FCF-Based Fundamental, Bottom

advertisement

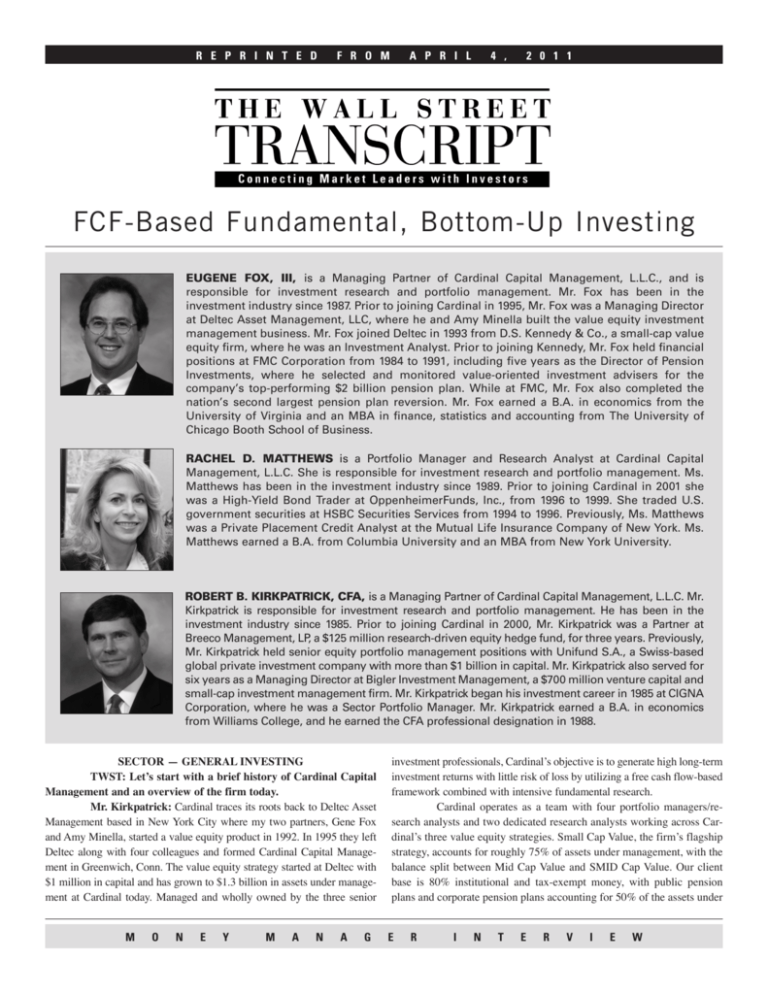

R E P R I N T E D F R O M A P R I L 4 , 2 0 1 1 FCF-Based Fundamental, Bottom-Up Investing EUGENE FOX, III, is a Managing Partner of Cardinal Capital Management, L.L.C., and is responsible for investment research and portfolio management. Mr. Fox has been in the investment industry since 1987. Prior to joining Cardinal in 1995, Mr. Fox was a Managing Director at Deltec Asset Management, LLC, where he and Amy Minella built the value equity investment management business. Mr. Fox joined Deltec in 1993 from D.S. Kennedy & Co., a small-cap value equity firm, where he was an Investment Analyst. Prior to joining Kennedy, Mr. Fox held financial positions at FMC Corporation from 1984 to 1991, including five years as the Director of Pension Investments, where he selected and monitored value-oriented investment advisers for the company’s top-performing $2 billion pension plan. While at FMC, Mr. Fox also completed the nation’s second largest pension plan reversion. Mr. Fox earned a B.A. in economics from the University of Virginia and an MBA in finance, statistics and accounting from The University of Chicago Booth School of Business. RACHEL D. MATTHEWS is a Portfolio Manager and Research Analyst at Cardinal Capital Management, L.L.C. She is responsible for investment research and portfolio management. Ms. Matthews has been in the investment industry since 1989. Prior to joining Cardinal in 2001 she was a High-Yield Bond Trader at OppenheimerFunds, Inc., from 1996 to 1999. She traded U.S. government securities at HSBC Securities Services from 1994 to 1996. Previously, Ms. Matthews was a Private Placement Credit Analyst at the Mutual Life Insurance Company of New York. Ms. Matthews earned a B.A. from Columbia University and an MBA from New York University. ROBERT B. KIRKPATRICK, CFA, is a Managing Partner of Cardinal Capital Management, L.L.C. Mr. Kirkpatrick is responsible for investment research and portfolio management. He has been in the investment industry since 1985. Prior to joining Cardinal in 2000, Mr. Kirkpatrick was a Partner at Breeco Management, LP, a $125 million research-driven equity hedge fund, for three years. Previously, Mr. Kirkpatrick held senior equity portfolio management positions with Unifund S.A., a Swiss-based global private investment company with more than $1 billion in capital. Mr. Kirkpatrick also served for six years as a Managing Director at Bigler Investment Management, a $700 million venture capital and small-cap investment management firm. Mr. Kirkpatrick began his investment career in 1985 at CIGNA Corporation, where he was a Sector Portfolio Manager. Mr. Kirkpatrick earned a B.A. in economics from Williams College, and he earned the CFA professional designation in 1988. SECTOR — GENERAL INVESTING TWST: Let’s start with a brief history of Cardinal Capital Management and an overview of the firm today. Mr. Kirkpatrick: Cardinal traces its roots back to Deltec Asset Management based in New York City where my two partners, Gene Fox and Amy Minella, started a value equity product in 1992. In 1995 they left Deltec along with four colleagues and formed Cardinal Capital Management in Greenwich, Conn. The value equity strategy started at Deltec with $1 million in capital and has grown to $1.3 billion in assets under management at Cardinal today. Managed and wholly owned by the three senior M O N E Y M A N A G investment professionals, Cardinal’s objective is to generate high long-term investment returns with little risk of loss by utilizing a free cash flow-based framework combined with intensive fundamental research. Cardinal operates as a team with four portfolio managers/research analysts and two dedicated research analysts working across Cardinal’s three value equity strategies. Small Cap Value, the firm’s flagship strategy, accounts for roughly 75% of assets under management, with the balance split between Mid Cap Value and SMID Cap Value. Our client base is 80% institutional and tax-exempt money, with public pension plans and corporate pension plans accounting for 50% of the assets under E R I N T E R V I E W MONEY MANAGER INTERVIEW ——————— FCF-BASED FUNDAMENTAL, BOTTOM-UP INVESTING management. About 25% of the assets come from foundations and endowments, and the rest is largely subadvisory of public mutual funds. We subadvise on a number of mutual funds, including the Brown Cardinal Small Companies Fund, BIACX, the ASTON/Cardinal Mid Cap Value Fund, ACDMX, the multimanager Vanguard Explorer Value Fund, VEVFX, and the multimanager Northern Trust small-cap fund, NOSGX. TWST: How would you describe your overall investment philosophy? Mr. Kirkpatrick: Our philosophy, which has remained the same for the 18 years we’ve been in business, is that a company’s stock price is ultimately determined by its ability to generate free cash flow and to redeploy that cash to enhance shareholder value. Cash flow is what management can use to build value and the redeployment of it through share repurchases, acquisitions or reinvestment in the business, either through fixed or working capital expenditures, requires judgment. We capitalize on our philosophy by integrating our intensive fundamental research with an in-depth five-year discounted cash flow-based valuation analysis. We then use our portfolio management skills to create a broadly diversified portfolio weighted towards our best ideas. different times for that same company. It may be appropriate for the company to be repurchasing its stock at one time, but not at another time. So it’s up to us through our research to become comfortable that management is running the company as we would run it if we were in their shoes. Mr. Fox: The decisions that we’re focused on are typically not going to affect this quarter or this year, but more often the long-term strategic direction. We will express our views to management on these issues, so that we have a clear understanding and an ongoing dialogue as to strategy and how and why free cash flow is being redeployed. As a result the numbers that we are focused on are different than Wall Street analysts who worry about this quarter, this year’s or next year’s results when they’re trying to determine whether or not a company is attractive to investors. Mr. Kirkpatrick: One of the keys for Cardinal’s approach is to apply the discounted cash flow methodology to the right type of company, meaning businesses with characteristics that enable us to forecast their financial results out five years with reasonable accuracy. Our term for these businesses is stable and predictable, and examples include revenue visibility via recurring revenue, whether by subscription, backlog or long-term fixed price contracts. Inelastic demand, Mr. Fox: Cardinal’s investment process is absolute, not relative-value based. Our long-term return objective is 20% per annum, and it is built into our discounted cash flow analysis. As a result we are looking for a higher rate of return than you would expect to earn under normal stock market conditions. Mr. Fox: Our process is also different than most other investment advisers when it comes to idea generation, as we don’t do conventional screening. We find ideas opportunistically by looking in market niches which we believe are inefficient, either because the standard financial information does not yet exist or because it’s not readily transparent, such as the difference between cash flow and earnings, or NOLs that aren’t captured. Also there may be money-losing divisions of companies which make the value of the whole company and its parts difficult to calculate, or where there have been changes in the business either through management or events, which have not yet been reflected in the numbers. Our goal is to end up with a portfolio that could not be easily assembled by someone with a database and computer. As Rob said, we do our own research. We do not rely on the Street for the numbers that go into our discounted cash flow analysis. Everything that goes into our decision process is based on the research that we do, not what someone else has done. TWST: Mr. Kirkpatrick mentioned looking for free cash flow that can be used to enhance shareholder value. Do you look for companies that pay out dividends or that are buying stock back? What do you look for? Ms. Matthews: We look at all of the above. But as Gene said, we don’t just screen for dividends because there is no single right answer for all companies. As part of our due diligence process with management, we form an opinion as to what’s the appropriate use of capital at each company. Whether that is stock buybacks, acquisitions or internal growth opportunities where they make capital expenditures or working capital commitments. It differs by company, management, business and situation. Mr. Kirkpatrick: Let me add to what Rachel said. I think not only is capital redeployment different for every company, but it differs at pricing power, economies of scale, intellectual property and monopolies are other factors that we look at in making this assessment. Without reasonably accurate forecasts, discounted cash flow can get investors into trouble because the range of outcomes is too wide, and that makes it very difficult to make attractive long-term returns. Mr. Fox: To follow on to Rob’s last point, Cardinal’s investment process is absolute, not relative value based. Our long-term return objective is 20% per annum, and it is built into our discounted cash flow analysis. As a result we are looking for a higher rate of return than you would expect to earn under normal stock market conditions. We assume that the companies that we’re investing in are out of favor, and it is critical for us to understand why and what it is about that investment that is creating the high return that we’re looking for. We must understand what needs to change about the perception of that business in order for us to make those returns. That is all part of our investment process, and what we look at when we are trying to assess whether we should make the investment, or continue to hold an investment. TWST: What kinds of opportunities do you find today in the small- and midcap areas of the markets? Mr. Fox: The obvious area of opportunity is companies that have significant amounts of cash on their balance sheets, because that cash is earning almost nothing today. These companies are receiving essentially no credit for the cash in their valuations despite the fact that, if the company chose to redeploy that cash through any of the means that Rachel highlighted earlier, significant value would be created. In fact several of our portfolio companies have been very active redeploying cash recently, which does raise the issue as to why now. What we think changed is that post-credit crisis companies were holding dry powder for once-in-a-lifetime opportunities and those never happened. As a result, with the credit markets in better shape, buyers are more willing to pay up MONEY MANAGER INTERVIEW ——————— FCF-BASED FUNDAMENTAL, BOTTOM-UP INVESTING for acquisitions as business confidence improved. Deals are still generally very accretive and debt is available and at very low interest rates by historical standards. TWST: It seems a lot of the recovery in the equity markets has been more in the small- and midcap range and not as much in the large-cap area. Do you have to dig deeper to find good values today? Mr. Kirkpatrick: One thing that we look at is the valuation of our companies on an enterprise value-to-EBITDA basis. Historically what we have found is that our portfolio tends to trade between five and eight times EBITDA. Immediately after the financial crisis, as you would expect, it was close to five times. Preceding that by a bit, it was into the high sevens. Today it’s about 6.5, which places it squarely in the middle of the range. To answer your question, when the portfolio was around five times EBITDA, when the market was at its low in early 2009, we had more opportunities than today. So we do have to dig a little deeper, but there are still plenty of opportunities out there. TWST: What have been some of your successful investment picks in the past? Mr. Fox: M&A, which has been an important contributor to our performance historically, picked up relatively significantly last year and was a major tailwind behind our performance. The relevance of M&A to our strategy comes from the fact that our methodology is very similar to what private equity firms look for in businesses. Consequently, as the to repurchase a substantial part of the noninsider float in the company, when the stock declined substantially. After finishing our due diligence we began purchasing the stock, and Cardinal became Argon’s largest outside shareholder by late 2008. The financial crisis hit but the company’s business remained strong, and when the third founder retired it became apparent to us that the retirees who still owned 30% of the shares would want to monetize their investment. Argon stock, however, was selling at 7.5 times EBITDA, and we felt that the real value of the business was closer to 12 to 14 times EBITDA based on its proprietary technology, the significant programs that Argon had won and the excellent multiyear visibility that the company had to deliver higher revenues and earnings. So Argon was at an inflection point in late 2009, and publicly disclosed their decision to explore strategic alternatives. Although there was a great deal of skepticism among analysts as to the value of the company, our work led us to retain the vast majority of our Argon stock right up until it was announced that Boeing Company (BA) was buying Argon ST at a substantial premium to the market. Mr. Fox: We also had several other companies acquired last year in our small- and midcap portfolios: Interactive Data and SkillSoft in our small-cap portfolios, and Hewitt Associates, NBTY and Interactive Data in our midcap portfolios. We believe that M&A is going to continue to be an important contributor in the future because Cardinal’s view is that the economic environment is going to be one of modest Mr. Kirkpatrick: As a result of our process our portfolios never mirror the benchmark and are broadly diversified. We believe this has, in fact, been a source of value added to our returns. Historically our portfolios are typically underweight financial stocks, usually banks and insurance companies, and overweight consumer stocks. credit markets opened and private equity firms had cash to spend, and corporations/strategic buyers looked to increase or maintain their earnings growth rate through acquisitions — we were quite well positioned to benefit. Specifically last year, we had two of our defense electronic investments, Argon ST and Applied Signal, acquired at very nice premiums and attractive valuations. Those were two very well-positioned companies where we had strong conviction that they had substantially more value to the prime defense contractors than they did as standalone companies. It was simply a matter of time before these companies were acquired, and that was a major contributor to our performance. Mr. Kirkpatrick: I can walk you through the Argon ST investment. Argon was the merger of two small defense electronics contractors early in the last decade. The four entrepreneurs who founded and ran the two companies ended up owning 40%-plus of the merged entity. Cardinal has successfully invested in several smaller defense businesses, and we had just sold our investment in EDO Corporation at a nice profit when it was purchased by ITT (ITT) in 2007. Argon’s business had gone through a downturn as a result of the cancellation of the Aerial Common Sensor program. Although the issue was beyond its control, Argon’s backlog and earnings did drop, but seemed to have bottomed and were poised to resume growth. Argon’s founders were also starting to retire, but had retained their equity stakes. In fact only two of the four were in operating positions at Argon when we first purchased the stock in late 2007. What peaked our interest in Argon was management’s willingness growth, and therefore all companies, but particularly large ones, are going to be challenged for growth; however, since interest rates are very low today, we believe that a number of large companies can and will pursue acquisitions to bolster their growth rates because most acquisitions are very accretive. Small-cap companies are less challenged for growth because they are starting from a smaller base and have opportunities to grow in a number of different ways, including geographic expansion. With respect to valuation, small-cap stocks also deserve an M&A premium relative to large caps because they are the targets. TWST: Do you look to overweight or underweight particular economic sectors? Mr. Kirkpatrick: As a result of our process, our portfolios never mirror the benchmark and are broadly diversified. We believe this has, in fact, been a source of value added to our returns. Historically our portfolios are typically underweight financial stocks, usually banks and insurance companies, and overweight consumer stocks. We believe over long periods of time these differences are one reason that our performance should do much better than our benchmarks. And our returns support this. TWST: Are there particular industry sectors you are looking to add to, or decrease, your exposure? Mr. Kirkpatrick: I don’t think we target sectors per se. I can tell you today we have greater-than-index weights in technology and industrials, and much lower-than-index weights in financials, primarily MONEY MANAGER INTERVIEW ——————— FCF-BASED FUNDAMENTAL, BOTTOM-UP INVESTING banks and utilities. We also have less exposure to consumer stocks than we have had historically. TWST: What sort of broader economic or macro trends are you keeping an eye on that may impact the small- and midcap stock space? Is M&A the primary one or are there others? Mr. Fox: Since Cardinal is a bottom-up, not top-down, firm and we don’t make major portfolios changes based on our macroeconomic views. What we have done is maintain relatively consistent levels of broad exposure through economic cycles. If you make major changes in economic exposure, you have to be right on your macroeconomic calls, and that’s not our competitive advantage. We pay attention to individual companies and monitor changes in their businesses. We obviously have economic views. They just make their way into our investment decisions through our company forecasts. In this regard we have forecast a prolonged economic recovery for some time. We also thought interest rates would remain very low because of the challenges to employment and housing, and that too has played out. The challenges to the banking system, although less publicized, are no less real as regulators remain concerned about capital levels and commercial real estate exposure. As a result we believe that regulators need to keep interest rates low so that banks can earn their way out of their capital problems. These are our views. They haven’t changed materially, but we keep them in mind when we think about businesses and particular exposures in the portfolio. fees, compared to the Russell 2500 Value, which returned 8.9% for the same time period. So we’ve outperformed by 150 basis points. Cardinal’s newest product, Mid Cap Value, was launched in 2006 and has an annualized return of 6% before fees, versus the Russell Midcap Value Index, which returned 5.1% for the same period. So we outperformed in all three products. TWST: What advice would you give investors today? Mr. Kirkpatrick: Our view, which we really became quite vocal about after the third quarter of last year, is that we think people are too bearish about the equity markets and too bullish about bonds as a result of poor returns in the equity markets over the last decade, in particular the decline in 2008 and the strong returns in bonds over the same period. The mutual fund flow data over the 2009 to 2010 period really does show that that’s what’s gone on with most investors. Mr. Fox: We think that investors with a long-term view should be buying equities and selling bonds. Simply, equities are trading near their historical norm from a valuation standpoint despite the fact that interest rates are very low. So we argue that equity prices are relatively cheap. Bonds, however, are trading at historically low yields. Although real interest returns are still positive, with the 10-year government bond yielding 3.5% and reported inflation at 1%-2%, we feel investors are being paid very little to take the risk that inflation will eventually rise. In addition, because equity market expectations are low, equities are inherently less risky, while as bonds are priced for perfection, they have Ms. Matthews: The SMID-cap value product, which we started in 2002, has an annualized return since inception of 10.4% before fees, compared to the Russell 2500 Value, which returned 8.9% for the same time period. So we’ve outperformed by 150 basis points. TWST: Talking about Cardinal Capital Management itself, would you tell us a bit about the firm’s performance? Mr. Fox: Cardinal has been in business since 1995, but our performance record goes back to June of 1992 at Deltec. We have an annualized return before fees of 14.3% through February versus 11.5% for the Russell 2000 Value. At least as important, with the exception of 2008, our lowest annual return in any year over the past 18 was -2.5%. We are proud of this performance because it demonstrates that our investment process does in fact protect capital in most bad equity markets as we would expect. This consistency is evident in our peer group rankings, where since inception, we have the lowest standard deviation of returns, or volatility, of any of the 30 small-cap value investment managers with an 18 year performance record. This is more impressive when you consider that only about a third of the products that were in the small-cap value universe, when we started our product, remain in the universe today. For the same period we also rank in the top 10 small-cap value products on most every measure of performance. Mr. Kirkpatrick: Gene was speaking specifically about Cardinal’s small-cap value product. We also have a small- to midcap value product and a midcap value product, and both of those have performance records going back a number of years, and Rachel will talk about the returns on those. Ms. Matthews: The SMID-cap value product, which we started in 2002, has an annualized return since inception of 10.4% before nowhere to go but down. Since we went out with this view, stock prices have risen and bond prices have declined and fund flows are starting to reverse. Our view though is this is just the beginning of a cyclical process, and equities remain quite reasonably valued, so equity investors with patience will be rewarded. Mr. Kirkpatrick: The other thing that investors have to keep in mind is that future investment returns are a function of the price which you pay to purchase the investment today, not your cost or past returns. TWST: Would each of you offer one or two investment ideas that are in your portfolios today? Ms. Matthews: I want to highlight DG FastChannel (DGIT). It’s a company we first invested in late in 2010. DG is a leading provider of digital technology that’s used to facilitate the electronic delivery of advertisements, syndicated programs and video primarily to the broadcast networks, local television stations and cable television companies in the U.S. We began to research the company because the stock price fell drastically due to temporary factors that we believe are unrelated to and did not significantly diminish the value of the business franchise, which we feel remains very attractive. This goes back to our approach of finding stocks that are unduly depressed for reasons that we understand, and at the same time uncovering catalysts or reasons why the perception should improve. As we did our research we concluded that DG’s stock price fell due to perceived increased competition, concern that the pricing on MONEY MANAGER INTERVIEW ——————— FCF-BASED FUNDAMENTAL, BOTTOM-UP INVESTING HD advertising was going to fall dramatically and the company’s mismanagement of the process of implementing quarterly earnings guidance. With respect to competition, DG was perceived to be a monopoly, but the startup of two competitors and the loss of a handful of accounts to one of them raised concerns. On closer examination, however, neither competitor had the same capabilities as DG nor could they operate profitably, and the client losses were relationship not business issues. In fact nue grows; the shift in direct-response marketing from SD to HD; and the opportunity for international expansion. DG’s free cash flow characteristics are compelling. Currently the stock trades at six times EV/ EBITDA with an 11% free cash flow yield on enterprise value. At its current price of $31 the stock is up significantly from our first purchase price late last year in the low $20s; however, we feel the stock is worth well over $40, which is where it was traded before the events of late last Ms. Matthews: We began to research [DG FastChannel] because the stock price fell drastically due to temporary factors that we believe are unrelated to and did not significantly diminish the value of the business franchise, which we feel remains very attractive. 1-Year Daily Chart of DG FastChannel Chart provided by www.BigCharts.com summer. The company has a share repurchase program and has been active. As investors realize that there is no imminent competitive threat to DG’s dominant market position and the shift to HD electronic delivery of advertising occurs at a faster pace than expected, we think the DG FastChannel stock should move materially higher. Mr. Kirkpatrick: I would like to discuss Kaman Corporation (KAMN). Kaman is a company started after World War II by an entrepreneur named Charlie Kaman. He ran the company, controlled it, fell ill in the late 1990s and then brought in professional executive management. That team came in, and in 2005 recapitalized the company by eliminating the super-voting stock owned by Kaman and his family and created one class of voting stock. That’s when we got interested because it became a company where we felt that shareholders would be amply represented. Kaman at that time was in three business lines: aerospace, 1-Year Daily Chart of Kaman Corporation one of the two has already exited the business. With respect to pricing, we believe declining prices are actually a positive as the industry moves from electronic delivery of standard-definition advertising to high definition over the next several years. Although HD prices are likely to fall, and we have made some conservative assumptions in our model, our long-term penetration rates for HD, which has much higher margins, than SD are also very conservative. Standard definition pricing is $10 to $12 electronically, versus HD, which is $150 per unit. So you can see, if that shift happens quickly and extensively, the revenue opportunity is pretty dramatic. Also HD penetration is only 11% today. It started last year in the mid-single-digits. We’re only assuming that it gets to 30% over the next five years. It clearly has the opportunity to get a lot higher than that, but we don’t need to be so aggressive in order to make our targeted level of returns. When we look at the business today, its cash flow margins are almost 50%. That’s a fixed-cost structure. Every incremental dollar that flows through is very, very profitable. We are also conservative in our modeling, assuming that the HD price comes down so that they get no margin expansion over time. In reality they are likely to get margin expansion because the price decline in HD isn’t likely to be as rapid, and if it is rapid, it’s likely to be because the share growth, the penetration, is that much higher. These are the dynamics that we focus on. It’s also important to us that management owns over 10% of the company, so they are not working against us. They are working with us. There are a host of reasons we like DG, including its fixed-cost business model, which provides significant operating leverage as reve- Chart provided by www.BigCharts.com which is a combination of commercial and defense, but primarily defense; an industrial distribution business, where they are the number three player in the industrial distribution area, behind Genuine Parts (GPC) and Applied Industrial Technologies (AIT); and a music distribution and instrument business, which they subsequently sold in 2007. Current management joined in 2007 and is led by Neal Keating, who has a background in aerospace and industrial distribution — strangely enough, the exact two business lines that Kaman was left with after it sold its music business. Keating has brought in a new CFO and appointed new heads of both the aerospace and industrial distribution businesses. The charge the board gave him was to profitably grow the two remaining businesses, which were substandard in size. As a result MONEY MANAGER INTERVIEW ——————— FCF-BASED FUNDAMENTAL, BOTTOM-UP INVESTING the management team reinvested the proceeds from the music sale into acquisitions on both the aerospace and industrial distribution side. They have also cleaned up legacy issues, including a large troubled Australian helicopter contract and pension underfunding. They have also continued to grow each business organically as well as via acquisition. In 2008 the company’s EBITDA reached a new peak, and then the financial crisis intervened. In 2009 EBITDA declined about 25%, but Motorola (MMI), Sony (SNE) and LG Electronics (LPL), whose contract expired at the end of last year and with whom they are negotiating a new 3G and a 4G license. As context, after Qualcomm (QCOM), InterDigital has the second position in terms of non-carrier-based IP that’s used in wireless cellular devices, and we would ultimately expect that the company’s technology will be licensed by everybody in the industry. Today InterDigital Mr. Fox: [InterDigital] is a $2.1 billion market-cap company which designs and develops advanced digital wireless technologies used in virtually all digital cellular and wireless products and networks and adopted by the international standards for 3G, 4G as well as earlier standards. 1-Year Daily Chart of InterDigital Chart provided by www.BigCharts.com 2010 was a very solid rebound year and back toward previous peak EBITDA levels. We believe that the company should be able to substantially grow sales, profits and free cash flow of each business over the next few years and thus leverage corporate overhead. Kaman stock sells in the low $30s or 7.5 times EV/EBITDA today, and if the company can meet its publicly disclosed revenue and margin targets by 2014, that would imply a stock price at the current valuation well north of twice the current stock price today. Mr. Fox: I am going to talk about InterDigital (IDCC). It is a $2.1 billion market-cap company which designs and develops advanced digital wireless technologies used in virtually all digital cellular and wireless products and networks, and adopted by the international standards for 3G, 4G, as well as earlier standards. The business was founded in the late 1960s by Sherwin Seligsohn, an entrepreneur who got tired of having to go to a phone booth to put in his stock trades while he was on the beach. He founded International Mobile Machines, the predecessor company to InterDigital, in 1972. InterDigital today has almost 20,000 patents that are essential to virtually every wireless device. Its 2G technology has been licensed by all of the mobile handset carriers, and its 3G technology is presently licensed by over half of the vendors. InterDigital is currently in litigation with Nokia (NOK) over their use of its 3G technology, although Nokia has an existing license for their 2G technology and licensed their 3G technology through April 30, 2006, but has not been willing to sign a license since. The litigation has lasted for several years, but is hopefully nearing a conclusion as the Federal Circuit Court of Appeals should rule shortly. At present the only other large mobile carriers which they do not have a current license agreement with are has $572 million in cash, or about $12 a share, so we are paying about $35 per share or 10 times last year’s earnings, very modest for the growth that we see. For example, the demand for mobile phones is forecasted to grow substantially over the next several years at 30%-plus per annum, and about half of their licensees pay royalties based on units sold. Many of the other licensees — including Apple (AAPL), HTC (2498.TW), Samsung (005930.KS) and LG — have fixed-price contracts based on far fewer units than they are selling today. These contracts expire over the next few years and are likely to be reset to reflect those higher volumes. For example, when InterDigital signed Apple to a license in 2006, Apple was selling less than 10% of the iPhones that they are selling today. So we would expect when these licenses get re-signed in a few 1-Year Daily Chart of IAC/InterActiveCorp. Chart provided by www.BigCharts.com years, Apple and others will pay much more. Factoring in the sales and profits from signing licenses with Nokia, Motorola and Sony, we believe that the earnings power of this company is likely to be much higher than we have seen in recent years. In addition, none of the existing license agreements reflect the benefit of InterDigital’s 4G patent portfolio, which we believe is more valuable and entitle it to higher royalties than their 3G technology. Finally, the company is currently spending considerable resources and efforts on solving the wireless data capacity problem. Simply, the capacity of the existing infrastructure and technology to meet today’s demand for high speed and quality data is insufficient, which is why your wireless devices don’t work very quickly. So InterDigital is spending resources to solve the problem of how to get data on a timelier and more efficient basis to an increasing number of phones by improving the dimensions of MONEY MANAGER INTERVIEW ——————— FCF-BASED FUNDAMENTAL, BOTTOM-UP INVESTING the pipes that transmit the data. We believe that this is likely to be a large business opportunity, and they are only starting to see revenue from it as it will take time to play out. For such a well-positioned company it surprised us that InterDigital has no major Street coverage. In the short run the catalyst for the stock is likely to be the sale via bankruptcy court auction of Nortel’s wireless patent portfolio, which is expected to fetch over a billion dollars, and be a valuation benchmark for this company. We expect the buyer will likely be Apple or Google (GOOG), because it’s very important in the wireless handset business that you have critical IP so that you can cross license your IP with competitors rather than pay a royalty to everybody, which can run up to 15% of the cost of each device. What they basically do is agree not to fight each other. TWST: Would you like to add one more, Ms. Matthews? Ms. Matthews: I’m going to discuss InterActive Corp. (IACI), which operates more than 35 online brands and is what remains of Barry are earning nothing on that cash and receiving little credit for it in their valuation. Also that $12/share in net cash is after buying back about a third of the market cap in the previous three years. We look at this company two different ways. We’ve done our DCF analysis as the businesses are solid and free cash flow generating. The company itself has over a 20% free cash flow yield on enterprise value. We think management will continue to put the cash to work given these returns, primarily through share repurchases, and that’s what they have said. They are not expecting to do any major acquisitions, and now that Diller is no longer CEO the market seems more comfortable that won’t be the case. So using our DCF model and putting the cash they have now to work plus any future cash that they generate, we get a mid- to high-$30s sell price. On a sum of the parts analysis, if Match.com ranges from $1 billion to $1.5 billion, that implies a seven or eight times multiple, which is very low in the Internet-based subscription model world. If you use an even lower valuation on the search and ServiceMaster businesses of five, Ms. Matthews: What intrigued us with this company was its valuation and business improvement. The stock was trading in the high-$20s, and going back to Gene’s earlier comments, IACI has about $12/ share or $1.2 billion of net cash on the books, which is almost half of the value. Diller’s conglomerate after the spin-off of Ticketmaster (LYV), HSN (HSNI), LendingTree (TREE) and Interval (IILG) back in 2008. Barry Diller was the Chairman and CEO of the company, but recently stepped down and named Greg Blatt — the CEO of Match.com, one of his business segments — as the new CEO of InterActive. Barry remains Chairman. The company has four business segments, the first one being search. Their primary search business is called Ask.com, but there is also a toolbars and applications business. Last year the company restructured Ask.com, number four or five in search, as they couldn’t effectively compete against Google or Yahoo! (YHOO). So they’ve essentially outsourced most of their operating expenses, which is going to materially improve the profitability of that segment. The toolbars and apps business has above-average growth and profitability, which is where they’re seeing most of their growth in the search segment. The second segment is Match.com, which is the personals business. It’s a very fragmented business where the company sees a lot of opportunity for growth. The target demographic for growth is slightly older and wealthier, and they feel that they can more than double their subscription-based revenues without coming close to penetrating the market. Analysts have valued the Match.com business at $1 billion to $1.5 billion. The third segment is ServiceMaster, which is a small online service-request business that has been hurt by weakness in the housing market over the last couple of years. They are seeing improvement, and there is a lot of room to expand their margins back to historical levels. The fourth segment is what they call “media and other,” and that’s where they put their incubation businesses that they’re investing in and trying to decide what these businesses will be once they get to critical mass and whether they will keep them. What intrigued us with this company was its valuation and business improvement. The stock was trading in the high-$20s, and going back to Gene’s earlier comments, IACI has about $12/share or $1.2 billion of net cash on the books, which is almost half of the value. Obviously they six times EBITDA, given that neither is a market leader you get a comparable valuation but with a conglomerate discount, which is how the market world has typically looked at IAC. So as the company monetizes their portfolio and narrows their business focus, you could see that discount go away and the company trade at a higher valuation. TWST: Would you like to add anything else? Mr. Fox: As you may have gathered from this interview, the vast majority of our time is spent gathering and analyzing information about businesses and people. We are trained to do it. We are very experienced at it, and we do it extremely well. It is a key part of our sustainable competitive advantage. To summarize, Cardinal is about research and about generating attractive risk-adjusted returns, risk being defined as risk of loss. Our performance record demonstrates that our returns mirror our process. We also continue to own the firm. One thing that Rob didn’t mention earlier is we have significant amounts of our own capital invested in our products, north of $5 million, meaning our interests are aligned with those of our investors. We believe that we offer a very good value proposition for investors. TWST: Thank you. (MN) EUGENE FOX, III RACHEL D. MATTHEWS ROBERT B. KIRKPATRICK, CFA Cardinal Capital Management, L.L.C. One Greenwich Office Park Building 1 North Greenwich, CT 06831 (203) 863-8990 (203) 861-4112 — FAX www.cardcap.com e-mail: rkapp@cardcap.com MONEY MANAGER INTERVIEW ——————— FCF-BASED FUNDAMENTAL, BOTTOM-UP INVESTING The information presented herein should not be considered a recommendation to purchase or sell any particular security. There can be no assurance that any securities discussed herein remains in a client portfolio or if sold will not be repurchased. The securities discussed herein do not represent a client’s entire portfolio and in the aggregate may represent only a small percentage of a client’s portfolio holdings. It should not be assumed that any of the securities discussed herein have been or will be profitable, or that recommendations made in the future will be profitable or will equal the investment performance of the securities discussed herein. This document does not constitute an offer to sell, or a solicitation of an offer to buy, any interest or investment in Cardinal’s private fund clients, which may only be made at the time a qualified offeree receives a confidential explanatory memorandum describing the offering and related subscription agreement. SK 01269 0001 1183934 © 2 011 T h e Wa l l S t r e e t Tr a n s c r i p t , 4 8 We s t 3 7 t h S t r e e t , N YC 10 018 Te l : ( 2 12 ) 9 5 2 - 74 0 0 • Fa x : ( 2 12 ) 6 6 8 - 9 8 4 2 • We b s i t e : w w w. t w s t . c o m