Non-Consolidated Financial Data of the Three Life Insurance

advertisement

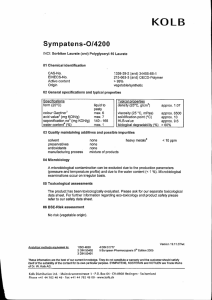

(Reference) Non-Consolidated Financial Data of the Three Life Insurance Companies for the Three Months Ended June 30, 2015 1. Sales Results (Individual Insurance and Annuities) Three Months Ended June 30, 2015 New policy amount Surrender and lapse amount Surrender and lapse rate Policy amount in force Annualized premiums of new policies Third Sector products Annualized premiums of total policies Total (Sum of Three Companies) Amount %Change 1,643.2 956.4 (15.1%) (0.1%) 60,502.2 33.8 6.8 1,450.8 172.7 0.9% (14.2%) 44.9% 1.7% 4.9% (Billions of yen) Taiyo Life Amount %Change 704.7 326.1 1.47% 22,212.5 10.2 3.7 649.9 99.4 (31.2%) (3.2%) (0.09 points) 1.0% (35.6%) 57.3% 1.5% 1.3% Daido Life Amount %Change 876.3 611.8 1.68% 36,478.8 19.3 3.1 684.4 70.2 3.8% 2.9% 0.03 points 1.0% 7.5% 32.2% 4.5% 11.3% T&D Financial Life Amount %Change 62.2 18.4 1.02% 1,810.7 4.2 0.0 116.4 3.0 (6.6%) (29.2%) (0.39 points) (0.9%) (23.4%) 1,143.4% (10.8%) (8.6%) Third Sector products Notes: 1. New policy amount includes increase from conversion. 2. Surrender and lapse rate is not annualized. 3. % Change is presented in comparison with the same period of the previous fiscal year (hereinafter, same if not mentioned otherwise). 4. Changes in policy amount in force from the previous fiscal year-end: Total: 0.2%; Taiyo Life: 0.3%; Daido Life: 0.2%; T&D Financial Life: 0.2%. 5. Changes in annualized premiums of total policies from the previous fiscal year-end: Total: 0.3%; Taiyo Life: (0.2%); Daido Life: 0.9%; T&D Financial Life: (0.2%). 2. Summary of Operations Three Months Ended June 30, 2015 Ordinary revenues Income from insurance premiums and others Investment income Ordinary expenses Insurance claims and other payments Investment expenses Ordinary profit Extraordinary gains Extraordinary losses Provision for reserve for policyholder dividends Income before income taxes Total income taxes Profit attributable to owners of parent (Billions of yen) T&D Holdings Consolidated Amount 558.7 431.8 103.2 514.9 398.0 24.7 43.7 0.0 5.6 8.0 30.0 8.6 21.4 %Change (4.9%) (10.7%) 25.3% (4.8%) 3.7% 208.9% (5.6%) (46.2%) 368.8% 7.2% (20.3%) (19.5%) (20.6%) Taiyo Life Amount %Change 274.5 200.8 54.4 254.6 213.8 13.0 19.9 4.9 4.6 10.2 2.9 7.2 (3.3%) (16.0%) 32.0% (4.8%) 19.8% 127.6% 22.2% (100.0%) 614.3% 9.0% (10.2%) (9.0%) (10.7%) Daido Life Amount %Change 231.7 181.5 42.8 208.3 125.9 8.9 23.4 13.2 0.7 3.4 32.4 9.1 23.3 5.7% 1.2% 20.7% 6.7% 4.1% 124.0% (2.4%) 60.6% 4.7% 59.9% 68.9% 56.6% T&D Financial Life Amount %Change 65.0 48.7 6.6 64.6 57.8 3.0 0.4 0.0 (0.0) 0.3 0.0 0.2 (31.6%) (24.9%) (25.4%) (27.5%) (31.3%) 187.4% (92.9%) 125.3% (93.9%) (95.1%) (93.4%) Notes: 1. T&D Holdings' consolidated figures do not always correspond to the sum of the three companies' figures. Simple sum of all three companies' income from insurance premiums and others is ¥431.1 billion (down 10.8%). 2. Extraordinary losses of ¥5.6 billion include provision for reserve for price fluctuations of ¥5.0 billion (Taiyo Life: ¥4.4 billion, Daido Life: ¥0.5 billion, T&D Financial Life: ¥0.0 billion). 3. The amount of net income is stated in the column of profit attributable to owners of parent for the three life insurance companies. 3. Key Indicators Three Months Ended June 30, 2015 (Billions of yen) Total (Sum of Three Companies) Amount Change Core profit 40.1 (9.0%) Amount of positive spread 7.6 29.7% Note: In case of negative spread, amount is shown in negative value. Taiyo Life Amount Change 13.1 2.0 (23.0%) (31.7%) Daido Life Amount Change 25.7 6.3 2.7% 75.8% T&D Financial Life Amount Change 1.3 (0.7) (35.7%) 0.9% (Billions of yen) As of June 30, 2015 T&D Holdings Consolidated Amount Solvency margin ratio Consolidated SM ratio Adjusted net assets 1,176.9% 2,567.5 Taiyo Life Change from previous FYE (43.8 points) (77.9) Amount 964.0% 970.8% 1,118.6 Daido Life Change from previous FYE (29.9 points) (30.3 points) (44.8) Amount T&D Financial Life Change from previous FYE 1,317.6% (46.1 points) 1,325.0% (46.5 points) 1,274.2 (14.2) Amount Change from previous FYE 1,314.2% 42.3 points 146.7 (9.5) (Billions of yen) As of June 30, 2015 Total (Sum of Three Companies) Amount Unrealized gains/losses on securities Domestic bonds Domestic stocks Foreign securities Other securities Monetary trusts Monetary claims purchased Unrealized gains/losses on real estate 1,251.8 530.0 439.0 220.2 38.4 9.9 14.0 26.6 Change from previous FYE (91.1) (58.9) 41.0 (73.8) 4.6 (2.4) (1.5) (10.6) Taiyo Life Amount 710.7 273.2 250.6 165.4 14.8 6.3 7.5 ─ 1 ─ Daido Life Change from previous FYE (55.2) (34.6) 19.5 (40.9) 1.5 (0.7) 0.0 Amount 491.2 216.9 188.3 54.8 23.5 7.6 19.0 T&D Financial Life Change from previous FYE (28.0) (18.8) 21.5 (32.9) 3.0 (0.7) (10.7) Amount 49.8 39.8 9.9 - Change from previous FYE (7.8) (5.3) (2.4) - T&D Holdings, Inc Notes: 1. Regarding net unrealized gains/losses on securities, the figures show only those of securities with market value. 2. Net unrealized gains/losses on real estate are basically calculated based on the appraisal price. Less important properties are calculated based on the posted price. (Billions of yen) As of June 30, 2015 T&D Holdings (Group MCEV) Amount MCEV (estimate) Three Months Ended June 30, 2015 2,363.8 Taiyo Life Change from previous FYE 65.8 T&D Holdings (sum of three companies) Amount Daido Life Change from previous FYE 891.6 Taiyo Life 23.0 Amount T&D Financial Life Change from previous FYE 1,359.8 Daido Life 53.0 Amount Change from previous FYE 98.6 2.8 T&D Financial Life Value of new business (estimate) 28.2 11.0 15.2 1.9 Notes: 1. Quarterly MCEV results are estimates calculated partly using simplified methods and are not reviewed by third party specialists. 2. Figures of MCEV and value of new business stated in the tables are estimates. 3. Value of new business for the same period of the previous fiscal year: sum of three companies; ¥24.0 billion, Taiyo Life; ¥9.0 billion, Daido Life; ¥14.0 billion, T&D Financial Life; ¥0.0 billion. ─ 2 ─ T&D Holdings, Inc (Reference) Forecasts for the Year Ending March 31, 2016 (April 1, 2015 - March 31, 2016) 1. T&D Holdings (Consolidated) Full year forecasts for the year ending March 31, 2016 have not been changed from the announcement on May 14, 2015. (Billions of yen) Forecast for the Year Ending March 31, 2016 Year Ended March 31, 2015 Ordinary revenues Ordinary profit 2,412.1 Approx. 1,870 188.9 Approx. 167 Net income attributable to 94.2 Approx. owners of parent Projected annual dividend per share for the year ending March 31, 2016 is ¥25. 78 2. Three Life Insurance Companies (Non-consolidated Basis) The followings are the three life insurance companies’ forecasts for the year ending March 31, 2016. (Billions of yen) Taiyo Life Daido Life T&D Financial Life Ordinary revenues Approx. 850 Approx. 890 Approx. 230 Ordinary profit Approx. 79 Approx. 81 Approx. 7 Net income Approx. 28 Approx. 55 Approx. 4 Note: 1. The differences between the consolidated figures and the sum of the figures of the three life insurance companies are mainly due to the intercompany reconciliation among the consolidated companies including the three life insurance companies. 2. Forecasts for Taiyo Life have been revised considering the current first quarter results: ordinary revenues; approx. ¥820 billion to approx. ¥850 billion, ordinary profit; approx. ¥77 billion to approx. ¥79 billion, net income; approx. ¥27 billion to approx. ¥28 billion. Sum of Three Companies Core profit Taiyo Life Daido Life T&D Financial Life Approx. 153 Approx. 57 Approx. 97 Approx. (2) Approx. 1,590 Approx. 660 Approx. 730 Approx. 200 (In case of negative spread, amount is shown in negative value.) Approx. 31 Approx. 11 Approx. 23 Approx. (3) New policy amount Approx. 6,110 Approx. 2,370 Approx. 3,420 Approx. 330 Policy amount in force Approx. 60,700 Approx. 22,220 Approx. 36,580 Approx. 1,900 Approx. 5.7% Approx. 6.7% Approx. 4.0% Income from insurance premiums and others Positive spread Surrender and lapse rate Notes: 1. Policy amount in force, new policy amount and surrender and lapse rate include individual insurance and annuities. The new policy amount includes increase from conversion. 2. Forecasts for Daido Life’s new policy amount and policy amount in force plus forecasts for the total insured amount of “J-type product” and “T-type product” are ¥4,100 billion and ¥38,890 billion, respectively. 3. Forecasts for Taiyo Life have been revised considering the current first quarter results: core profit; approx. ¥56 billion to approx. ¥57 billion, Income from insurance premiums and others; approx. ¥540 billion to approx. ¥660 billion, new policy amount; approx. ¥2,670 billion to approx. ¥2,370 billion, policy amount in force; approx. ¥22,530 billion to approx. ¥22,220 billion. The above forecasts for the year ending March 31, 2016 reflect the Company’s current analysis of existing information and trends. Actual results may differ from expectations based on risks and uncertainties that may affect the Company’s businesses. ─ 3 ─ T&D Holdings, Inc