Market-oriented sustainability

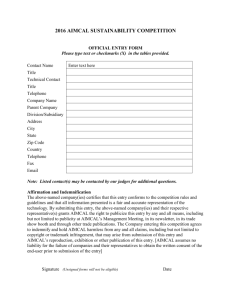

advertisement