power of the purse reform in the philippines

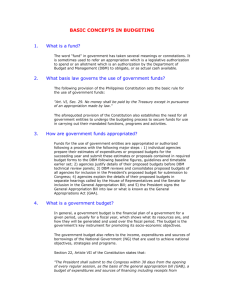

advertisement

POWER OF THE PURSE REFORM IN THE PHILIPPINES PROPOSED REVISIONS TO 1987 ADMIN CODE (BOOK VI) JULY 2009 This publication was produced for review by the United States Agency for International Development. Power of the Purse Reform in the Philippines PROPOSED REVISIONS TO 1987 ADMIN CODE (BOOK VI) Management Systems International Corporate Offices 600 Water Street, SW Washington, DC 20024 Contracted under Agreement No. 6043-001-53-14 Philippines National Budget Monitoring Project This publication is made possible by the generous support of the American people through the United States Agency for International Development (USAID) and Management Systems International (MSI). The contents are the responsibility of INCITEGov and do not necessarily reflect the views of MSI, USAID or the United States Government. DISCLAIMER The author’s views expressed in this publication do not necessarily reflect the views of the United States Agency for International Development or the United States Government. CONTENTS I. OVERVIEW ...................................................................................................................... 1 II. PROPOSED AMENDMENTS TO THE ADMINISTRATIVE CODE OF 1987 .................................................................................................................................... 3 A. Draft Bill on Impoundment.................................................................................... 3 B. Draft Bill on the Revision of the Administrative Code of 1987 ............................ 9 C. Proposed Amendments to Budget Law................................................................ 14 D. Budget Reform Bills filed in 2008-2009 ............................................................. 24 IIi. CONCLUSION ............................................................................................................... 24 TABLES Table 1: Comparison of Proposed vs. Approved Budget.............................................................. 16 Table 2: Calculation of Excess Releases and Obligations ............................................................ 20 POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE i I. OVERVIEW In line with the efforts to monitor the national budget, the Institute for Popular Democracy (IPD) and the International Center for Innovation, Transformation and Excellence in Governance (INCITEGov) has jointly undertaken the Conference-workshop entitled, Power of the Purse Reform in the Philippines held last 05 December 2008. Acknowledging the authority of the Executive Department over the budget and without setting rigid parameters, the activity aims at engaging government and civil society organizations in the discussions on how to restore the balance in the Congress’ power of the purse where it rightfully belongs as stated in Article VI Section 29 of the 1987 Constitution. As such, the National Budget remains as a tool in implementing national priorities for public interest while maintaining the bureaucracy’s efficiency and to guard it against abuses. There are several questionable actions and budgetary scams that the current administration is facing and these include the following: premature release of the “Katas ng VAT” (VAT proceeds); unreleased Priority Development Assistance Fund (PDAF) or Pork Barrel; ambiguous appropriations of lump sums; and the treatment on savings. In early 2008, President GMA implemented the program, “Katas ng VAT” which seeks to allocate funding for social programs focusing on the most vulnerable sectors of the society. The first package allotted P4Billion for the following: power subsidies to lifeline users (P2 billion), scholarships and student loans, (P1 billion); the conversion of public utility vehicles to make them more energy efficient (P500 million); and the replacement of incandescent bulbs with fluorescent lamps (P500 million). The first P4Billion release was sourced from the P114Billion Unprogrammed Funds included in the 2008 GAA which include revenue from VAT from oil during the first quarter of 2008. The second package provided another P4 billion for: continued power subsidies (P1 billion); loans for the wives and relatives of transport workers (P1 billion); rehabilitation of areas damaged by typhoons (P1 billion); upgrading of provincial hospitals (P500 million); and cash allowances for senior citizens not covered by pension funds (P500 million).1 Secretary Margarito B. Teves, Department of Finance (DOF) declared that total collections from the VAT on oil from July to September reached P22 billion, surpassing the target of P13.98 billion with the P8 billion excess revenues due to high oil prices. However, as of October 2008, the Bureau of Internal Revenue (BIR) declared that only P644.81 billion was collected as compared with the target of P671.35 billion for the period. In October alone, the BIR was only able to collect P56.94 billion which is below its target of P64.59 billion. Some officials from DOF said that given the shortfall, the BIR might find it difficult to meet its full-year tax collection goal of P854.0 billion.2 Another constitutional exercise of the congressional power of the purse is the appropriation of Priority Development Assistance Fund (PDAF) or pork barrel. These funds are appropriated for 1 ‘Katas ng VAT’ initiative to fund new social programs by Alexis Douglas B. Romero BusinessWorld. October 29, 2008. (http://www.gmanews.tv/story/130000/Katas-ng-VAT-initiative-to-fund-new-socialprograms) 2 BIR shortfall widens to P26.54B by Michelle Remo . Philippine Daily Inquirer. December 02, 2008. (http://archive.inquirer.net/view.php?db=1&story_id=175f572) POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 1 priority programs and projects under the 10-point Legacy Agenda of the National Government. Each Congressional district, Senatorial national constituencies and sectoral constituencies through their party list are entitled to equal amounts of “soft” and “hard” (infrastructure) projects. Identified projects and beneficiaries are subject to specific criteria and implementation shall be undertaken by the appropriate government agency after an open public bidding. However, several legislators from both Houses of Congress, who are mainly members of the opposition, have not received their PDAF for the past 2 to 3 years. The allocation for ‘soft’ or health care/education projects of Sen. Antonio Trillanes IV remains unreleased. Likewise, Sen. Pia Cayetano was only able to receive a “neglible” portion of her P200Million pork barrel in 2005. Sen. Panfilo Lacson introduced a special provision in the 2008 national budget limiting the Impoundment Power of the President over the amount authorized and approved for PDAF allocation of all members of Congress regardless of political affiliations. These appropriations shall have a validity of two years as provided under Sec. 65 of the General Provision Act. The senator’s initiative was brought about by the unreleased pork barrels since 2005 which are part of the national budget which have not been accounted for. As stated in Sec. 35 and 47, Book VI of the Administrative Code, the President has authority over the appropriation and administration of expenditures from lump sums which are released without clear budget items. One of the most recent and obvious manifestation of the abuse of power over lump sums is the Department of Agriculture (DA) fertilizer scam involving former Usec. Joc Joc Bolante. He was charged as the architect in the misuse of the P728 Million farm input and implement program funding which were allegedly diverted to the 2004 candidacy funds of Pres. Arroyo. Usec. Bolante ardently denied such scam and said that the money was from the unreleased fund of the Ginintuang Masaganang Ani (GMA) budget in 2003 under the Rice and Corn and High Value Commercial Crops budget. Such funds could be released even without seeking approval from the President. Several of the observations in the Commission on Audit (COA) Audit report states that the list of proponents included in the SARO No. 04-00164 for the P728Million GMA farm inputs fund submitted to the DBM was not the same with the one used in the sub-allocation of funds. Also, only 59% of the P547Million transferred to the LGUs and NGOs-POs was liquidated after 19 months of its implementation. Some of the NGOs that entered into agreements concerning the fertilizer fund were of dubious legitimacy. As seen in the 2009 National Expenditure Program (NEP), a total of P106Billion savings from the 2007 budget which should have been reverted to the General Funds were realigned to augment other items in the general appropriations laws for her office. However, it is still unclear if these are savings or unauthorized releases and this clearly show that the Congress has lost its power over the purse. In dealing with these issues, it is therefore necessary to establish rules and conditions for transparency and accountability for the appropriation of public funds and in the execution of the National Budget. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 2 II. PROPOSED AMENDMENTS TO THE ADMINISTRATIVE CODE OF 1987 Atty. Ibarra Gutierrez discussed two draft bills that address the abuse of the power of the executive over the budget vis-à-vis the idea that Congress should actually be the principal agency that should have power over budget appropriations. Atty. Gutierrez presented proposals in regulating the impoundment power of the President and revisions in the 1987 Administrative Code particularly to provide the executive with firmer control or limitations over the entire budget process. A. Draft Bill on Impoundment This proposed legislation, An Act Regulating the Power of the President to Defer, Rescind, or Reserve Expenditure of Appropriations Authorized by Congress, is essentially directed at addressing the need to control the power of impoundment. Impoundment refers to the refusal of the president for whatever reason to spend fund made available by Congress. Essentially, this covers a situation where there is a budgetary appropriation made by Congress and yet the Chief Executive, notwithstanding the presence of such appropriation either abuses or for whatever reasons fails to spend such fund allocated. Under the current law, the authority to impound seems to be broadly exercised as stated in the Administrative Code of 1987. Apart from the recognition that the President has the power to suspend expenditures, there is no clear procedure outlined which the President has to follow for this power to be exercised. This is in contrast with the experience of the United States where they have a specific law enacted in 1974 – the Impoundment Control Act of 1974 – which expressly provides for a specific set of procedures that a president has to follow and comply with before a suspension of expenditure can be validly made. This is the gap that the proposed bill on impoundment attempts to address by providing a more detailed and more specific procedure and importantly, emphasizing the role that Congress has to play in the process of impoundment in cases where the President should choose to propose a suspension, rescission or referral of expenditures for appropriations. Another idea included in the proposed impoundment law is the creation of appropriation of reserves. Under the Administrative Code, apart from the power of the President to suspend expenditures provided for under the GAA, there is also the power granted to the budget secretary to establish reserves against appropriations provided for contingencies, emergencies that may arise later. This is in effect a temporary suspension of the releases for the purpose of holding the funds previously appropriated. The net effect is the same in the sense that the money is not disbursed and spent at a time when it normally should have been if one follows the appropriation made by Congress. Section 2. Declaration of Policy: This section sets the state policy on the budget. It contains the key principles cited by some commentators in criticizing the rule on impoundment and the basis for the particular law to be enacted. Towards this end , all appropriations, except those which shall be explicitly deferred, rescinded, reserved, or provided for otherwise in the General Appropriations Act, shall be automatically released within the first semester of the year POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 3 through the issuance of advices of allotment in accordance with approved work and financial plans, and shall be utilized according to the corresponding purposes provided for in the GAA. This is a declared policy embodied in a rule in the proposed bill which says that those appropriations, unless they are specifically deferred or otherwise rescinded in the GAA itself, should be automatically released in the first semester of the year through the issuances of advises of the government. In other words, it mandates the automatic release of funds. The only exception is when the GAA itself provides that the automatic release shall not take place. This removes or limits discretion of the executive in choosing when and where the budgetary allocations under the GAA are to be released. Section 11. Penal Provision. Any violation of Section 2,4,5,6,7, 8 or 10 of this Act shall be punished by imprisonment from one (1) to six (6) years, a fine not exceeding one hundred thousand pesos P100,000.00), and the penalty of temporary special disqualification. In relation to the abovementioned rule, violation of Section 2 is punishable by imprisonment. If there is failure to comply with the automatic release of funds pursuant to the GAA, it is a criminal liability. The President cannot be punished obviously because he/she enjoys immunity from suit. But all other executive officials who have a hand in budget releases can incur liability. The reason for the penal provision is not so much because you want people to go to jail but to make clear that there is a course of action available against a person or official who refuse to comply with the procedures laid down in the law. The penalty is provided for under the Penal Code that essentially imposes a time bound prohibition on the person from holding public office. Section 3. Definition of Terms. Contains pertinent definitions used in the draft act. Section 4. Rescission and Reservation of Appropriation. Whenever the President determines that all or part of any budget appropriation will not be required to carry out the full objectives or scope of programs for which it is provided, or that such budget appropriation should be rescinded for fiscal policy or other reasons, including the termination of authorized projects or activities, or whenever all or part of any budget appropriation for the current fiscal year is to be reserved from obligation for such fiscal year, the President shall transmit to both Houses of Congress a special message specifying: 1. the amount of budget appropriation which he proposes to be rescinded or which is to be so reserved; 2. any account, department, agency or instrumentality of the government to which such budget appropriation is available for obligation, and the specific projects or governmental functions involved; 3. the reasons why the budget appropriation should be rescinded, or is to be so reserved; POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 4 4. the estimated fiscal, economic and budgetary effect of the proposed rescission or reservation; and 5. all facts circumstances and considerations relating to or bearing upon the proposed rescission or reservation upon the purposes, programs, activities and projects for which such appropriation is provided.Penal Provision. Any violation of Section 2,4,5,6,7, 8 or 10 of this Act shall be punished by imprisonment from one (1) to six (6) years, a fine not exceeding one hundred thousand pesos P100,000.00), and the penalty of temporary special disqualification. This section is the meat of the proposed legislation. It contains the start of a process which the President has to go through in case he/she wants to exercise the power of impoundment. The president transmits to both houses of Congress a special message, a written communication stating that the former seeks to actually exercise the power of impoundment or to reserve a particular appropriation for the current year. The message should indicate 5 items which is to a large extent based on the US Impoundment Control Law of 1974. There is an impact assessment not only on the fiscal, economic and budgetary effect of the rescission but also on the actual implementation of government programs which will definitely be affected if certain facts are withheld from certain agencies. The key here is to provide Congress with appropriate information to base its decision and what decision is to be made. After the President transmitst his message, both houses of Congress should enact a resolution either approving or disapproving the President’s proposal for impoundment. The decision to approve or disapprove will be based on the information that is already contained in the special message. Section 5. Approval of Rescission or Reservation: Both Houses of Congress shall act on the proposed rescission or reservation within forty-five (45) calendar days after the receipt of such proposal from the President by issuing a joint impoundment resolution, either approving or disapproving the same. Provided, that if the President's special message is received within a period of less than forty-five (45) calendar days before the end of a regular session, the President's message shall be deemed to have been submitted on the first day of the succeeding regular session of Congress and the forty-five (45) day period referred to in this Section shall commence on the day after such first day. Provided further, that if Congress does not issue an impoundment resolution within the specified period, the proposed rescission or reservation shall be deemed disapproved. And provided furthermore, that funds corresponding to the rescinded appropriations shall revert to the unappropriated surplus of the general fund and shall not be made available for expenditure for any purpose except as may be provided for in a subsequent law enacted by Congress. This section contains how the process of approval or disapproval should take place – Congress is to act within 45 days upon the receipt of the proposal. A similar bill was filed in 2004 then by Sen. Flavier that required 60 days period. The reason for the 45-day period is that if congress does not issue within the prescribed period, the proposed rescission shall be deemed disapproved. The implication is that Congress is given by the proposed law to act on the president’s request. If Congress does nothing, the president POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 5 cannot proceed. This is a consequence or a rule which is different from that proposed in the earlier draft filed in the Senate in 2004. In the earlier draft, the rule established that if Congress failed to act within the prescribed period, the resolution would be deemed automatically approved. The proposed rule was patterned to that of the United States because precisely the objective is to enhance congressional control over the presidential power of impoundment. This is to avoid or not to promote a situation where there is essentially a token submission by the President for a special message asking for an authorization to undertake an impoundment. At the end of the day, explicit congressional approval is not required. It is more advantageous in so far as congressional control is concerned for Congress to be required to pass a resolution agreeing before the impoundment can be done. As a consequence of that, the 60 days had to be shortened to 45 days for if you allow Congress a longer period, you might actually be impairing the utility of the impoundment in the first place. In theory, there is usefulness in allowing certain flexibility to the executive to say that under certain circumstances they can withhold the spending of certain appropriations. After all, the executive is in a better position to be able to respond to impending crisis. You have a shorter period for Congress to come up with a response of approval in a more timely fashion as opposed to a longer 60-day period where the issue of flexibility might somehow be impaired. The significance of the last proviso in this section is that if the impoundment resolution is passed, and the president’s authority is upheld to actually effect a suspension of expenditures, what happens to the money? The last proviso answers that by saying that the money reverts back to the general fund and it cannot be simply spent again for some other purpose by the executive unless they go back to Congress and ask for a new law specifically saying that this money was reserved and be rescinded for a new purpose. You would need a new congressional enactment for that. It is precisely to avoid providing the executive the opportunity in effect to rewrite a budget by realigning funds through the simple expedient of exercising the power of impoundment and reallocating for some other purpose. The procedure in Sections 4 and 5 both refer to rescission which is the actual suspension of expenditures and reservation is undertaken by the Secretary of Budget and Management to create some reserves for some future use later in the year. Section 6. Use of Reserves. When changes in conditions during the year justify the use of the reserved appropriations which have been imposed under this Act or under the General Appropriations Act, the amount involved shall be allocated back for the use by, and upon the request of the department, office, or agency on whose appropriation the reserve was originally imposed. Under Section 6 they will be reserved but if at some later point in the year the Department to which this appropriation was originally made shall declare that they need to make use of these funds, they can do so by making a request and have the funds re-released to them. The only issue is in this current draft is it is not made explicitly clear that the re-release of these reserves is for, it is not made clear for what purpose the agency or the department can spend them. For example Department X which has program 1 and there is a reservation made in so far as the allocation for program 1 is concerned. The funds are reserved, it has been approved by Congress under Section 5, it is set aside and the expenditure is not made. Later in the year, the Department POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 6 says it needs the money again and asks for the reserved amount. Under Section 6, it can be done. The only question is if they are required to re-release these funds only for the original program or if it can be used for some other purpose. The present wording of this section is not clear and its limitation is confined to the original purpose for which the funds were allocated. The implication is they can use it for any other purpose within the purview of the Department. This is something that has to be discussed later on because there are two conflicting interests. One interest is flexibility. One purpose of reservation is precisely to have a fund for use later on for contingencies or emergencies that might occur. So you would want a certain degree of flexibility of how this fund can be spent. On the other hand, you have the interest that the executive does not circumvent congressional control over the budget which can occur when there is no specific statement that the funds can be only used again for the original purpose that they were allocated to under the GAA. This is something that has to be resolved. Section 7. Deferral of Releases. Whenever the President, the Secretary of Budget and Management, the head of any department, agency or instrumentality of the Government proposes to defer the release of any appropriation for a specific purpose, program, activity, or project, the President shall transmit to the House of Representatives and the Senate a special message specifying: 1. the amount of the appropriation proposed to be deferred; 2. any account, department, agency or instrumentality of the Government to which such appropriation is available for obligation, and the specific projects or governmental functions involved; 3. the period of time during which the appropriation is proposed to be deferred; 4. the reasons for the proposed deferral, including any legal authority invoked by him to justify the proposed deferral; 5. the estimated fiscal, economic and budgetary effect of the proposed deferral; 6. all facts, circumstances and considerations relating to or bearing upon the proposed deferral and the decision to effect the proposed deferral, including any analysis of such facts, circumstances and considerations in terms of their application to any legal authority and specific elements of legal authority invoked by him to justify such proposed deferral upon the objects, purposes, program, activities and projects for which such appropriation is provided. A deferral may not be proposed for any period of time extending beyond the end of the fiscal year in which the special message proposing the deferral was transmitted to the House of Representatives and the Senate. In the framework provided under this proposed law, a deferral is treated differently from a rescission. The main difference is that although the president may still submit a special message to Congress, after the lapse of the 45-day period, inaction by Congress is tantamount to an approval of the deferral. If Congress wants to stop the deferral, it has to say so explicitly. If it says nothing then the deferral can take place. There is this difference in treatment because deferral POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 7 does not actually mean that the funds will no longer be spent. It simply means that the time for which the fund is released is pushed back. As stated in the last part of Section 7, deferral is limited by the rule that it may not be proposed for any period of time extending beyond the end of the fiscal year in which the special message proposing the deferral was transmitted to the House of Representatives and the Senate. You cannot defer something beyond the current fiscal year. The expenditure is still to be incurred sometime in the same fiscal year. Section 9. Mode of Transmittal of the Special Message of the President. The President shall transmit to Congress at any time during the budget year but not later than the fifteenth (15th) day of October of the budget year the special message referred to in either Section 4 or 7 of this Act, which may include one or more proposals for rescission, reservation, or deferral on one or more appropriation items, through the Committee on Finance of the Senate and the Committee on Appropriations of the House of Representatives. This section states the technical details on the mode of transmission, recipients and limitation such as the president has no opportunity to transmit past 15 October for if you count the 45-day period, it ends up in December and there is no more time to act on it. Section 10. Submission of Quarterly Reports. Within thirty (30) days after the end of each quarter, the Secretary of Budget and Management shall submit to the Committee on Appropriations of the House, of Representatives and the Committee on Finance of the Senate, a list of releases made out of reserved and deferred appropriations, and comparative statements showing the annual general appropriations, the annual program of continuing and automatic appropriations, and the corresponding releases of allotments and cash allocations for each department, agency, corporation and fund. Provided, that the releases from each lump-sum or special-purpose fund shall be supported with schedules indicating the specific departments, agencies, corporations, or entities which received the fund releases and the purposes of such releases. The quarterly reports shall also include a cumulative summary of all appropriations rescinded, deferred, or reserved, including, where applicable, the corresponding impoundment resolution/s approving such rescissions, deferrals, or reservations. This section expresses that there is a continuing duty reposed on the executive to continuously update Congress every quarter as to the status of the implementation of the budget including the suspension of expenditures made pursuant to procedures of the proposed act. In contrast to the current rule found under the Revised Administrative Code of 1987 that the impoundment can be undertaken by the President solely at his/her discretion without any oversight or control on the part of the legislative branch, the proposed law creates a specific procedure that the President has to comply with and provides a significant role on the part of the legislature through the corresponding committees in the senate and the house to approve or disapprove the president’s proposal or action of impoundment. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 8 B. Draft Bill on the Revision of the Administrative Code of 1987 The proposed bill on the revision of the Administrative Code of 1987 covers a comprehensive amendment of the entire budget process not only to address the issue of impoundment but to provide firmer control or limitations on the executive control over the entire budget process. It is an overarching approach to the situation and includes certain provisions which relate to the first bill. One of the things to be looked into is the form in which these legislative proposals should actually be made. Either through Omnibus Bill by Congress which includes all our proposals or bullet amendments or both, or have one Omnibus bill and several smaller bills at the same time. The proposed legislation has for its objectives like making the release of the budget mandatory and corresponding penalties for non-compliance, and on the matter of impoundment. Of note is the role given to Congress. The legislation essentially proposes specific revisions to the Revised Administrative Code which is really the law that provides in general how the budgetary process is. Specifically, this legislation intends to achieve the following reforms in budget execution: • Ensure that the Executive branch of the Philippine government implements the budget as specified in the General Appropriations Act, making the execution of the budget as approved by Congress mandatory and making it illegal and punishable by law to do otherwise without Congressional authorization. • Ensure that permission for budget deferral, rescission or impoundment is secured from Congress in cases where a fiscal crisis or other contingencies creates a situation that makes it difficult for the Executive to implementing the entire budget as approved in the General Appropriations Act. Where fiscal difficulties are encountered the Executive will need to go to Congress with a special message from the president requesting: i) authorization for new revenues or borrowings, if additional authority to borrow is required ii) authorization for the impoundment, rescission or deferral of low priority budget items. • Ensure that savings generated from an unexpected reduction in the costs of achieving project and program objectives supported by the General Appropriations Act are properly accounted for and reported to Congress on a quarterly basis. Ensure further that unspent amounts from lump sum appropriations will be reverted to the general fund, and disbursed only following fresh Congressional authorization. • Ensure that in case of budget re-enactment, that the budget that is re-enacted is identical to the budget of the previous year. Thus, the budget that is re-enacted is not a lump-sum that can be disbursed in its entirety without new authorization. The scope for disbursements is only in as far as there are still unexpended budgets, in as far as there are lump sum amounts in the previous budget that can be allocated based on duly authorized implementing rules and regulations and other budgets whose expenditure is specifically authorized through other laws. • Ensure that, in addition to receiving reports about savings generated from completed projects, programs and activities, Congress shall also be consulted and fully informed by the executive regarding the implementing rules POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 9 and regulations and guidelines used by departments and agencies in the allocation and disbursement of lump-sum budgets. In this regard, no disbursements of lump-sums shall be made until this process of consultation is deemed to have been completed through a joint resolution by the two houses of Congress. Section 2. Declaration of Policy and Rule. The implementation of the General Appropriations Act is mandatory. Any unauthorized suspension, transfer or use of appropriations other than that for which they are intended and made in violation of this Act shall be dealt with in accordance with Sections 43 and 80 of Book VI of the Revised Administrative Code as amended herein. This section expressly states the mandatory nature in the implementation of the GAA and failure of any official to actually comply will be subject to penal sanction. Section 3. Definition of Terms. Several new terms are included amending Section 2, Chapter 1, Book VI of EO 292. Augment -- is the power to transfer savings from one appropriation to cover deficits in another as exercised by the President, Senate President, Speaker of the House, Chief Justice, and Heads of the Constitutional Commissions within their respective branches and agencies as provided in this Book. This is important for it should be made clear that augmentation is for the specific purpose of using savings to cover deficit in another purpose also under the same agency. It is not a blanket authorization to spend the money in any other way that the concerned official sees fit. Deficit – means an insufficiency in the appropriated amount for the completion of a particular program, project or activity or the fulfillment of current operating expenditures and capital outlays not arising from causes such as overpricing or other factors which could have been reasonably foreseen in order to complete the program, project or activity or fulfill current operating expenditures and capital outlays within the given appropriation specified in the General Appropriations Act for said program, project or activity, current operating expenditures and capital outlays. Savings - This shall not refer to an unexpended amount as resulting from the President’s exercise of the power to impound. It is only savings and therefore can only be used to augment if it is actually real surplus. A particular amount was intended for a particular program, the program has been completed and there is some money left, an actual surplus. It does not cover where fund releases were stopped and therefore there is money available. In such a case, you cannot rely on the authorization under the Constitution to certain heads of agencies to use the savings to augment the other expenditures within their particular branch. Re-enacted budget -- refers to the previous year's budget that takes effect in case Congress fails to pass a new General Appropriations Act for the current year. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 10 The re-enacted budget is not the entire lump sum amount of the previous year that can be spent at the discretion of the executive. Section 4. Budget Preparation. Sections 12 and 21, Chapter 3, Book VI of EO 292 are hereby amended to read as follows: Section 12. Form and Content of the Budget. - The budget proposal of the President shall include current operating expenditures and capital outlays. It may comprise such funds as may be necessary for the operation of the programs, projects and activities of the various departments and agencies. All appropriations and expenditures for a particular department, office, agency and/or government-owned or controlled corporations shall be included and listed exclusively in the budget for such department, office, agency and/or governmentowned or controlled corporations having control over such funds. All expenditures of the various departments, offices, agencies and/or government-owned or controlled corporation should be uniformly classified by common account titles. The presentation of all projected revenue and proposed expenditure items must show the current year’s corresponding revenue and expenditure together with the last three years’ corresponding actual revenue and expenditure. Of note in this section is on the form and content of the budget wherein an additional insertion was made concerning budget proposal of the President to include current operating expenditures and capital outlays. This creates a greater of detail in the submission of the budget and it requires in addition to spending expenditure items should show the corresponding revenue sources that will be used to fund these expenditure items; as well as information on the last three years of corresponding actual revenues and expenditure. It is an attempt to make the crafting of the budget more rational because you are tying it more specifically to more specific programs and directly linked to the notion of revenue. Estimated expenditures are also included in the budget message that should be sent to Congress by the Executive as well as an explanation of what were loans spent for and explanations of patterns on expenditure in the past. These are all meant to ensure a greater degree of rationality in the budget process and accountability. Section 21. Appropriation for Personal Services. Appropriations for personal services shall be included in the amount specified for each budgetary program and project of each department, Bureau, office or agency, and shall be itemized. The itemization of personal services shall be prepared by the Secretary as provided in Section 23 hereof. Itemization of personal services shall also be prepared for all agencies of the Legislative, Executive and Judicial Branches and the Constitutional bodies, except as may be otherwise approved by the President for positions concerned with national security matters. The current rule provides that there should be no itemization for these in so far as the budget is concerned. It is not broken down into specific positions and offices when the GAA is enacted although there is an itemization prepared by the executive but not made part by the budget. The proposal is to change this entire framework and itemize each except for positions that are concerned with national security matters. This is to have a greater degree of accountability POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 11 because right now there is an idea that there are unitemized expenditures employed for personal expenses. Section 5. Budget Authorization. Section 23, 24, 25, 27 and 28, Chapter 4, Book VI of EO 292 are hereby amended to read as follows: Section 24. Prohibition Against the Increase of Appropriation for the Operation of Government. Congress may not increase the appropriations recommended by the President for the operation of the Government as specified in the budget. However, it may increase appropriation for the operation of a department, agency, or office with the corresponding adjustment in the appropriations of another so as not to exceed the total appropriations submitted by the President in his budget proposal for the operation of the entire Government. The current rule is found under the Constitution Article 6, Sec. 25 paragraph 1 expresses that it is the executive that submits the budget proposal, Congress approves but the rule under the Constitution is you cannot give more than what the executive asks. Because the Constitution does not specify what Congress cannot increase, it is unclear if the Constitution is referring to the entire budget that the executive asks for or refers to the individual budgets of each department or agency. The current interpretation in the current Administrative Code is it refers to the agency level. So if the President asks for a hundred billion for a particular agency, Congress cannot give more than that. It is not just a ban on increasing the total budget but a ban on increasing specific allocations for specific programs. The proposed amendment is that Congress may not increase the total appropriations but can increase individual appropriations for programs or agencies. The constitution is vaguely worded, it does not specify which the Congress cannot increase and if it refers to entire budget or the agency level. This is being pointed out for this will be assailed when this particular bill is passed. Section 27. Supplemental Appropriations. All appropriation proposals shall be included in the budget preparation process. However, after the President shall have submitted the budget, supplemental appropriation measures may be passed by Congress provided these are supported by funds actually available as certified by the National Treasurer, or to be raised by a corresponding revenue proposal therein. The current rule is that supplemental appropriations have to be funded from new revenue source, cannot be sourced from existing monies held by the national government. The proposed amendment states that it may be supplemented by either new revenue sources or if there is a certification by the national treasurer that there are actually funds available to support such supplemental appropriation. If the government has sufficient funds anyway without having to resort to new revenue measure, Congress is authorized to make a supplemental appropriation to be funded from existing funds held by the national treasurer. There is only a requirement that there has to be a certification. The budget and the General Appropriations Act may provide lumps sums in order to support bills for later action by the Congress: Provided, that the Treasury Certification requirement shall be deemed complied with in case of bills which are funded from lump sums in the General Appropriations Act approved by POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 12 the Congress for purposes of supporting programs, projects, or activities which require specific legislative authorization and in the case of bills whose expenditures estimates are included in the budget submission of the President pursuant to Section 12 of this Book. Provided further that Congress will be consulted before implementing rules for the disbursement of lump sum budgets are issued, and Congress issues joint resolutions stating that such consultations by the Executive with Congress have been achieved and are deemed completed. The budget and the GAA may provide lump sums that may be later supported by Congress. A lump sum is a grant of money without specifying the particular purpose for it to be spent. And precisely they are supposedly to cover a situation where Congress will enact a law later on for which these funds will be used. Lump sums may be provided for provided that the Treasury certification is deemed complied with. Looking at the previous proviso, the change is that supplemental appropriations need no longer be sourced exclusively from new revenue sources. They can be funded from existing government funds provided that the national treasurer certifies that there are funds available. In addition these supplementary appropriations may be funded from lump sums already included in the GAA. But it adds another part to the process that Congress has to be consulted before the implementing rules for the disbursement of the lump sum can be enacted by the specific executive agency involved. Congress has to be made part in of the process in determining how the lump sum will be spent and as proof that Congress has been consulted, it has to issue a joint resolution that the consultations actually took place and that the goals achieved. Lump sum spending is no longer in the hands of the executive and Congress is given a role on two levels. One level is the requirement of an enactment that there is a supplemental that states the use of the lump sum. Second, in the implementing rules, Congress has to ensure that they were consulted by the executive on how they actually plan to spend the money. Unexpended amounts of lump sum appropriations under this Section shall under no circumstances be considered and used as savings but shall automatically revert back to the General Fund at the end of the fiscal year pursuant to Section 28 of this Book. Any act to the contrary shall be considered misuse of government funds and illegal expenditures as provided in Sections 80 and 43 of this Book. Another rule that is being proposed with regard to lump sums is that unexpended amounts of lump sum appropriations cannot be considered as savings. They will revert back to the general fund. Any act to the contrary, e.g., the President chooses to spend excess lump sums on its own, will be considered an illegal expenditure and punished accordingly with the corresponding provisions of the Revised Administrative Code. Other proposals related to impoundment are also in this proposed legislation. The procedure in both draft bills is more or less the same although the specific impoundment bill has a more detailed process that the President has to follow in case he wants to exercise the power to suspend the expenditure of appropriations. Proposed bill mandates the creation of a Congressional Oversight Committee. This is the administrative mechanism that is established by the law. Aside from the numerous changes discussed in the other draft bill with respect to the budget process, Congress is also mandated to create a committee that will oversee the faithful execution of the provisions. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 13 C. Proposed Amendments to Budget Law Likewise Prof. Emilia Boncodin gave several inputs on the need to review, modify and amend the budget law. The General Appropriations Act is the one and only law that can be initiated by the President which is submitted and approved by Congress. Once the GAA is approved, the President is given line item veto power which is a very powerful authority. This allows the President or the executive to remove certain items in the GAA that he/she does not like. This power can be tempered by Congress’ power to override but there has never been an instance in the history of budget making that Congress has overridden the President’s budget. Once the budget is approved, the President implements it and the executive has a lot of leeway in terms of implementing the appropriations laws. Some of these are the power to impose reserves, power to suspend expenditures of appropriations, release of appropriations of agencies with fiscal autonomy in full, transfer of unused appropriations through use of savings within the Executive Branch. In the implementation, Congress is supposed to undertake oversight of fiscal and financial transactions as well as the use of savings but these functions have been very poorly exercised. In reality, the Executive has tremendous powers when it comes to budget implementation and it could even be possible for the President to negate what Congress intended to do. In relation with this, Prof. Boncodin cited several major budget issues which could be possibly resolved through the amendment of the budget law. These show that the fault not only lies with the Executive but on the side of Congress also: 1. Delayed enactment of the budget resulting in the delayed delivery of public services. Budget enactment is one of the fundamental functions of the legislative branch. 2. Interpretation of the authorized appropriations under a partly-reenacted budget scenario which increases the available appropriations beyond what Congress authorized. This is an implied violation of budget authority. Once there is a reenactment of the budget, a portion of the previous year’s budget is utilized within the current budget year, what effectively happens is that the budget is overstated. For example, supposing in 2008 the budget was passed in March. From January to March, the budget that was being used pertains to the 2007 appropriations. What DBM/executive did was use the one quarter equivalent of the budget of the previous year. But when the budget for 2008 was passed, they used the entire year’s budget also. In effect, they used one budget plus the re-enacted portion of the previous year. When a fiscal year budget is approved, Congress’ clear intention is to use that budget for one fiscal year (12 months) whatever month it starts; it is a 12-month period. The increase in the available appropriations beyond what Congress authorized implies a violation of budget authority. 3. Inclusion of automatic appropriations in the GAA that increases total expenditures beyond what the Executive proposed. When automatic appropriations are incorporated in the GAA and is used as a ploy to increase general appropriations, the net effect is Congress has effectively increased the budget proposed by the executive which happened in 2008. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 14 In 2008, Congress reduced the amount appropriated for debt servicing. They were very sure that the peso will remain at Ph42 to the US dollar but that did not happen and the deduction made cannot be restored. One can never tell when automatic appropriations will be such amount. It is something that is not cut because it depends on factors like the exchange rate. When you reduce something that should be automatically appropriated and you use that amount to increase expenditures in the GAA, you have effectively increased the budget proposed by the president. Such violates the Constitutional provision that Congress cannot increase the appropriations for general operations of the government as submitted by the President. 4. Non-release or delayed release of authorized appropriations. One of the reasons why the DBM is not releasing the increased appropriations for 2008 funded from the debt service fund is because they know they will exceed their program for 2008. The major impact of which, programs/projects intended to be undertaken by Congress are not implemented or delayed, and the Executive overrides the mandate of law as enacted by Congress. 5. Use of unreleased appropriations by transferring savings and using amounts for other purposes. This result in the delay or non-implementation of the programs or projects intended to be undertaken by Congress and the Executive Branch overrides the mandate of law as enacted by Congress. 6. Laxity in the use of intelligence or confidential funds. There is a mechanism for making people honest about intelligence and confidential funds which is to create a bipartisan select committee in Congress with similar nature as the Commission on Appointments. The members of such committee are allowed to scrutinize how the intelligence and confidential funds were used but are not allowed to divulge any information. However, there is still the possibility that the person using the intelligence fund can deceive the members of the committee. Still, such a mechanism is better rather than none at all. 7. Abuse of unprogrammed funds. The unprogrammed funds were created to have ready funds to draw from times of emergency since it is difficult to get an appropriation from Congress. It is to be able to expedite the appropriation in cases where such appropriations are very significant. However, experience shows that it has been abused. 8. Locus of responsibility in the event of a fiscal crisis falls on the executive branch. At present, when there is a fiscal crisis, it is the executive that takes the responsibility. For example, revenues have gone down, there is a slowdown in the economy, there is a recession abroad and revenues are not met, the responsibility squarely falls on the executive. The executive then imposes reserves or suspends appropriations to manage the deficit. It is common sense that the executive reduces expenditures for the fiscal situation to be manageable. But then it goes against the grain of the authority of the GAA to spend, not an authority to withhold. This is not clear in the budget law. In other countries, the responsibility falls on both the executive and legislative branches. If an emergency like that happens, the executive will prepare a report to Congress and informs the latter of the policy that it wants to implement and it will be Congress that will decide whether or not to withhold funds. This clearly is a policy issue not an implementing issue. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 15 9. Inadequate reportorial responsibilities; financial reports oftentimes not submitted. The move of the government to computerize and institute an integrated financial management information system is in the right direction. 10. Inadequate technical oversight. If implementing agencies do not comply or the executive in reporting, it is because the technical oversight of Congress is not good. Chapter 1: General Provisions Section 1. Constitutional Policies on the Budget. (2) The Congress may not increase the appropriations recommended by the President for the operation of the Government as specified in the budget. The form, content and manner of preparation of the budget shall be prescribed by law. However, Congress effectively increases “…appropriations…for the operation of the government as specified in the budget…” when automatic appropriations are reduced and programmed General Appropriations are increased. The proposal is clarify appropriations for the operation of the government as specified in the budget as referring to the programmed component of appropriations through amendment in Budget Law. Alternatively, unprogrammed appropriation from GAA should be removed. To illustrate: TABLE 1: COMPARISON OF PROPOSED VS. APPROVED BUDGET Planned Proposed by President 1,100 ------------1,000 100 General Appropriations Programmed Unprogrammed Supplemental Automatic Interest Payments Others TOTAL APPROPRIATIONS Less: Unprogrammed TOTAL BUDGET/ EXPENDITURES Approved by Congress - Implemented 1,100 ------------1,070 30 - 1,100 ------------1,070 30 - 350 --------300 50 1,450 280 --------230 50 1,380 350 --------300 50 1,450 100 30 30 1,350 1,350 1,420 Appropriations is what the Congress authorizes while the budget or expenditure is what is actually implemented. A budget can be sourced from several appropriation sources such as the GAA, the automatic and continuing, the so-called supplemental appropriations. From the table, the first column is what the President proposed, a budget of Php1.35T of which Php1.1B will be taken from general appropriations and automatic is Php350B that amounts to 1.4T. There are Php100M of unprogrammed which is just a standby authority and it has no POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 16 money. If an agency puts a request in the unprogrammed, it means that no funds would be released. The real budget is just the Php1.35T. In this particular illustration, it is assumed that there are no supplemental appropriations. If Congress deducts Php70M from automatic appropriations, it would become Php280B while the Php70M is included in the programmed funds. Thus, the general appropriations of Php1.1T remain unchanged and the automatic fund was reduced which would make the total appropriation appear to have decreased also. The increase in Php70M in the programmed funds was actually deducted from the unprogrammed so that the total budget is still the same. Assuming that there are no unreleased funds, the entire Php1,070 will be used but the automatic did not decrease because you never know when it is going to be so. Supposing you still spent Php350B, the total budget is actually Php1.420T and not Php1.35T as intended by the Executive. This is the implication of reducing the automatic appropriations and putting it in the GAA. The Supreme Court has a ruling that when Congresss does this, it is unconstitutional. (3) No provision or enactment shall be embraced in the general appropriations bill unless it relates specifically to some particular appropriation to which it relates. Often times there are “riders” included in the general appropriations bill (GAB) such as special provisions for automatically appropriated funds. The Supreme Court has already declared that riders are unconstitutional and should no longer be included in the subsequent GAB. A new provision in the budget law should be incorporated. (5) A special appropriations bill shall specify the purpose for which it is intended, and shall be supported by funds actually available as certified by the National Treasurer or to be raised by a corresponding revenue proposal therein. If you want to submit a special appropriation, it means there should be a source of funds. What happens is expenditure bills are passed without funding source which becomes unfunded appropriations Congress oftentimes files expenditure bills without corresponding funding source. Such bills, when enacted, are considered enabling bills and not appropriation bills. Funding will be provided in subsequent GAAs when funds are available. This practice has resulted in unfunded laws. It is proposed to incorporate a new provision in the budget law clarifying the status of unfunded expenditure laws. (6) No law shall be passed authorizing any transfer of appropriations. However, the President, the President of the Senate, the Speaker of the House of Representatives, the Chief Justice of the Supreme Court and the heads of Constitutional Commissions may, by law, be authorized to augment any item in the general appropriations laws for their respective offices from savings in other items of their respective appropriations. The law states that transferring appropriations is prohibited. But appropriations may be transferred within the 3 branches of government (Congress, Executive, Judiciary) through the use of savings within their respective jurisdiction. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 17 In cases of transfer, the proposal is to clarify the definition of savings: will savings mean allotments that have already been used or can you include unreleased allotments/appropriations as savings. There is a need to clarify this because at present there is a very generous interpretation of savings. It includes allotments that were not released and there is no intention to have it released. However, it is another issue if it is unreleased because they want to use it for other purposes which is a technical malversation because it is going against what the intention was.. (7) Discretionary funds appropriated for particular official shall be disbursed only for public purposes to be supported by appropriate vouchers and subject to such guidelines as may be prescribed by law. Discretionary funds are subject to abuse. Perhaps a Legislative Select Committee should be created to provide oversight over discretionary, intelligence, and confidential funds. The committee will be bipartisan, and members shall be bound by an oath of confidentiality. And a new legislation should be enacted for the purpose. Even with the Commission on Audit, the nature of the audit of intelligence funds is only through submission of a certification. (8) If, by the end of any fiscal year, the Congress shall have failed to pass the general appropriations bill for the ensuing fiscal year, the general appropriations law for the preceding fiscal year shall be deemed reenacted and shall remain in force and effect until the general appropriations bill is passed by the Congress. The Philippine fiscal year is from January to December which is equivalent to one calendar year. The GAA is always stated as an act for the operations of the national government from January 01 to December 31 for the fiscal year X. The budget for the year 2007 was approved in March and because there was no budget yet by January to March, the executive implemented Php195B which came from the budget for 2006 that is chargeable against the re-enacted budget. When the 2007 budget was passed in March, the amount that Congress approved was P635B which the government made effective in April only. Thus, the PhP635 budget intended for one whole fiscal year, from January to December 2007 was used only for nine months. The budget then became PhP830B when the authority is PhP635B only. This is the practice now. FIGURE 1: MISUSE OF THE FY 2007 REENACTED BUDGET January 01 (FY 2007) December 31 (Php 635B) Php1.215T released and used from April 2007 FY 2006 Reenacted budget Php 195B = 36B over released + 106B overall savings + unreleased POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 18 The re-enactment of the budget happens all the time but the practice with the amount approved for the fiscal year, is considered as a budget for one year (January – December). As such, the authority is Php635B and the PhP 195B is then deducted. In effect, the PhP195 B is an advanced release for the PhP635B budget. So the allegation that it is the usual practice is a lie. However, DBM said that the PhP195B wasn’t all used up because there were savings and unprogrammed funds. On an overall basis, what they used was PhP36B, which is the minimum level that they used as reflected on the documents that DBM submitted to Congress. The excess was used to augment the departments’ budgets. A very clear example is the Department of National Defense-Office of the Secretary with its re-enacted budget of PhP592M (Jan-Mar) yet authority for the whole year is PhP576M (Jan-Dec). From here, one can see that the first quarter budget is bigger than the fiscal year’s budget and their total budget then was doubled, PhP1.169B. This is a consequence of how the re-enacted budget is practiced which is true for all departments, no exception. This also means that approval of the budget could be done until November so one can use the re-enacted budget of the previous year from January to November and use for one month the entire budget for the year. An issue that also arises from this practice if you say that you used the amount for salaries yet no additional manpower was hired. There are internal rules to make sure that this doesn’t happen but if you want to violate it, no one can prevent you. And it is rampantly being violated. In 2007, the revenue performance was good which is why the excess in expenditures did not come out as deficit. The practice of the Executive Branch of adding reenacted portion of the previous year’s general appropriations to the current appropriations in determining authorized budget is untenable. This can be solved by specifically prohibiting addition of the reenacted appropriation to the current appropriations as this violates the concept of one fiscal year which is only 12 months. Likewise, a new provision should be incorporated in the budget law to ensure that this is followed. Alternatively, Congress should pass a Congressional Resolution in the event of failure to enact new appropriations. The table in the next page illustrates that the Executive released Php37B more than what they should have released. They practically used the entire FY 2007 budget and released Php37B from the reenacted budget which is not a correct way to interpret the reenacted budget. The implication of the over releases in allotment is that the agencies over obligated by an amount equivalent to Php26B. (9) Fiscal autonomy shall be enjoyed by the Judiciary, Constitutional Commissions, Office of the Ombudsman, Local Government and Commission on Human Rights. There has never been any law passed defining what fiscal autonomy is and what it entails. As such, the agencies with fiscal autonomy interpret it in their own way. It is necessary to clarify the meaning of fiscal autonomy through an amendment in the budget law. Alternatively, enact a new law on fiscal autonomy. Chapter 3: Budget Preparation Section 11. Submission of the Budget. - The President may transmit to the Congress from time to time, such proposed supplemental or deficiency appropriations as are, in his judgment, (1) necessary on account of laws enacted after the POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 19 transmission of the Budget, or (2) otherwise needed in the public interest.. TABLE 2: CALCULATION OF EXCESS RELEASES AND OBLIGATIONS Proposed Approved 641,120,897 Reenacted, 2006 Revised Allotment Releases Obligations NEP 2008 NEP 2009 635,041,878 635,041,878 635,041,878 - - - 195,310,127 Continuing - - 40,126,566 47,362,534 712,199,877 Automatic 552,226,582 552,226,582 552,226,582 532,850,527 532,850,527 1,193,347,479 1,187,268,460 1,227,395,026 1,410,565,066 GAA TOTAL Appropriations 1,410,565,066 Allotments 1,245,050,404 LESS: Unreleased appropriations Unobligated allotment Unprogrammed Programmed Appropriations - - - - 165,514,662 - - - - - - 89,541,646 67,008,479 61,129,460 61,129,460 31,043,977 - - 1,126,339,000 1,126,139,000 1,166,265,566 1,379,521,089 Allotments 1,245,050,404 Obligations 1,155,508,758 Excess Allotment 36,892,623 Excess Obligations 26,515,620 Once the General Appropriations is submitted, the President is authorized to submit a supplemental or deficiency appropriation. It is proposed to clarify what supplemental, deficiency or special appropriations is since each is governed by a specific rule. And incorporate a clarificatory provision in the budget law. Section 13. Budget Levels. Proposals creating additional sources of funds shall be prepared in the form of revenue bills. A clarificatory provision should be incorporated in the budget law in relation to the special appropriations. Chapter 4: Budgetary Authorization Section 25. Prohibition Against Enactment of Additional Special Provisions. - The Congress shall not add special provisions in the budget earmarking the use of appropriations for specific programs or activities nor shall it increase the amounts specified in special provisions beyond those proposed by the President. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 20 This provision should be omitted from the budget law because it is an encroachment of Congressional power. Congress violates this legal provision often and the Executive vetoes. Section 26. Automatic Appropriations. - All expenditures for (1) personnel retirement premiums, government service insurance, and other similar fixed expenditures, (2) principal and interest on public debt, (3) national government guarantees of obligations which are drawn upon, are automatically appropriated: provided, that no obligations shall be incurred or payments made from funds thus automatically appropriated except as issued in the form of regular budgetary allotments. GFIs/GOCCs have abused the power to borrow due to automatic guarantee by the national government. These institutions borrow yet they do not have the capacity to pay and in turn the National Treasury pays for their debts. Hence, the budget law should be amended particularly deleting the provision on automatic appropriations for guaranteed obligations to encourage GFIs/GOCCs to maintain fiscal discipline. Section 27. Supplemental Appropriations. - All appropriation proposals shall be included and considered in the budget preparation process. After the President shall have submitted the Budget, no supplemental appropriation measure supported from existing revenue measures shall be passed by the Congress. However, supplemental or deficiency appropriations involving the creation of new offices, programs or activities may be enacted if accompanied and supported by new revenue sources. Supplemental appropriations should be rationalized together with special and deficiency appropriations. Section 28. Reversion of Unexpended Balances of Appropriations, Continuing Appropriations. - Unexpended balances of appropriations authorized in the General Appropriation Act shall revert to the unappropriated surplus of the General Fund at the end of the fiscal year and shall not thereafter be available for expenditure except by subsequent legislative enactment: Provided, that appropriations for capital outlays shall remain valid until fully spent or reverted: provided, further, that continuing appropriations for current operating expenditures may be specifically recommended and approved as such in support of projects whose effective implementation calls for multi-year expenditure commitments: provided, finally, that the President may authorize the use of savings realized by an agency during given year to meet non-recurring expenditures in a subsequent year. The general rule is that funds unused are reverted back to the general fund. The final exception in this proviso gives the President authority to use savings realized by an agency during a given year to meet non-recurring expenditures in a subsequent year. If this provision remains, all unutilized savings will continue to be used in the succeeding years. This authority is subject to abuse and encroaches on congressional power of the purse. Actual savings should only be used during the year of appropriations. The use of actual savings in subsequent year should be subject to congressional legislation. The final provision should be deleted from the budget law. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 21 Section 29. Loan Proceeds. - Expenditures funded by foreign and domestic borrowings shall be included within the expenditure program of the agency concerned. Loan proceeds, whether in cash or in kind, shall not be used without the corresponding release of funds through a Special Budget as herein provided. Sometimes there are loans that are availed of not in the form of cash but in kind. For example, a funding organization agrees to lend but instead of giving cash, they will provide equipments. Before the equipment or material can be delivered, DBM should release an allotment for the loan to authorize the availment from the loan and the expenditure of the loan. However, oftentimes this is violated by implementing agencies specially in cases of loans availed of under direct payment or supplier’s credit methods. The creditor or the supplier already delivers the equipment even if it has not been appropriated and no allotment has been released for that purpose. Thus, the agency spends without authority. Therefore, there is a need to clarify prohibition in a stronger language and amend the budget law to prevent the availment of loans prior to an appropriation and prior to the release of an allotment. Chapter 5: Budget Execution Section 32. Use of Appropriated Funds. All moneys appropriated for functions, activities, projects and programs shall be available solely for the specific purposes for which these are appropriated. A new provision should be incorporated in the budget law to clarify exception and to specify rules in cases where appropriations are not released intentionally. Section 33. Allotment of Appropriations. The Secretary shall have authority to modify or amend any allotment previously issued. In case he shall find at any time that the probable receipts from taxes or other sources of any fund will be less than anticipated and that as a consequence the amount available for the remainder of the term of the appropriations or for any allotment period will be less than the amount estimated or allotted therefor, he shall, with the approval of the President, and after notice to the department or agency concerned, reduce the amount allotted so as to conform to the targeted budgetary goals. This should be read in conjunction with the authority to impose appropriations reserves. Thus, reduction in allotments may only be allowed in the event of an unmanageable deficit but only after approval of the President and due notice to agencies involved. After the Asian financial crisis in 1998, DBM withdrew allotments so that the deficit would not be very high. All of the provisions on non release, authority to reduce or to withdraw should be consolidated and clarified so that these are not interpreted as separate provisions. Clarificatory provisions in the budget law should be incorporated. Section 37. Creation of Appropriation Reserves. The Secretary may establish reserves against appropriations to provide for contingencies and emergencies which may arise later in the calendar year and which would otherwise require deficiency appropriations. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 22 The establishment of appropriation reserves shall not necessarily mean that such portion of the appropriation will not be made available for expenditure. Should conditions change during the fiscal year justifying the use of the reserve, necessary adjustments may be made by the Secretary when requested by the department, official or agency concerned. Use of reserves should only be allowed when revenues fall short of target. Once lifted, reserves should be returned to the agencies. In the event new funding requirements are identified, supplemental of deficiency appropriations must be passed. There is a possibility of abuse of power of suspension because nobody keeps track of the reserves. The real intention is to return it to the agency that owned the appropriations. It is necessary to clarify the policy in instances of reserves. Section 38. Suspension of Expenditure of Appropriations. Except as otherwise provided in the General Appropriations Act and whenever in his judgment the public interest so requires, the President, upon notice to the head of office concerned, is authorized to suspend or otherwise stop further expenditure of funds allotted for any agency, or any other expenditure authorized in the General Appropriations Act, except for personal services appropriations used for permanent officials and employees. The Executive can suspend appropriations that may be used for other purposes which is an encroachment of Congressional Power. The proposal is to clarify condition for suspension. Alternatively, there should be prior notice to Congress or delete the provision. Chapter 6: Budget Accountability Section 51. Evaluation of Agency Performance. The President, through the Secretary shall evaluate on a continuing basis the quantitative and qualitative measures of agency performance as reflected in the units of work measurement and other indicators of agency performance, including the standard and actual costs per unit of work. The budget law should be revised to incorporate results-based budgeting system. Other New Provisions: • New provision to regulate unprogrammed funds or to prohibit the appropriation thereof. A provision on the unprogrammed fund should be included in the budget law and not only in the GAA. o The unprogrammed component (of foreign assisted projects) pertains only to those that are newly contracted. For if it were contracted, it is in the budget already. The debt service will not include those that are not still in the unprogrammed. No way can they put in the debt service program the servicing of the debt that is still to be contracted. • New provision to require the submission of a comprehensive budget, including offbudget accounts and so that Congress could do oversight over the budget. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 23 o D. Off-budget accounts are created by Congress. The executive cannot create offbudget accounts. However, the issue is that they are not reported entirely and there is no limit for it. • New provision to strictly enforce reportorial requirements among agencies and provide penalties in cases of violation. • New provision on budget transparency and public reporting of budget releases. Budget Reform Bills filed in 2008-2009 As a result, legislators filed proposed amendments to the budget law in the first quarter of 2009. Three bills were filed by Senators Benigno Aquino III and Mar Roxas, and four House Bills by Representatives Risa Hontiveros-Baraquel and Emiliio Abaya. 1. Senate Bill 3121, “The Budget Impoundment Control Act” by Senator Benigno Aquino III 2. Senate Bill 2995, "Budget Impoundment Control Act" and Senate Bill 2996, "Budget Reform Act of 2009" by Senator Mar Roxas 3. House Bill 6026, “Impoundment Control and Regulation Act of 2009” and House Bill 6027, “Savings and Augmentation Act of 2009” by Rep. Risa Hontiveros-Baraquel 4. House Bills 6030 and 6031, “An Act Prescribing Reforms in National Government Budgeting, Amending for These Purposes Pertinent Provisions of Book VI of Executive Order 292, Otherwise Known as the Revised Administrative Code of 1987, and Providing for Other Related Purposes” by Rep. Joseph Emilio Abaya These are in addition to the bills earlier filed focused in reforming the Administrative Code of 1987 particularly provisions governing the national budget processes. Senator Panfilo Lacson filed the Senate Bill 3020, People’s Participation in Budget Deliberations Act and the House Bill 5580, Impoundment Control Act of 2008 by Representative Teofisto Guingona III. III. CONCLUSION These draft legislations seek to address the misuse and abuse of the Executive’s discretionary powers over the budget specifically on savings, impoundment, and lump sum appropriations. This abuse in power is evident whenever there is a huge discrepancy between the President’s budget proposal and what the Congress approves. If the Executive and the Legislative would not arrive at a consensus to address such discrepancies, it leads to the reenactment of the annual budget. The reenacted budget is more beneficial to the President giving her the power to disburse the budget based on her discretion. The proposed amendments in the Administrative Code aim to restore balance over the power of the purse, particularly Congress’ power of check and balance over the Executive in the process, approval, and execution of the national budget. The revisions in the existing budget law advocate for the effective implementation of the budget to achieve transparency and accountability. POWER OF THE PURSE REFORM IN THE PHILS: PROPOSED REVISIONS TO 1987 ADMIN CODE 24