2014 Texas Trends® Hotel Industry Report

advertisement

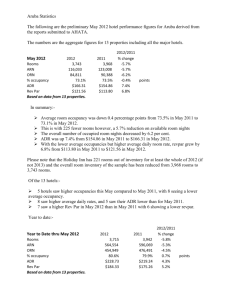

2014 Texas Trends® Hotel Industry Report San Antonio Hotel & Lodging Association November 13, 2014 Presentation Outline I. The Economy II. Lodging Forecasts – U.S. III. Lodging Forecasts - Texas IV. San Antonio Submarkets V. Hotel Market Cycle United States: Economic Outlook Employment Personal Income GDP CPI (Inflation) 2013 1.7% 1.7% 1.9% 1.5% 2014 1.8% 2.4% 1.7% 1.9% 2015 2.3% 4.3% 3.7% 2.2% 2016 2.4% 4.7% 3.3% 2.5% 2017 1.6% 3.5% 2.9% 2.9% 2018 0.6% 2.2% 2.2% 2.8% Source: Moody’s Analytics, July 2014 San Antonio: Economic Outlook Employment Personal Income GMP CPI (Inflation) 2013 2.7% 2.4% 3.2% 1.6% 2014 2.9% 4.0% 2.0% 2.2% 2015 3.8% 6.1% 4.0% 2.5% 2016 3.7% 5.7% 4.2% 2.8% 2017 2.9% 4.3% 3.8% 3.1% 2018 1.9% 3.1% 3.2% 3.1% Source: Moody’s Analytics, July 2014 Unemployment Comparison* June 2013 June 2014 United States 7.5% 6.3% Texas 6.9% 5.5% Austin 5.7% 4.4% Dallas/Fort Worth 6.7% 5.4% Houston 6.7% 5.4% San Antonio 6.6% 5.1% * Not seasonally adjusted Source: Texas Work Force Commission What Could Derail the Economy? • Unpredictable World Event • Price of Oil & Gas • International Crises Presentation Outline I. The Economy II. Lodging Forecast – U.S. III. Lodging Forecast - Texas IV. San Antonio Submarkets V. Hotel Market Cycle Hotel Horizons® • Econometric Forecasting Model − Smith Travel Research – historical lodging data, pipeline data − Moody’s Economy.com – economic forecasts • Five-Year Forecasts of Supply, Demand, Occupancy, ADR, RevPAR − 55 Major U.S. Markets • Updated Quarterly United States: 2nd Quarter 2014 = Below/Above Long Run Average Long Term Average 2010 2011 2012 2013 2014F 2015F 2016F 2017F 2018F Supply 1.9% 1.7% 0.5% 0.4% 0.7% 0.9% 1.3% 1.7% 2.1% 2.4% Demand 1.9% 7.2% 4.7% 2.8% 2.2% 4.5% 2.2% 1.6% 1.1% 0.4% 61.9% 57.5% 59.9% 61.3% 62.2% 64.4% 65.0% 64.9% 64.3% 63.0% ADR 3.0% 0.0% 3.8% 4.2% 3.9% 4.5% 5.7% 5.9% 5.4% 4.1% RevPAR 3.0% 5.4% 8.1% 6.6% 5.4% 8.2% 6.7% 5.8% 4.3% 2.1% Occupancy Source: PKF Hospitality Research – Hotel Horizons® Report, Smith Travel Research 2015 US Hotel Industry Achievements • Six consecutive years of increasing occupancy, the longest since 1988. • An occupancy level of 65%, the highest level of occupancy ever recorded by STR, Inc. • 14 of the 55 markets in the Hotel Horizons® universe will achieve their highest occupancy levels in the past 25 years. • 49 of 55 markets are above their long run average occupancy level. 10.0% 8.0% -2.0% -4.0% Austin Pittsburgh New York West Palm Beach Miami Raleigh-Durham Houston Cincinnati Nashville Boston Columbus Louisville San Jose-Santa Cruz Salt Lake City Charleston Chicago New Orleans Cleveland Denver Savannah Baltimore Washington DC Anaheim Fort Lauderdale Seattle Dallas San Diego Indianapolis Orlando Richmond Portland Memphis Jacksonville Charlotte Los Angeles San Antonio Saint Louis Atlanta Albuquerque Minneapolis Hartford Philadelphia Phoenix Detroit Tampa Kansas City Newark Fort Worth San Francisco Oahu Norfolk-VA Beach Tucson Sacramento Oakland Long Island Net Supply Change 2009 vs. 2015 United States 48,000 New Rooms in 2014 65,000 New Rooms in 2015 130,800 New Rooms in 2009 6.0% 4.0% 2.0% 0.0% 2015 2009 Source: PKF-HR Hotel Horizons® September-November 2014 Edition, STR, Inc.. Presentation Outline I. The Economy II. Lodging Forecast – U.S. III. Lodging Forecast – Texas IV. San Antonio Submarkets V. Hotel Market Cycle Texas Summary Occupancy 54.6% $91.79 56.5% $89.72 60.4% $92.06 63.4% $94.38 66.0% $99.63 ADR RevPAR $50.09 237,491 2009 $50.70 $55.60 $59.81 $65.76 247,971 251,917 254,933 257,555 2010 2011 2012 2013 Supply 68.0% $105.00 $71.36 261,111 2014F 68.5% $110.00 $75.50 267,248 2015F Austin: 2nd Quarter 2014 = Below/Above Long Run Average Long Term Average 2010 2011 2012 2013 2014F 2015F 2016F 2017F 2018F Supply 3.3% 4.8% 2.4% 0.7% 2.8% 2.4% 6.0% 3.1% 2.1% 2.4% Demand 4.3% 10.3% 6.8% 3.1% 7.7% 3.4% 5.3% 2.0% 1.5% 1.0% 66.2% 63.7% 66.5% 68.0% 71.3% 72.0% 71.5% 70.8% 70.3% 69.4% ADR 4.0% -2.6% 5.9% 7.9% 5.5% 6.9% 4.7% 1.7% 1.6% 2.0% RevPAR 5.3% 2.6% 10.5% 10.4% 10.5% 7.9% 4.1% 0.7% 0.9% 0.6% Occupancy Source: PKF Hospitality Research – Hotel Horizons® Report, Smith Travel Research Dallas: 2nd Quarter 2014 = Below/Above Long Run Average Long Term Average 2010 2011 2012 2013 2014F 2015F 2016F 2017F 2018F Supply 2.5% 2.7% 0.8% 1.4% 0.3% 0.6% 1.7% 1.9% 2.8% 3.4% Demand 3.4% 9.5% 9.1% 4.8% 5.7% 5.4% 3.3% 3.2% 2.9% 2.5% 60.7% 54.5% 59.0% 61.0% 64.2% 67.3% 68.3% 69.2% 69.2% 68.6% ADR 2.1% -2.6% 3.4% 1.1% 5.1% 5.0% 6.5% 5.4% 4.0% 3.2% RevPAR 3.1% 3.9% 11.9% 4.4% 10.7% 10.0% 8.2% 6.8% 4.1% 2.3% Occupancy Source: PKF Hospitality Research – Hotel Horizons® Report, Smith Travel Research Fort Worth: 2nd Quarter 2014 = Below/Above Long Run Average Long Term Average 2010 2011 2012 2013 2014F 2015F 2016F 2017F 2018F Supply 3.1% 3.7% 1.3% 1.2% 0.5% 1.5% 0.3% 2.1% 3.8% 4.4% Demand 3.5% 7.7% 7.1% 3.0% 3.9% 3.7% 3.3% 2.7% 2.8% 2.7% 60.9% 56.1% 59.3% 60.3% 62.3% 63.7% 65.5% 66.0% 65.3% 64.3% ADR 3.2% -0.9% 1.1% -1.4% 1.5% 4.3% 4.4% 3.8% 3.8% 3.3% RevPAR 3.8% 2.8% 6.9% 0.3% 4.9% 6.6% 7.5% 4.5% 2.8% 1.6% Occupancy Source: PKF Hospitality Research – Hotel Horizons® Report, Smith Travel Research Houston: 2nd Quarter 2014 = Below/Above Long Run Average Long Term Average 2010 2011 2012 2013 2014F 2015F 2016F 2017F 2018F Supply 2.5% 6.1% 1.8% 0.9% 0.6% 1.5% 3.0% 2.8% 2.5% 1.8% Demand 3.9% 5.4% 10.6% 10.4% 6.2% 4.1% 2.2% 2.0% 1.5% 1.1% 61.8% 55.0% 59.7% 65.4% 69.1% 70.8% 70.3% 69.8% 69.1% 68.6% ADR 3.0% -4.0% 2.6% 3.7% 7.8% 7.0% 4.1% 1.4% 1.6% 1.9% RevPAR 4.6% -4.6% 11.5% 13.6% 13.8% 9.7% 3.3% 0.7% 0.6% 1.1% Occupancy Source: PKF Hospitality Research – Hotel Horizons® Report, Smith Travel Research San Antonio – Local Demand Factors • Economy • Auto Industry - Employment – Up 1 pt. to 3.8% - Tundra – Near Capacity - Unemployment – 4.8% - Toyota – Add New Line - Military Payrolls – Up 2.4% - Toyotetsu & Arvin Sango - House Sales/Pricing - Rising • Eagle Ford Shale - Calumet Specialty Products - Tex-Star Midstream Logistics • Healthcare Industry - Continued Expansion - UTSA Faculty Additions • Caterpillar – New Orders Up • Tobin Center - Open • Convention Activity - 2015 – Transition Year - 2016 – Renovation Complete • 300th Anniversary – 2018 • Per Diem Rate Up $5 to $115 San Antonio – Long-Term Average Year Average Occupancy % 1988 - 1995 69.0% 1996 - 2013 63.2% Total (1988 - 2013) 65.0% Source: PKF Consulting USA San Antonio: 2nd Quarter 2014 = Below/Above Long Run Average Long Term Average 2010 2011 2012 2013 2014F 2015F 2016F 2017F 2018F Supply 3.4% 8.5% 2.5% 1.6% 0.5% 1.4% 1.1% 1.2% 2.4% 3.3% Demand 3.6% 12.4% 7.1% 5.5% -0.1% . 2.9% 2.8% 2.8% 2.5% 3.0% 65.0% 58.2% 60.8% 63.2% 62.8% 63.8% 64.8% 65.8% 65.9% 65.7% ADR 3.0% 0.3% 0.1% 1.3% 4.8% 1.9% 3.9% 3.4% 3.0% 3.0% RevPAR 3.4% 4.0% 4.6% 5.2% 4.2% 3.5% 5.6% 5.0% 3.2% 2.7% Occupancy Source: PKF Hospitality Research – Hotel Horizons® Report, Smith Travel Research San Antonio: Upper-Priced = Below/Above Long Run Average Long Term Average 2010 2011 2012 2013 2014F 2015F 2016F 2017F 2018F Supply 4.1% 13.4% 3.3% 2.1% 0.2% 0.7% 1.1% 1.3% 2.0% 2.5% Demand 4.6% 16.2% 7.4% 4.8% 0.4% 2.4% 2.5% 2.5% 2.5% 3.0% 70.3% 64.3% 66.9% 68.6% 68.8% 69.9% 70.9% 71.8% 72.1% 72.5% ADR 2.8% -0.2% -0.5% 0.6% 6.0% 2.4% 4.0% 3.5% 3.0% 3.0% RevPAR 3.4% 2.3% 3.4% 3.2% 6.2% 4.1% 5.5% 4.7% 3.6% 3.5% Occupancy Source: PKF Hospitality Research – Hotel Horizons® Report, Smith Travel Research San Antonio: Lower-Priced = Below/Above Long Run Average Long Term Average 2010 2011 2012 2013 2014F 2015F 2016F 2017F 2018F Supply 3.0% 5.5% 2.0% 1.2% 0.7% 1.8% 1.2% 1.2% 2.6% 3.9% Demand 3.1% 9.6% 6.9% 6.0% -0.5% 3.3% 3.0% 3.0% 2.5% 3.0% 61.8% 54.2% 56.9% 59.6% 58.8% 59.7% 60.8% 61.8% 61.8% 61.3% ADR 2.8% -1.2% 0.9% 2.8% 2.8% 1.6% 4.0% 3.5% 3.0% 3.0% RevPAR 3.1% 2.7% 5.7% 7.7% 1.5% 3.1% 5.8% 5.3% 2.9% 2.2% Occupancy Source: PKF Hospitality Research – Hotel Horizons® Report, Smith Travel Research Presentation Outline I. The Economy II. Lodging Forecast – U.S. III. Lodging Forecast - Texas IV. San Antonio Submarkets V. Hotel Market Cycle San Antonio Summary Occupancy 56.2% $95.51 58.2% $95.82 60.8% $95.92 63.2% $97.15 62.8% 64.0% 65.0% $101.84 $104.00 $108.00 $63.91 $66.29 ADR RevPAR $53.69 38,567 2009 $55.79 40,641 2010 $58.28 41,665 2011 $61.37 42,378 2012 Supply 42,546 2013 43,025 2014F $69.70 43,504 2015F San Antonio CBD Occupancy 62.3% $127.95 64.6% $127.59 66.6% $122.79 68.7% $123.43 67.4% $132.48 68.5% $136.00 69.0% $142.00 ADR RevPAR $79.71 12,746 2009 $82.42 13,118 2010 $81.78 13,592 2011 $84.80 13,797 2012 Supply $89.29 13,806 2013 $93.16 14,060 2014F $97.98 14,060 2015F North San Antonio / Airport Occupancy 60.9% $79.07 64.3% $76.09 64.3% $75.39 66.5% $77.57 67.1% $79.00 ADR RevPAR $48.15 7,098 2009 $48.93 7,023 2010 $48.48 7,302 2011 $51.58 7,377 2012 Supply $53.01 7,363 2013 69.0% $80.00 $55.20 7,363 2014F 71.0% $84.00 $59.64 7,363 2015F Northeast San Antonio Occupancy 47.2% $62.63 47.3% $63.76 50.9% $67.50 54.0% 52.4% 52.5% $69.98 $71.47 $72.00 $37.79 $37.45 $37.80 7,610 7,728 53.5% $75.00 ADR RevPAR $29.56 6,760 2009 $30.16 7,360 2010 $34.36 7,485 2011 7,555 2012 Supply 2013 2014F $40.13 7,867 2015F Northwest San Antonio Occupancy 53.8% $87.55 56.1% $92.20 59.4% $97.25 61.0% $98.83 ADR RevPAR $47.10 9,073 2009 $51.72 10,154 2010 $57.77 10,280 2011 $60.29 10,594 2012 Supply 64.5% 62.5% 64.0% $103.17 $104.50 $64.48 $66.88 $69.34 10,701 10,946 10,594 2013 2014F $107.50 2015F South San Antonio Occupancy 46.5% $63.70 50.1% $63.82 55.0% $67.63 60.3% 58.2% 58.0% $68.38 $69.32 $69.50 $41.23 $40.34 $40.31 3,173 3,173 59.0% $73.00 ADR RevPAR $29.62 2,890 2009 $31.97 2,986 2010 $37.20 3,006 2011 3,055 2012 Supply 2013 2014F $43.07 3,268 2015F Presentation Outline I. The Economy II. Lodging Forecast – U.S. III. Lodging Forecast – Texas IV. San Antonio Submarkets V. Hotel Market Cycle Hotel Market Cycle In the Sweet Spot Rapid Development Lodging Decline, Leads Other Sectors Accelerated Development ? Development Picks Up 2016/2017 We are Here Long Run Occupancy 2015 2014 Equilibrium ADR Occupancy Declines, ADR Follows ADR and Margins Recover A Year Ago Development Slows Occupancy Recovers Development at Minimum Lodging Recovers, Lags Levels Other Sectors (Not this Time!) For a Copy of This Presentation Please Visit www.pkfc.com/presentations or Contact: Randy McCaslin Email: Randy.McCaslin@pkfc.com 713.621.5252 Ext. 21