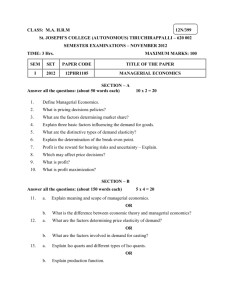

EC611--(Ch 10) Pricing Practices

advertisement

Special Pricing Practices EC611--Managerial Economics Dr. Savvas C Savvides, European University Cyprus Price Leadership It may be hidden (covert) or implicit Collusion Price leader may be: Largest, dominant, or lowest-cost producing firm in the industry Leader’s demand curve is the total market demand less the supply of the followers The followers take the price set by the leader as given and act as perfect competitors They are price takers and face a horizontal demand curve at the rice set by leader Managerial Economics DR. SAVVAS C SAVVIDES 1 Price Leadership Price MCL ΣMCF 3.00 2.50 2.00 DT 1.50 DL 1.25 MRL 1.00 50 Managerial Economics 100 DR. SAVVAS C SAVVIDES 150 Q 2 Price Discrimination Charging different prices for a product when the price differences are not justified by cost differences. Objective of the firm is to attain higher profits than would be available otherwise. Î Price discrimination is different from Price differentiation Managerial Economics DR. SAVVAS C SAVVIDES 3 Price Discrimination Conditions for Price Discrimination: 1. 2. 3. Firm must be an imperfect competitor (a price maker) Price elasticity must differ for units of the product sold at different prices Firm must be able to segment the market and prevent resale of units across market segments Managerial Economics DR. SAVVAS C SAVVIDES 4 3rd-Degree Price Discrimination Charging different prices for the same product sold in different markets Firm maximizes profits by selling a quantity on each market such that the marginal revenue on each market is equal to the marginal cost of production Managerial Economics DR. SAVVAS C SAVVIDES 5 Discriminating Oligopoly Suppose an oligopolist supplies two separate groups of customers with differing elasticities of demand Î e.g. business travellers may be less sensitive to air fare levels than tourists The oligopolist may increase profits by charging higher prices to the businessmen than to tourists. Discrimination is more likely to be possible for goods that cannot be resold Î e.g. services consumed “on the spot” Managerial Economics DR. SAVVAS C SAVVIDES 6 Examples of Price Discrimination The charging of different rates / prices by: telephone companies during “peak” vs. “off-peak” periods (such as at night or on week-ends) electricity companies to commercial users compared with residential users doctors to poor than to rich people movie theatres for evening than for matinees (morning) shows bus and train companies for the elderly, students, soldiers, etc hotels for tourists than for locals or for conventions and groups than for individuals Managerial Economics DR. SAVVAS C SAVVIDES 7 3rd-Degree Price Discrimination Q1 = 120 - 10 P1 Q2 = 120 - 20 P2 or Î P1 = 12 - 0.1 Q1 or Î P2 = 6 - 0.05 Q2 TR1 = 12 Q1 - 0.1 Q21 TR2 = 12Q - 0.1 Q22 ÎMR1 = 12 - 0.2 Q1 ÎMR2 = 6 - 0.1 Q2 MR1 = MC = 2 MR2 = MC = 2 MR1 = 12 - 0.2 Q1 = 2 MR2 = 6 - 0.1 Q2 = 2 Q1 = 50 Q2 = 40 P1 = 12 - 0.1 (50) = $7 Managerial Economics P2 = 6 - 0.05 (40) = $4 DR. SAVVAS C SAVVIDES 8 3rd-Degree Price Discrimination Managerial Economics DR. SAVVAS C SAVVIDES 9 International Price Discrimination Persistent Dumping Predatory Dumping Temporary sale at or below cost Designed to bankrupt competitors Trade restrictions apply Sporadic Dumping Occasional sale of surplus output Managerial Economics DR. SAVVAS C SAVVIDES 10 Transfer Pricing Pricing of intermediate products sold by one division of a firm and purchased by another division of the same firm Made necessary by decentralization and the creation of semiautonomous profit centers within firms Managerial Economics DR. SAVVAS C SAVVIDES 11 Transfer Pricing No External Market Transfer Price = Pt MC of Intermediate Good = MCp Pt = MCp Managerial Economics DR. SAVVAS C SAVVIDES 12 Transfer Pricing Competitive External Market Transfer Price = Pt MC of Intermediate Good = MC’p Pt = MC’p Managerial Economics DR. SAVVAS C SAVVIDES 13 Transfer Pricing Imperfectly Competitive External Market Transfer Price = Pt = $4 Managerial Economics External Market Price = Pe = $6 DR. SAVVAS C SAVVIDES 14 Pricing in Practice Cost-Plus Pricing Markup or Full-Cost Pricing Fully Allocated Average Cost (C) Average variable cost at normal output Allocated overhead Markup on Cost (m) = (P - C)/C Price = P = C (1 + m) Managerial Economics DR. SAVVAS C SAVVIDES 15 Pricing in Practice Optimal Markup ⎛ 1 ⎞ MR = P ⎜1 + ⎟ E ⎝ P ⎠ ⎛ EP ⎞ P = MR ⎜ ⎜ E + 1 ⎟⎟ ⎝ p ⎠ MR = C ⎛ EP ⎞ P =C⎜ ⎜ E + 1 ⎟⎟ ⎝ p ⎠ Managerial Economics DR. SAVVAS C SAVVIDES 16 Pricing in Practice Optimal Markup ⎛ EP ⎞ P =C⎜ ⎜ E + 1 ⎟⎟ ⎝ p ⎠ P = C (1 + m) ⎛ EP ⎞ C (1 + m) = C ⎜ ⎜ E + 1 ⎟⎟ ⎝ p ⎠ EP −1 m= EP + 1 Managerial Economics DR. SAVVAS C SAVVIDES 17 Pricing in Practice Two-Part Tariff: Consumers pay an initial fee for the right to purchase/use a product/service, plus a usage fee for each unit of consumption Tying: Buying a product also requires the purchase of another necessary for using the first Bundling: A form of tying requiring customers buying one product to also buy a second one Skimming: the setting of a high price when a product is introduced and gradually lowering it. Managerial Economics DR. SAVVAS C SAVVIDES 18 Uses of Break-Even Analysis BE analysis can help in the following business situations / decisions: New Product development: BE can determine the level of Q for the firm to achieve profitability Expansion of Operations: Increasing sales would also increase the level of FC and VC Modernization and Automation Projects: Fixed investments increase in order to lower VC (especially labor) BE analysis can help Managerial Economics DR. SAVVAS C SAVVIDES 19