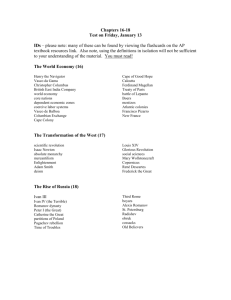

CRAFT FIRST PAPER The Scope of the Craft Industry in the

advertisement