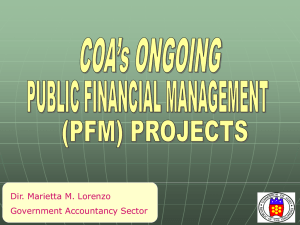

Updates on Accounting and Auditing Reforms

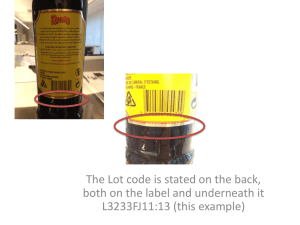

advertisement

Updates on Accounting and Auditing Reforms LOURDES M. CASTILLO Assistant Commissioner Government Accountancy Sector Commission on Audit Delivered during the 35th ANC of the Government Association of Certified Public Accountants Crown Regency Suites and Residences April 17-20, 2013 1 Topical Outline 1. COA-DBM Joint Circular No. 2013-1 dated March 15, 2013 “Revised Guidelines on the Submission of Quarterly Accountability Reports on Appropriations, Allotments, Obligations and Disbursements” 2. COA Circular No. 2013-002 dated January 30, 2013 “Adoption of the Revised Chart of Accounts for National Government Agencies” 2 3. COA Resolution No. 2013-007 dtd. January 29, 2013 “Adoption of the Philippine Public Sector Standards for Auditing” 4. COA Circular No. 2012-005 dtd. December 07, 2012 “Revocation of COA Circular No. 2009-008 dated November 9, 2009 and Prescribing the Use of Punong Barangay’s Certification (PBC) and COA Auditor’s Advice (CCA)” 5. COA Circular No. 2012-004 dtd. November 28, 2012 “Demand for the Immediate Liquidation and Settlement of All Cash Advances Outstanding as of December 31, 2011” 3 Revised Guidelines on the Submission of Quarterly Accountability Reports on Appropriations, Allotments, Obligations and Disbursements 4 Legal Basis COA-DBM Joint Circular No. 2013-1 dated March 15, 2013 5 Rationale • The DBM and COA, as oversight agencies on Financial Management require agencies to submit on a regular basis, Budget and Financial Accountability reports. • The DBM uses the budget and accountability reports in monitoring the agencies’ performance and providing the President and other fiscal agencies, the necessary information for policy making. • The COA uses the data in the Financial Statements to prepare the Annual Financial Report of Allotments, Obligations and Disbursements being submitted to the President and Congress, pursuant to R.A. 7226 dtd. March 12, 1992. 6 Purpose 1. To prescribe harmonized formats of the financial accountability reports (FAR) on appropriations, allotments, obligations, disbursement authorities, disbursements and balances; and 2. To prescribe guidelines on the preparation and timely submissions of FARs by the agencies to the DBM and the COA after the end of each quarter. 7 Coverage The Circular covers all departments, bureaus, offices and agencies of the national government and government-owned and/or controlled corporations maintaining Special Accounts in the General Fund. 8 Definition of Terms 1. Appropriation – an authorization made by law or other legislative enactment, directing the payment of goods and services out of government funds under specified conditions or for specified purposes. 2. Allotment – a specific authority in the form of Agency Budget Matrix (ABM) or Special Allotment Release Order (SARO) issued by DBM to identified agencies to incur obligations not exceeding a given amount during a specified period for the purpose indicated therein. 9 3. Sub-Allotment – a specific authority in the form of SubAllotment Release Order (Sub-ARO) issued by the Central Office (CO)/Regional Office (RO) of a department/office/agency to its ROs/lower operating units (i.e. field office, district office or provincial office ) which allow them to incur obligations within a specified amount during a specified period. The Sub-ARO should not exceed the allotment releases to the CO. 4. Obligation – a commitment by the government agency arising from an act of a duly authorized official which binds the government to the immediate or eventual payment of a sum of money. The agency is authorized to incur obligations only in the performance of activities which are in pursuit of its functions and programs authorized in the appropriation acts/laws within the limit of the allotment released by the DBM. 10 7. Commitment – an obligation incurred by government agencies for which items have not yet been delivered and services not yet rendered. This is also called “Obligations Not Yet Due and Demandable”. 8. Unpaid Obligation – this is the balance of an accounts payable or commitment. 9. Operating Unit – a “national government agency” or a unit thereof receiving direct release of a Notice of Cash Allocation (NCA) from the DBM. 11 Guidelines A. The head of each operating unit (OU), office or agency shall be responsible for the timely submission, either physically or electronically, the following FARs to the DBM and COA (Audit Team Leaders and the Government Accountancy Sector (GAS) not later than the 30th day after the end of each quarter: 1. Statement of Appropriations, Allotments, Obligations Disbursements and Balances (SAAODB) 2. List of Agency Budget Matrix (ABM) or SAROs and Sub-AROs 3. Detailed Statement of Current Year’s Obligations, Disbursements and Unpaid Obligations (SODUO-CY) 4. Summary of Prior Year’s Obligations, Disbursements and Unpaid Obligations (SODUO-PY) 5. Summary of Report of Disbursements 12 B. The FARs prescribed in the Circular shall replace the following DBM and COA reports as follows: 1. DBM Statement of Allotments, Obligations and Balances (SAOB) – BAR No. 4 Financial Report of Operations (BAR No. 2) Monthly Report of Disbursements – Bar No. 3 2. COA SAOB Detailed Breakdown of Obligations Detailed Breakdown of Disbursements Regional Breakdown of Expenses Statement of Cumulative Allotments, Obligations Incurred and Unobligated Balances Detailed Statement of Cumulative Expenditures/Obligations Incurred, Obligations Liquidated/Disbursements and Unliquidated Obligations 13 Responsibilities 1. The FARs shall be prepared and certified correct by the following officials: Budget Officer/Head of Budget Unit – for the portion of the report pertaining to appropriations, allotments, obligations, unobligated allotments and unreleased appropriations Chief Accountant/Head of Accounting Unit – for the portion of the report pertaining to appropriations, allotments, obligations, unobligated allotments and unreleased appropriationsChief Accountant/Head of Accounting Unit – for the portion of the report pertaining t disbursement and unpaid obligations The FARs shall be signed by the Agency Head as the approving official. He/she shall ensure the timely submission of the accurate and reliable FARs. 14 Due Dates of Submission to COA and DBM All Departments/Agencies – not later than the 30th day after the end of each quarter The Lower Operating Units – within (5) days after the end of each quarter for consolidation The Agency Regional Offices – to submit the consolidated report to COA (GAS) and DBM CO within (10) days after the end of each quarter 15 Penalty Clause COA and DBM shall regularly monitor agency/OU compliance with the reporting requirements prescribed in the Circular. For failure to submit the FARs, the “no report, no release” policy of the DBM shall be enforced. Administrative sanctions on the automatic suspension of the payment of salaries of the officials concerned. Violation for three (3) times without justifiable cause during the year, shall constitute a ground for the filing of an administrative/disciplinary action against the officials for inefficiency and incompetence. 16 COA REVISED CHART OF ACCOUNTS 17 Legal Basis COA Circular No. 2013-002 dated January 30, 2013 Effective Date: January 01, 2014 18 Objectives To provide new accounts for the adoption of the Philippine Public Sector Accounting Standards (harmonized with IPSAS) To provide uniform accounts for national government accounting and budget systems to facilitate the preparation of harmonized financial and budgetary accountability reports 19 Objectives To expand the account code from three (3) digits in the NGAS Chart of Accounts to eight (8) digits, to allow expansion or creation of new accounts as may be necessary to implement new standards or policies and provide up to four levels of consolidation depending on the users’ information needs. 20 Major Changes a. Coverage is limited only to all national government agencies and GOCCs receiving funds constituted as SAGF from the National Government b. Expanded account code structure from three (3) digits to eight (8) digits 21 Account Code Structure 22 Account Groups Codes are assigned to account groups to facilitate location of accounts in the general and subsidiary ledgers, to provide systematic arrangement and classification of accounts and facilitate preparation of the consolidated financial reports as follows: Code 1 2 3 Account Groups Assets Liabilities Equity 23 Asset without Contra Account Ex. Cash, Collecting Officer 24 Asset with Contra Account Ex. Accounts Receivable Asset with contra account 1 03 01 01 0 1 03 1 01 1 Asset Asset Receivables Receivables Loans and Receivable Loans and Receivable Accounts Accounts Accounts Receivable Accounts Receivable Allowance for Impairment General Ledger Receivable Accounts Contra-Account 25 Asset with Contra Account Ex. Allowance for Impairment – Accounts Receivable Asset with contra account 1 03 1 01 1 1 03 01 01 1 Asset Receivables Loans and Receivable Accounts Accounts Receivable Allowance for Impairment Accounts Receivable 26 Major Changes c. New accounts were provided for the implementation of the Philippine Public Sector Accounting Standards (PPSAS) 27 New Accounts Example: 1 02 01 010 1 02 02 011 Financial Assets Held for Trading Allowance for Impairment Investments in Treasury Bills Local in compliance with IPSAS 28-30 in compliance with IPSAS 29 (Financial Instruments Recognition and Measurement) 1 03 02 020 1 03 02 021 Finance Lease Receivable Allowance for Impairment Finance Lease Receivables Investment Property, Buildings Accumulated Depreciation Investment Property, Buildings Accumulated Impairment Losses Investment Property, Buildings in compliance with IPSAS 13 (Leases) in compliance with IPSAS 13 (Leases) 1 05 01 020 1 05 01 021 1 05 01 022 in compliance with IPSAS 16 (Investment Property) in compliance with IPSAS 16 (Investment Property) in compliance with IPSAS 26 (Impairment of Cash Generating Assets) 28 New Accounts 1 01 04 010 1 01 04 020 1 01 04 030 Cash-Treasury/Agency Deposit, Regular Cash - Treasury/Agency Deposit, Special Account Cash - Treasury/Agency Deposit, Trust 29 Major Changes d. Some accounts were deleted since these accounts are for use by local government units or governmentowned and/or controlled corporations, while other accounts are no longer applicable to national government agencies. 30 Deleted Accounts Example: 31 Major Changes e. Some accounts were either expanded or compressed. For instance, expense accounts for repairs and maintenance and depreciation of property, plant and equipment which were previously presented per asset account were compressed based on the major account classification 32 Compressed Accounts Example: 811 Repairs and Maintenance 5 02 13 040 Repairs and Office Buildings Maintenance812 Repairs and Maintenance Buildings and Other School Buildings Structures 813 Repairs and Maintenance Hospitals and Health Centers 814 Repairs and Maintenance Market and Slaughterhouses 815 Repairs and Maintenance Other Structures 33 Compressed Accounts Example: 811 Depreciation-Office Buildings 812 Depreciation-School Buildings 813 Depreciation-Hospitals and Health Centers 814 Depreciation-Market and Slaughterhouses 815 Depreciation-Other Structures 5 05 01 040 Depreciation Buildings and Other Structures 34 Repairs and Maintenance – Buildings and Other Structures Subsidiary Ledgers: 01 - Buildings 02 - School Buildings 03 - Hospitals and Health Centers 04 - Markets 05 - Slaughterhouses 06 - Hostels and Dormitories 99 - Other Structures 35 Depreciation - Buildings and Other Structures Subsidiary Ledgers: 01 - Buildings 02 - School Buildings 03 - Hospitals and Health Centers 04 - Markets 05 - Slaughterhouses 06 - Hostels and Dormitories 99 - Other Structures 36 Expanded Account Example: 716 Subsistence, Laundry 5 01 02 050 Subsistence and Quarters Allowance Allowance 5 01 02 060 Laundry Allowance 5 01 02 070 Quarters Allowance 37 Expanded Account Example: Cash - National Treasury, Modified Disbursement System (MDS) 1 01 04 040 Cash-Modified Disbursement System (MDS), Regular 1 01 04 050 Cash-Modified Disbursement System (MDS), Special Account 1 01 04 060 Cash-Modified Disbursement System (MDS), Trust 38 The Revised Chart of Accounts As Object Code in the Unified Account Code Structure 39 Purposes of Object Classification and Coding To capture all financial transactions such as goods or services acquired, payments made, revenue sources and the causes of increases or decreases in assets and liabilities. To enable the classification and coding of transactions for reporting of impact of government revenues and expenditures on the economy as well as internal departmental analysis and decisionmaking by oversight agencies. 40 The object coding in the information system provides a repository of government-wide information which can be used by oversight agencies without requiring departments and agencies to respond to individual requests. Provides a basis for coding the object classification which uses accrual accounting requiring transactions to be recorded in the period when they occur and not only when cash or equivalents are received or paid. 41 The Unified Account Code Structure FUNDING SOURCE 6Digits ORGANIZATION 12 digits LOCATION 9 digits MFO/PROGRA M, ACTIVITY and PROJECT 9 digits Financin g Source 1 digit Department Agency Operating 2 digits 3 digits Unit 7 digits Region Province City, Barangay 2 digits 2 digits Municipa 3 digits lity 2 digits MFO/PAP Code COACo Sub9 digits A*Obje Object ct8 2 digits digits Required Required Optional Unique for each Department/Agenc y Required Authorization Fund Category 2 digits 3 digits Required Required Optional OBJECT CODE 10 digits Uniform across Government 42 The Unified Account Code Structure (UACS) Jointly developed by DBM, DOF and COA It is a government-wide coding framework to provide a harmonized budgetary and accounting code classification that will facilitate reporting of actual revenues and collections and expenditures compared with programmed revenues and expenditures, starting fiscal year 2014 43 The UACS is to be adopted in identifying, aggregating, budgeting, accounting, auditing and reporting the financial transactions of the government. Enhance the quality and timeliness of financial data for the generation of the required reports and analysis of the same. Strengthen financial controls and accountability. 44 Key Elements of the UACS Funding Source Codes: Six (6) digit code to reflect the Financing Source, Authorization and Funding Category Organization Codes: Twelve (12) digit code to reflect the Department, Agency and SubAgency or Operating Unit/Revenue Collecting Unit 45 Location Codes: Nine (9) digit code to reflect the Region/Province/Municipality/Barangay following the Philippine Standard Geographic Code prescribed by the National Statistical Coordination Board Major Final Output (MFO)/Program, Activity and Project (PAP) codes: Nine (9) digit code to reflect the MFO/PAP codes Object codes: Assets, Liabilities, Equity, Revenues, and Expenses following the COA Chart of Accounts by object and sub-objects provided by BTr, BIR, DOF, BOC and DBM 46 Object Code Structure in UACS OBJECT CODE 10 digits COA Revised Chart of Accounts 8 digits DBM Sub-Object Code 2 digits 47 Account Code Structure in UACS Generally, the account code structure below shall be followed. Account Code Structure 8 digits FS Element 1 digit Major Summary Account Account 2 digits 2 digits GL Account 3 digits FS Elements: 1 Assets 2 Liabilities 3 Equity 4 Income 5 Expenses 48 Sub-Object Code If disaggregation is necessary, sub object codes of two digits shall be used to show the breakdown of selected assets, income and expenses, otherwise, two zeros will be used. The responsibility for disaggregation and sub-coding of the following accounts are as shown below. Accounts Cash in Bank Taxes Import Duties Non-Tax Revenues Personnel Services MOOE Capital Outlays Agency Responsible for Disaggregation BTr BIR BOC DOF/BTr DBM DBM DBM 49 COA Resolution No. 2013-007 dated January 29, 2013 “Adoption of the Philippine Public Sector Standards for Auditing” 50 Twenty-four (24) PPSSAs already adopted Eleven (11) PPSSAs are being finalized for submission to the Commission Proper for approval Eighteen (18) ISAs / ISSAs are ongoing evaluation for adoption as PPSSAs 51 PPSSA Book 1 PPSSA 20 - Principles of Transparency and Accountability PPSSA 30 - Code of Ethics PPSSA 40 - Quality Control for the Commission on Audit PPSSA Book II – Volume 1 PPSSA 100 - Basic Principles in Government Auditing PPSSA 200 - General Standards in Government Auditing and Standards with Ethical Significance PPSA 300 - Field Standards in Government Auditing PPSSA 400 - Reporting Standards in Government 52 Auditing PPSSA Book II – Volume 3A – Part 1 PPSSA 1200 - Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with International Standards on Auditing PPSSA 1210 - Agreeing the Terms of Audit Engagements PPSSA 1220 - Quality Control for an Audit of Financial Statements PPSSA 1230 - Audit Documentation 53 PPSSA Book II – Volume 3A – Part 2 PPSSA 1240 - The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements PPSSA 1250 - Consideration of Laws and Regulations in an Audit of Financial Statements PPSSA 1260 - Communication with Those Charged with Governance PPSSA 1265 - Communicating Deficiencies in Internal Control to Those Charged with Governance and Management 54 PPSSA Book II – Volume 3B – Part 1 PPSSA 1300 - Planning an Audit of Financial Statements PPSSA 1315 - Identifying and Assessing the Risks of Material Misstatement Through Understanding the Entity and Its Environment PPSSA 1320 - Materiality in Planning and Performing an Audit PPSSA 1330 - The Auditor’s Responses to Assessed Risks PPSSA 1402 - Audit Considerations Relating to an Entity Using a Service Organization PPSSA 1450 - Evaluation of Misstatements Identified During the Audit 55 PPSSA Book II – Volume 3D PPSSA 1700 - Forming an Opinion and Reporting on Financial Statements PPSSA 1705 - Modifications to the Opinion in the Independent Auditor’s Report PPSSA 1706 - Emphasis on Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report 56 Updates on Accounting Reforms Twenty-Three (23) PPSAS are prepared and are ready for focus group discussions prior to adoption Six (6) PPSAs remaining are 45% completed Revision of NGAS Manual is 83% completed Prescribed the necessary accounting guidelines and procedures on the reversion of dormant accounts and unnecessary Special and Trust Funds to the General Fund pursuant to the Permanent Committee Joint Circular No. 4-0012 dated September 11, 2012 implementing Executive Order No. 431 dated May 30, 2005 57 COA Circular No. 2012-004 dated November 28, 2012 “Demand for the Immediate Liquidation and Settlement of All Cash Advances Outstanding as of December 31, 2011” 58 Rationale As a general rule, cash advances must be liquidated within the prescribed periods depending on the nature and purpose of the cash advance: – – – – – Salaries and wages Petty and field operating expenses Local travel and foreign travel Honoraria and similar payments to officials and employees Expenses for special projects/activities such as anniversary celebration – Cultural and athletic activities The above cash advances must be liquidated within twenty (20) days from the accomplishment of the purpose. 59 Settlement and Liquidation of Cash Advance A cash advance is settled and liquidated either by: 1. Returning the money advanced if unspent, 2. Or by the presentation of regularly accomplished vouchers, giving satisfactorily detail of the items thereon paid which must be in accordance with the purpose for which the cash advance was granted, and further supported by proper receipts and other evidence of payment, subject to the result of the post-audit thereof by the auditor concerned. 60 Primary responsibility of Heads of Agencies Section 2 of Presidential Decree (P.D.) No. 1445, the Government Accounting Code of the Philippines, places the responsibility to faithfully take care that government funds and property be safeguarded from wastage directly with and primarily on the chief or head of the government agency concerned 61 Legal presumption against non-liquidation of cash advance Article 217 of the Revised Penal Code states in unequivocal terms that: “The failure of a public officer to have duly forthcoming any public funds or property with which he is chargeable, upon demand by any duly authorized officer, shall be prima facie evidence that he has put such missing funds or property to personal use.” 62 Final demand to settle unliquidated cash advance Final notice and demand is hereby made to all concerned to settle and liquidate all outstanding cash advances as of December 31, 2011, on or before January 31, 2013. Provided, however, that those who have been issued by the Commission on Audit notice and demand, prior to the issuance of this Circular, to settle and liquidate their cash advances within a specified period, shall do so within the period specified in the said notice. 63 This Circular shall serve as the demand required under appropriate law, rules and regulations to settle the accountable officer’s unliquidated cash advance as well as all those who are already separated from the service or have transferred to other agency. 64 Duties of Agency officials: a. On or before December 15, 2012, all heads of government agencies shall disseminate in writing this Circular to all Accountable officials and employees within their respective agencies and serve a written notice to and demand settlement of the outstanding cash advances as of December 31, 2011. b. The Chief Accountant shall, within the same period, furnish the head of agency and the head of the auditing unit thereat a list of accountable officers with unliquidated and outstanding cash advances. 65 Duties of the Commission on Audit: Ensure that the outstanding cash advances are liquidated within the specified periods Shall Evaluate the cash advances of Accountable Officers to determine compliance with pertinent COA Rules and Regulations and to report violations thereof Shall report on or before February 28, 2013 to the agency head and to the Director, FAIO, compliance with this Circular including the ageing of the cash advances showing the purpose and other information Submit to the respective COA Directors the vouchers and all supporting documents relative to the grant of the cash advance, copy furnished the COA Chairperson 66 COA Circular No. 2012-005 dated December 7, 2013 “Revocation of COA Circular 2009-008 dated Nov. 9, 2009 and Prescribing the Use of Punong Barangay’s Certification (PBC) and COA Auditor’s Advice (CAA)” 67 Salient Features The responsibility to initiate, process, approve financial transactions and issue Punong Barangay’s Certification (PBC) under oath rests with the Barangay officials. The PBC to be issued only under oath after the PB has duly examined and been satisfied that the: The DVs are duly certified and approved, The supporting documents are complete. The expenditure or disbursement is proper and valid, and 68 Salient Features The PB shall be primarily accountable for all losses arising from issuance of the PBC. The Authorized Government Depository Bank (AGDB) shall encash the checks issued if the corresponding PBC is issued. Checks encashed without the corresponding PBC or with falsified PBC shall be the responsibility of the AGDB. The PBC shall be numbered sequentially by year and by barangay and in (4) copies. 69 Salient Features The PBC (4th) copy shall be submitted to the accountant for recording within (10) days after end of month and subsequently submitted to the COA auditor for audit. Non-submission of PBCs within (15) days after demand by the Auditor shall be a ground for preparation of the COA Auditor’s Advice (CAA) to the AGDB to hold further payments of checks issued by the said barangay. 70 COA Circular No. 2012-003 dated October 29, 2012 “Updated Guidelines for the Prevention of Disallowance of Irregular, Unnecessary, Excessive and Unconscionable Expenses as enumerated under COA Circular No. 85-55A dated Sept. 8, 1985” 71 Legal Basis Section 2(2), Article IX-D of the 1987 Constitution Section 33 of P.D. 1445 72 Definitions 1. “Irregular” Expenditures Expenditure incurred without adhering to established rules, regulations, procedural guidelines, policies, principles or practices that have gained recognition in laws Transactions conducted in a manner that deviates or departs from, or which does not comply with standards set 73 2. “Unnecessary” Expenditures Expenditures which could not pass the test of prudence or the diligence of a good father of a family, thereby denoting non-responsiveness to the exigencies of the service Not supportive of the implementation of the objectives and mission of the agency relative to the nature of its operation Not dictated by the demands of good government, and those, the utility of which cannot be ascertained at a specific time Not essential or that which can be dispensed with without loss or damage to property 74 3. “Excessive” Expenditures Signifies unreasonable expense or expense incurred at an immoderate quantity and exorbitant price Includes expenses which exceed what is usual or proper, as well as expenses which are unreasonably high and beyond just measure or amount 75 4. “Extravagant” Expenditures Signifies those incurred without restraint, judiciousness and economy Exceeds the bounds of propriety Immoderate, prodigal, lavish, luxurious, grossly excessive, and injudicious 76 5. “Unconscionable” Expenditures Pertains to expenditures which are unreasonable and immoderate, and which no man in his right sense would make, nor a fair and honest man would accept as reasonable, and those incurred in violation of ethical and moral standards 77 Outline Fundamental Principles – PD 1445 General Requirements for all Types of Disbursements Specific Requirements for Each Type of Disbursement – Cash Advances – Fund Transfers to NGOs/Pos – Fund Transfers to Implementing Agencies/From Trust Fund to Gen Fund for Unspent Balance – Salary 78 – Allowances, Honoraria and Other Forms of – – – – – – – – Compensations Other Expenditures Extraordinary and Miscellaneous Expenses Prisoner’s Subsistence Allowance Procurement Cultural and Athletic Activities Human Resource Development and Training Program Financial Expenses Road Right-of-Way (ROW)/Real Property 79 Fundamental Principles, Sec. 4, P.D. 1445 No money shall be paid except in pursuance of an appropriation law or other specific statutory authority Use solely for public purpose Trust funds only for the specific intended purpose Fiscal responsibility shared by all those exercising authority over finance, transactions and operations Disbursements or dispositions should bear approval of proper officials Claims should be supported with complete documentation Faithful adherence to all pertinent laws and regulations Observance of GAAP and practices as well as sound management and fiscal administration, provided they do not contravene with existing laws and regulations 80 General Requirements for All Types of Disbursements Certification of Availability of Fund by Chief Accountant Lawful and sufficient allotment duly obligated as certified, except for GOCCs and GFIs Legality of transaction and conformity with laws, rules and regulations Approval of expenditure by Head of Office or authorized representative Sufficient and relevant documents to establish validity of claim 81 1.0 Cash Advances General Guidelines – COA Circulars 97-002, 2009-002, Sec. 89 of PD 1445, pertinent GAA provisions Specific Guidelines and Documents Required Types of Cash Advances (Payroll Fund, PCF, Field/Activity COE, TA (local and foreign) Granting of Cash Advance – General Guidelines – Documents Required Common to All CAs except for travel – Additional Documents per type of Cash Advance Liquidation of Cash Advances 82 2.0 Fund Transfers to NGOs/POs General Guidelines – pertinent provision of the GAA for the year, Sec. 4.5.6 COA Circular 2007-001 and GPPB Res. 12-2007 Specific Guidelines and Documentary Requirements – Release of Funds – Implementation and Liquidation of Funds Released – Staggered Release of Funds to NGO/PO 83 3.0 Fund Transfers General Guidelines – COA Cirular 94-013, COA Memo 2010-014 Specific Guidelines and Documents Required – Transfer to Implementing Agencies Transfer Implementation and Liquidation by – Implementing Agency Liquidation by Source Agency From Trust Fund to General Fund for Unspent/Excess Amount 84 85