intermediate accounting, study guide for test 2, chapters 18?19

advertisement

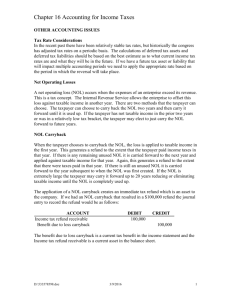

INTERMEDIATE ACCOUNTING, STUDY GUIDE FOR TEST 2, CHAPTERS 18-19 Note: You would wise to spend the bulk of your time reviewing exercises/problems on assignments because the following study guide will help you review the theory but provide only limited help in preparing for the exercise/problems. You may bring a 3” by 5” card or piece of paper that size with both sides crammed with whatever info you think will help you on the test. Chapter 18 1. Review the reasons why a new standard on revenue recognition was needed? Is the new standard more principles or rules-based? Which is better in your opinion? When is the implementation date for the new standard? 2. Under the new standard, what are the five steps needed to determine how to record revenue? 3. What two conditions are necessary in order to recognize (record) revenue? 4. What do the words "realized" and "realizable" mean? 5. When is revenue generally recorded? What are situations which complicate the general rule? 6. S “sells” its inventory to B with the agreement to buy it back on an installment basis. Did S really “sell” the inventory? This repurchase agreement is really a financing transaction even though legal title was transferred. S has in essence borrowed money using its inventory as collateral. Because legal title has passed to B, S argues that it should be able to remove the inventory and especially the related liability from off of its balance sheet and record the sales revenue. According to accounting rules, can S do this? 7. If a seller sells goods knowing that a high percentage of those goods will be returned (such as in the publishing industry), how much revenue should the sellar record? 8. What is channel stuffing? What industries are notorious for this practice? 9. What are two methods that allow revenue to be recognized before delivery? 10. When must the percentage-of-completion method be used? When must the completed-contract method be used? Which method is preferred? 11. What is the basis most commonly used to measure the extent of completion of a project? 12. What kind of an account is construction in progress (CIP)? What kind of an account is Billings on CIP? 13. For any one construction project, if CIP minus Billings is a net debit, where on the balance sheet is this net amount reported? For any one construction project, if CIP minus Billings is a net credit, where on the balance sheet is this net amount reported? How would your answers change if there were several long-term constructions projects happening at once? 14. How does the CIP account differ under the completed-contract method from the percentage-of-completion method? What is the journal entry that is missing under the completed-contract method? 15. Make sure you can prepare journal entries for percentage-of-completion and completed-contract methods. 16. What are two methods that require that revenue (gross profit) be recorded after the point of delivery? Why is gross profit deferred under these methods? 17. When must the installment sales method be used? When must the cost recovery method be used? 18. What are some examples of industries that use the installment sales method? 19. T or F: Under the installment method, gross profit is recognized in proportion to the amount realized (cash collected) as a percentage of the total amount to be realized (total cash to be collected). 20. When inventory is sold on an installment basis is repossessed, how should it be valued when it is put back on the books? How is the amount of deferred gross profit that needs to be removed from the books calculated? 21. Where does deferred gross profit appear on the balance sheet? 22. When is gross profit first recognized under the cost recovery method? 23. Review the homework carefully and be able to do the journal entries for both the installment sales and cost recovery methods. 24. What type of assistance do franchisors provide to franchisees? 25. When should franchise fees be recorded as revenue? Is revenue recorded for the down payment if there is a reasonable chance that it might be refunded? 26. When are continuing franchise fees recorded as revenue? 27. Review the journal entries you did in your homework on franchises. 28. Does inventory on consignment appear on the consignee's or consignor’s balance sheet? When does the consignor record a sale of inventory on consignment? Review the exercise you did for consignments. Chapter 19 29. AN HISTORICAL TIDBIT: Back when Toews was in college, accounting rules for deferred income taxes were so tedious and complicated that everyone began to complain. As a result, the FASB eventually simplified the rules, which is why this chapter in your current text is about half as long as when I was in school. So I had it hard and you have it easy. Oh well, life’s not fair. Sniff, sniff. 30. Because tax rules differ from GAAP, a company is essentially required to keep two sets of books. For tax purposes, the books that are kept are not what you might think, with a general ledger etc. Rather tax books are schedules of depreciation and other items that might differ from GAAP. When tax rules and GAAP rules differ, there arise either temporary or permanent differences. Can you differentiate between the two? Which ones eventually reverse themselves? Which ones never reverse themselves? Which differences give rise to deferred tax assets/liabilities? Which ones are ignored for deferred tax purposes? 31. What is an example of a future taxable amount? What is an example of a future non-deductible amount? Why are these considered deferred tax liabilities? 32. What is an example of a future deductible amount? What is an example of future non-taxable amount? Why are these considered deferred tax assets? 33. What is the difference between an originating and reversing difference? 34. When future years' tax rates are expected to be different from the current year's tax rate, should these different tax rates be used to calculate deferred taxes? Even if they have not been enacted into law? 35. When a change is made in tax rates that have already been enacted into law, when should the effect on deferred taxes be recorded? 36. Why does the IRS allow companies to carryback and carryforward net operating losses (NOLS)? 37. How many years can an NOL be carried back or forward? 38. If a company elects an operating loss carryback, must it carryback a NOL to the earliest year first? Must a NOL be applied as a carryback before it can be applied as a carryforward? 39. Can the tax benefits of carryforwards be recognized in the year of the originating loss? When can the tax benefits of carryforwards be recognized? 40. What should be done if it is more likely than not that a carryforward will not be realized in future years? Why did GM have such a huge deferred tax asset on its books in 2006? Why did the asset disappear in 2007? Why did investors not panic when income tax expense of some $30b hit the income statement in 2007? 41. Where does the account "benefit due to loss carryback" appear on the financial statements? 42. Can you prepare the journal entries to record NOL carryforwards and carrybacks? 43. T or F: Taxable income multiplied by the current tax rate (or current average tax rate) always equals tax payable which also always equals the current portion of income tax expense. 44. When preparing a journal entry, in what order should the components be calculated? [Answer: Inc. tax payable, deferred tax asset/liability, income tax expense.] 45. How is the classification (current or long-term) of a deferred tax asset/liability determined? How is the classification determined if the deferred tax asset/liability is not related to a balance sheet item (such as operating loss carryforwards)? 46. Income tax expense consists of what two components? How are these components reported on the income statement? 47. On the balance sheet, should current deferred tax differences be netted against long-term differences? Is it possible to have a S/T and L/T deferred tax liability on the balance sheet at the same time? Why or why not? 48. Review the homework carefully on deferred income taxes. Be able to reconcile GAAP income to taxable income, prepare the journal entries, and show how the balance sheet and income statement are affected. 49. How does iGAAP compare/contrast with U.S. GAAP in the area of deferred income taxes?