Detailed Analysis of Sales Tax Data By 4

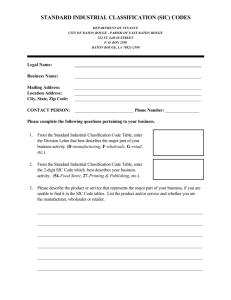

advertisement

AE-09012 DETAILED ANALYSIS OF SALES TAX DATA BY 4-DIGIT SIC CODE FOR STILLWATER, OKLAHOMA 2009 Suzette Barta, Community & Economic Development Educator, Stillwater (405) 747-8320 Lara Brooks, Assistant Extension Specialist, OSU, Stillwater (405) 744-4857 Dave Shideler, Extension Economist, OSU, Stillwater (405) 744-6170 Cindi Browne, Graduate Assistant, OSU, Stillwater Lindsey Rodman, Student Assistant, OSU, Stillwater OKLAHOMA COOPERATIVE EXTENSION SERVICE OKLAHOMA STATE UNIVERSITY May 2009 Detailed Analysis of Sales Tax Data by 4-Digit SIC Code for Stillwater, Oklahoma Suzette Barta Community & Economic Development Educator Payne County Extension Office 315 W 6th Avenue, Suite 103 Stillwater, OK 74074-4044 Suzette.barta@okstate.edu Lara Brooks Assistant Extension Specialist 526 Ag Hall Oklahoma State University Stillwater, OK 74078 lara.brooks@okstate.edu Dave Shideler Extension Economist 323 Ag Hall Oklahoma State University Stillwater, OK 74078 Dave.shideler@okstate.edu Cindi Browne Graduate Assistant 506 Ag Hall Oklahoma State University Stillwater, OK 74078 Lindsey Rodman Student Assistant 323 Ag Hall Oklahoma State University Stillwater, OK 74078 ABSTRACT The goal of this paper is to provide an analysis of taxable sales for the City of Stillwater, OK. Sales tax data collected at the 2- and 4-digit SIC code level are used to calculate estimates of trade area capture and pull factors. Eight 2-digit SIC codes are considered retail (SIC 52 – SIC 59), and each of these will be considered in turn by examining the 4-digit entries for each. Fiscal years 2000 through 2008 will be examined. "Oklahoma State University, in compliance with Title VI and VII of the Civil Rights Act of 1964, Executive Order 11246 as amended, Title IX of the Education Amendments of 1972, Americans with Disabilities Act of 1990, and other federal laws and regulations, does not discriminate on the basis of race, color, national origin, sex, age, religion, disability, or status as a veteran in any of its policies, practices or procedures. This includes but is not limited to admissions, employment financial aid, and educational services." "Readers may make verbatim copies of this document for non-commercial purposes by any means." EXECUTIVE SUMMARY The City of Stillwater has strong retail pull with a wide range of successful retail establishments from drinking establishments to hobby shops to family clothing stores. This study calculates a measure of retail pull called a pull factor or gap coefficient for 2- and 4-digit SIC codes that are defined as retail. High pull factors suggest that a community either attracts shoppers from outside of itself or that the local consumers spend above average amounts on products in these sectors. Some of the 4-digit sectors for Stillwater with high pull factors include: 5699 Misc. Apparel and Accessory Stores: current PF = 9.488 5942 Book Stores: current PF = 8.537 5735 Record and Prerecorded Tape Stores: current PF = 7.820 5994 News Dealers and News Stands: current PF = 4.720 5813 Drinking Places: current PF = 4.452 5943 Stationery Stores: current PF = 3.617 5651 Family Clothing Stores: current PF = 3.282 5945 Hobby Toy and Game Shops: current PF = 3.264 5431 Fruit and Vegetable Markets: current PF = 3.059 5661 Shoe Stores: current PF = 2.860 5311 Department Stores: current PF = 2.267 5211 Lumber and Other Building Materials Dealers: current PF = 2.134 5571 Motorcycle Dealers: current PF = 1.9823 5511 New and Used Motor Vehicle Dealers: current PF = 1.669 Pull factors less than one suggest that the sector does not attract consumers from outside the community, and it may not retain consumers within the community as well. Some of the sectors in Stillwater retail market with low pull factors include: 5714 Drapery, Curtain and Upholstery Stores: current PF = 0.105 5311 Variety Stores: current PF = 0.130 5949 Sewing, Needlework, and Piece Good Stores PF = 0.230 5421 Meat and Fish Markets: current PF = 0.270 5719 Misc. Home Furnishings Stores: current PF = 0.428 1 DETAILED ANALYSIS OF SALES TAX DATA BY 4-DIGIT SIC CODE FOR STILLWATER, OKLAHOMA Introduction Sales tax collections are important to a community for several reasons. On a practical level, they are an important source of revenue for the municipal budget. They can, however, also serve as valuable indicators of how well the local economy is doing relative to other cities across the state. Detailed sales tax data, such as data presented by 2- and 4-digit SIC code, can indicate areas of strengths and weaknesses for an economy. Local leaders involved in economic development efforts may be interested in such detailed data as a way to identify sectors with large retail leakage that may be potential targets for business recruitment. Methodology This report uses pull factor analysis to approximate the number of customers served by a given retail trade sector. This section describes the methodology and data used to generate the pull factors. Pull factors build upon the idea of trade area capture, so we begin with a description of this concept. Trade area capture gives an estimate of the population served by a local market, e.g., Stillwater. It is calculated by dividing the city's total sales by state per capita total sales and adjusting for income differences between the state and the relevant local area. The specific equation utilized is: TAC C = TS C TS S PCI C X PS PCI S Where: TACc = Trade Area Capture by city, TSc = Total Sales by city, TSs = Total Sales for the state, Ps = State Population, PCIc = Per Capita Income by county, and 2 PCIs = Per Capita Income for the state. Trade area capture figures incorporate both income and expenditure factors, which may be influencing total trade trends. An underlying assumption of the trade area capture estimate is that local tastes and preferences are similar to that of the state as a whole. If a trade area capture estimate is larger than city population, two explanations are possible: 1) the city is attracting customers outside its boundaries or 2) residents of the city are spending more than the state average. Stillwater saw growth in its trade area capture between 2000 and 2007 to 70,210, but the trade area capture declined slightly in 2008 to 68,851. See Table 1 and Figure 1 for more information regarding these trends. Building on this idea of trade area capture, one can estimate the amount of total local sales by consumers outside of the market by using pull factors. The pull factor is a ratio of the trade area capture figure to city population, PF C = TAC C , where: PC PFc=City Pull Factor, and Pc=City Population. A pull factor of 1.0 means the city is keeping all the customers from within its boundaries but is not attracting any from the outside. A pull factor of 1.50 means the city is drawing non-local customers into the city to shop equal to 50 percent of the city population. A pull factor of less than 1 means the city is not capturing the shoppers within its boundaries, or they are spending relatively less than the state average; this is considered leakage of local sales or a sales gap. Stillwater had a pull factor of 1.466 in 2008, a slight decline from the pull factors earlier in the decade that were around 1.53. (See Table 2 and Figures 2 and 3present the historical trends for pull factors, and Figures 2 and 3 compare the Stillwater pull factors to other communities in Payne County and the average pull factor of communities of Stillwater’s size, respectively.) Additional discussion of trade area capture and pull factors can be found in the references cited 3 in this report (Barta and Woods; Harris; Stone and McConnon; Hustedde, Shatter, and Pulver). The Oklahoma Cooperative Extension Service has been conducting pull factor/gap analysis and sales tax analysis since 1991 (Woods, 1991). When applied to detail sector analysis, as in this report, pull factors are often called sales gap coefficients; we use these terms interchangeably in this report. Sales tax collections by 4-digit SIC code, as reported by the Oklahoma Tax Commission, were used to compute measures of taxable sales by retail sector. Table 3 presents the historical sales tax and estimates taxable sales for Stillwater since 1980. Total sales tax collections exceeded $22 million from more than $640 million in taxable sales in 2008. Taxable sales will serve as a proxy for sales in a community. Population data were obtained from the Oklahoma Department of Commerce’s “2007 Population Estimates by Place by County.” Income figures were taken from Bureau of Economic Analysis estimates for counties. Since similar income data for cities were not available, county income was used as a proxy. Figure 4 presents nominal and real taxable sales in Stillwater since 1980. Both measures of taxable sales have increased steadily since then. The remainder of this report applies the methodology above to each of the eight retail sectors (SIC 52-59) for which data is available from the Oklahoma Tax Commission. For each sector, we present the sales tax collections, estimated taxable sales, and gap coefficients. We also provide charts comparing the amount of sales across the 4-digit SIC codes for each retail sector (2-digit SIC code). 4 Table 1 Trade Area Capture, Stillwater, OK, 1980-2008 Year 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008* (*) Trade Area Capture 46,093 41,879 47,932 51,169 51,578 53,727 53,741 51,619 51,577 49,222 48,644 50,425 51,014 52,581 54,344 54,753 55,314 56,999 58,796 60,170 59,344 62,873 64,242 65,703 67,539 69,741 70,717 70,210 68,851 Population 38,268 39,350 39,750 39,500 38,800 38,400 37,650 37,500 37,200 36,200 36,659 36,688 37,250 37,644 37,603 38,063 38,141 38,430 38,305 38,444 39,276 40,981 41,818 42,845 43,367 45,674 46,383 46,976 46,976 2007 Per Capita Income and Population Data 5 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Figure 1. Trade Area Capture for Stillwater, OK, 1980-2008 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 6 Table 2 Pull Factors for Cities and Towns in Payne County, 1980-2008 Year 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Cushing 1.868 1.599 1.916 1.652 1.642 1.645 1.624 1.454 1.410 1.417 1.462 1.511 1.514 1.493 1.407 1.387 1.347 1.304 1.261 1.231 1.118 1.140 1.227 1.212 1.190 1.293 1.201 1.201 1.229 Glencoe 0.468 0.388 0.446 0.371 0.393 0.533 0.537 0.546 0.502 0.436 0.455 0.433 0.634 0.499 0.460 0.447 0.505 0.462 0.487 0.491 0.453 0.501 0.480 0.465 0.440 0.525 0.366 0.411 0.408 Perkins 0.688 0.638 0.643 0.602 0.629 0.637 0.548 0.524 0.513 0.528 0.649 0.665 0.627 0.675 0.600 0.622 0.628 0.684 0.696 0.738 0.704 0.772 0.802 0.822 0.832 0.968 0.852 0.947 0.884 7 Ripley Stillwater Yale 0.274 0.586 1.204 0.217 0.495 1.064 0.249 0.633 1.206 0.329 0.538 1.295 0.355 0.487 1.329 0.343 0.528 1.399 0.297 0.521 1.427 0.303 0.409 1.376 0.275 0.401 1.386 0.254 0.398 1.360 0.341 0.545 1.327 0.351 0.538 1.374 0.358 0.529 1.370 0.366 0.515 1.397 0.344 0.496 1.445 0.359 0.480 1.438 0.411 0.483 1.450 0.355 0.456 1.483 0.347 0.462 1.535 0.348 0.466 1.565 0.343 0.435 1.511 0.317 0.448 1.534 0.328 0.454 1.536 0.290 0.418 1.534 0.294 0.409 1.557 0.285 0.390 1.527 0.234 0.332 1.525 0.213 0.383 1.495 0.207 0.270 1.466 Figure 2. Pull Factors for Cities and Towns in Payne County, 1980-2008 2.500 2.000 1.500 1.000 0.500 0.000 Cushing Glencoe Perkins 8 Ripley Stillwater Yale Figure 3. Pull Factors for Stillwater vs. Other Cities with Population 25,000-50,000 1.800 1.600 1.400 1.200 1.000 0.800 0.600 0.400 0.200 0.000 Stillwater 25,000-50,000 9 Table 3 Tax Returns, Stillwater, Oklahoma, FY 1980-2008 Year *1980(2) Collections $479,098.99 Tax Rate 2.00% Retail Sales $23,954,949.50 *1980(10) 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 $3,772,305.28 $4,868,239.59 $5,720,574.32 $6,271,321.45 $6,784,710.58 $7,271,167.96 $7,145,305.98 $6,861,694.49 $7,061,006.41 $7,235,042.23 $7,479,441.05 $8,083,761.44 $8,384,702.81 $8,780,124.14 $9,614,879.74 $10,117,135.77 $10,717,258.34 $11,330,464.32 $11,848,595.59 $12,703,126.10 $13,545,329.72 $14,451,531.98 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% $125,743,509.33 $162,274,653.00 $190,685,810.67 $209,044,048.33 $226,157,019.33 $242,372,265.33 $238,176,866.00 $228,723,149.67 $235,366,880.33 $241,168,074.33 $249,314,701.67 $269,458,714.67 $279,490,093.67 $292,670,804.67 $320,495,991.33 $337,237,859.00 $357,241,944.67 $377,682,144.00 $394,953,186.33 $423,437,536.67 $451,510,990.67 $481,717,732.67 *2002(5) $6,101,226.74 3.00% $203,374,224.67 $9,813,361.72 $17,012,962.84 $17,935,355.80 $18,759,116.91 $20,129,394.51 $21,243,113.26 $22,442,475.17 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% $280,381,763.43 $486,084,652.57 $512,438,737.14 $535,974,768.86 $575,125,557.43 $606,946,093.14 $641,213,576.29 (7) *2002 2003 2004 2005 2006 2007 2008 (*) Denotes number of months of the fiscal year that sales tax was collected at the tax rate shown. 10 Figure 4. Estimated Retail Sales for Stillwater, OK, 1980-2008: Actual and Inflation-Adjusted $700,000,000.00 $600,000,000.00 $500,000,000.00 $400,000,000.00 $300,000,000.00 $200,000,000.00 $100,000,000.00 $0.00 Actual Inflation-Adjusted 11 SIC 52 Building Materials, Hardware, Garden Supply, and Mobile Home Dealers SIC 52 is a sector that is increasingly being dominated by the large home improvement stores such as Lowe’s and Home Depot. In the past, small hometown hardware stores have been a relatively stable source of sales tax revenue. Much as the “five and dime” stores of the past buckled under the competitive pressure of Wal-Mart, the hometown hardware stores are struggling to compete against the home improvement superstores. Stillwater, of course, is home to a Lowe’s, and thus reaps the benefits of this large retailer. Table 4a reports sales tax collections for the City of Stillwater for SIC 52 for fiscal years 2000 through 2008. SIC 5211, Lumber and Other Building Materials, is clearly the primary source of revenue in this sector, generally collecting over $1 million. Figure 5 shows that 5211 represents 89.3% of the total collections for the 52 group. Table 4b shows these sales tax data converted to gap coefficients. SIC 5211 is a strong sector in Stillwater, consistently drawing more than double the population of Stillwater. Hardware stores, SIC 5251, saw a dramatic increase in its gap coefficient, going from serving only 2/5 of Stillwater’s population to serving 1.54 times Stillwater’s population. Both nurseries and mobile homes dealers had gap coefficients decline, which is reflective of the declines in sales tax revenues. How can sales tax revenues increase while pull factors decline or remain steady? At least two factors can create this situation. If nothing else changed, but per capita income (PCI) for Stillwater increased, this would lower the trade area capture and thus lower the pull factor (because PCI is in the denominator of the trade area equation). Also, if nothing else changed, but Stillwater’s population increased, this would lower the pull factor (because population is in the denominator of the pull factor equation). For SIC 5211 and 5231, both factors contributed to the falling pull factors from 2004 to 2008, for example, even though sales tax collections increased. 12 The pull factor for SIC 5231, Paint, Glass and Wallpaper Stores, continues to be a very healthy number at 1.959 for FY 2008. Trade area capture calculations are based on average statewide spending patterns. When average spending patterns are considered, these Stillwater stores attracted approximately 92,026 average shoppers in FY 2008 which is 1.959 times the city’s population for that year. This explains why 5231 has such a strong gap coefficient and yet only represents 4.5% of the city’s collections in this category. Overall, the sales tax collections for SIC 52 have grown. However, population and per capita income growth outpaced sales tax revenue growth, leading to small declines in pull factors for sectors 5211 and 5231. The high growth in sales tax revenues for hardware stores exceeded these trends, leading to an increased gap coefficient. 13 Table 4a Sales Tax Collections by 4-Digit Detail for SIC 52 SIC 5211 5231 5251 5261 5271 52 Description Lumber and Other Building Materials Dealers Paint, Glass, and Wallpaper Stores Hardware Stores Retail Nurseries, Lawn and Garden Supply Mobile Home Dealers Group Total FY 2004 FY 2005 1,358,504.81 1,583,780.63 65,052.23 72,709.88 21,828.71 20,039.27 9,113.36 12,818.80 1,239.50 4,470.90 1,455,738.61 1,693,819.48 FY 2006 1,724,130.63 85,586.83 16,414.39 6,376.12 0.00 1,832,507.97 FY 2007 FY 2008 1,655,582.71 1,818,037.72 88,953.37 93,493.67 60,208.27 124,010.74 3,328.62 1,199.92 0.00 0.00 1,808,072.97 2,036,742.05 Table 4b Gap Coefficients by 4-Digit Detail for SIC 52 SIC 5211 5231 5251 5261 5271 52 Description Lumber and Other Building Materials Dealers Paint, Glass, and Wallpaper Stores Hardware Stores Retail Nurseries, Lawn and Garden Supply Mobile Home Dealers Group Total FY 2004 2.325 2.000 0.399 0.424 1.540 2.098 . 14 FY 2005 2.286 1.995 0.326 0.550 4.789 2.078 FY 2006 2.079 1.873 0.243 0.248 0.000 1.890 FY 2007 2.028 1.916 0.813 0.118 0.000 1.870 FY 2008 2.134 1.959 1.538 0.039 0.000 2.011 Figure 5. Total Sales Tax Collections for SIC Code 52, FY 2008 Paint, etc 4.6% Lawn/Garden 0.1% Hardware 6.1% Building Materials 89.3% 15 Mobile Home 0.0% SIC 53: General Merchandise Stores The 2-digit SIC Code for General Merchandise stores is dominated by Wal-Mart. With very few exceptions, towns that have a Wal-Mart store will post a pull factor that is greater than 1.0 for the General Merchandise Stores sector. All Wal-Mart stores, including Supercenters, report their sales under SIC 5311, Department Stores. This includes their sales of groceries and apparel. According to the U.S. Census Bureau, 5311 Department Stores normally having 50 employees or more and have sales of apparel and soft goods combined amounting to 20% or more of total sales. Merchandise tends to be grouped by department. Based on average statewide spending patterns, Stillwater’s sector 5311 attracted 106,495 shoppers in FY 2008. This is 2.267 times the city’s population. According to Table 5a, sales tax collections for 5311 have grown steadily for the years shown. The pull factor, however has declined since FY 2004. (See Table 5b.) As shown in Figure 6, 5311 Department Stores comprise 93.6% of the FY 2008 sales tax collection for SIC 53 for Stillwater. Other stores such as Dollar General and Family Dollar would likely report under SIC 5399, General Merchandise Stores (although this has not been confirmed), defined by the U.S. Census as stores selling commodities covered in the definition for department stores but normally having less than 50 employees. Sales in this category have steadily grown since FY 2004 as has the pull factor for this sector. Overall, SIC 53 has performed quite well for the City of Stillwater, with pull factors over 2.0 for FY 2002. These large pull factors are driven by the strong Department Stores of 5311 (Wal-Mart). 16 Table 5a Sales Tax Collections by 4-Digit Detail for SIC 53 SIC 5311 5331 5399 53 Description Department Stores Variety Stores General Merchandise Stores Group Total FY 2004 FY 2005 4,107,876.84 4,255,436.31 1,525.39 54.99 217,761.55 227,921.74 4,327,163.78 4,483,413.04 FY 2006 4,623,697.25 810.55 330,665.72 4,955,173.52 FY 2007 FY 2008 4,697,388.23 5,413,862.05 4,947.01 3,916.07 347,495.88 368,629.26 5,049,831.12 5,786,407.38 Table 5b Gap Coefficients by 4-Digit Detail for SIC 53 SIC 5311 5331 5399 53 Description Department Stores Variety Stores General Merchandise Stores Group Total FY 2004 2.424 0.057 1.061 2.246 17 FY 2005 2.227 0.002 0.959 2.061 FY 2006 2.255 0.028 1.227 2.110 FY 2007 2.084 0.170 1.118 1.947 FY 2008 2.267 0.130 1.134 2.109 Figure 6. Total Sales Tax Collections for SIC Code 53, FY 2008 General Merchandise 6.4% Variety Stores 0.1% Department Stores 93.6% 18 SIC 54: Grocery Stores The largest 4-digit category in SIC 54 is 5411, Grocery Stores. This category does not include groceries sold at Wal-Mart but would include grocery sales from most convenience stores. Figure 7 shows that revenues from 5411 account for about 94.5% of total revenues in SIC 54. Collections in 5411 declined between 2004 and 2008. (See Table 6a.) Collections for 2008 totaled nearly $1.14 million. As shown in Table 6b, the 2008 pull factor for 5411 equaled 1.044. Overall for SIC 54, the pull factor is 1.049 for 2008. People tend to appreciate the convenience of shopping for groceries close to home, so it is common to find that even very small towns will have pull factors in the 1.0 to 2.0 range for SIC 54. Given this, it may seem surprising that Stillwater’s SIC 54 pull factor is as small as it is. The explanation for this is that if the Wal-Mart Supercenter in Stillwater sells large quantities of groceries (and it does), then these sales will be reported in SIC 53, so SIC 54 is less than it ought to be. While Fruit and Vegetable Markets only represent 0.59 % of total sales tax collections, this sector has the highest pull factor among food retailers – attracting over three times Stillwater’s population. Historically, this has been a strong sector, but it was particularly strong in FY 2007 and 2008. Retail Bakeries, 5461, also has a strong pull factor—over 1.609 in 2008. Collections in this category have fluctuated, resulting in the pull factor declining to 1.609. Miscellaneous food stores show a significant decrease in collections over the last 2 years, and its pull factor fell to 0.975 in 2008. According to the Census, these are establishments primarily engaged in the retail sale of specialized foods, not elsewhere classified, such as eggs, poultry, health foods, vitamins, spices, herbs, coffee, and tea. 19 Table 6a Sales Tax Collections by 4-Digit Detail for SIC 54 SIC 5411 5421 5431 5441 5451 5461 5499 54 Description Grocery Stores Meat and Fish Markets Fruit and Vegetable Markets Candy, Nut and Confectionary Stores Dairy Product Stores Retail Bakeries Miscellaneous Food Stores Group Total FY 2004 FY 2005 1,486,043.26 1,297,120.10 1,112.93 1,339.50 4,388.02 5,343.86 5.47 619.53 137,400.75 75,425.69 24,914.70 39,295.39 72,989.99 76,513.28 1,726,855.12 1,495,657.35 FY 2006 1,218,520.04 1,357.63 4,476.75 2,717.20 2,469.04 21,718.63 80,468.01 1,331,727.30 FY 2007 FY 2008 1,194,162.14 1,141,250.95 1,375.58 1,742.08 6,707.52 5,762.94 2,833.03 4,034.01 2,256.41 2,165.65 24,391.87 26,877.47 25,604.13 25,378.53 1,257,330.68 1,207,211.63 Table 6b Gap Coefficients by 4-Digit Detail for SIC 54 SIC 5411 5421 5431 5441 5451 5461 5499 54 Description Grocery Stores Meat and Fish Markets Fruit and Vegetable Markets Candy, Nut and Confectionary Stores Dairy Product Stores Retail Bakeries Miscellaneous Food Stores Group Total FY 2004 1.502 0.186 2.417 0.001 2.850 2.283 3.826 1.599 20 FY 2005 1.300 0.269 2.744 0.144 2.548 2.610 3.575 1.392 FY 2006 1.230 0.255 2.163 0.624 1.226 1.453 3.237 1.275 FY 2007 1.170 0.225 3.252 0.618 1.173 1.545 1.044 1.169 FY 2008 1.044 0.270 3.059 0.823 1.153 1.609 0.975 1.049 Figure 7. Total Sales Tax Collections for SIC Code 54, FY 2008 Candy Stores Fruit and Vegetables 0.3% 0.5% Dairy 0.2% Bakeries 2.2% Meat and Fish 0.1% Grocery Stores 94.5% 21 Misc. Food Stores 2.1% SIC 55 Automotive Dealers and Gasoline Service Stations SIC category 55 is difficult to interpret because motor vehicle and gasoline sales are exempt from municipal sales tax in Oklahoma. Sales tax, however, is due on accessories, optional equipment, or parts, which are not attached but are sold as part of the purchase price on the sale of the motor vehicle. As for gas stations, most of them sell snack items, tires, some auto parts, oil, antifreeze, etc. and these items are subject to sales tax. If, however, over half of a station’s sales are food/convenience items, the store would be classified as a convenience store and would likely report under SIC 54. Despite these caveats, there are still several interesting things to note about Stillwater’s SIC 55. The 4-digit sector with the largest level of collections is 5531, Auto and Home Supply Stores. (See Table 7a.) According to the U.S. Census, these are establishments primarily engaged in the retail sale of auto supplies such as automotive batteries, parts, accessories; and sundry supplies such as polishes, paint, and decorative items. NAPA and O’Reilly’s would both be examples of this kind of store. In FY 2008, the 5531 stores collected over $307,000 in sales tax for a 2008 pull factor of 1.061 (See Table 7b). These stores accounted for 62.3% of total collections for 2008 in SIC 55. (See Figure 8.) SIC 5511, Motor Vehicle Dealers New and Used, are essentially what we think of as new car dealers. Again, motor vehicles are not subject to sales tax, but parts and accessories are. Given this, the 5511 dealers collected over $114,000 in sales tax in FY 2008 for a pull factor of 1.669. The 2008 values are down a bit from 2007, but are still relatively strong. One might assume that this kind of activity is indicative of these dealers’ success in their primary market of vehicle sales. Their collections comprised 23.2% of total collections in SIC 55 for 2008. An incredibly interesting 4-digit sector for Stillwater is 5571, Motorcycle Dealers. Note that sales tax collections decreased from $60,968 in 2004 to $31,050 in 2008. That is a decrease of roughly 50%! The pull factor only decreased from 3.620 to 1.923. However, in 2008, Motorcycle 22 Dealers were responsible for 6.3% of total collections in SIC 55. Obviously, there are several successful motorcycle shops in Stillwater, and, interestingly enough, the Harley Davidson dealership on South Perkins Road (which has become a destination for leisure bikers) does not contribute to this growth. That store is outside of the city limits and so does not collect city sales tax. Gas Service Stations, 5541, have seen sales tax collections and the pull factor both declined since 2004. (Keep in mind that this probably does not include most convenience stores.) This decline may be related to high gasoline prices over the last year. Used Auto Dealers (5521), Boat Dealers (5551), and Recreational Vehicle Dealers (5561) have not collected any sales tax over the last few years. Obviously there are some Used Auto Dealers in Stillwater, but apparently they do not sell the accessories and parts items that their new car counterparts do. Clearly, SIC 5599, Automotive Dealers Not Elsewhere Classified, experienced a major decline from 2004 to 2008, with pull factors going from 1.1 down to 0.023. The Census Bureau defines these as establishments primarily engaged in the retail sale of new and used automotive vehicles, utility trailers, and automotive equipment and supplies, not elsewhere classified, such as snowmobiles, dune buggies, and go-carts. Also included are establishments primarily engaged in the retail sale of aircraft. Overall, SIC 55 appears to be a relatively stable 2-digit sector, with an overall pull factor hovering around the 1.0 mark. 23 Table 7a Sales Tax Collections by 4-Digit Detail for SIC 55 SIC 5511 5521 5531 5541 5551 5561 5571 5599 55 Description Motor Vehicle Dealers (New and Used) Motor Vehicle Dealers (Used Only) Auto and Home Supply Stores Gasoline Service Stations Boat Dealers Recreational Vehicle Dealers Motorcycle Dealers Automotive Dealers Not Elsewhere Classified Group Total FY 2004 111,686.23 0.00 235,253.43 60,634.24 0.00 0.00 60,967.80 FY 2005 107,531.50 0.00 287,188.45 45,306.69 0.00 0.00 64,934.96 FY 2006 107,857.45 0.00 314,769.41 32,150.55 0.00 0.00 30,281.97 FY 2007 120,506.36 0.00 346,564.35 42,014.18 41.95 0.00 23,722.77 FY 2008 114,375.32 0.00 307,391.68 40,646.20 23.21 0.00 31,049.72 4,255.87 472,797.57 4,061.71 509,023.31 113.00 485,172.85 79.27 532,928.88 110.41 493,596.54 Table 7b Gap Coefficients by 4-Digit Detail for SIC 55 SIC 5511 5521 5531 5541 5551 5561 5571 5599 55 Description Motor Vehicle Dealers (New and Used) Motor Vehicle Dealers (Used Only) Auto and Home Supply Stores Gasoline Service Stations Boat Dealers Recreational Vehicle Dealers Motorcycle Dealers Automotive Dealers Not Elsewhere Classified Group Total FY 2004 2.168 0.000 1.140 0.928 0.000 0.000 3.620 FY 2005 1.998 0.000 1.261 0.590 0.000 0.000 3.419 FY 2006 1.808 0.000 1.246 0.360 0.000 0.000 2.120 FY 2007 1.893 0.000 1.246 0.422 0.011 0.000 1.651 FY 2008 1.669 0.000 1.061 0.338 0.005 0.000 1.923 1.100 1.343 0.891 1.301 0.024 1.124 0.017 1.130 0.023 0.965 24 Figure 8. Total Sales Tax Collections for SIC Code 55, FY 2008 Motorcycle Dealers 6.3% Automotive NEC 0.0% Boat Dealers 0.0% Gas Stations 8.2% Auto New and Used 23.2% Auto and Home Supply 62.3% 25 SIC 56 Apparel and Accessory Stores Overall, SIC 56 is one in which Stillwater does very well. Frankly, this is a category that small- to medium-sized towns have difficulty with. It is not uncommon to find that these towns have very little sales in this category and pull factors less than 0.10. Larger cities, especially those with malls, tend to perform the best in this category. Given that Stillwater does not have a mall, it posts pull factors greater than 1 in several sectors, which is a very strong showing. Family Clothing Stores, SIC 5651, are clearly important to the success of SIC 56. As shown in Figure 9, Family Clothing Stores account for about 58.3% of the sales in this 2-digit category. As shown in Table 8a, sales tax collections for 5651 have grown to over $696,000 in 2008. Table 8b shows that pull factors for 5651 have been greater than 3.0 for all years shown. Old Navy would be a good example of a Family Clothing Store. Miscellaneous Apparel Stores (5699) have shown substantial growth over the last four years with a 2008 pull factor of 9.488. According to the Census Bureau, these are establishments primarily engaged in the retail sale of specialized lines of apparel and accessories, not elsewhere classified, such as uniforms, bathing suits, raincoats, riding apparel, sports apparel, umbrellas, wigs, and toupees. This industry also includes custom tailors primarily engaged in making and selling men's and women's clothing, except fur apparel. Shoe Stores, sector 5661, collected over $152,000 in FY 2008, representing about 12.7% of total collections for SIC 56 in 2008. Pull factors for 5661 stay consistently above the 2.8 range (for the five years shown). Children’s and Infant’s Wear Stores (5641) tended to have a high pull factor (between 1.6 and 2.74), but this sector realized a significant decline in sales tax collections in 2008. Its pull factor fell to 0.509 in 2008. Women’s Accessory and Specialty Stores (5632) have grown in sales tax collections between 2004 and 2008, though the growth has been slower than population and income – causing the pull factor to decline over this period. 26 Table 8a Sales Tax Collections by 4-Digit Detail for SIC 56 SIC 5611 5621 5632 5641 5651 5661 5699 56 Description Men and Boys' Clothing and Furnishings Stores Women's Ready to Wear Stores Women's Accessory and Specialty Stores Children's and Infant Wear Stores Family Clothing Stores Shoe Stores Miscellaneous Apparel and Accessory Stores Group Total FY 2004 FY 2005 FY 2006 0.00 57,026.33 15,029.64 11,687.91 622,364.95 117,556.84 92,342.36 916,008.03 0.00 60,329.38 16,963.17 9,244.49 624,753.86 126,109.56 91,803.14 929,203.60 0.00 58,389.03 20,019.92 10,182.14 612,613.34 129,153.00 79,493.18 909,850.61 FY 2007 FY 2008 0.00 11.02 75,697.07 76,400.79 22,529.20 18,259.28 19,689.33 4,030.22 730,269.85 696,594.23 159,609.47 152,040.81 246,036.10 247,129.72 1,253,831.02 1,194,466.07 Table 8b Gap Coefficients by 4-Digit Detail for SIC 56 SIC 5611 5621 5632 5641 5651 5661 5699 56 Description Men and Boys' Clothing and Furnishings Stores Women's Ready to Wear Stores Women's Accessory and Specialty Stores Children's and Infant Wear Stores Family Clothing Stores Shoe Stores Miscellaneous Apparel and Accessory Stores Group Total FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 0.000 1.054 1.911 2.742 4.099 3.076 6.543 3.277 0.000 0.959 1.777 1.883 3.710 3.146 5.211 2.959 0.000 1.030 1.133 1.622 3.218 2.865 3.411 2.590 0.000 1.320 1.093 2.660 3.505 3.198 10.359 3.293 0.001 1.306 0.842 0.509 3.282 2.860 9.488 3.038 27 Figure 9. Total Sales Tax Collections for SIC Code 56, FY 2008 Men's 0.0% Misc Apparel 20.7% Women's 6.4% Women's Accessory 1.5% Children 0.3% Shoe Stores 12.7% Family Clothing 58.3% 28 SIC 57: Furniture, Home Furnishings and Equipment Stores SIC 57 has realized modest and consistent growth over the last five years. While the largest category in SIC 57 is 5712, Furniture Stores, with 28.8% of the sales tax collections in SIC 57 (Figure 10), sector 5735, Record and Pre-recorded Tape Stores, had the highest pull factor of 2.92. Furniture Stores collected over $263,000 in FY 2008 (Table 9a) and posted a pull factor of 1.40. (See Table 9b). Other strong 4-digit sectors of note in SIC 57 include Musical Instrument Stores, 5736, which posted a pull factor of 1.574 in 2008. Also, Floor Covering Stores, 5713, posted a pull factor of 1.131 for 2008. SIC 5731, Radio, Television, and Consumer Electronics Stores, is the third largest sector in this group by volume of sales tax collections. Sales tax collections in 5731 are nearly $189,000 in 2008 and account for 20.6% of collections in SIC 57. The pull factor for 5731, however, is a surprising low 0.82 for 2008. The highest pull factor shown for 5731 was in 2007 at 0.88. Stillwater appears to have retail leakage in the market for consumer electronics. One might speculate that large stores such as Best Buy and Ultimate Electronics (located primarily in Oklahoma City and Tulsa) are pulling customers from Stillwater. 29 SIC 5712 5713 5714 5719 5722 5731 5734 5735 5736 57 SIC 5712 5713 5714 5719 5722 5731 5734 5735 5736 57 Table 9a Sales Tax Collections by 4-Digit Detail for SIC 57 Description FY 2004 FY 2005 FY 2006 Furniture Stores 192,800.22 229,839.57 248,287.78 Floor Covering Stores 52,606.95 57,523.03 45,206.83 Drapery, Curtain and Upholstery Stores 476.57 523.93 344.14 Misc. Home Furnishings Stores 11,886.46 8,527.01 12,819.90 Household Appliance Stores 47,588.03 49,785.91 62,990.05 Radio, Television and Consumer Electronics 99,570.06 98,468.69 146,907.52 Computer and Computer Software Stores 73,483.36 101,195.39 99,340.24 Record and Prerecorded Tape Stores 200,113.33 194,526.68 215,649.48 Musical Instrument Stores 12,703.81 15,989.62 17,751.15 Group Total 691,228.79 756,379.83 849,297.09 Table 9b Gap Coefficients by 4-Digit Detail for SIC 57 Description FY 2004 FY 2005 FY 2006 Furniture Stores 1.351 1.464 1.413 Floor Covering Stores 1.038 1.026 0.727 Drapery, Curtain and Upholstery Stores 0.150 0.149 0.087 Misc. Home Furnishings Stores 0.536 0.356 0.434 Household Appliance Stores 0.615 0.690 0.688 Radio, Television and Consumer Electronics 0.698 0.639 0.801 Computer and Computer Software Stores 0.775 1.106 0.960 Record and Prerecorded Tape Stores 8.946 8.557 9.167 Musical Instrument Stores 1.540 1.608 1.560 Group Total 1.225 1.280 1.240 30 FY 2007 249,500.85 42,386.65 2,275.71 14,044.11 62,062.68 FY 2008 263,065.64 75,435.09 409.56 14,943.74 61,868.49 181,619.31 72,539.29 214,786.47 17,524.32 856,739.39 188,708.86 86,886.14 205,188.12 18,454.03 914,959.67 FY 2007 1.345 0.652 0.540 0.426 0.591 FY 2008 1.400 1.131 0.105 0.428 0.574 0.880 0.639 8.425 1.485 1.143 0.820 0.750 7.820 1.574 1.165 Figure 10. Total Sales Tax Collections for SIC Code 57, FY 2008 Computers 9.5% Consumer Electronics 20.6% Household Appliances 6.8% Record Stores 22.4% Misc. Home Furnishings 1.6% Drapery 0.0% Floor Covering 8.2% Furniture 28.8% 31 Musical Instruments 2.0% SIC 58 Eating and Drinking Places SIC 58 is a straightforward sector. It contains only two 4-digit sectors: 5812, Eating Places and 5813, Drinking Places. For FY 2004, 89.2% of total sales tax collections for SIC 58 are attributed to 5812, Eating Places (Figure 11). These restaurants collected nearly $2.8 million in sales taxes in FY 2008. Bars collected about $335,000. (See Table 10a.) Overall, SIC 58 reports strong and steady pull factors for the five years shown, 1.988 for 2008. The restaurants’ pull factor for 2008 equals a healthy 1.863, while the bars’ have a 2008 pull factor that is very high at 4.452. (See Table 10b.) One might speculate that the large student population influences the pull factor for 5813. 32 Table 10a Sales Tax Collections by 4-Digit Detail for SIC 58 SIC 5812 5813 58 Description Eating Places Drinking Places Group Total FY 2004 FY 2005 1,794,734.41 2,078,685.82 334,111.43 312,288.28 2,128,845.84 2,390,974.10 FY 2006 2,488,937.85 301,277.56 2,790,215.41 FY 2007 FY 2008 2,600,213.71 2,769,659.54 344,169.05 335,221.95 2,944,382.76 3,104,881.49 Table 10b Gap Coefficients by 4-Digit Detail for SIC 58 SIC 5812 5813 58 Description Eating Places Drinking Places Group Total FY 2004 1.894 5.605 2.114 33 FY 2005 1.869 4.800 2.031 FY 2006 1.949 4.462 2.076 FY 2007 1.900 4.723 2.043 FY 2008 1.863 4.452 1.988 Figure 11. Total Sales Tax Collections for SIC Code 58, FY 2008 Drinking Places 10.8% Eating Places 89.2% 34 SIC 59: Miscellaneous Retail SIC 59 has the most sub-sectors of the retail sectors. SIC 59 collected total sales tax of over $2.2 million in 2008 (Table 11a) and posted a pull factor of 2.044 (Table 11b). The types of businesses that are a part of SIC 59 are quite often those that are located in the downtown business district of a community. It includes Drug Stores, Antique Stores, Jewelry Stores, Florists, and Gift Shops. Many times, these are the businesses that struggle to compete with the retail superstores. Not many communities in Oklahoma can boast of a pull factor of over 1.9 in SIC 59. For Stillwater, the largest collector of sales tax in SIC 59 is 5942, Book Stores, which collected more than $526,000 of taxes in 2008. The 2008 pull factor for Book Stores is 8.537. This is unusually high, but certainly reflects the fact that university students purchase their textbooks in Stillwater every semester (at least for the most part). Collections from the Book Stores account for 23.7% of total collections for SIC 59. Miscellaneous Retail Stores, 5999, are the second largest collectors of sales tax for SIC 59, collecting over $400,000 of taxes in 2008, but it posted a pull factor of only 1.683. This sector includes such stores as art galleries, sign shops, cosmetic stores, hearing aid dealers, pet food and pet shops. Several other 4-digit sectors posted pull factors greater than 1.0 for 2004, including Drug and Proprietary Stores, Liquor Stores, Used Merchandise Stores, Jewelry Stores, Hobby, Toy and Game Shops, Florists, Optical Goods Stores, and Miscellaneous Retail Stores Not Elsewhere Classified. Two other sectors stand out for their high pull factors. Direct Selling Establishments posted a pull factor of 2.032. The Census defines these as establishments primarily engaged in selling merchandise by house-to-house canvass, by party plan, by telephone, or from trucks or wagons or other temporary locations. Schwann Foods and Avon are examples of a direct selling establishments. News Dealers and News Stands posted a pull factor of 4.72. The Census defines 35 these as establishments primarily engaged in the retail sale of newspapers, magazines, and other periodicals. 36 SIC 5912 5921 5932 5941 5942 5943 5944 5945 5946 5947 5948 5949 5961 5962 5963 5983 5984 5989 5992 5993 5994 5995 5999 59 Table 11a Sales Tax Collections by 4-Digit Detail for SIC 59 Description FY 2004 FY 2005 FY 2006 Drug Stores and Proprietary Stores 201,570.14 215,009.97 226,699.77 Liquor Stores 115,917.50 172,411.55 232,717.87 Used Merchandise Stores 71,496.66 72,724.93 73,076.57 Sporting Goods Stores and Bicycle Shops 65,899.93 84,559.63 101,259.25 Book Stores 462,958.36 480,591.03 516,522.98 Stationary Stores 249,934.98 261,974.54 277,201.26 Jewelry Stores 87,532.10 78,179.86 77,105.82 Hobby, Toy, and Game Shops 121,818.32 147,655.26 141,181.13 Camera and Photographic Supply Stores 49.52 499.47 7,282.35 Gift, Novelty and Souvenir Shops 39,873.79 43,291.82 42,847.81 Luggage and Leather Goods Stores 133.56 160.88 86.00 Sewing, Needlework and Piece Good Stores 2,192.14 6,363.24 6,191.31 Mail Order Houses 404.90 409.93 797.26 Automatic Merchandising Machine Operators 138.34 418.39 163.84 Direct Selling Establishments 36,294.27 40,229.73 35,725.50 Fuel Oil Dealers 0.00 0.00 0.00 Liquefied Petroleum Gas (Bottled Gas) Dealers 6,394.17 7,343.59 4,064.10 Fuel Dealers, NEC 0.00 0.00 0.00 Florists 51,820.17 38,655.66 34,943.68 Tobacco Stores and Stands 20,579.12 13,391.64 0.00 News Dealers and News Stands 6,524.42 5,904.05 5,955.90 Optical Goods Stores 14,687.60 16,493.69 19,198.54 Miscellaneous Retail Stores, NEC 192,686.52 160,897.53 74,892.84 Group Total 1,748,906.51 1,847,166.39 1,877,913.78 37 FY 2007 231,877.33 198,777.41 79,995.63 93,360.57 508,501.10 283,607.11 73,802.21 142,039.86 -2,767.36 45,886.89 79.46 3,976.54 616.84 FY 2008 234,806.56 209,044.65 97,129.85 100,278.78 526,803.97 269,047.53 73,032.63 140,892.06 172.49 50,647.96 92.90 3,601.93 236.11 561.82 36,621.24 0.00 752.76 33,282.04 0.00 4,813.03 5,585.22 0.00 0.00 32,359.69 47,215.66 0.00 34.58 5,975.10 6,270.75 20,650.46 23,014.05 338,326.79 403,723.39 2,099,061.72 2,225,665.87 SIC 5912 5921 5932 5941 5942 5943 5944 5945 5946 5947 5948 5949 5961 5962 5963 5983 5984 5989 5992 5993 5994 5995 5999 59 Table 11b Gap Coefficients by 4-Digit Detail for SIC 59 Description FY 2004 FY 2005 FY 2006 Drug Stores and Proprietary Stores 1.781 1.759 1.664 Liquor Stores 1.745 2.205 2.591 Used Merchandise Stores 1.450 1.356 1.261 Sporting Goods Stores and Bicycle Shops 0.999 1.102 1.090 Book Stores 8.746 7.799 8.518 Stationary Stores 4.807 4.318 4.053 Jewelry Stores 1.810 1.441 1.316 Hobby, Toy, and Game Shops 3.604 4.401 3.763 Camera and Photographic Supply Stores 0.011 0.120 1.653 Gift, Novelty and Souvenir Shops 0.920 0.903 0.927 Luggage and Leather Goods Stores 0.050 0.060 0.024 Sewing, Needlework and Piece Good Stores 0.151 0.424 0.384 Mail Order Houses 0.197 0.193 0.235 Automatic Merchandising Machine Operators 0.047 0.140 0.070 Direct Selling Establishments 3.247 2.984 2.376 Fuel Oil Dealers 0.000 0.000 0.000 Liquefied Petroleum Gas (Bottled Gas) Dealers 1.038 0.965 0.438 Fuel Dealers, NEC 0.000 0.000 0.000 Florists 1.951 1.124 1.274 Tobacco Stores and Stands 2.263 2.143 0.000 News Dealers and News Stands 7.120 6.660 5.003 Optical Goods Stores 1.030 1.122 1.118 Miscellaneous Retail Stores, NEC 1.415 1.172 0.321 Group Total 2.312 2.222 1.909 38 FY 2007 1.546 1.940 1.364 0.856 8.243 3.735 1.172 3.447 -0.626 0.917 0.017 0.244 0.202 FY 2008 1.415 1.958 1.642 0.894 8.537 3.617 1.189 3.264 0.041 0.936 0.018 0.230 0.240 0.194 2.165 0.000 0.232 2.032 0.000 0.516 0.000 1.131 0.000 4.725 1.211 1.708 2.063 0.510 0.000 1.640 0.019 4.720 1.294 1.683 2.044 Figure 12. Total Sales Tax Collections for SIC Code 59, FY 2008 Florists Newsstands Optical Goods Liquified Petroleum 0.3% 1.0% 2.1% 0.3% Direct Tobacco Mail Order Houses Selling 0.0% 0.0% 1.5% Mis. Retail Stores NEC 18.1% Sewing/Needlework 0.2% Luggage Stores 0.0% Gift Shops 2.3% Camera/Photography Stores 0.0% Drug Stores 10.6% Hobby/Toy Shops 6.3% Liquor Stores 9.4% Jewelry Stores 3.3% Stationary Stores 12.1% Book Stores 23.7% Used Merchandise 4.4% Sporting Goods/Bicycle Shops 4.5% 39 Additional Remarks In general, the City of Stillwater has a very strong retail market, with an overall market pull factor of about 1.65. Obviously, some types of businesses do better than others, and there is always some room for improvement. Furthermore, no city or town can reasonably expect to curtail all retail leakages. Shoppers are constantly drawn to larger markets. Even so, the Stillwater market has a wide range of successful retail establishments from restaurants to hobby shops to family clothing stores. Some of the strongest 4-digit sectors for Stillwater for 2008, in terms of high gap coefficients, include: 5699 Misc. Apparel and Accessory Stores: current PF = 9.488 5942 Book Stores: current PF = 8.537 5735 Record and Prerecorded Tape Stores: current PF = 7.820 5994 News Dealers and News Stands: current PF = 4.720 5813 Drinking Places: current PF = 4.452 Sectors for which retail leakages from Stillwater occurred include: 5714 Drapery, Curtain and Upholstery Stores: current PF = 0.105 5311 Variety Stores: current PF = 0.130 5949 Sewing, Needlework, and Piece Good Stores PF = 0.230 5421 Meat and Fish Markets: current PF = 0.270 5719 Misc. Home Furnishings Stores: current PF = 0.428 40 REFERENCES Barta, S.D. and M.D. Woods. Gap Analysis as a Tool for Community Economic Development. WF 917, Oklahoma Cooperative Extension Service, Oklahoma State University, <http://agweb.okstate.edu/pearl/agecon/resource/wf-917.pdf>, 2000. Hustedde, R., R. Shatter, and G. Pulver, Community Economic Analysis: A How To Manual. Ames, Iowa. North Central Regional Center for Rural Development, 1984. Oklahoma Department of Commerce. “2007 Oklahoma Population Estimates by Place by County.” Released July 10, 2008. http://staging.okcommerce.gov/test1/dmdocuments/2007_Oklahoma_Population_Estimat es_by_Place_by_County_1407082493.xls; downloaded 9/10/08, 3:45pm Oklahoma Tax Commission City Sales Tax Collections By SIC Code Returned to Cities and Towns in Fiscal Year, 2000 to 2008. (Fiscal Year End-June 30) Stone, K. and J.C. McConnon, Jr. "Trade Area Analysis Extension Program: A Catalyst for Community Development," Proceedings of Realizing Your Potential as an Agricultural Economist in Extension. Ithaca, New York, August 1984. United States Department of Commerce, Bureau of Economic Analysis. "Personal Income by Major Source and Earnings by Major Industry," Regional Economic Information System, 1969-2006. Version 4.0.4 Woods, Mike D. Retail Sales Analysis in Oklahoma By County, 1977, 1982, 1987. Bulletin B801, Agricultural Experiment Station, Oklahoma State University, October 1991. 41