Financial Accounting - NUS Business School

advertisement

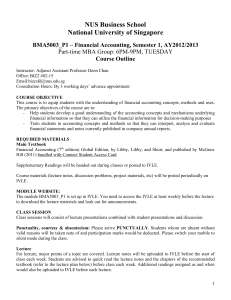

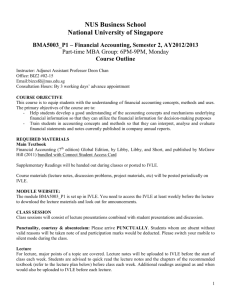

NUS Business School National University of Singapore BMA5003_P1 – Financial Accounting, Semester 2 2015/2016 Part-time MBA Group: 6PM-9PM Course Outline Instructor: Adjunct Associate Professor Deon Chan Office: BIZ2 #02-15 Email:bizcsfd@nus.edu.sg Consultation Hours: 3 working days’ advance appointment COURSE DESCRIPTION This course is to equip students as managers to interpret and use the financial statements information in business analysis and decisions. Managers need a firm basis for using financial statement information in their careers in marketing, finance, banking, manufacturing, human resources, sales, information systems or other areas of management. AIMS AND OBJECTIVES The course will equip the students with the understanding of financial accounting concepts, methods and uses. The primary objectives of the course are to: - Help students develop a good understanding of the accounting concepts and mechanisms underlying financial information so that they can utilize the financial information for decision-making purposes in business problems. - Train students in accounting concepts and methods so that they can interpret, analyse and evaluate financial statements and notes currently published in company annual reports. - Provide students with a broad range of experience with realistic business and financial accounting practices. - Provide students with exposure on ethical and corporate governance issues in the business world. PRE REQUISITE FOR THE COURSE Nil. REQUIRED MATERIALS Main Textbook Financial Accounting (8th edition) Global Edition, by Libby, Libby, and Short, and published by McGraw Hill. Supplementary Readings will be handed out during classes or posted to IVLE. Course materials (lecture notes, discussion problems, project materials, etc) will be posted periodically on IVLE. MODULE WEBSITE: The module BMA5003_P1 is set up in IVLE. You need to access the IVLE at least weekly before the lecture to download the lecture materials and look out for announcements. 1 CLASS SESSION Class sessions will consist of lecture presentations combined with student presentations and discussion. Punctuality, courtesy & absenteeism: Please arrive PUNCTUALLY. Students whom are absent without valid reasons will be taken note of and participation marks would be deducted. Please switch your mobile to silent mode during the class. Lecture For lecture, major points of a topic are covered. Lecture notes will be uploaded to IVLE before the start of class each week. Students are advised to quick read the lecture notes and the chapters of the recommended textbook (refer to the lecture plan below) before class each week. Additional readings assigned as and when would also be uploaded to IVLE before each lecture. CLASS PARTICIPATION (10%) Please participate during the case discussions and lessons actively. Marks will be given for class participations. Please participate by asking questions, answering questions posed by lecturer and fellow students, offering opinions, relating material taught to your working experiences, commenting on presented solutions to assignments. INDIVIDUAL TUTORIAL (10%) The purpose of the tutorial assignment is to help you to practice the accounting concepts and mechanisms, and apply them to the questions. This is key part of the learning. All students are expected to complete the tutorial questions before the due date. You can discuss the tutorial questions in your group. However, all submission of the assignment is on an individual basis. Each student is required to submit the tutorial. GROUP CASE (20%) A group will be assigned to present the solutions of the group case, while the other students are expected to contribute to the discussion of the answers. Due to time constraint, sometimes not all the questions can be discussed during the class, by which, the suggested solutions will be uploaded by the instructor for selfchecking. The grading will be based on the solutions submitted and the presentation. The presentation slides should be uploaded to the student’s workbin before the lecture by 12noon. Please submit by the deadline stated. The rest of the class is expected to prepare the assignment and participate actively in the discussion of the assignment. Participation marks would be given. ANNUAL REPORT PROJECT (30%) This is a group project where the group will perform an analysis of a real-world company annual report by applying the accounting concepts and methods taught in the course. It requires the reading and analysis of annual report of listed companies. It serves to integrate all the topics covered and is also the self-learning component of the course. Deliverable will be the Project Report. Limit to the number of words would be announced during the class. Grading will be based on clarity, conciseness and correctness of the written report of your analysis. Details on the course project will be provided later. 2 FINAL TEST (30%) The final test is an open-book, open-notes test. All materials covered during the semester in lectures, presentations, assignments, assigned readings and group project are examinable. All University-approved calculators are permitted. Any other electronic and mobile devices e.g. laptop, smartphones and mobile phones are not allowed. EVALUATION Your final grade will be determined on the following basis: Final Test Annual report project Individual Tutorial submission Group Case Class participation 30% 30% 10% 20% 10% 100% Lecture Plan Lecture Topic 1 Overview and Fundamentals of Financial Accounting Communicating and Interpreting Accounting Information Readings* Libby Ch1 Libby Ch 5 Concepts and Understanding of Balance Sheet Libby Ch2 2 Concepts and Understanding of Income Statement Libby Ch3 3 Libby Ch 14 4 Performing Financial Statement Analysis 5 Concepts and Understanding of Sales Cycle and Receivables Libby Ch 6 6 Cost of Goods Sold and Inventory Accounting Libby Ch 7 7 Recess Week Concepts and Understanding of Long Term Assets and Intangibles Libby Ch 8 8 Concepts and Understanding of Liabilities Libby Ch 9 3 9 Concepts and Understanding of Owner's Libby Ch 11 Equity 10 Concepts and Understanding of Investments and Cash Flow Statements 11 Synthesis of Financial Reporting, Course Wrap-up & Final Revision 12 Break 13 Final Test 14 Submission of Project Libby Ch 12 & 13 Libby Ch 4 *- For supplementary readings for the lecture, please download from IVLE. Module Website Resources 1. www.sgx.com This is the website through which all corporate information and share information are found. The annual reports reside in Listed Companies – Annual / Financial Reports link. Weblink is http://www.sgx.com/wps/portal/marketplace/mpen/listed_companies_info/annual_reports_financial_reports You need to access the above to download the Singtel and other company’s Annual Report for lecture and project. 2. www.asc.gov.sg/frs/index.htm All financial reporting standards for Singapore are found in the above weblink. It is not essential to understand all that is written in the standards as BMA5003 is an elementary module that cover the basic principles and not the detailed rules in the standards, usually covered in intermediate accounting courses. Advisory Although this module is a basic accounting module, students who have no accounting or business finance background are likely to find it challenging at the beginning. This is because this will be a new language with its own unique terminology, concepts and rules, hence time and efforts are needed to familiarize with them. Do not give up. Work hard and hope you will have an enjoyable learning experience equipping you with the knowledge to the accounting world. 4