determined (in a one-way-sense) by expectations about the future.

Rather, there is mutual dependence. In view of yt being an element in the information

It , the expectation of yt+1 in (20.1) may depend on yt just as much as yt depends on the

expectation of yt+1 .

4

Christian Groth, 2009

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

618

20.2

Repeated forward substitution

It turns out that the set of solutions to (20.1) takes a different form depending

on whether |a| < 1 or |a| > 1:5

The case |a| < 1. Generally, there is a unique “fundamental solution” and

infinitely many explosive “bubble solutions”.

The case |a| > 1. Generally, there is no fundamental solution but infinitely

many non-explosive solutions. (The case |a| = 1 to some extent resembles this.)

As mentioned above, the non-uniqueness of solutions will often only hold

as long as (20.1) is treated in isolation from the larger model in which it is a

part. Yet, it is useful to first characterize the whole set of solutions to (20.1)

considered in isolation. Then one can later find subsets of this set that can

be ruled out in view of additional restrictions on yt coming from the larger

model.

For solving linear expectational first-order difference equations, we have

various methods at our disposal. Repeated forward substitution when |a| < 1

and repeated backward substitution when |a| > 1 are the more easily understood methods that we will use. Both methods are based on the law of

iterated expectations (see Appendix A to Chapter 19). In the model (20.1)

the law of iterated expectations implies

Et (Et+1 yt+2 ) = Et yt+2 .

(20.2)

That is, my best forecast today of how I am going to forecast tomorrow a

share price the day after tomorrow, will be the same as my best forecast

today of the share price the day after tomorrow. Put differently: given that

expectations are rational, then an earlier expectation of a later expectation

of y is just the earlier expectation of y. If, beforehand, one expected to revise

expectations in a specific direction in case additional information arrived, the

original expectation would be biased and thus not rational.

We first shift (20.1) one period ahead:

yt+1 = a Et+1 yt+2 + c xt+1 .

Then we take the conditional expectation on both sides to get

Et yt+1 = a Et (Et+1 yt+2 ) + c Et xt+1 = a Et yt+2 + c Et xt+1 ,

5

(20.3)

The following is much in debt to the exposition in Blanchard and Fischer (1989, Ch.

5, Section 1).

Christian Groth, 2009

20.3. Solutions when |a| < 1

619

by the law of iterated expectations. Inserting (20.3) into (20.1) gives

yt = a2 Et yt+2 + ac Et xt+1 + c xt .

(20.4)

The procedure is repeated by forwarding (20.1) two periods ahead; then

taking the conditional expectation and inserting into (20.4), we get

yt = a3 Et yt+3 + a2 c Et xt+2 + ac Et xt+1 + c xt .

We continue in this way and the general form (for n = 0, 1, 2, ...) becomes

yt+n = a Et+n (yt+n+1 ) + c xt+n ,

Et yt+n = a Et yt+n+1 + c Et xt+n ,

yt = an+1 Et yt+n+1 + cxt + c

n

X

ai Et xt+i .

(20.5)

i=1

20.3

Solutions when |a| < 1

The case |a| < 1 will be our main focus since it occurs frequently in economic

models with rational expectations. This is the case where the expected future

has modest influence on the present.

20.3.1

The fundamental solution

PROPOSITION 1 If

lim

n→∞

n

X

ai Et xt+i exists,

(20.6)

i=1

then

yt = c

∞

X

i

a Et xt+i = cxt + c

i=0

∞

X

ai Et xt+i ,

t = 0, 1, 2, ...,

(20.7)

i=1

is a solution to the expectational difference equation (20.1).

Proof Assume (20.6). Then the formula (20.7) is meaningful; we will

show it satisfies (20.1). In view of (20.5), this is the case if and only if

limn→∞ an+1 Et yt+n+1 = 0. Hence, it is enough to show that the latter holds.

Christian Groth, 2009

620

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

In (20.7), replace t by t + n + 1 to get yt+n+1 = c

Using the law of iterated expectations, this yields

Et yt+n+1 = c

∞

X

ai Et xt+n+1+i

P∞

i=0

ai Et+n+1 xt+n+1+i .

so that

i=0

an+1 Et yt+n+1 = c an+1

∞

X

ai Et xt+n+1+i = c

i=0

It remains to show that limn→∞

∞

X

j

a Et xt+j =

j=1

follows

∞

X

j=n+1

j=n+1

aj Et xt+j = 0. From the identity

j

a Et xt+j +

j=1

aj Et xt+j =

∞

X

j=1

aj Et xt+j .

j=n+1

P∞

n

X

∞

X

∞

X

aj Et xt+j

j=n+1

aj Et xt+j −

n

X

aj Et xt+j .

j=1

Letting n → ∞, this gives

∞

X

lim

n→∞

j

a Et xt+j =

j=n+1

∞

X

j=1

j

a Et xt+j −

∞

X

aj Et xt+j = 0,

j=1

which was to be proved. ¤

The solution (20.7) is called the fundamental solution of (20.1). It is

(for c 6= 0) defined only when the condition (20.6) holds. In practice this

condition requires that |a| < 1 and that the absolute value of the expectation

of the exogenous variable does not increase “too fast”. More precisely, the

requirement is that |Et xt+i |, when i → ∞, has a growth factor less than |a|−1 .

As an example, let 0 < a < 1 and g > 0, and suppose that Et xt+i−1 > 0 for i

= 1, 2, ..., and that 1 + g is an upper bound for the growth factor of Et xt+i .

Then

Et xt+i ≤ (1 + g)Et xt+i−1 ≤ (1 + g)i Et xt = (1 + g)i xt ,

so that ai Et xt+i ≤ ai (1 + g)i xt . By summing from i = 1 to n,

n

X

i=1

i

a Et xt+i ≤ xt

n

X

i=1

[a(1 + g)]i = xt

a(1 + g)

< ∞,

1 − a(1 + g)

if 1 + g < a−1 , using the sum rule for an infinite geometric series.

Christian Groth, 2009

20.3. Solutions when |a| < 1

621

As noted in the proof of Proposition 1, the fundamental solution (20.7)

has the property that

lim an Et yt+n = 0.

(20.8)

n→∞

That is, the expected value of y is not “explosive”: its absolute value has

a growth factor less than |a|−1 . Given |a| < 1, the fundamental solution is

the only solution of (20.1) with this property. Indeed, it is seen from (20.5)

that whenever (20.8) holds, (20.7) must also hold. In Example 1 below, yt

is interpreted as a share price and xt as dividends. Then the fundamental

solution gives the share price as the present value of the expected future

flow of dividends. In finance theory this present value is referred to as the

fundamental value of the share. It is by analogy with this that the general

designation fundamental solution has been introduced.

EXAMPLE 1 (the fundamental value of a share) Consider arbitrage between

shares (stock) and a riskless asset paying the constant rate of return r > 0.

Let period t be the current period. Let dt+i and pt+i denote the dividend

and the price of the share, respectively, in period t + i, i = 0, 1, 2, .... As seen

from period t there is uncertainty about pt+i and dt+i for i = 1, 2, .... Using

the same timing convention as in previous chapters, pt is the price at the

beginning of period t for a share that at the end of the same period yields

the dividend dt .6 Suppose agents have rational expectations and care only

about expected return (risk neutrality). Then the no-arbitrage condition

reads (dt + Et pt+1 − pt )/pt = r. This can be written

pt =

1

1

Et pt+1 +

dt ,

1+r

1+r

which is of the same form as (20.1) with a = c = 1/(1+r) ∈ (0, 1). Assuming

dividends do not grow “too fast”, we find the fundamental solution, denoted

p∗t , as

p∗t

X

1

1

1

1 X

dt +

=

E

d

=

Et dt+i .

t

t+i

i

1+r

1 + r i=1 (1 + r)

(1 + r)i+1

i=0

∞

∞

(20.9)

The fundamental solution is simply the present value of expected future

dividends (the fundamental value). If the dividend process is dt+1 = dt +

εt+1 , where εt+1 is white noise, then the process is known as a random walk

and Et dt+i = dt for i = 1, 2, ... . Thus p∗t = dt /r, by the sum rule for an

6

This is in accordance with our general timing convention, but is unlike standard finance

notation, where pt would be the-end-of-period-t price of an asset that begins to yield

dividends next period.

Christian Groth, 2009

622

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

infinite geometric series. In this case the fundamental value is itself a random

walk. More generally, the dividend process could be a martingale, that is,

a sequence of stochastic variables with the property that the expected value

next period exists and equals the current value, where the expectation is

conditional on all information up to and including the current period. Again

Et dt+1 = dt ;, but now εt+1 need not be white noise; it is enough that Et εt+1 =

0.7 Given the constant required return r, we still have p∗t = dt /r. So the

fundamental value itself is in this case a martingale. ¤

We could also think of pt as the market price of a house rented out and

dt as the rent. Or pt could be the market price of a mine and dt the revenue

(net of extraction costs) from the extracted oil in period t.

20.3.2

Bubble solutions

Other than the fundamental solution, the expectational difference equation

(20.1) has infinitely many bubble solutions. In view of |a| < 1, these are

characterized by violating the condition (20.8). That is, they are solutions

whose expected value explodes over time.

It is convenient to first consider the homogenous expectational equation

associated with (20.1). This is defined as that equation which emerges by

setting c = 0 in (20.1):

yt = aEt yt+1 .

(20.10)

Every stochastic process {bt } of the form

bt+1 = a−1 bt + ut+1 ,

where Et ut+1 = 0,

(20.11)

has the property that

bt = aEt bt+1 ,

(20.12)

and is thus a solution to (20.10). The “disturbance” ut+1 represents “new

information” which may be related to unexpected movements in “fundamentals”, xt+1 . But it does not have to. In fact, ut+1 may be related to conditions

that per se have no economic relevance whatsoever (as we shall see below).

For ease of notation, from now we just write bt even if we think of the

whole process {bt } rather than the value taken by b in the specific period

t. The meaning should be clear from the context. A solution to (20.10) is

referred to as a homogenous solution associated with (20.1). Let bt be a

given homogenous solution and let K be an arbitrary constant. Then Bt

= Kbt is also a homogenous solution (try it out for yourself). Conversely,

7

A random walk is thus a special case of a martingale.

Christian Groth, 2009

20.3. Solutions when |a| < 1

623

any homogenous solution bt associated with (20.1) can be written in the

form (20.11). To see this, let bt be a given homogenous solution, that is,

bt = aEt bt+1 . Let ut+1 = bt+1 − Et bt+1 . Then

bt+1 = Et bt+1 + ut+1 = a−1 bt + ut+1 ,

where Et ut+1 = Et bt+1 − Et bt+1 = 0. Thus, bt is of the form (20.11).

Returning to our original expectational difference equation (20.1), we

have:

PROPOSITION 2 Let ỹt be a particular solution to (20.1). Then every

stochastic process of the form

Yt = ỹt + bt ,

(20.13)

where bt satisfies (20.11), is a solution to (20.1).

Proof Yt = ỹt +bt = a Et ỹt+1 +c xt +bt , since ỹt satisfies (20.1). Consequently,

by (20.10),

Yt = a Et ỹt+1 + c xt + a Et bt+1 = a Et (ỹt+1 + bt+1 ) + c xt = a Et Yt+1 + c xt .

Thus (20.13) satisfies (20.1). ¤

PROPOSITION 3 Let ỹt be a particular solution to (20.1). Then every

solution to (20.1) can be written in the form

yt = ỹt + bt ,

(20.14)

where bt is an appropriately chosen homogenous solution associated with

(20.1).

Proof Let Yt be an arbitrary solution to (20.1). Define bt = Yt − ỹt . Then

we have

bt = Yt − ỹt = aEt Yt+1 + cxt − (aEt ỹt+1 + cxt )

= aEt (Yt+1 − ỹt+1 ) = aEt bt+1 ,

where the second equality follows from the fact that both Yt and ỹt are

solutions to (20.1). This shows that bt is a solution to the homogenous

equation (20.10) associated with (20.1). Since Yt = ỹt + bt , the proposition

is hereby proved. ¤

Propositions 2 and 3 hold for any a 6= 0. In case |a| < 1 and the fundamental solution (20.7) exists, it is natural to choose this solution as the

Christian Groth, 2009

624

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

particular solution in (20.13) or (20.14). Thus, referring to the right-hand

side of (20.7) as yt∗ , we can use the particular form,

yt = yt∗ + bt .

(20.15)

When the component bt is different from zero, the solution (20.15) is

called a bubble solution and bt is called the bubble component. In the typical

economic interpretation the bubble component shows up only because it is

expected to show up next period, cf. (20.12). The name bubble springs from

the fact that the expected value conditional on the information available

in period t explodes over time when |a| < 1. To see this, let for instance

0 < a < 1. Then, from (20.10), by repeated forward substitution we get

bt = a Et (aEt+1 bt+2 ) = a2 Et bt+2 = ... = ai Et bt+i ,

i = 1, 2, ....

It follows that Et bt+i = a−i bt , that is, not only does it hold that

½

∞, if bt > 0

lim Et bt+i =

,

i→∞

−∞, if bt < 0

but the absolute value of Et bt+i will for rising i grow geometrically towards

infinity with a growth factor equal to 1/a > 1.

Let us consider a special case of (20.1) that allows a simple graphical

illustration of both the fundamental solution and some bubble solutions.

When xt has constant mean

Suppose the stochastic process xt (the “fundamentals”) takes the form xt

= x̄ + εt , where x̄ is a constant and εt is white noise. Then

yt = a Et yt+1 + c(x̄ + εt ),

0 < |a| < 1.

(20.16)

The fundamental solution is

yt∗

= c xt + c

∞

X

ai x̄ = cx̄ + cεt + c

i=1

cx̄

ax̄

=

+ cεt .

1−a

1−a

Referring to Proposition 2,

yt =

cx̄

+ cεt + bt

1−a

is thus also a solution of (20.16) if bt is of the form (20.11).

Christian Groth, 2009

(20.17)

20.3. Solutions when |a| < 1

625

y

II

cx

1− a

I

t

III

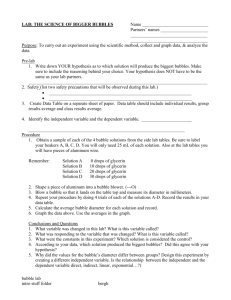

Figure 20.1: Deterministic bubbles (the case 0 < a < 1, c > 0, and xt = x̄).

It may be instructive to consider the case where all stochastic features are

eliminated. So we assume ut ≡ εt ≡ 0. Then we have a model with perfect

foresight; the solution (20.17) simplifies to

yt =

cx̄

+ b0 a−t ,

1−a

(20.18)

where we have used repeated backward substitution in (20.11). By setting

cx̄

+ b0 . Inserting this into (20.18) gives

t = 0 we see that y0 = 1−a

yt =

cx̄

cx̄

+ (y0 −

)a−t .

1−a

1−a

(20.19)

In Fig. 20.1 we have drawn three trajectories for the case 0 < a < 1,

c > 0. Trajectory I has y0 = cx̄/(1 − a) and represents the fundamental

solution, whereas trajectory II, with y0 > cx̄/(1 − a), and trajectory III, with

y0 < cx̄/(1 − a), are bubble solutions. Since we have imposed no a priori

boundary condition, one y0 is as good as any other. The interpretation is

that there are infinitely many trajectories with the property that if only the

economic agents expect the economy will follow that particular trajectory, the

aggregate outcome of their behavior will be that this trajectory is realized.

This is the potential indeterminacy arising when yt is not a predetermined

variable. However, as alluded to above, in a complete economic model there

will often be restrictions on the endogenous variable(s) in addition to the

basic expectational difference equation(s), here (20.16). It may be that the

economic meaning of yt precludes negative values and, hence, no-one can

rationally expect a path such as III in Fig. 20.1. And/or it may be that

for some reason there is an upper bound on yt (which could be the fullemployment ceiling in a situation where the natural growth rate is smaller

Christian Groth, 2009

626

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

than a−1 − 1). Then no one can rationally expect a trajectory like II in the

figure.

Our conclusion so far is that in order for a solution of a first-order linear

expectational difference equation with constant coefficient a, where |a| < 1,

to differ from the fundamental solution, the solution must have the form

(20.15) where bt has the form described in (20.11). This provides a clue as

to what asset price bubbles might look like.

Rational asset price bubbles

An asset price bubble (or a speculative bubble) is at the theoretical level defined as the difference between the market price of the asset and its fundamental value. An asset price bubble that emerges in a setting where everybody

has rational expectations and arbitrage is completed, is called a rational asset

price bubble or just a rational bubble.

EXAMPLE 2 (an ever-expanding rational bubble) Consider again a share

for which the no-arbitrage condition is

dt + Et pt+1 − pt

= r,

pt

(20.20)

as in Example 1. Let the price of the share be pt = p∗t + bt , where the bubble

component follows the deterministic process, bt+1 = (1 + r)bt , b0 > 0. This

is called a deterministic rational bubble. Agents may be ready to pay a price

over and above the fundamental value if they expect they can sell at a higher

price later; trading with such motivation is called speculative behavior. If

generally held, perhaps this expectation could be self-fulfilling. Yet the fact

that we are not acquainted with such ever-expanding incidents in real world

situations, makes a deterministic rational bubble not very plausible. ¤

A stochastic rational bubble which sooner or later bursts seems less implausible.

EXAMPLE 3 (a bursting bubble) The no-arbitrage condition is once more

(20.20) where for simplicity we still assume the required rate of return is constant, though possibly including a risk premium. The implied expectational

difference equation is pt = aEt pt+1 + cdt , with a = c = 1/(1 + r) ∈ (0, 1).

Following Blanchard (1979) we assume the market price, pt , of the share

contains a stochastic bubble of the following form:

½ 1+r

b with probability qt ,

qt t

bt+1 =

(20.21)

0

with probability 1 − qt ,

Christian Groth, 2009

20.3. Solutions when |a| < 1

627

where t = 0, 1, 2, ... and b0 > 0. In addition we may assume that qt = f (bt ),

f 0 ≤ 0. Strict inequality here means that the probability that the bubble

persists at least one period ahead is less, the greater the bubble has already

become. In this way the probability of a crash becomes greater and greater

as the share price comes further and further away from fundamentals. Note

also that in this case, the longer time the bubble has lasted, the higher is the

expected growth rate of the bubble in the absence of a collapse.

This bubble satisfies the criterion for a rational bubble. Indeed, (20.21)

implies

1+r

Et bt+1 = (

bt )qt+1 + 0 · (1 − qt+1 ) = (1 + r)bt .

qt+1

This is of the form (20.11) with a−1 = 1 + r, and the bubble is therefore a

rational stochastic bubble. The stochastic component is ut+1 = bt+1 − Et bt+1

= bt+1 − (1 + r)bt and has conditional expectation equal to zero. Note that

although ut+1 must have zero conditional expectation, it need not be white

noise (it can for instance have varying variance).

The market price of the share is pt = p∗t + bt , where p∗t is the fundamental

value of the share, which depends only on the expected dividends. Suppose

dividends are known to follow the process: dt = (1 + g)t d¯ + εt , where g is a

constant satisfying 0 < g < r and εt is white noise. Thus, Et dt+i = (1+g)t+i d¯

for i = 1, 2, ... . Applying the general formula, (20.9), we get in this case,

p∗t

−1

= (1 + r)

µ

¶

∞

X

(1 + g)t+1 d¯

−i

−1

dt +

(1 + r) Et dt+i = (1 + r)

,

r

−

g

i=0

in view of (1 + g)/(1 + r) ∈ (0, 1). Essentially, the fundamental value grows

at the same rate as dividends, the rate g. If the noise term in dividends is

ignored, we have dt+1 = (1 + g)t+1 d¯ = (1 + g)dt so that p∗t = dt /(r − g). The

market price of the share is then dt /(r − g) + bt , where bt follows the process

(20.21). As long as the bubble has not yet crashed, it is growing faster than

the fundamental value, namely with the growth factor (1 + r)/qt+1 > 1 + r

> 1 + g, and so the ratio p∗t /pt tends to zero as time proceeds. The major

motive for buying and holding the asset must be the expected capital gains.

That is, the asset is held primarily with a view to selling at a higher price

later.

Note that in spite of the presence of a bubble, if all dividend payments

are reinvested in the stock, then the present value of the portfolio has the

martingale property (in line with Example 1). To see this, let the number

of shares of the stock at the beginning of period t be Nt . Define Mt ≡ (1 +

r)−t pt Nt . Then reinvestment of the dividends implies Nt+1 = Nt + Nt dt /pt+1 .

Christian Groth, 2009

628

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

Hence, pt+1 Nt+1 = (pt+1 + dt )Nt so that

Et pt+1 Nt+1 = (Et pt+1 + dt )Nt = (1 + r)pt Nt ,

since, by (20.20), Et pt+1 + dt = (1 + r)pt . It follows that Et Mt+1 ≡ Et (1 +

r)−(t+1) pt+1 Nt+1 = (1 + r)−t pt Nt ≡ Mt , showing that M is a martingale.

Having found that a time series for an asset price looks like a martingale

does therefore not rule out that a bubble can be present. ¤

In this example the bubble did not have the implausible ever-expanding

form considered in Example 2. Yet, under certain conditions even a bursting

rational bubble of this kind can be ruled out. Argument (e) in the list below

is a case in point. We will now consider different cases where rational asset

price bubbles are unlikely as economic equilibrium phenomena.

20.3.3

When rational bubbles in asset prices can or

can not be ruled out

(a) Assets which can freely be disposed of (“free disposal”) An

object which can just be thrown away can never have a negative price in a

market with self-interested rational agents. Nobody would be willing to pay

for getting rid of the object if it can just be thrown away. Thus, assets that

can be freely disposed of (share certificates for instance) can not have negative

rational bubbles because if they had, the expected asset price at some finite

date in the future would be negative. And when a negative rational bubble

can be ruled out, then, if at the first date of trading of the asset there were

no positive bubble, no positive rational bubble can arise later. Let us make

this precise:

PROPOSITION 4 Assume free disposal of a given asset. Then, if a rational

bubble in the asset price is present today, it must be positive and must have

been present also yesterday and so on back to the first date of trading the

asset. And if a rational bubble bursts, it will not restart later.

Proof In view of free disposal, a negative rational bubble in the asset price

can be ruled out. It follows that bt ≥ 0 for t = 0, 1, 2, ..., where t = 0 is

the first date of trading the asset. That is, any rational bubble in the asset

price must be a positive bubble. We now show by contradiction that if for

t = 1, 2, ..., bt > 0, then bt−1 > 0. Let bt > 0. Then, if bt−1 = 0, we have

Et−1 bt = Et−1 ut = 0 (from (20.11) with t replaced by t − 1), implying, since

bt < 0 is not possible, that bt = 0 with probability one as seen from period

t − 1. Ignoring zero probability events, this rules out bt > 0 and we have

arrived at a contradiction. Thus bt−1 > 0. Replacing t by t − 1 and so on

Christian Groth, 2009

20.3. Solutions when |a| < 1

629

backward in time we end up with b0 > 0. The argument also implies that if a

bubble bursts in period t, it can not restart in period t + 1, nor, by extension,

in any subsequent period. ¤

This proposition (due to Diba and Grossman, 1988) informs us that a

rational bubble in an asset price must have been there since trading of the

asset began. Yet such a conclusion is not without ambiguities. If radically

new information comes up at some point in time, is a share in the firm then

the same asset as before? Even if an earlier bubble has crashed, cannot a

new rational bubble arise later in case of an utterly new situation?

(b) Bonds with finite maturity The finite maturity ensures that the

value of the bond is given at some finite future date. Therefore, if there were

a positive bubble in the market price of the bond, no rational agent would buy

just before that date. Anticipating this, no one would buy the date before,

and so on ... nobody will buy in the first place. By this backward induction

argument follows that a positive bubble cannot get started. And since there

is also “free disposal”, all rational bubbles can be precluded. This argument

does not, however, rule out positive bubbles on perpetuities (“consols”).

In the remaining cases, we assume negative rational bubbles are ruled

out. So, the discussion is about whether positive rational asset price bubbles

may exist or not.

(c) Assets whose supply is elastic Real capital goods (including buildings) can be reproduced and have clearly defined costs of reproduction. This

precludes rational bubbles on this kind of assets, since a potential buyer can

avoid the overcharge by producing instead. Notice, however, that building

sites with specific amenity value and apartments in attractive quarters of a

city are not easily reproducible. Therefore, rational bubbles on such assets

are more difficult to rule out.

What about shares of stock in firms? The price evolution of these will be

limited to the extent that market participants expect that firms issue more

shares if there is a bubble. On the other hand, it is not obvious that the

firm would always do this. The firm might anticipate that the bubble would

burst. To “fool” the market the firm continues to behave as if no bubble was

present. Thus, it is hard to completely rule out rational bubbles on shares

of stock by this kind of argument.

(d) Assets for which there exists a “backstop-technology” For some

commodities there exists substitutes in elastic supply which will be demanded

Christian Groth, 2009

630

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

if the price of the commodity becomes sufficiently high. Such a substitute is

called a “backstop-technology”. For example oil and other fossil fuels will,

when their prices become sufficiently high, be subject to intense competition from substitutes (say, renewable energy sources). This precludes the

unbounded bubble process in the price of oil.

On account of the arguments (c) and (d) bubbles seem more probable

when it comes to assets which are not reproducible or substitutable and

whose “fundamentals” are difficult to ascertain. By “fundamentals” we mean

any information relating to the earnings capacity of an asset: a firm’s technology, resources, market conditions etc. For some assets these matters are

not easily ascertained. Examples are paintings of past great artists, rare

stamps, diamonds, gold etc. Also new firms that introduce novel products

and technologies are potential candidates (cf. the IT bubble in the 1990s).

Sometimes foreign exchange is added to the list; for a collection of theoretical

and empirical studies of this candidate, see Flood and Garber (1994).8

The above considerations are of a partial equilibrium nature. On top of

this, general equilibrium arguments can be put forward to limit the possibility

of rational bubbles. We shall return to this in Chapter 22. To give a flavour,

however, the essence of one of these arguments is the following.

(e) An economy with interest rate above the growth rate In the

arbitrage examples 1, 2, and 3 we have a−1 = 1 + r so that a rational bubble

has the form bt+1 = (1 + r)bt +ut+1 , where Et ut+1 = 0. So in expected value

the bubble is growing at a rate equal to the rate of return, r. For this reason

the possibility of rational bubbles is often dismissed. The argument is that

the value of the bubble would sooner or later be larger than the economy and

so nobody would be able to buy it. The agents anticipate this and so the

bubble never gets started. This argument is valid when the rate of return

in the long run is higher than the growth rate of the economy − which is

usually considered the realistic case. Yet, the opposite case is possible and in

that case it is less easy to rule out rational asset price bubbles. Moreover, the

presence of segmented financial markets or externalities that create a wedge

between private and social returns on productive investment may increase

the scope for rational bubbles (for references, see the end of Chapter 22).

The empirical evidence concerning asset price bubbles in general and rational asset price bubbles in particular is inconclusive. It is very difficult

to statistically distinguish between bubbles and misspecified fundamentals.

Rational bubbles can also have more complicated forms than the bursting

8

Blanchard and Fischer (1989, p. 223) add foreign exchange to the list. For a collection

of theoretical and empirical studies of this candidate, see Flood and Garber (1994).

Christian Groth, 2009

20.3. Solutions when |a| < 1

631

bubble in Example 3 above. For example Evans (1991) and Hall et al. (1999)

study “regime-switching” rational bubbles. For surveys on the theory of rational bubbles and econometric bubble tests, see Salge (1997) and Gürkaynak

(2008). For discussions of famous historical bubble episodes, see the symposium in Journal of Economic Perspectives 4, No. 2, 1990, and Shiller (2005).

Whatever the possible limits to the emergence of rational bubbles in asset

prices, it is useful to be aware of their logical structure and the variety of

forms they can take as logical possibilities. Rational bubbles may serve as a

benchmark for the analytically harder cases of “irrational asset price bubbles”

(bubbles arising when a significant fraction of the market participants are

not fully rational). Besides, there are situations where bubbles as such are

absent, but nevertheless a part of a bubble solution is temporarily operative.

For example, when policy announcement effects are present, then the set of

bubble solutions will deliver the relevant candidate for a temporary partway

to be patched up with the trajectory followed when the announced policy

change is implemented (see next chapter). And whereas the above discussion

has been about the feasibility of rational bubbles in asset prices, bubble

solutions to expectational difference equations can arise in a broader context

due to self-fulfilling expectations.

20.3.4

Time-dependent coefficients

In the theory above we assumed that the coefficient a is constant. But the

concepts can easily be extended to the case with a time-dependent. Consider

the expectational difference equation

yt = at Et yt+1 + ct xt ,

(20.22)

where 0 < |at | < 1 for all t. We also allow the coefficient to xt to be timedependent. But this is less crucial, because ct xt could always be replaced by

cx̃t , where x̃t is a new exogenous variable defined by x̃t ≡ ct xt /c.

Repeated forward substitution in (20.22) and use of the law of iterated

expectations give, in analogy with (20.5),

yt = (Πnj=0 at+j )Et yt+n+1 +

n

X

(Πi−1

j=0 at+j )ct+i Et xt+i + ct xt .

(20.23)

i=1

P

a )c E x

In analogy with Proposition 1 one can show (see Appendix A) that if limn→∞ ni=1 (Πi−1

£ n

¤ j=0 t+j t+i t t+i

exists, then (20.22) has a solution with the property limn→∞ (Πj=0 at+j )Et yt+n+1

= 0, namely

∞

X

yt∗ = ct xt +

(Πi−1

(20.24)

j=0 at+j )ct+i Et xt+i .

i=1

Christian Groth, 2009

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

632

This is the fundamental solution of (20.22).

In addition, (20.22) has infinitely many bubble solutions of the form yt =

yt∗ + bt , where bt satisfies bt+1 = a−1

t bt + ut+1 with Et ut+1 = 0.

EXAMPLE 4 (time-dependent required rate of return) We modify the noarbitrage condition from Example 1 to

dt + Et pt+1 − pt

= rt ,

pt

(20.25)

where rt is the required rate of return. The corresponding expectational

difference equation is pt = at Et pt+1 + ct dt , with at = ct = 1/(1 + rt ) ∈ (0, 1).

Assuming dividends do not grow “too fast”, we find the fundamental solution

p∗t

X

X

1

1

1

=

dt +

d

=

E

Et dt+i .

t

t+i

i

i

1 + rt

Πj=0 (1 + rt+j )

Πj=0 (1 + rt+j )

i=1

i=0

∞

∞

A bubble solution is of the form pt = p∗t + bt , where bt could be a bursting

bubble like in Example 3 (replace r in (20.21) by rt ); if the probability of a

crash is increasing with the size of the bubble, then also the required rate of

return is likely to be increasing when agents are risk-averse. ¤

For now, we shall return to the simpler case with constant coefficients, a

and c.

20.3.5

Three classes of bubble processes

Consider again the stochastic difference equation yt = aEt yt+1 + cxt , where

the exogenous stochastic variable xt reflects the economic environment (“fundamentals”). As we saw, the defining characteristic of a bubble associated

with this equation is: bt+1 = a−1 bt + ut+1 , where Et ut+1 = 0. We classified

bubbles according to their deterministic or stochastic nature. But bubbles

may also be distinguished according to which variables in the economic system they are related to. This leads to the following taxonomy:

1. Markovian bubbles. A Markovian bubble is a bubble that depends only

on its own realization in the preceding period. That is, the probability

distribution for bt+1 is a function only of time and the previous realization, bt . A deterministic bubble, bt+1 = a−1 bt , is an example. Another

example is the bursting bubble in Example 3 above.

2. Intrinsic bubbles. An intrinsic bubble is a bubble that depends on the

stochastic variable xt , which in turn reflects “fundamentals”. As an

example, consider the stochastic process

bt = a−t xt ,

Christian Groth, 2009

(20.26)

20.3. Solutions when |a| < 1

633

where xt+1 is a martingale, i.e., xt+1 = xt + εt+1 with Et εt+1 = 0. Then

bt+1 = a−t−1 xt+1 so that

Et bt+1 = a−t−1 Et xt+1 = a−1 a−t xt = a−1 bt .

(20.27)

We see the process (20.26) satisfies the criterion for a rational bubble.

For a financial asset this shows that a rational bubble can be closely

related to the dividend process. This is one of the reasons why it is

difficult to empirically disentangle rational bubbles from movements in

market fundamentals (see Froot and Obstfeld, 1991).

3. Extrinsic bubbles. An extrinsic bubble on an asset is a bubble that

depends on a stochastic variable which has no connection whatsoever

with fundamentals in the economy. This kind of stochastic variables

was termed “sunspots” by Cass and Shell (1983), using a metaphorical

expression. Let zt be an example of such a variable and assume zt is a

martingale (Et zt+1 = zt ). Then the process

bt = a−t zt ,

(20.28)

satisfies the criterion of a rational bubble in that (20.27) holds with x

replaced by z. Thus, stochastic variables which are basically economically irrelevant may still have an impact on the economy if only people

believe they do or if only every individual believes that most others

believe it. The actual level of sunspot activity can be thought of as an

economically irrelevant stochastic variable that nevertheless ends up affecting economic behavior.9 If people believe that this variable has an

impact on the course of the economy, this belief may be self-fulfilling.

The hypothesis of extrinsic bubbles has been applied to cases where multiple rational expectations equilibria may exist (like in Diamond’s OLG model).

In such cases it is possible that agents condition their expectations on some

extrinsic phenomenon like the sunspot cycle. In this way expectations may

become coordinated such that the resulting aggregate behavior validates the

expectations. Since these notions have proved useful in particular in the case

|a| > 1, we shall briefly return to them at the end of the next section, which

deals with this case.

9

In fact, since the actual level of sunspot activity may influence the temperature at the

Earth and thereby economic conditions, the sunspot metaphor chosen by Cass and Shell

was not particularly felicitous.

Christian Groth, 2009

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

634

20.4

Solutions when |a| > 1

Although |a| < 1 is the most common case in economic applications, there

exist economic examples where |a| > 1.10 In this case the expected future

has “large influence”. Generally, there will then be no fundamental solution

because the right-hand side of (20.7) will normally equal ±∞. On the other

hand, there are infinitely many non-explosive solutions. Indeed, propositions

2 and 3 are still true, since they were derived independently of the size of

a. Any possible bubble component bt will still satisfy Et bt+1 = a−1 bt , but

now we get limi→∞ Et bt+i = 0, in view of |a| > 1. Consequently, instead of

an explosive bubble component we have an implosive one (which is therefore

usually not termed a bubble any longer).

Let us consider the case where xt has constant mean, i.e.,

yt = a Et yt+1 + c(x̄ + εt ),

|a| > 1,

(20.29)

where Et εt+i = 0 for i = 1, 2, ... An educated guess (cf. Appendix B) is that

the process

cx̄

ỹt =

+ cεt

(20.30)

1−a

satisfies (20.29). That this is indeed a solution is seen by shifting (20.30) one

period ahead and taking the conditional expectation: Et ỹt+1 = cx̄/(1 − a).

Multiplying by a and adding c(x̄ + εt ) gives

aEt ỹt+1 + c(x̄ + εt ) =

acx̄ + (1 − a)cx̄

cx̄

+ cεt =

+ cεt = ỹt ,

1−a

1−a

which shows that ỹt satisfies (20.29).

With this ỹt and the process bt given by (20.11) we have from Proposition

2 that

cx̄

+ bt + cεt

(20.31)

yt =

1−a

is also a solution of (20.29). By backward substitution in (20.11) the bubble

component bt can be written as

t−1

X

a−i ut−i + a−t b0 .

bt =

(20.32)

i=0

If for example ut is white noise, this shows that the bubble will gradually

die out over time. And if also εt is white noise, we see that, as t → ∞, yt

converges towards cx̄/(1 − a) except for white noise. If ut ≡ 0 and εt ≡ 0,

Christian Groth, 2009

20.4. Solutions when |a| > 1

635

y

cx

1− a

t

Figure 20.2: Deterministic implosive “bubbles” (the case a > 1, c < 0, and xt

= x̄).

we get again the formula (20.19) which now implies converging paths as

illustrated in Fig. 20.2 (for the case a > 1, c < 0).11

Two theoretical implications should be mentioned. On the one hand,

the lack of uniqueness (which follows from the fact that y0 is a forwardlooking variable) is much more “troublesome” in this case than in the case

|a| < 1. When |a| < 1, imposing the restriction that the solution be nonexplosive (say because of a transversality condition or some other constraint)

removes the ambiguity. But when |a| > 1, this is no longer so. As Fig. 20.2

indicates, when |a| > 1, there are infinitely many non-explosive solutions.

On the other hand, exactly this feature opens up for the existence of nonexplosive equilibrium paths with stochastic fluctuations driven by random

events that per se have no connection whatsoever with fundamentals in the

economy. The theory of extrinsic bubbles (“sunspot equilibria”) has mainly

been applied to this case (|a| > 1). The hypothesis is that in situations with

multiple rational expectations equilibria it may happen that some extraneous

stochastic phenomenon de facto becomes a coordination device. If people

believe that this particular phenomenon has an impact on the economy, then

it may end up having an impact due to the behavior induced by the associated

conditional expectations. It turns out that when strong nonlinearities are

present, cases like |a| > 1 may arise. These mechanisms have relevance for

10

See, e.g., Taylor (1986, p. 2009) and Blanchard and Fischer (1989, p. 217).

The fact that |a| > 1 is associated with convergence may seem confusing if one is

more accustomed to difference equations on backward -looking form. Appendix C relates

our forward-looking form to the backward-looking form, common in math textbooks. The

relationship to the associated concepts of characteristic equation and stable and unstable

roots is briefly exposed.

11

Christian Groth, 2009

636

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

business cycle theory and have affinity with themes from Keynes like “animal

spirits”, “self-justifying beliefs”, and “expectations volatility” (Keynes, 1936,

Ch. 12). For a discussion, see Farmer (1993), Salge (1997), and Guesnerie

(2001).

20.5

Concluding remarks

This chapter has studied forward-looking rational expectations giving rise to

expectational difference equations of the form yt = aEt yt+1 + cxt . The case

|a| < 1 is the most common in macroeconomics. In that case there is only

one solution which in expected value n periods ahead does not explode for

n going to infinity, the fundamental solution. On the other hand there are

infinitely many solutions which in expected value n periods ahead explode

for n going to infinity, the bubble solutions. When conditions in the model

as a whole allow us to rule out the latter, we are left with the fundamental

solution. In the next chapter, we will apply the fundamental solution to a

series of simple economic models with forward-looking expectations.

We have listed cases where already from a partial equilibrium point of

view, rational asset price bubbles seem unlikely to occur. In Chapter 22

we consider general equilibrium arguments limiting the possibility of such

bubbles. But whatever the likelihood of rational bubbles, it is useful to

understand their logical structure, for example as a benchmark for different

kinds of “irrational bubbles” in asset prices. Indeed, numerous econometric

studies have shown that stock prices appear to exhibit “excess volatility”.

Asset prices move more than seems explainable by changes in information

about fundamentals.

Some of the economic models considered in the next chapter lead to more

complicated expectational difference equations than above. An example is

the equation yt = a1 Et−1 yt + a2 Et yt+1 + c xt . Here forward-looking expectations as well as past expectations of current variables enter into the determination of yt . As we will see, however, a solution method based on

repeated forward substitution can still be used. Sometimes in the economic

literature appear complex stochastic difference equations where more elaborate methods are required. The reader is referred to Blanchard and Fischer

(1989, Chapter 5, Appendix), Obstfeld and Rogoff (1996), and Gourieroux

and Monfort (1997).

Christian Groth, 2009

20.6. Appendix

20.6

637

Appendix

A. Proof of (20.24)

P

We shall show that if limn→∞ ni=1 (Πi−1

j=0 at+j )ct+i Et xt+i exists, then (20.22)

has the solution (20.24). First we replace t by t + n + 1 in (20.24) to get

yt+n+1 = ct+n+1 xt+n+1 +

∞

X

(Πi−1

j=0 at+n+1+j )ct+n+1+i Et+n+1 xt+n+1+i ⇒

i=1

∞

X

= ct+n+1 Et xt+n+1 +

(Πi−1

j=0 at+n+1+j )ct+n+1+i Et xt+n+1+i .

Et yt+n+1

i=1

Multiplying by (Πnj=0 at+j ) on both sides gives

(Πnj=0 at+j )Et yt+n+1

Ã

∞

X

= (Πnj=0 at+j ) ct+n+1 Et xt+n+1 +

(Πi−1

j=0 at+n+1+j )ct+n+1+i Et xt+n+1+i

i=1

!

∞

X

n

= (Πj=0 at+j )ct+n+1 Et xt+n+1 +

(Πn+i

j=0 at+j )ct+n+1+i Et xt+n+1+i

i=1

=

∞

X

(Πk−1

j=0 at+j )ct+k Et xt+k .

(20.33)

k=n+1

In view of (20.23) it is enough to show that (20.24) implies limn→∞ (Πnj=0 at+j )Et yt+n+1

P

k−1

= 0. By (20.33) this is equivalent to showing that limn→∞ ∞

k=n+1 (Πj=0 at+j )ct+k Et xt+k

= 0. We have

∞

n

∞

X

X

X

k−1

(Πk−1

a

)c

E

x

=

(Π

a

)c

E

x

+

(Πk−1

j=0 t+j t+k t t+k

j=0 t+j t+k t t+k

j=0 at+j )ct+k Et xt+k ⇒

k=1

∞

X

lim

n→∞

(Πk−1

j=0 at+j )ct+k Et xt+k =

k=n+1

∞

X

(Πk−1

j=0 at+j )ct+k Et xt+k

k=n+1

which was to be proved.

Christian Groth, 2009

k=1

∞

X

k=n+1

n

X

k=1

k=1

k=1

(Πk−1

j=0 at+j )ct+k Et xt+k −

k=1

(Πk−1

j=0 at+j )ct+k Et xt+k ⇒

∞

∞

X

X

=

(Πk−1

a

)c

E

x

−

(Πk−1

j=0 t+j t+k t t+k

j=0 at+j )ct+k Et xt+k = 0,

638

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

B. Repeated backward substitution

When |a| > 1, a particular solution, ỹt , of our basic equation

yt = aEt yt+1 + cxt ,

t = 0, 1, 2, ....

(20.34)

can often be found as a perfect-foresight solution constructed by repeated

backward substitution. We will examine whether (20.34) has a solution with

perfect foresight. We substitute yt+1 = Et yt+1 into (20.34) and write the

resulting equation on backward-looking form:

1

c

yt+1 = yt − xt .

a

a

(20.35)

Repeated backward substitution gives

#

"µ ¶

µ ¶n

µ ¶n−1

n

1

1

1

1

yt+1 =

yt+1−n − c

xt−n+1 +

xt−n+2 + ... + xt ,

a

a

a

a

for n = 1, 2, ... . By letting n → ∞ in this expression we see that a reasonable

guess of a particular solution of (20.34) is

ỹt+1

∞

X

1

= −c

( )i xt+1−i ,

a

i=1

(20.36)

if this sum converges (by replacing t by t − 1, we P

get the corresponding

1 i

formula for ỹt ). By (20.36) follows that Et ỹt+1 = −c ∞

i=1 ( a ) xt+1−i = ỹt+1 ,

which corresponds to perfect foresight (reflecting that, by (20.36), ỹt+1 is

completely determined by past events which are included in the information

on the basis of which expectation is formed in the preceding period). Hence,

(20.36) implies

!

Ã

∞

∞

X

X

1

1 i

1

1 i−1

ỹt+1 = Et ỹt+1 = −c xt − c

( ) xt+1−i =

( ) xt+1−i

−cxt − c

a

a

a

a

i=2

i=2

!

Ã

∞

X

1

1

1

−cxt − c

( )i xt−i = (−cxt + ỹt ) , so that

=

a

a

a

i=1

ỹt = aEt ỹt+1 + cxt .

The process (20.36) therefore satisfies (20.34) and our guess is correct.

the special case

(20.29). Here (20.36) takes the form ỹt+1 =

£Consider

¤

P∞

x

1 i

−c a−1 + i=1 ( a ) εt+1−i , where we can replace t by t − 1. This is the background for the “educated guess”, made in the main text, that also the simpler

process (20.30) is a (particular) solution of (20.29).

Christian Groth, 2009

20.6. Appendix

639

C. The relationship between unstable roots and uniqueness of a

converging solution

In the main text we considered stochastic first-order difference equations

written on a forward-looking form. In math textbooks difference equations

are usually written on a backward-looking form, suitable for the natural sciences. Concepts such as the characteristic equation and stable and unstable

roots are associated with this backward-looking form. There is a link between these concepts and the question of uniqueness or non-uniqueness of a

convergent solution to a forward-looking difference equation.

To clarify this link we will for simplicity ignore uncertainty. That is, we

assume expected values are always realized. Then the forward-looking form

(20.34) reads yt = a yt+1 + c xt . The corresponding backward-looking form is

1

c

yt+1 − yt = − xt ,

a

a

(a 6= 0),

or

yt+1 + kyt = mxt .

(20.37)

This is the standard form for a linear first-order difference equation with

constant coefficient k = −1/a and time-dependent right-hand side equal to

mxt , where m ≡ −c/a. The homogeneous difference equation corresponding

to (20.37) is yt+1 + kyt = 0, to which corresponds the characteristic equation

ρ + k = 0. The characteristic root is ρ = −k (= 1/a). Any solution to this

difference equation can be written

yt = ỹt + Cρt ,

(20.38)

where ỹt is a particular solution of (20.37) and C is a constant depending on

the initial value, y0 . If, for example xt = x̄ for all t, then (20.37) becomes

yt+1 + kyt = mx̄,

and a particular solution is the stationary state

ỹt =

mx̄

.

1+k

(k 6= −1)

By substitution into (20.38) we get C = y0 − mx̄/(1 + k). Hence, the general

solution is

yt =

mx̄

mx̄ t

cx̄

cx̄

1

+ (y0 −

)ρ =

+ (y0 −

)( )t .

1+k

1+k

1−a

1−a a

This is the same as (20.19).

Christian Groth, 2009

(20.39)

640

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

Now define case A and case B in the following way:

Case A: |ρ| < 1, that is, |a| > 1.

Case B: |ρ| > 1, that is, |a| < 1.

The solution formula (20.39) shows that in case A the solution diverges

unless y0 = cx̄/(1 − a). The characteristic root, ρ, is in case A called an

unstable root. In case B, the characteristic root is called a stable root since

in this case all solutions converge.12 Which of the two cases the researcher

typically finds most “convenient” depends on whether y0 is a predetermined

or a jump variable:

I. y0 being predetermined.

Case A: |ρ| < 1. The solution for yt is unique and converges for every y0 .

Case B: |ρ| > 1. The solution for yt is unique but does not converge when

cx

y0 6= 1−a

.

II. y0 being a jump variable.

Case A: |ρ| < 1. Even if we can impose the restriction that yt must converge,

y0 is not uniquely determined.

Case B: |ρ| > 1. If we can impose the restriction that y must converge, y0 is

cx̄

uniquely determined as y0 = 1−a

.

Hence, the cases I.A and II.B are the more “convenient” from the point

of view of a researcher preferring unique solutions.

The question of multiplicity of solutions is harder in the case of a nonlinear expectational difference equation. In this case, even if a condition

corresponding to |a| < 1 is satisfied close to the steady state, there may be

more than one non-explosive solution (for an example, see Blanchard and

Fischer, 1989, Ch. 5, and the references therein).

In the appendix to Chapter 22 these matters are generalized to systems

of first-order difference equations.

20.7

Problems

Problem 20.1 The housing market in an old city quarter (partial equilibrium analysis) Consider the housing market in an old city quarter with

unique amenity value (for convenience we will speak of “houses” although

perhaps “apartments” would fit real world situations better). Let H be the

aggregate stock of houses (apartments), measured in terms of some basic

unit, i.e., as the number of houses of “normal size” (in principle adjusted

12

In the case |ρ| = 1 we have: if ρ = −1, the conclusion is as in case A; if ρ = 1, then

yt = y0 − cx̄t. Being a “knife-edge case”, however, |ρ| = 1 is usually less interesting.

Christian Groth, 2009

20.7. Problems

641

for quality) existing at a given point in time. No new building is allowed,

but repair and maintenance is required by law and so H is constant through

time. Let

pt

m

R̃t

Rt

= the real price of a house (stock) at the beginning of period t,

= real maintenance costs of a house (assumed constant over time),

= the real rental rate, i.e., the price of housing services (flow), in period t,

= R̃t − m = the net rental rate = net revenue to the owner per unit

of housing services in period t

Let the housing services in period t be called St . Note that St is a flow: so

and so many square meter-months are at the disposal for utilization (accommodation) for the owner or tenant during period t. We assume the rate of

utilization of the house stock is constant over time. By choosing proper measurement units the rate of utilization is normalized to 1, and so St = 1 · H.

The prices pt , m, and Rt are measured in real terms, that is, deflated by the

consumer price index. We assume perfect competition on both the market

for houses and the market for housing services.

Suppose the aggregate demand for housing services in period t is

D(R̃t , Xt ),

D1 < 0, D2 > 0,

(*)

where the stochastic variable Xt reflects factors that in our partial equilibrium

framework are exogenous (for example aggregate financial wealth and present

value of expected future labor income in the region).

a) Set up an equation expressing equilibrium at the market for housing

services. In a diagram in (H, R̃) space, for given Xt , illustrate how R̃t

is determined.

b) Show that the equilibrium net rental rate at time t can be expressed as

an implicit function of H, Xt , and m, written Rt = R(H, Xt , m). Sign

the partial derivatives wrt. H and m of this function. Comment.

Suppose a constant tax rate τ R ∈ [0, 1) is applied to rental income, after

allowance for maintenance costs. In case of an owner-occupied house the

owner still has to pay the tax τ R Rt out of the implicit income, Rt , per house

per year. Assume further there is a constant property tax rate τ p ≥ 0 applied

to the market value of houses. Finally, suppose a constant tax rate τ r ∈ [0, 1)

applies to interest income, whether positive or negative. We assume capital

gains are not taxed and we ignore all complications arising from the fact

Christian Groth, 2009

642

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

that most countries have nominal-income based tax systems rather than realincome-based tax systems. In a low-inflation world this limitation may not

be serious.

We assume housing services are valued independently of whether you

own or rent. Further, let the market participants be risk-neutral and ignore

transaction costs. Then in equilibrium,

(1 − τ R )Rt − τ p pt + pet+1 − pt

= (1 − τ r )r,

pt

(**)

where pet+1 denotes the expected house price next period as seen from period

t, and r is the real interest rate in the loan market. We assume r > 0 and

all tax rates are constant over time.

c) Interpret (**).

Assume from now the market participants have rational expectations (and

know the stochastic process which Rt follows as a consequence of the process

of Xt ).

d) Derive the expectational difference equation in pt implied by (**).

e) Find the fundamental value of a house, assuming Rt does not grow

“too fast”. Hint: write (**) on the standard form for an expectational

difference equation and use the formula for the fundamental solution.

Call the fundamental value p∗t . Assume Rt follows the process

Rt = R̄ + εt ,

(***)

where R̄ is a positive constant and εt is white noise with variance σ 2 .

f) Assuming (***), find p∗t .

g) How does Ep∗t (the unconditional expectation) depend on each of the

three tax rates? Comment.

h) How does Var(p∗t ) (the unconditional variance) depend on each of the

three tax rates? Comment.

Christian Groth, 2009

20.7. Problems

643

Problem 20.2 A housing market with bubbles (partial equilibrium analysis)

We consider the same setup as in Problem 20.1, including the equations (*),

(**), and (***).

Suppose that until period 0 the houses were owned by the municipality.

But in period 0 the houses are sold to the public at market prices. Suppose

that by coincidence a large positive realization of ε0 occurs and that this

triggers a bubble of the form

bt+1 = [1 + τ p + (1 − τ r )r] bt + εt+1 ,

where Et εt+1 = 0 and b0 = ε0 > 0.

(^)

We assume b0 is large enough so that the probability that bt becomes negative

or zero is negligible, t = 1, 2, ....

a) Can (^) be a rational bubble? You should answer this in two ways: 1)

by using a short argument based on theoretical knowledge, and 2) by

directly testing whether the price path pt = p∗t + bt is arbitrage free.

Comment.

b) Determine the value of the bubble in period t, assuming εt−i known for

i = 0, 1, ..., t.

c) Determine the market price, pt , and the conditional expectation Et pt+1 .

Both results will reflect a kind of “overreaction” of the market price to

the shock εt . In what sense?

d) It may be argued that a bubble of the form (^) does not seem plausible.

What kind of arguments could be used to support this view?

e) Still assuming b0 = ε0 > 0, construct a rational bubble which has a

constant probability of bursting in each period t = 1, 2, ....

f) What is the expected further duration ofP

the bubble as seen from any

∞

i

13

period t = 0, 1, 2, ..., given bt > 0? Hint:

i=0 iq (1 − q) = q/(1 − q).

g) If the bubble is alive in period t, what is the probability that the bubble

is still alive in period t + s, where s = 1, 2, ...? What is the limit of this

probability for s → ∞?

h) Assess this last bubble model.

P∞

P∞

i

i−1

Here is a proof of this formula.

= (1 −

i=0 iq (1 − q) = (1 − q)q

i=0 iq

¢

¡

P∞

P

∞

−1

i

i

q)q i=0 dq /dq = (1 − q)qd

/dq

=

(1

−

q)qd

(1

−

q)

q

/dq

=

(1

−

q)q

(1

−

q)−2 =

i=0

−1

q (1 − q) . ¤

13

Christian Groth, 2009

644

CHAPTER 20. FORWARD-LOOKING EXPECTATIONS UNDER

UNCERTAINTY

i) Housing prices are generally considered to be a good indicator of the

turning points in business cycles in the sense that house prices tend

to move in advance of aggregate economic activity, in the same direction. In the language of business cycle analysts housing prices are a

procyclical leading indicator. Do you think the present bubble model

fit this observation? Hint: consider how a rise in p affects residential

investment and private consumption via private financial wealth and

credit worthiness; also think about the likely feedback from expected

shifts in aggregate economic activity.

Christian Groth, 2009