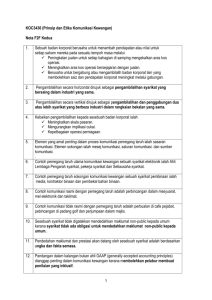

Kandungan Rasional Logo - Advance Synergy Berhad

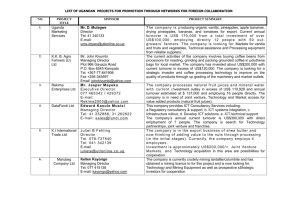

advertisement