Understanding and Quantifying Risk

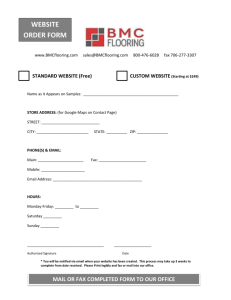

advertisement