Economic Theory as a Guide for the Specification and Interpretation

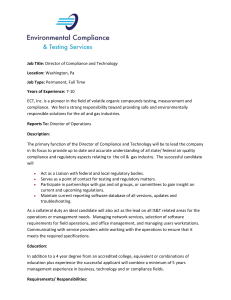

advertisement