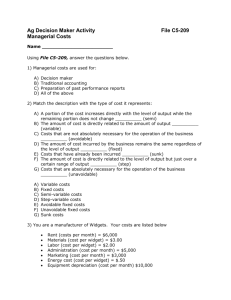

Cost Allocation and Pricing

advertisement