Research In Motion - Canadian Advanced Technology Alliance

advertisement

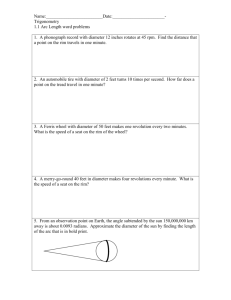

Hi-Tech Strategy Formulation Dr. Tom Koplyay Presented by: Chris Hamad Dix Lawson Tarek Radi Decmeber 17th, 2002 Research In Motion 1 High-Level Agenda l l l l l l l l l l Overview and Financial Highlights of RIM The Wireless Market RIM’s Family of Products Customer Profile Corporate Leadership & Culture Competitive Analysis Financial Analysis SWOT, SPACE, BCG, Porter, Dupont Formula, & Vector Growth Analyses RIM’s Stock Situation Current News and Issues December 17th, 2002 Chris, Dix, & Tarek 2 2 Overview of RIM • Founded 1984 • Head Office & Manufacturing Facility in Waterloo, Ontario • Offices in Ottawa (R&D), Mississauga, and United Kingdom • Primary Product: Electronic Content Pagers • Market Leader in Wireless e-mail • Total of 1950 Employees • President, co-CEO: Michael Lazaridis • Chairman, co-CEO: James Balsillie December 17th, 2002 Chris, Dix, & Tarek 3 3 RIM Financial Highlights Based on last 12 months ending Oct 2002 - All figures in $US • • • • • • • • • • • • • RIMM on NASDAQ, RIM on TSX 78,790,747 outstanding shares Share Prices (NASDAQ, Dec 2002: US$14.73) 52-week Range: $8.35 - $29.55 Avg. trading volume (NASDAQ): 1,560,909 Institutional Ownership: 50.2% Market Capitalization: $1.133 Billion Net Sales: $282 Million Income: -$39.9 Million Debt/Equity Ratio: 0.01 Net Profit Margin: -14.10% Earnings per share: $ -0.51 Revenue per share: $3.66 December 17th, 2002 Chris, Dix, & Tarek 4 4 Wireless Market l l l l l l l Wireless Services (Voice, Data, Pagers, Wireless LANs, Wireless WANs) Handheld Devices (PDA revolution) Functionality Advantages Internet Integration Software Support RIM’s Introduction of Blackberry December 17th, 2002 Chris, Dix, & Tarek 5 •Wireless is the one of the hottest markets and is expected to continue to grow as support for new services keeps growing. The cellular phone market is a classic example of how a small market limited to frequent travelers has grown so much in the last 5 years to appeal to almost the entire population. The driving forces behind it is the technology and how far it has come, the industry standards that are in place, and the affordability of the services. •Most cellular providers now support some form of text messaging •Wireless LANs that allow people to carry their laptops and get wireless Internet access at conventions, conferences, airports and coffee shops (e.g. Starbucks) is another example of the popularity of wireless products. Wireless WANs connect buildings through wireless devices and save organizations money on network extensions. •Another aspect of the Wireless Market was reinforced by the huge market of Personal Digital Assistants (PDAs) that have become so popular for many people especially with the application support they received over the last few years. •Wireless Consumers have been demanding more functionality as they have become accustomed to relying on their services. •The advantages of Wireless products are obvious: convenience, Less restrictive (no cables), anywhere and everywhere •Internet support for Wireless products has contributed to their attractiveness with services for web banking and up-to-the-minute news updates powered by Wireless services (based on WAP and other standards) for handheld devices. •When RIM introduced their Blackberry pager, it seemed like a simple enough idea, but its popularity spread like wild fire. The product appealed to innovators who were so reliant on e-mail and wanted to be connected at all times. The portability of the small device packed with many wireless options and a cute keyboard made addicts out of thousands of users. Today RIM boasts the largest market share for wireless e-mail with an estimated 400,000 users. 5 Product Overview December 17th, 2002 Chris, Dix, & Tarek 6 •Sample products from RIM, from left to right: ØBlackberry 950 ØBlackberry 5810 ØEmbedded Radio Modem 6 Products l Blackberry Handheld devices Ø Hardware Ø Software Ø Voice Enabled l Blackberry Enterprise Servers (BES) l Client Licensing l Embedded Radio Modems December 17th, 2002 Chris, Dix, & Tarek 7 §RIM’s current product list is still heavily focused on the Blackberry product and its supporting cast. Their popular 950 and 957 Blackberry pagers with the standard features including text e-mail are still hot. §The newer Blackberry models (5810, 6710, 6720, 6750) offer additional functionality such as voice capabilities (phone) electronic calendaring, and attachment viewing. §The magic behind the Blackberry pager is the Blackberry Enterprise Server (BES) which is the main piece of the infrastructure. The BES interacts with the corporate email servers and allows for the extension of the mail services (including the calendaring) by MS Exchange & Lotus Notes to be extended to the Blackberry wireless device. §In addition to the (North America) popular CDMA and the new 1x standards, the Wireless network support has been extended to GSM/GPRS which is dominant in the rest of the world. In Canada, Bell Mobility and Telus offer the 1x service, while Rogers offers the GPRS. §RIM is also getting into licensing their Blackberry software to other vendors including competitors (Nokia) to run on other products. Not only is this a steady source of income, but it also reinforces their market leader position. §Recently, RIM released their Embedded radio modem that allows third-party manufacturers to make wireless devices using RIM’s technology. These devices may include: consumer electronics, Interac terminals, biomedical devices, etc. §When corporate customers buy RIM, they have to buy the RIM pagers, BES, service through service provider (who pays royalty to RIM), and licensing. 7 Customer Profile l RIM current customers Ø Mostly corporate Ø Roaming Users Ø Early Adapters l Geographical Reach fuelled by technology support for CDMA, GMS, and other standards Ø North America Ø Europe Ø Asia Pacific December 17th, 2002 Chris, Dix, & Tarek 8 •As the product & associated service tends to be very pricey for individuals, the appeal for the Blackberry pagers is mainly for corporate users. As mentioned earlier, users have to pay for the device, licensing, backend servers, support/maintenance, and network service (whose charges depend on how much data is transmitted). •The product is targeted towards users who travel or roam a lot and are unable to check their e-mail which happens to be a crucial piece of their daily communication. With the Blackberry product, they stay connected and are able to stay up-to-date on any issues going on at the office. •Nonetheless, there are many individual Blackberry users who sign up for a service through the service providers and get their personal e-mail on their pagers. •Whether it is corporate or individuals, users still fall in the Early Adopters category as the RIM pagers are not main stream yet. They are making headway going in that direction with additional functionality and application support. •By extending their support to different standards (GPRS, 1x), RIM’s market is expanding to cover Europe and Asia Pacific, even though their main market is still North America. •On September 11th, after the terrorist attacks on New York and Washington, the phone systems (land and cellular) were jammed from over-usage, however RIM users (using the Data networks) were able to continue communicating as usual. This increased the popularity of RIM products since they became viewed to provide reliable service. Today, almost every Congressman, Senator, and their staff are using RIM pagers as an alternative way to stay connected. 8 Suppliers/Partners l l Support for GSM & CDMA Voice and DataTAC, Mobitex, & GPRS Data Networks United States Canada Europe AT&T Wireless VoiceStream Nextel Verizon Motient Corporation Cingular Interactive Rogers Bell Mobility T-Mobile O2 Vodafone TIM Alliances & Partnerships with Telecommunication Providers, and HW & SW Vendors December 17th, 2002 Chris, Dix, & Tarek 9 •Blackberry’s popularity has made it an attractive product to service for many Internet and telecommunication service providers. With support for many standards such as CDMA, GSM, GPRS, 1x, .. Many providers were able to leverage their existing networks (overlaying networks – SW upgrades not infrastructure) to provide attractive services for corporate and individual clients. •Much like mobile phones, these providers also sell the actual product Blackberry pagers and act as service providers and channel distributor for RIM. •RIM has established partnerships with many service providers in North America, Europe and Asia Pacific. They also signed agreements with software vendors to support their platform (e.g. Cognos, SAP, Palm, Remedy, MS, IBM, Entrust, Sun, to name a few) •On the value chain, since RIM manufactures their own hardware (with very few exceptions, e.g. pager screens), they are at the lower end of the chain and therefore are not pressured by suppliers (h/w). They also build the software applications to support the hardware they produce. 9 Leadership l Senior Leadership Michael Lazaridis President, Director, co-CEO Ø Founder of Research in Motion Ltd. (RIM), oversees all product development and operations at RIM and is responsible for the development and ownership of several patents James Balsillie Chairman of the Board, co- CEO Ø l l Leads design, manufacturing and marketing of the digital wireless transmission of data and access to the Internet. Balance of the leadership team provides growth management Success is leading the management team style from Entrepreneurial toward Managerial as the company matures with growth and customer base expands past early adapters December 17th, 2002 Chris, Dix, & Tarek 10 •Mike Lazaridis – founder of RIM, overlooks all product development and operations at RIM and is responsible for the development of several patents for Digisync, software code, and radio technologies. He has received the following awards •Deloitte & Touche Fast 50 Award (1999), •New Technology Development Award (1997 National IWAY Awards), •the High-tech Entrepreneur of the Year Award (1996), •the CATA award for best high-tech product (1995), •an Emmy award (1994) •Technical Achievement Academy Award (1998) for designs in computer film editing equipment, and designed industrial communications cards that won the Canada Award for Business Excellence (Innovation-1992). His wireless technical achievements include: •BlackBerry, the first complete, wireless email solution for accessing corporate email and PIM from a single handheld; •the world’s first two-way interactive pagers for the Mobitex and DataTAC nationwide wireless data networks; •world’s first PCMCIA Type II wireless radio modem for the Mobitex wireless data network; •and the world’s first integrated wireless terminals for Point-Of-Sale credit-card and debit-card applications. Jim Balsillie – Chairman and Co-CEO of RIM. A graduate of the University of Toronto and the Harvard Graduate School of Business Administration, Mr. Balsillie is also a Chartered Accountant with the Institute of Chartered Accountants of Ontario (ICAO). •Both are entrepreneurs, yet by adding more directors with managerial skills, there is a balance between the entrepreneur leadership and general management leadership. 10 Leadership December 17th, 2002 Chris, Dix, & Tarek 11 •RIM was founded in 1984 and by 1997 it was approaching maturity in its market. The introduction to market in 1997 of the Blackberry handheld devices was the work of entrepreneurial spirit and drive. The Blackberry generated significant market demand from the early adaptors especially during and following 9/11. The maturing market demand has meant a shift in the company management style as additional directors have been brought on board to help connect the functional areas of manufacturing and sales and create a greater coordinated effort to meet market demand. The original entrepreneurs are still in position of leadership, therefore the company is currently viewed as being in a shift from entrepreneur to managers with greater internal processes demands and experience. 11 Corporate Culture Internet Company-type l Young l Fast-paced Development Environment l Casual l Informal l Product-functional teams l Centralized Decision-making l December 17th, 2002 Chris, Dix, & Tarek 12 •Examples of product functional teams: Blackberry 6710 team specifically developing for Bell Mobility at the Ottawa location •A relatively small company slowly maturing relies on centralized decision-making procedures 12 Competitive Analysis l Main Competitors Ø Ø Ø Ø l New Entrants Ø Ø l Motorola Handspring Nokia Good Technology Microsoft (Smartphone) Dell RIM’s Market Share Ø Ø Very high market share – 62% First to market – Pioneer December 17th, 2002 Chris, Dix, & Tarek 13 •Motorola – Large communications company that manufactures and sells a diverse line of electronic equipment and components. Products include communications systems, semiconductors, electronic engine controls and computer systems. Market Cap: $22.02 Billion •Handspring – small company, direct competitor, second to market, equipment loaded on Palm, 15% of market. Handspring is engaged in personal communications and handheld computing. Products include the Treo wireless communicators and Treo 90 organiser, Visor expandable handheld computers and client and server software for fast Web access. Market Cap: $171 Million •Nokia – Very Large communications company that supplies telecommunications systems and equipment, and is engaged in the development, manufacture and delivery of mobile phones, and mobile, fixed and IP networks. Market Cap: $81.5 Billion •Good Technology – A tiny private company with less than 5% of the market. Good Technology develops wireless software, services and handhelds that “provide mobile professionals with a wireless connection to their corporate email and information”. 13 Product Lifecycle Analysis RIM Market Push l l l Market Push - first to market strategy, optimize channels, focus on customers & competitors, branding (Blackberry well known) Client base - Early adaptors stable, moving to higher market share and greater potential market as first to market, shakeout imminent Core Competencies/Capabilities Ø Ø l Pioneers Innovation Economies of S - Scope, Scale and Synergy December 17th, 2002 Chris, Dix, & Tarek 14 •Market Push - Though RIM is some 18 years old now, it is only since 1997 when Blackberry was introduced that the company began dynamic growth. The company maintains a first to market situation and is deeply engaged in the strategies that support its position. Its market share is large, it has the added value of branding as it is well known for its capabilities as associated with the unique name Blackberry. Its early to market following is strong and new products are easily sold to this group. The company is focussed on their competitors as evidenced by lawsuits they have engaged in to protect their patents and alliances formed with Nokia. •Client Base - The client base is early adaptors who maintain the company sales. The company is moving to expand its market ahead of it competitors. While the potential market is significant it remains to be seen whether devices such as Blackberry can penetrate the much larger business market to become an everyday usable device. A shakeout is imminent as competitors are struggling to maintain the pace set by RIM. 14 Financial Ratio Profile * December 17th, 2002 Chris, Dix, & Tarek 15 •Profitability = Very low since RIM is still reporting losses despite very good revenues. This is typical of a company moving from early growth and attempting to defeat its opponents by winning the biggest market share through shakeout. •Liquidity = About right •Leverage = Balanced •Activity = The activity ratios indicate potential for improvement in inventory turnover and accounts receivables. 15 BCG Growth Share Matrix RIM December 17th, 2002 Chris, Dix, & Tarek 16 After obtaining some valuable financial data on RIM, it was evident that RIM is currently generating good revenue, with a potential for significant increase in the near future. However, this revenue has not translated into any profit yet. RIM is currently a Star organization, having its main product lines in an industry with a high rate of growth, and fortunately entered this market early in the game and currently has the largest market share in this industry. With the anticipated growth in the near future, and the increasing revenue generated from licenses, we envision that RIM’s handheld business will potentially become a cash cow. 16 SWOT Analysis l Internal Strengths Ø Ø Ø Ø Diverse distribution channels Joint Ventures with service providers Strong R&D team with lots of innovative ideas Cross platform software capability l Internal Weaknesses l External Threats Ø Ø Ø l RIM has no cash cow projects to backup star projects Competitive products Lawsuits External Opportunities Ø Ø Ø Ø Ø Product features appeal to clients (first to market) Global growth and expansion Licensing (e.g. the Nokia deal) Brand loyalty Third party application developers December 17th, 2002 Chris, Dix, & Tarek 17 Internal Strengths Currently, the hand held devices that RIM produces are not sold directly by RIM. Instead, RIM has an intricate and sophisticated distribution channel with its service providers. End users, wishing to buy a Blackberry for example, can only buy it from service providers such as Rogers, Telus , etc, which then charge these end users a fee for the activation and service provided to this device. Without the service there would be very limited use to these devices, and a strong relationship with these providers is essential and a strength that RIM shows. This is one of RIM’s core capabilities. The devices being produced are very complicated and RIM has the core competency of very strong R&D with lots of innovative ideas. Not only is the hardware designed and manufactured by RIM, the software on these devices is also developed. RIM provides the capability for thirdparty companies to develop and provide software applications that run on the RIM hand held devices and they do that by supplying an Application Programming Interface (API). Internal Weaknesses RIM finances its handheld projects primarily using debt from banks and equity from share holders, instead of cash from other money-making projects/products in the organization. External Threats Lots of competitors are entering this luscious market of hand held devices since the barriers of entry are prohibitive for big players. Other competition has stemmed from companies providing similar products. All these competitors are a threat to RIM. External Opportunities Because RIM was first to this market, and some of its product features appealed to many end users, this has provided a strong brand loyalty. RIM has patented some of its product features, and is licensing competitors such as Nokia to use its patents as well as its software, since these two have become de facto standard in this industry. Also, the API it has developed, means there is more programs for end users to download and run. The more applications are available, the more attractive the product is and the more widely used it becomes. Partnerships with other vendors and ISP’s are key success factors for RIM. 17 SPACE Analysis December 17th, 2002 Chris, Dix, & Tarek 18 •Based on the market data we obtained, we have determined that RIM is advancing in its product lifecycle and is showing signs of maturity. This is in line with the findings of the SPACE analysis which is shown here. We see RIM starting to play an aggressive and cost leadership role, rather than its initial competitive strategy. •We believe that during the early phases of the life cycle for RIM’s hand held devices, the company adopted mainly a competitive strategy, trying and succeeding in differentiating its products from others on the market, creating a market niche that it absolutely dominated, and has created some barriers of entry for competitors without deep pockets. With the promising future of this market, and these barriers that are impossible to overcome, big-name competitors are jumping in and RIM is in turn starting to adopt an aggressive role, in which it is cutting its costs and aiming for profitability. RIM is maturing and preparing for the imminent future shakeout in this market of hand held devices. Its biggest weapon is the product popularity and continuous innovation. 18 Return on Assets – Dupont Formula Sales 294,053,000 Costs of goods sold 195,493,000 plus minus Costs 335,298,000 Operating Expenses 139,805,000 EBIT (41,245,000) Divided by Sales 294,053,000 Inventories 37,477,000 Earnings as % of sales (14%) Multiplied by Return on Assets (4.62) plus Sales 294,053,000 Accounts Receivable 42,642,000 plus Cash 644,559,000 Current Assets 724,678,000 Divided by Asset Turnover .33 Total Assets 876,521,000 plus plus Prepaid Expenses 0 December 17th, 2002 Fixed Assets 151,843,000 Chris, Dix, & Tarek 19 •As a further financial analysis of RIM the team applied the Dupont Formula as indicated in Chapter 8 of the Strategic Planning course reference book. The financial numbers used are from RIM 2001 annual data. •Overall the negative ROA is in line with the other financial indicators and it should be expected that it will stay this way for some time as the company expands its market. •The negative EBIT is consistent with other financial indicators and supports the position that RIM “top line” activities are still higher than its “bottom line”. This is indicative of the company’s expanding growth and attempts to solidify its market base and bury its competitors. Assuming the company maintains its market position and survives shakeout the EBIT should move to a profit situation as the product lifecycle reaches maturity and sales increase. Any move by the company to reduce its operating expenses now will also help it to reach bottom line sooner than later. There are indications elsewhere that RIM is attempting to cut operating expenses by expanding its leadership team to include more process orientated managers. •The asset turnover is consistent with the RIM’s market position and strategies. As EBIT improves the company should also be moving to reduce its inventories and accounts receivable in order to produce whole number asset turnover ratios. Measures to be taken by management to improve EBIT should also be applied to asset turnover to improve the ROA. 19 Growth Vector Analysis Product Alternatives Present Products Existing Market CDMA for Text only Devices North e.g. 950, 957 America Improved Products New Products Text & Voice, security Features, attachment Support. e.g. 5810, 6710, 6720 OEM Modems Expanding GPRS & GSM to Market expand to Europe New Market Expanding to Asia Pacific Region December 17th, 2002 Chris, Dix, & Tarek 20 •RIM started off with the Blackberry 950 and 957 models which were primarily text only devices. It then improved its products and added attachment support, encryption (S/MIME) support, PKI support, and voice functionalities. The recent 5810,6710,6720 and 6750 models offer these capabilities, and more recently, RIM started to develop new products such as Wireless embedded modems for 3rd party products. Therefore, RIM is adopting a product improvement strategy. •It is also adopting a market growth strategy since it started at first to target the North American market with its CDMA products. It then expanded into Europe with its GSM and GPRS capable devices, and is currently targeting the Asia Pacific markets. GPRS stands for General Packet Radio Service. It is a step between GSM and 3G cellular networks. It offers faster data transmission via a GSM network within a range 9.6Kbits to 115Kbits. It makes it possible for users to make telephone calls and transmit data at the same time. (For example, if you have a mobile phone using GPRS, you will be able to simultaneously make calls and receive e-mail massages.) The main benefits of GPRS are that it reserves radio resources only when there is data to send and it reduces reliance on traditional circuit-switched network elements. 20 Porter’s Analysis Substitutes Suppliers Hand-Held Market RIM Customers New Entrants December 17th, 2002 Chris, Dix, & Tarek 21 •Because of the profile of the target customer, which is an early adaptor, this market is relatively price in-elastic. The change in the price of the product does not cause a significant change in the demand of the product. We saw several cases in which the client preferred the latest and more expensive model. Thus the market has a high level of influence on the customer and the customer has a much lower influence on the market (basically the influence is by some customers requiring additional features) •There are almost no suppliers to RIM for this market, since they design, manufacture and program all their devices. Thus the level of influence of the suppliers and on the suppliers is minimal. •Substitute products such as cell phone and PDA’s have a medium influence on this market, mostly in the form of functionality. If a phone has a new functionality, chances are the handheld device will catch up and get similar functionality designed into it. However, this market has a larger influence on these substitute products. More and more, the functionality of the hand held devices is starting to appear on cell phone for example •Several new entrants are appearing (including Microsoft as of late with Smartphone). Handspring has produced Treo - a product with striking similarities to some BlackBerry features (RIM sued HandSpring over patent violations). This fact proves that the new entrants do have an influence over the hand-held market. Analysts did not react much to these threats (as opposed to concerns about RIM’s earnings) indicating that this influence is medium in impact and not strong. However, just like substitutes, the hand-held market has a major influence on the new entrants, who keep trying to provide the same functionality and more at a lower price. The threat from big players could be problematic as they can afford to lose money to capture market share. 21 RIM’s Stock Performance December 17th, 2002 Chris, Dix, & Tarek 22 •At the peak of the hi-tech/Internet market, RIM’s shares reached $150. As the rest of the stocks fell, so did RIM’s but it had many come backs over the last 2 years and due to new product functionalities, and a growing wireless market. Their 52-week range is $8.35 – $29.55 (NASDAQ), and they are currently hovering around the $14 mark. 22 Analyst Ratings *Source: CNBC December 15th 2002 December 17th, 2002 Chris, Dix, & Tarek 23 •Another indication that analysts are concerned about RIM’s lack of profit, even though they realize the potential of the Wireless handheld market. •In an economy that has been struggling for a while, and an IT stock market that has been battered since 2000, RIM has held its grounds and exploited the niche market it carved out and dominated. The analyst ratings have had some effect on the company’s strategy (recent layoffs, streamlining of operations, cost cutting measures). 23 Current News and Issues l l l l l Separate Lawsuits against Good Technology and Handspring for patent violation Lost a lawsuit against Patent Licensing firm HPT Inc. Analysts do not think it is a problem Voice-Data service – Verizon Major licensing agreement with rival Nokia (shares up 30%) Radio modems for GSM/GPRS networks received regulatory certifications in North America, Europe and Asia Pacific December 17th, 2002 Chris, Dix, & Tarek 24 •RIM filed lawsuits against Good Technology and Handspring for violating patents owned by the company. RIM has patented almost every aspect of their popular pagers including the keyboard, screen, interface, encryption methods, wheel, etc.. Handspring and RIM just forged an agreement to license RIM’s software on Handspring devices. If Handspring fulfills its end of the agreement, RIM agreed to drop the lawsuit against it. •RIM just lost a patent lawsuit against a legal firm called HPT Inc. worth $20 million. Although RIM vowed to appeal the court’s decision, analysts do not think it is a worrisome sign. The plaintiff is not in a position to hurt RIM’s future product development with the ruling. •RIM recently landed a big Voice Data service through Verizon (largest Wireless provider in the US) in support of the voice activated Blackberry pagers (5810, 6710) •Realizing the popularity of RIM’s software, Nokia, one of RIM’s rivals and a market leader in the mobile industry, caved in and agreed to license RIM’s software on their new cellular phones. As a result, RIM’s shares shot up 30% in one day, and many analysts upgraded their stock. The agreement allows RIM to charge royalty for every user of a Nokia phone ($7/month) fitted with certain Blackberry features (similar to Qualcom’s CDMA licensing). This licensing deal is a strong endorsement that RIM has strong technological advantages over others. It also opens up the European market for RIM where wireless customers use a popular s hort messaging service (SMS). •RIM’s radio modems have received the certification blessing for GSM/GPRS in Europe, Asia Pacific after the initial N American certification. This opens up the doors for 3rd party vendors using RIM’s hardware for these markets. 24 Current News and Issues l l l l l l RIM planning “Blackberry on a Chip” product to be sold to potential 3rd-party vendors RIM and Nextel introducing a phone ($500) with Blackberry keyboard and screen (Dec 2002) Sales in Fiscal Quarter ended Sept 1, Sales of Blackberry Fell 42% to $55 Million Service Revenue from Blackberry Subscribers rose 58% to $60 Million Workforce Reduction of 10% (Nov 02) New Blackberry software supports PKI Encryption, Digital Signatures, and Attachment viewing December 17th, 2002 Chris, Dix, & Tarek 25 •To go a step further after the embedded modems (usually used in large devices), RIM has announced they are working on producing Blackberry on a chip to be used in third party products. This will enable device manufacturers to make small devices powered by the Blackberry chip. •The big advantage of licensing Blackberry to phones is that ISP’s subsidize the cellular phones (not the case with Blackberry pagers). This could mean more sales for RIM. •The decline in sales was offset by more revenue from service charges. The introduction of new features is expected to boost sales in the near future. •Workforce down from 2200 to 1950 in a streamlining process aimed to please analysts and aim for profitability sooner rather than later. •In addition to voice capabilities, the 6710, 6720, 6750 models now provide PKI support to encrypt and sign mail messages based on digital certificates. They also allow users to view attachments (not available previously) in MS Word, Excel, PowerPoint, and PDF formats with selective options (whole document, table of contents, particular sections). 25 Strategic Profile: Design Factors l l l l l l l l l l Sustainability - Robust and able to continue market growth Uniqueness - 1st to Market, maintaining significant lead Value Added - Yes Enhancement - NIL Flexibility - Average as past early cycle & focus on niche product Stability - Able to respond to strategic direction Fit - Good fit, underlying procedures support Performance - Average Consistency - Very good, reflective of company in growth mode Stretch - Company leaders challenging all to retain market lead December 17th, 2002 Chris, Dix, & Tarek 26 26 Thanks for your Time December 17th, 2002 Chris, Dix, & Tarek 27 27