Treating death as a commodity

advertisement

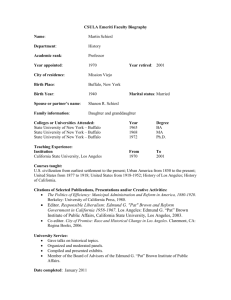

Treating death as a commodity - Los Angeles Times Page 1 of 3 Hello Visitor Register Sign-In LAT Home | My LATimes | Print Edition | All Sections Jobs | Cars.com California | Local | Real Estate | More Classifieds SEARCH You are here: LAT Home > California | Local News > Orange County Treating death as a commodity Email | Print | Text California/Local » » » » » » » » Los Angeles Orange County S.F. Valley Ventura County Inland Empire Crime&Courts Politics Education Columnists: » Steve Lopez » Sandy Banks » Patt Morrison » George Skelton » Dana Parsons » Steve Harvey Community Papers: » Burbank » Newport Beach » Laguna Beach » Huntington Beach » Glendale News California | Local National World Entertainment Business Sports Campaign '08 Science Environment Opinion Columnists Print Edition Readers' Rep Corrections Calendarlive The Guide The Envelope Travel Magazine Home & Garden Health Food Autos Books Image Arts & Culture Living Green Photography Obituaries Crossword, Sudoku Your Scene Blogs More Orange County News - Mother of drowned Anaheim toddler due in court - Collector says O.J. encounter was a set-up - O.C. officials OK sheriff's watchdog Michael Robinson Chavez Selma Mannheim, 86, of West Los Angeles says the payout from her life-settlement deal enabled her to have the pleasure of giving money to her family. Subscribe to Section More RSS Readers > A growing industry involves buying, selling and profiting from life insurance. By Marc Lifsher, Los Angeles Times Staff Writer February 20, 2008 Robert Mannheim was stunned when he found out that strangers wanted to lend his mother in West Los Angeles money to buy her a $2-million life insurance policy and pay her premiums. Most Viewed Most E-mailed Related News - Kobe has more than chants to be MVP - Police find buried loot near 118 Freeway - More teenagers ignoring CDs, report says - Cheating scandal roils elite Harvard Westlake school - Taxpayers not planning rebate spending spree All most viewed > The deal got better after two years: She would sign over her death benefits to investors and collect $200,000. FOR THE RECORD: Insurance: An article in Section A on Wednesday on life insurance and the increased popularity of life-settlement agreements misspelled the last name of a San Luis Obispo attorney who said she was concerned about the marketing of the investments. She is Barbara Guerena, not Guarena. — The idea of leveraging the value of her newly acquired insurance into a big cash payoff tickled Selma Mannheim, a child of the Great Depression, who knows the importance of having money in the bank. "I have no complaints because it did not cost me anything," she said. Selma Mannheim is one of a growing number of older Americans and their relatives who are taking advantage of a booming life-settlement industry that involves buying, selling and profiting from life insurance policies. Not everyone is enchanted with the idea of selling life insurance policies to faceless investors. "You ought to know who you sell to. You don't want Tony Soprano buying your life insurance policy," said Newport Beach attorney Jay Adkisson, who writes about financial fraud on an Internet blog called quatloos.com. "I don't like the idea of people growing life insurance like so many crops." http://www.latimes.com/news/local/orange/la-fi-lifesettlement20feb20,1,292430,full.story?... 2/27/2008 Treating death as a commodity - Los Angeles Times All Sections These agreements also have riled insurance companies and threatened their profits. Buy, Sell & More Investing in people's lives and collecting on their deaths is a growing enterprise. As investors began to pool these investments and sell them as a package, these securities soon attracted hedge funds, pension funds and institutional endowments. Jobs Cars Real Estate Apartments Personals Deals at Local Stores Coupons Newspaper Ads Place an Ad In the Newspaper Online Settings & Services Sign In Register Personalized News E-Mail Newsletters RSS Feeds Help Contact Us L.A. Times Archives Reprint Requests Work for Us Home Delivery Customer Support Subscribe Page 2 of 3 Financial giants such as Goldman, Sachs & Co. and Bear, Stearns & Co., as well as a unit of Warren Buffett's Berkshire Hathaway Inc., are backers. Battles over these new securities are looming in state capitals and courtrooms across America. Today, they will be examined in Sacramento, where the state Senate Banking, Finance and Insurance Committee will consider this growing and largely unregulated market in California. "Enticing seniors with offers of free cash to allow the purchase of life insurance on their lives for the benefit of third-party investors is wrong, and apparently not currently illegal in California," committee Chairman Michael Machado (D-Linden) said. He thinks state regulation is overdue. The total face value of policies purchased for the secondary market rose to $6.1 billion in 2006 from $2 billion in 2002, according to Conning Research and Consulting of Hartford, Conn. Experts are predicting that total market volume could hit $20 billion this year. "This is a runaway freight train," said Frank N. Darras, a top California attorney specializing in senior citizen issues. "Somebody needs to put brakes on it or we might have a lot of people extremely distressed. The only folks making money will be those swapping and selling and co-brokering." Life-settlement providers stress that these agreements are a boon for elderly consumers and an attractive investment for Wall Street. For years, they contend, life insurance companies have been a monopoly, sitting back and collecting premiums on policies that consumers allow to lapse. Selma Mannheim, 86, said her life-settlement deal enabled her to have the pleasure of giving money to her three children, five grandchildren and three great-grandchildren. Her son, Robert Mannheim, a retired tax attorney from Agoura Hills, said he gave his mother the go-ahead after carefully scrutinizing the proposal brought to him by an investment advisor, who had done similar deals with acquaintances. "My brother and I looked at it and said 'That's a winner!' " he said. Traditionally, insurance companies have given consumers the option to give up their policies and collect a small sum. But now policyholders can sell to investors for much more money. As a result, consumers may gain, yet insurance companies still have to pay the policy's full value as a death benefit. Consumers cannot buy an unlimited amount of life insurance coverage. Insurers set limits on the coverage a policyholder can buy. This amount varies from company to company and is based principally on the person's net worth. As a result, critics of these life-settlement agreements warn that consumers who sell too much of their coverage to investors might not be allowed to buy more insurance if they need it later. The burgeoning market in life-insurance-backed securities offers investors a relatively safe bet, unaffected by gyrating currencies, soaring oil prices or shaky equities. Larry Simon, chief executive of San Diego-based Life Settlements Solutions Inc., a pioneer in purchasing policies for resale on the secondary market, said the risk for investors was minimal. "You always get the policy paying off. That's the beauty of the asset." Critics, especially insurers, see these investments as a morbid way to misuse life insurance and its promise of providing family security. The investments also exploit seniors, drain money from their estates and expose policyholders to the possibility of fraud, opponents contend. Lawmakers and regulators in California also are concerned. Machado is considering legislation to rein in one kind of life-settlement agreement that allows strangers to buy and collect on insurance policies for others. Insurance Commissioner Steve Poizner has taken no public position on these lifesettlement agreements. However, his department currently is upgrading its website to http://www.latimes.com/news/local/orange/la-fi-lifesettlement20feb20,1,292430,full.story?... 2/27/2008 Treating death as a commodity - Los Angeles Times Page 3 of 3 warn senior citizens against being victimized by strangers who offer them "risk-free" life insurance deals. Life insurance companies and life settlement promoters are gearing up for a highstakes battle at the state Capitol. The insurance industry is a powerful political force and a large contributor to politicians' campaign funds. Life-settlement companies have recruited three of Sacramento's premier lobbyists and hired at least one media-savvy public relations firm. Other states, meanwhile, are considering tightening their own rules on licensing and sales practices. Both the National Assn. of Insurance Commissioners and the National Conference of Insurance Legislators have drafted model statutes in recent years. Pressure to regulate life settlements has been building with recent stories of abuses. In Los Angeles, federal prosecutors last year indicted a pair of men for allegedly getting investors to finance the purchase of stranger-originated policies for thousands of members of an African American church. According to the indictment, the accused pocketed most of the proceeds instead of buying insurance. At least three life-settlement-related lawsuits are pending in state and federal courts in Los Angeles. They include a high-profile action by CNN talk show host Larry King against a Maryland-based insurance agent, who advised him to buy and almost immediately resell a $10-million life insurance policy. At a San Luis Obispo County senior center, crudely printed fliers recently circulated, telling members that they could get as much as $50,000 from "investors that want to speculate on our life expectancy." Barbara Guarena, a San Luis Obispo attorney specializing in senior citizen issues, said the hard sell gives her the willies. "I hate to see seniors make their lives into commodities." marc.lifsher@latimes.com Save/Share Save over 50% off the newsstand price. Subscribe to The Times now! Balenciaga mixes the old with the new Show us How Your Garden Grows! View our readers' photos and share yours at Your Scene. At Paris Fashion Week, minimalism and intergalactic silhouettes mark Nicolas Ghesquiere's sculptural pieces. Photos Submit your photo or video >> Ads by Google Vehicle Invoice Prices What Is Your Dealer Hiding? Learn Invoice Prices & Hidden Fees! SmartCarPrices.com Honda Crash Test Facility Honda develops new technologies that improve real-world safety. www.honda.com How Romantic Are You? Take this Fun Personality Test and see how Romantic you really are! www.Chatterbean.com/Romantic Ford Car Safety Visit the Official Ford Site Now for the Latest Ford vehicle Info. fordvehicles.com High Visibility Clothing ANSI Safety Vests, High Visibility High Visibility TShirt, Safety Vest www.urbanhart.com More on LATimes.com Los Angeles | Orange County | San Fernando Valley | Ventura County | Inland Empire Partners Hoy | KTLA | ShopLocal | Shopping | Grocery Coupons Copyright 2008 Los Angeles Times Classifieds Career Builder | Cars.com | Apartments.com (For Sale By Owner) | Open Houses FSBO Privacy Policy | Terms of Service | Advertise | Home Delivery | Reprint Requests | Help & Services | Contact | Site Map http://www.latimes.com/news/local/orange/la-fi-lifesettlement20feb20,1,292430,full.story?... 2/27/2008