Frozen Food Products Marketing and Distribution Challenges in a

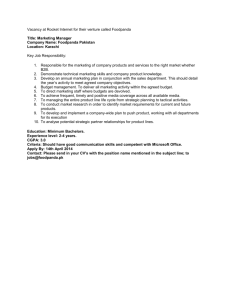

advertisement