1 Chapter 1: What is Economics? 1. Scarcity and Factors of

advertisement

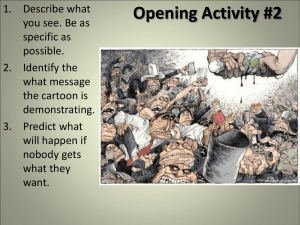

1 Chapter 1: What is Economics? 1. Scarcity and Factors of Production 2. Opportunity Cost 3. Production Possibilities Curves 1. Scarcity and the Factors of Production How does scarcity force people to make economic choices? What is Economics? Study of how people seek to satisfy their needs (essential) and wants (desires) by making choices How can we make the best economic choices? Scarcity and Choice •Scarcity, the principle of limited goods and services, affect the choices we make •Goods-physical objects that someone produces •Services-actions that one person performs to another The Problem of Limits •Unlimited needs and wants •Limited goods and services = scarcity •Scarcity forces you to make choices •All natural resources by definition are scarce Scarcity versus Shortage •What is the difference? •Scarcity-limited amount of goods and services •Shortage-consumers want more than producers are willing to make The Factors of Production •Land-all natural resources that are used to make goods and services •Labor-effort people devote to tasks for which they are paid •Capital-human-made resource that is used to produce other goods and services 2. Opportunity Cost •The most desirable alternative given up as the result of a choice or decisions •Weigh the choices you make •How does opportunity cost affect decision making? 2 Trade Offs •The act of giving something up in order to gain something better •“Time for money and wheels”-get a part time job (time) in order to get a car •“Guns and Butter”-government decision to spend money on military defense or on domestic needs Marginal Thinking •Process of deciding whether to use a resource •Cost /benefit analysis-what you will sacrifice and gain by your actions •Marginal cost vs. Marginal benefit 3. Production Possibilities Curves •Graphs that shows ways to use an economy’s productive resources •How does a nation decide what and how much to produce? Efficiency, Growth, and Cost •Efficiency-use of resources in such a way to maximize the output of goods and services •Growth-an increase in goods and services •Cost-what you gave up to increase productivity Chapter 2: Economic Systems 1. 2. 3. 4. Answering three Economic Questions? The Free Market Centrally Planned Economics Mixed Economics 1. Answering three Economic Questions •What goods and services should be produced? •How should these goods and services be produced? •Who consumes these goods and services? . . . . Because resources are scarce Economic System •The structure of methods and principles a society uses to produce and distribute goods and services •A way a society answers these questions defines its economic system Economic Goals and Societal Values •Different societies answer the questions based on importance they attach to various economic goals Economic Goals 1. Efficiency-Societies try to maximize their resources 2. Freedom-the opportunity to make your own choices 3 3. Security-”Safety net”-programs that protect people who face unfavorable economic conditions 4. Equity-How should we divide the pie? 5. Growth-innovation plays a huge role in economic growth Traditional Economies •An Economic system that relied on habit, custom, or ritual to decide the three economic questions. •There is little room for innovation or change in traditional economies •Led to more modern economic systems Three Economic Systems •Dominates the modern world •The free market economy (capitalism) •The centrally planned economy (communism) (socialism) •The mixed economy –a little of both 2. The Free Market •Economic Freedom-highly valued by American Society •Markets-any arrangement that allows buyers and sellers to exchange things •We are not producers of all our wants Why Markets Exist •Specialization-concentration of the productive efforts of individuals and businesses on a limited number of activities •Buying and Selling-sell what we produce and buy what we want Free Market Economy •An economic system in which decisions on the three key economic questions are based on voluntary exchange in markets •Individuals make their own decisions •Capitalism-the capital that entrepreneurs invest in businesses are vital Households and Firms •Household-person or group of people living in a single residence •Firm-business or an organization that uses resources to produce a product, which it then sells 4 Factor and Product Markets •Factor Market-the arena of exchange in which firms purchase the factors of productions from households •Product Market-the arena of exchange in which households purchase goods and services from firms The Self-Regulating Nature of the Marketplace •Self Interest-an individual’s own personal gain •Incentive-the hope of reward or fear of penalty that encourages a person to behave in a certain way •Competition-the struggle among producers for the dollars of consumers •The Invisible hand-Adam Smith-the self regulating nature of the market place Advantages of the Free Market •Efficiency-produce what consumers want •Freedom-work where you want, produce what you want, consume what you want •Growth-innovations •Consumer Sovereignty- having the power to decide 3. Centrally Planned Economics •How Central Planning Works •Government makes all the decisions on three questions (command economy) •Government owns all factors of production •Direct contrast to free market structure Socialism and Communism •Socialism – range of economic and political systems based on belief that wealth should be distributed evenly throughout a society •Communism-political system in which government owns all resources and means of production and makes all economic decisions Authoritarian •Form of government that limits individual freedoms and requires strict obedience from its citizens •Communist governments are always authoritarian Two Communist Economies •The Soviet Union-1917-Bolshevik Revolution-Joseph Stalin-broke up in 1991 •China-1949 to late 1970’s-government planners controlled all aspects of Chinese society Disadvantages of Centrally Planned Economies •Efficiency-no incentive to work hard •Freedom-discourages competition •Growth-no innovation no growth •Equity-human intuition prohibits equity The need to satisfy all wants and needs 5 4 Mixed Economies •Reasons for Government Involvement •Laissez-faire-government generally should not intervene in the marketplace •Private Property-property owned by individuals not the government •Mixed economy-market-based economics in which government is involved to some extent Government in Market •Factor Market-government instead of individual owns factors of production Product Market-government purchases all goods and services and provides them the public Continuum of Mixed Economies The United States Economy •Free enterprise economy-private or corporate ownership of capital goods •Government of the U.S. plays a major role in the economy •“promote the general welfare” •Some people think that the government intervenes too much in the economy •What do you think? Chapter 3:American Free Enterprise 1 - Benefits of Free Enterprise 2 - Promoting Growth and Stability 3 - Providing Public Goods 4 – Providing a Safety Net 1. Basic Principles of Free Enterprise 1. Profit Motive – incentive that drives individuals and business owners to improve their material well-being 2. Open Opportunity – anyone can compete in the market place 3. Legal Equality – everyone has the same legal rights 4. Private Property – individual has the right to control their possessions 5. Freedom to Buy and Sell – people decide what, when, and how they want to buy and sell The Role of the Consumer •Consumers send signals to businesses telling them what to produce and what not to produce •Through interest groups-private organizations that try to persuade public officials to act in a way that benefits the members Economic Freedom and the Constitution •Patriotism-love of one’s country 6 •Property rights-eminent domain-the government’s right to take private property for public use •Taxation-Constitution spells out how government can tax individuals •Contracts-legal binding agreements between people and business The Role of Government in the market place •Public interest-the concerns of society as a whole •Public disclosure laws-companies must provide information about their products or services •Protecting public health, safety, and well-being-laws aimed at protecting the consumer •There is a negative impact of Regulation 2. Promoting Growth and Stability •Macroeconomics-the study of economic behavior and decision-making in a nation’s whole economy •Microeconomics-study of economic behavior and decision-making in small units, such as households and firms Tracking business cycles •Gross Domestic Product (GDP)-the total value of all final goods and services produced in a country in a given year •Business cycle- macroeconomic growth followed by macroeconomic decline •Changes occur in business cycles because people make predictions Promoting Economic Strength 1. Employment-ensure jobs for everyone who can work 2. Economic Growth-higher standard of living 3. Stability and Security-government seeks to keep economy stable 4. Economic citizenship-voters play a vital role in shaping government economic actions 5. Referendums-proposed law submitted directly to the public Technology and Productivity 1. Technological progress-improved technology is essential –innovation 2. The Government’s Role-government promotes innovation and invention through funding research-must show results or no funding! 3. Government grants patents-licenses that gives the inventor exclusive right and copyrights-licenses that give authors exclusive rights 3. Providing Public Goods •A shared good or service for which it would be inefficient to make consumers pay individually and to exclude those who did not pay Public v Private sector •Public Sector-the part of the economy that involves the transactions of the government •Private sector-the part of the economy that involves the transaction of the individual or business 7 Costs and Benefits •Infrastructure-the basic facilities that are necessary for a society to function and grow •1. The benefit to each individual is less than the cost that each would have to pay if it were provided privately •2. The total benefits to society are greater than the total cost Free Rider Problem •Someone who would not be willing to pay for certain good or service but who would get the benefits of it anyway if it were provided as a public good Market Failures •A situation in which the free market, operating on its own, does not distribute resources efficiently Externalities •Economic side effect of a good or a service that generates benefits or costs to someone other than the person deciding how much to produce or consume •Positive-generates benefits to many people •Negative-generates unintended costs Government’s Role •Government must take action to create positive externalities and at the same time limit negative externalities Providing a Safety Net •The Poverty Problem-an income level below that which is needed to support families and households •The Welfare System-the governments efforts to ease poverty by collecting taxes from individuals and redistributing some of those funds in the form of money (FDR-Great Depression) Redistribute Programs 1. Cash Transfers-direct payment of money by the government to poor, disabled, or retired people (ex-TANF, Social Security, Unemployment insurance) 2. In-kind benefits-goods and services provided for free or at reduced prices 3. Medical benefits-government provided healthcare to elderly, the disabled, the poor 4. Education-opportunities to those who need instruction Private Action •Grant-A financial award given by the government agency to a private individual or group in order to carry out a specific task