JCR-VIS Credit Rating Company Limited

Rating Report

Affiliate of Japan Credit Rating Agency, Ltd.

Engro Foods Limited

Chairman: Mr. Aliuddin Ansari; Chief Executive: Mr. Sarfraz A. Rehman

February 11, 2015

Rating Rationale

Analyst: Faryal Ahmad

Moiz Badshah

Category

Sukuk

Latest

A+

Dec 31, 2014

Outlook

Previous

A+

Jan 21, 2013

Stable

Dec 31, 2014

Stable

Jan 21, 2013

Key Financial Trends

28

24

20

16

12

8

4

0

9M14

Gross Margin (%)

ROAA (%) (annualized)

6

5

4

3

2

1

0

2013

2012

Net Margin (%)

_________________________________________

9M14

Gearing (x)

(Rs. billion)

2013

2012

Debt Servicing (x) (annualized)

9M14

2013

2012

Net Sales

30.7

37.9

40.2

Net Profit

0.3

0.2

2.6

Net Equity

10.9

10.7

10.0

Debt Leverage (x)

1.4

1.2

1.2

Total Debt

10.1

8.2

7.8

(inc. current

maturity)

7.2

8.2

7.7

FFO (annualized)

1.5

2.4

4.5

0.15

0.3

0.6

3.1

2.0

29.2

Long Term Debt

FFO (annualized)

/Total Debt (x)

ROAE(%)

(annualized)

Engro Foods Limited is operating in the consumer goods segment, and is engaged in the

manufacturing, processing and sale of dairy products, beverages, ice cream and frozen

desserts. Over the years, the business has been able to establish several brands which have

become household names in Pakistan. These include Olper’s (Milk), Omore (Ice cream),

Dairy Omung (UHT dairy liquid) and Tarang (tea whitener), to name a few.

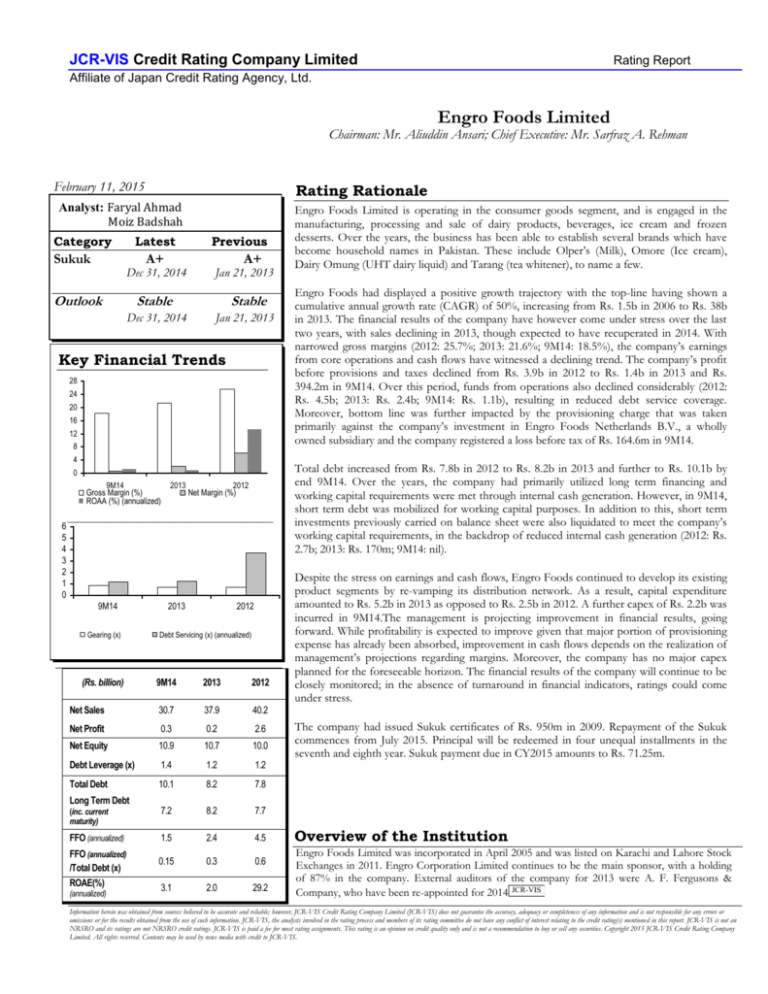

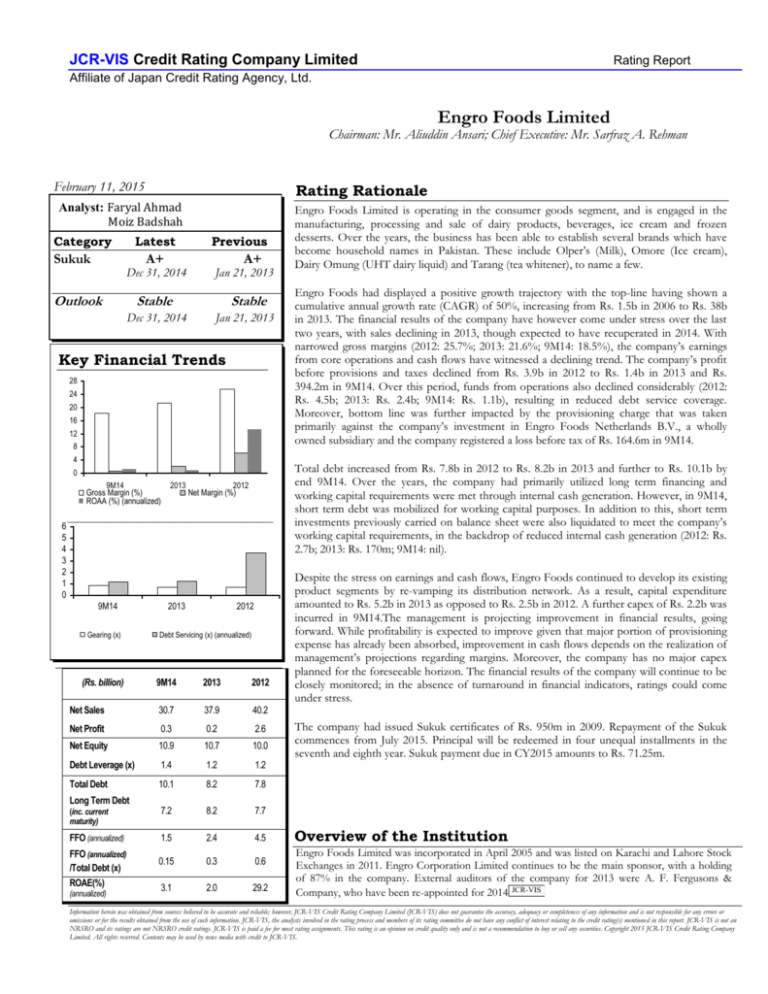

Engro Foods had displayed a positive growth trajectory with the top-line having shown a

cumulative annual growth rate (CAGR) of 50%, increasing from Rs. 1.5b in 2006 to Rs. 38b

in 2013. The financial results of the company have however come under stress over the last

two years, with sales declining in 2013, though expected to have recuperated in 2014. With

narrowed gross margins (2012: 25.7%; 2013: 21.6%; 9M14: 18.5%), the company’s earnings

from core operations and cash flows have witnessed a declining trend. The company’s profit

before provisions and taxes declined from Rs. 3.9b in 2012 to Rs. 1.4b in 2013 and Rs.

394.2m in 9M14. Over this period, funds from operations also declined considerably (2012:

Rs. 4.5b; 2013: Rs. 2.4b; 9M14: Rs. 1.1b), resulting in reduced debt service coverage.

Moreover, bottom line was further impacted by the provisioning charge that was taken

primarily against the company’s investment in Engro Foods Netherlands B.V., a wholly

owned subsidiary and the company registered a loss before tax of Rs. 164.6m in 9M14.

Total debt increased from Rs. 7.8b in 2012 to Rs. 8.2b in 2013 and further to Rs. 10.1b by

end 9M14. Over the years, the company had primarily utilized long term financing and

working capital requirements were met through internal cash generation. However, in 9M14,

short term debt was mobilized for working capital purposes. In addition to this, short term

investments previously carried on balance sheet were also liquidated to meet the company’s

working capital requirements, in the backdrop of reduced internal cash generation (2012: Rs.

2.7b; 2013: Rs. 170m; 9M14: nil).

Despite the stress on earnings and cash flows, Engro Foods continued to develop its existing

product segments by re-vamping its distribution network. As a result, capital expenditure

amounted to Rs. 5.2b in 2013 as opposed to Rs. 2.5b in 2012. A further capex of Rs. 2.2b was

incurred in 9M14.The management is projecting improvement in financial results, going

forward. While profitability is expected to improve given that major portion of provisioning

expense has already been absorbed, improvement in cash flows depends on the realization of

management’s projections regarding margins. Moreover, the company has no major capex

planned for the foreseeable horizon. The financial results of the company will continue to be

closely monitored; in the absence of turnaround in financial indicators, ratings could come

under stress.

The company had issued Sukuk certificates of Rs. 950m in 2009. Repayment of the Sukuk

commences from July 2015. Principal will be redeemed in four unequal installments in the

seventh and eighth year. Sukuk payment due in CY2015 amounts to Rs. 71.25m.

Overview of the Institution

Engro Foods Limited was incorporated in April 2005 and was listed on Karachi and Lahore Stock

Exchanges in 2011. Engro Corporation Limited continues to be the main sponsor, with a holding

of 87% in the company. External auditors of the company for 2013 were A. F. Fergusons &

Company, who have been re-appointed for 2014 JCR-VIS

Information herein was obtained from sources believed to be accurate and reliable; however, JCR-VIS Credit Rating Company Limited (JCR-VIS) does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or

omissions or for the results obtained from the use of such information. JCR-VIS, the analysts involved in the rating process and members of its rating committee do not have any conflict of interest relating to the credit rating(s) mentioned in this report. JCR-VIS is not an

NRSRO and its ratings are not NRSRO credit ratings. JCR-VIS is paid a fee for most rating assignments. This rating is an opinion on credit quality only and is not a recommendation to buy or sell any securities. Copyright 2015 JCR-VIS Credit Rating Company

Limited. All rights reserved. Contents may be used by news media with credit to JCR-VIS.

JCR-VIS Credit Rating Company Limited

Affiliate of Japan Credit Rating Agency, Ltd.

Engro Foods Limited Rating History

Rating

Date

Medium to

Outlook

Short Term

Long Term

Rating Type – TFC-1

Rating

Action

12/31/2014

A+

Stable

Reaffirmed

1/21/2013

A+

Stable

Upgrade

4/26/2011

A

Stable

Upgrade

1/7/2010

A-

Positive

Maintained

1/6/2009

A-

Stable

Final

8/13/2008

A-

Stable

Preliminary