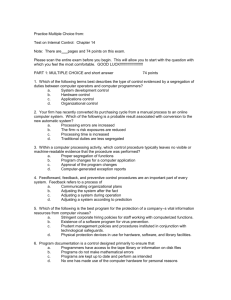

January 2011

advertisement