Transfer Pricing, Section 482, and International Tax Conflict

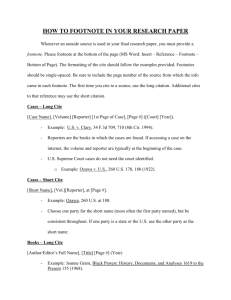

advertisement