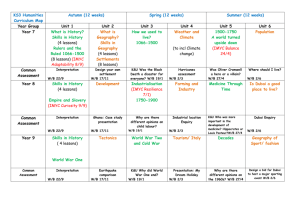

Three Phases of Globalization - Centre for Applied South Asian

advertisement