Corporate Governance Guide for Investment Companies

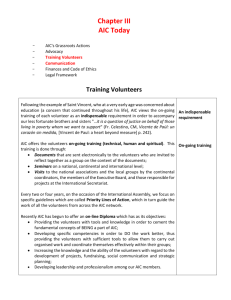

advertisement