info - Oxford-Man Institute of Quantitative Finance

advertisement

Short-Term Shareholders

John Thanassoulis∗

Warwick Business School, University of Warwick†

July 17, 2014

Abstract

This paper studies the effect of corporate investors with short investment horizons

on Board business model choice; the price of key inputs under general equilibrium; and

CEO incentives. When investors have imperfect information as to the skills of the firm,

business model choice sends a signal. Pooling on business models which will only succeed

for the best management raises short run equity values. This pooling effect leads to the

mis-allocation of too many firms to risky technologies, an increase in the cost of equity

capital, and a bubble in the price of key inputs which is pushed above fundamentals. The

business-model distortion effect grows with the elasticity of input supply. A market signal

as to the true ability of management can both increase and reduce the distortion. CEO

incentives are robustly biased towards short-run bonuses, and weaken incentives for effort

on any actions not immediately priced by the market.

Keywords: investor time-horizons; short-term shareholders; CEO compensation; cost of

capital; short-termism; bonuses; shareholder register.

JEL Classification: G12, G34, L21, L25.

∗

email: john.thanassoulis@wbs.ac.uk. https://sites.google.com/site/thanassoulis/

I would like to thank Roberto Barontini, Vincent Crawford, Alexander Gumbel, James Malcolmson,

Joao Montez, Alan Morrison, Pasquale Schiraldi, Richard Taffler, Mungo Wilson, and Peyton Young for

helpful comments, as well as seminar audiences at Oxford University, London Business School, Cambridge

University, EFMA 2013, and at the Swiss IO day 2013. All errors remain my own.

†

Oxford-Man Institute, University of Oxford, Associate Member and Nuffield College, University of

Oxford, Associate Member.

1

Introduction

There is widespread public concern that some shareholders are not committed to the long

term success of the firms they own. Lack of appropriate shareholder oversight has been

blamed for many corporate failings in the US and UK economies. Short-term shareholders

are accused of distorting corporate investment decisions away from long run growth and

the true interests of owners and the economy. Such short-termism may, for example,

be the key theme behind the collapse of UK manufacturing since the second world war

(Mayer (2013)); and is an important difference between US/UK ownership structures

versus those in Germany and other Civil Law based countries (La Porta, Lopez-de-Silanes,

Shleifer, and Vishny (1998)). This long standing concern over short-term shareholders

has led to persistent calls for regulatory intervention to try to encourage long-term share

ownership. For example, in the US the Aspen Institute (2009) allege short-termism in the

US is ‘system-wide.’ They propose, inter alia, that shareholders should be able to vote

only after a minimum holding period to try to ensure only long-term owners influence

corporate decisions.1 This paper rigorously studies these fears using theoretical Finance

and Industrial Organization techniques to explore the effect of corporate investors with

short investment horizons on Board business model choice; the price of key inputs under

general equilibrium; and CEO incentives.

I build a tractable general equilibrium model in which firm business-model choices,

resultant input purchases, and shareholders interact. There are two key assumptions

which underpin the analysis. The first is that there is an information gap between the

firm and investors. The Board of a firm have superior information as to their management

skill and so the risks and rewards which attach to different business model choices. This

asymmetric information assumption is not controversial.2 The second assumption of this

work is that the Board of a firm seeks to maximise the aggregate expected value of the

shareholders on their register at the time a business decision is taken. This is one of

two standard paradigms used in the Finance literature. For example, the Pecking Order

theory of capital structure uses this assumption. Specifically, the seminal work of Myers

and Majluf (1984) has the firm maximising the value of the old shareholders as opposed to

those who might buy the stock in the future, and this distinction gives rise to the negative

signalling effects of issuing equity. The second paradigm is to posit that firms maximise

net present value. With the presence of shareholders this approach of npv maximisation

is delivered by the Fisher Separation Theorem (Fisher (1930, p141)). The Separation

1

In the UK the Kay review (2012) also concluded that ‘short-termism is a problem (Executive Summary, para ii)’. They proposed, inter alia, that CEO remuneration should be altered to forcibly reduce

the weighting on current performance. In the EU the Commission are consulting on increasing the voting

weight of shareholders who are long-term holders of the stock. (See Brussels aims to reward investor

loyalty, Financial Times, Jan 23, 2013.)

2

However this is not to say that management cannot learn anything from the market; Foucault and

Laurent (forthcoming).

1

Theorem notes that npv maximisation optimises every owner’s consumption opportunity

set and so would be unanimously supported. In capital markets in which risk-sharing

opportunities are not complete, or asymmetric information exists, the application of the

Fisher Separation Theorem is disputed (DeAngelo (1981)).

In the model studied the firms in an industry must decide between two competing

technologies. One is a business-as-usual technology and offers a known expected payoff.

The second is a risky technology. The expected payoff of this technology depends upon the

skills the firm has to profit from the opportunity. For some firms the expected payoff from

the risky technology will outweigh those expected from the business-as-usual technology.

As noted, the Board has better information as to the firm’s ability than investors. These

assumptions have broad applicability. For example, prior to the financial crisis a bank

could decide to pursue a business model of securitising mortgage backed securities, or

not. Not all banks would be equally adept at assessing the value and riskiness of the

underlying assets. Outside of Finance, the risky business-model might be outsourcing a

part of the supply chain offshore to a developing country. Not all firms will be equally

adept at managing this method of production.

If the firms were held solely by long-term investors, each firm’s Board could maximise

its value by developing the technology with the greatest expected long run payoff. However, suppose that the population of shareholders include a proportion who are subject

to liquidity shocks in which case they will need to sell their stake before payoffs are fully

realised. Or equivalently suppose the shareholder population contains a proportion of

owners who buy shares intending a short investment horizon. Such shareholders care

about the price of the shares at the point they sell. The Board, representing the totality

of the shareholder base, is therefore concerned for both the time-path of the share price

as well as the final payoff. An implication of management having better information as

to the firm’s abilities than outside investors is that the firm’s choice of technology sends

a signal to the market. Firms with the management most able to profit from the risky

technology would select it. However for other firms this effect creates a short-run value

to pooling with such firms. By choosing the risky technology there will be an increase in

the short-run market value due to the market inference that the firm type must be drawn

from a set which includes high ability firms. Firms in an economy containing short-term

shareholders will be willing to sacrifice some long run expected payoff for this short run

price increase.

Short-term shareholders and asymmetric market information therefore create a value

to pooling on the risky technology. It follows that the presence of short-term shareholders

increases the demand for the inputs required for the risky technology above the level

justified by fundamentals. This pushes the price of the inputs required for the risky

technology up. A bubble is created. This is a bubble in the technical sense that the input

price for the technology is divorced from fundamentals, however it is not a bubble in which

2

prices rise without limit in this model. The increase in the price of the inputs required

to develop the risky technology will imply that, ceteris paribus, firms will enter into the

risky technology at a smaller scale. Market clearing then implies that more firms will be

subject to the firm mis-allocation effect. On average therefore too many firms will choose

to develop the risky technology, and the inputs required to do so are more expensive.

Hence the cost of equity capital must rise as the equity is used ever less effectively as

the short-term pressures rise. If the input can be supplied elastically then the increased

demand will lead to increased supply, and a more modest input price rise. In this case

I show that the pooling value increases further, due to the reduction in the price of the

input asset, hence the mis-allocation effect is exacerbated.

Information asymmetry is key to the mechanism developed in this study. If there were

perfect information as to firm type then the liquidity preferences of investors would be

immaterial and the Fisher Separation Theorem would apply. Given this I explore the

effect of an informative signal on firm type on the business choice decisions. The effect

is ambiguous: even though the precision with which the market sees the firm’s type is

enhanced, this does not imply reduced business-model distortion. The decision to distort

or not the business model choice hinges on the expected value of the firm conditional

on being of a type which would select the risky technology. This is the statistical entity

which underpins the market’s short-term valuation of a firm. For example, if the signal

the market receives is poor but sufficiently precise, then the weight attached to high

types falls, but it falls least for the highest types. Hence the expected value conditional

on choosing the risky technology can rise, and so the distortion in firm behaviour can be

exacerbated.

The Board require the CEO to enact the business-model decisions, as well as to improve

firm type by exerting effort. Incentives can be provided by appropriate use of bonuses at

various time horizons, and these of course cost money. When the firm is owned in part

by short-term shareholders the balance of benefit and cost in the provision of managerial

incentives is altered. I show that greater short-term shareholder pressure leads robustly

to Boards under-weighting long-term CEO incentives (e.g. LTIPs), lowering the extent

to which the CEO is incentivised to raise the firm’s long-run potential. Short-term shareholders undervalue effort to improve long-term performance to the extent that such effort

is not factored into the early share price. Thus, as the horizon of the investors shrinks,

the Board structure CEO incentives to be based increasingly on the short-term so that

the CEO focuses on projects whose value is quickly apparent to the market, and not on

valuable but longer-term endeavours.

In the final part of this paper, I empirically demonstrate that short-termism in share

ownership differs significantly between the leading civil law countries (Germany/Switzerland)

and the leading common law one (US). Hence I conclude that understanding the channels

through which short-term ownership operates is relevant, and can potentially contribute

3

to the active policy debate.

2

Review Of The Literature

The objective of this study is to explore how corporate investors with short investment

horizons affect business model choice; the price of key inputs in general equilibrium; and

CEO incentives. There is a large literature on managerial myopia in which CEOs exogenously have the current share price as part of their remuneration, but the economy wide

implications of corporate investors with short investment horizons has, I believe, rarely

been analysed theoretically. Two salient papers in this regard are Bolton, Scheinkman

and Xiong (2006) and Albagli, Hellwig, and Tsyvinski (2013). Bolton et al. study a setting in which some investors are rational while others, and in particular would-be buyers,

are over-optimistic and so incorrectly value some projects. The authors show that the

optimal CEO compensation in this setting is one which encourages the CEO to pursue the

projects which potential investors will over-value the most. This study is complementary

to Bolton, Scheinkman and Xiong (2006) as, firstly, there is no bounded rationality just

differences in the realisation of individual liquidity shocks, and secondly we conduct a

general equilibrium analysis of business model choice. Albagli et al. (2013) develop a

rational expectations model of information aggregation in asset markets and demonstrate

that this can lead to corporate distortions. Their model is fundamentally different in

that the firm has no control over the information environment whereas here the Board

do, allowing us to explore how improvements in the information environment alter the

incentives for firms to invest so as to change further the information available to the asset

market.

The relative paucity of theoretical studies of investor time horizons on firm behaviour

has not held back a fruitful empirical research agenda which seeks to make the link

between the two. An early contribution to this endeavour is Gaspar, Massa, and Matos

(2005) who construct an index of investor time-horizon for a population of investors and

show that firms with short-term owners do less well in acquisition situations. Since this

work others have also demonstrated empirically that short investor time horizons are

correlated with firms being less responsive to investment opportunities (Derrien, Kecskes,

and Thesmar (2013), Polk and Sapienza (2009)). Graham, Harvey, and Rajgopal (2005)

offer evidence that publicly owned firms, which are argued to have owners with short

investment horizons, cause management to forego valuable investment opportunities if

needed to lower the volatility of current announced results. Brochet, Loumioti, and

Serafeim (2012) offer evidence that the cost of equity capital declines with the time horizon

of investors.

A full and influential theoretical literature exists which explores managerial myopia

induced by having a CEO incentivised on the short-term share price when there is asym4

metric information between the market and the manager. Stein (1989) shows that if the

market cannot observe investment decisions then the short-run motivated manager will

under-invest. Bebchuk and Stole (1993) note that if however the market can observe

the investment decision, as is the case here, then the short-run motivated manager will

over-invest. In both cases the market draws inferences on the extent of investment from

the earnings which are announced. The mechanism and analysis here are both different.

The market here draws inferences in a general equilibrium setting on the ability of management by looking at the business-model choice across firms; I do not study the volume

of investment as these papers do. Further these analyses are silent on the relationship

between ownership liquidity, input price distortions, cross-sectional mis-allocation, and

the link between information precision and business-model choice.

The literature linking the time profile of executive compensation to management myopia has seen numerous recent contributions, though the implications owner liquidity has

on the incentives have remained unexplored. Thanassoulis (2013) links optimal CEO incentives with industry structure. Edmans et al. (2012) and He (2012) derive the optimal

contract in a principal-agent setting if an executive can save and take myopic actions. All

of these models demonstrate that deferral of pay is part of the optimal contract, but they

remain silent on the effect of short term shareholders on corporate outcomes.

This work is also related to the rich literature on bubbles in asset markets. Allen and

Gale (2000) offer a model of asset bubbles in which investors borrow from a banking sector

which cannot observe their investments. Due to assumed limited liability the investors

seek to risk-shift and move the funds into the risky asset, thus pushing the price of

the risky asset above fundamental levels. A related mechanism is at work in Allen and

Gorton (1993).3 Unlike these works, there is no risk-shifting rationale in the framework

here. Rather maximisation of shareholder value is linked to firms’ technology choices, and

hence to the equilibrium price of input assets. Further this prior work on bubbles is silent

on the optimal incentive contracts for the CEOs of firms subject to these effects.

3

The Model

Consider a continuum of firms indexed by type variable: τ ∈ [0, 1] . The types of firms in

the population are distributed according to the commonly known cumulative distribution

function G (τ ) with probability density g (τ ) . The Board of the firm privately knows its

type. Thus management are more informed about their firm’s capabilities than investors.

The Board publicly selects and announces a business activity choice at time t = 1. There

are two possible technologies to select from. The Board can choose to develop a businessas-usual technology. This technology requires an input priced at the numeraire of 1 and

yields an expected payoff at t = 2 of r > 1. Alternatively the Board can choose to develop

3

For a review of the broader literature on bubbles see Camerer (1989).

5

a risky technology. In this case the firm must buy a different input labelled the input

asset. It has a price per unit of P . The t = 2 expected payoff from investing a unit in the

risky technology is R̄ · τ. This simple formulation captures that for some firms the risky

technology generates a higher expected payoff. However for others the risky technology is

dominated in that the firm’s skills are better adapted to profit from the business-as-usual

technology. One can interpret the risky technology as a true new business model, or as a

fad or fashion. What is key in the model is that the new technology is not self-evidently

a good idea for all firms in the industry. For example, firms might not be equally adept

at managing overseas factories and long distance supply chains; or financial institutions

might not be equally adept at trading and managing a portfolio of loans to a given sector.

Each firm is assumed to have a unit of capital, and the input asset is assumed to be

in restricted supply of b. I assume that

R̄b < r < R̄

(1)

This guarantees that we remain within an interior solution so that an intermediate proportion of firms will develop the risky technology. The price, P, of the input asset will be

determined in equilibrium by the balance of supply and demand. The input asset captures

the specific input needed to access the risky business line. For example in finance, the

input asset may be sub-prime mortgages which can be securitized and so used to create

tranches of Mortgage Backed Securities (MBSs). The type τ captures that firms differ in

their ability to value and/or harness these assets.

The firms are assumed to be entirely equity owned. The shareholders however will not

all be long-term owners, and so will not necessarily hold their shares until after all profits

are realised. Shareholders are ex ante identical, but have a probability L of suffering a

liquidity shock. This liquidity shock assumption is standard in the banking literature

for example (Allen and Gale (2009)). Those who suffer a liquidity shock will sell their

holding at the end of t = 1, after the Board make their technology choice, but before

the profits are realised. The sale price at the end of t = 1 will be the fair market value

which is the expected t = 2 payoff conditional on all public information. The remaining

shareholders, proportion 1 − L, hold their shares until the payoffs are realised at t = 2.4

Hence L measures the time horizon of shareholders in the industry.

The probability L ∈ [0, 1) of short-term ownership is common knowledge. In practice

chairmen claim to develop an insight for the likely time horizon of shareholders through

extensive discussion with owners and experience of the prior behaviour of given investors.5

4

The model however has a second equivalent interpretation that every firm in the economy/industry

contains a proportion L of shareholders who intentionally have a short time horizon and will sell before

results are realised, with the remainder being buy-and-hold investors.

5

For example, the Chairman of Cadbury, the main UK confectionery company until its purchase by

Kraft, claimed to be very aware of the time horizon of his investors, and how it changed during the

takeover process. See ‘The inside story of the Cadbury Takeover.’ Financial Times, March 12, 2010.

6

The academic empirical literature demonstrates that by analysing the breadth of investors’

portfolios and their stock turnover rate, investor time horizons can be deduced.6 The

objective function of the Board is to seek to maximise the expected value generated for

the shareholders who own the firm at the time the business decision is made.

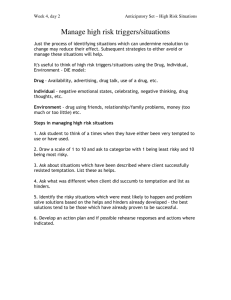

The timeline of the entire model is depicted graphically in Figure 1. I restrict attention

in the analysis to pure strategy Nash equilibria.

t=1

Start of period

t=2

End of period

-

Buy a unit of

input, cost 1

-

-

Buy 1/P units of

input asset

-

Develop business as

usual technology

Expected payoff

r

Board of firm type τ

decides and announces

business activity.

Develop fad /

risky technology

Short-term

shareholders sell.

Expected payoff

Rτ /P

All profits returned

to shareholders.

Figure 1: Time line of the model.

Notes: The Board select the technology the firm develops so as to maximise the expected value of the

shareholders who own the firm at the point the decision is made. Short-term shareholders (e.g. because of

liquidity shocks) sell after the business decision, but before payoffs are realised. Long term shareholders

hold their shares until the payoffs are realised. Firms are endowed with a unit of capital which they use to

buy the required input for the technology chosen. All payoffs are returned to shareholders at the end of

t = 2. The firm type is private information, the choice of technology and the probability L of short-term

ownership are both public information.

6

Bushee (1998), Gaspar, Massa, and Matos (2005), and Derrien, Kecskes, and Thesmar (2013).

7

4

Shareholder and Technology Choice Analysis

In this section we solve the model to explore the relationship between short-term shareholders, the price of the input to the risky technology, and the allocation of firms to

different technologies.

4.1

Input Asset Fundamental Value

The fundamental value of an asset is the market price established when agents are obliged

to subsequently maintain their holdings for ever (Allen, Morris, and Postlewaite (1993)).

The fundamental value of the input asset can therefore be found when all firms are longterm value maximisers.

If a firm of type τ invests in the business-as-usual technology then it generates an

expected long-run payoff of r. If instead it invests in the risky technology then it invests

at a scale of 1/P and so its expected payoff is R̄τ /P . It is immediate that if a firm of type

τ would invest in the risky technology, so would all firms of higher type. Market clearing

at the fundamental price P f requires that the total supply of the input asset is bought.

Define the function q (y) as the type for which there exists a mass y of higher type firms.

Thus G [q (y)] := 1 − y. The market clearing condition is then that firms τ ∈ [τ̂ , 1] invest

in the risky technology where

Z

1

τ =τ̂

1

g (τ ) dτ = b ⇒ τ̂ = q bP f

f

P

(2)

Market clearing requires the borderline firm τ̂ to be indifferent between developing the

risky and the safe technology. Hence the fundamental price P f is defined implicitly by

the relation

R̄q bP f P f = r

(3)

Lemma 1 The fundamental price for the input asset (equation (3)) exists and is unique.

Proof. All proofs are in the appendix.

4.2

Short-term Shareholder Analysis

We now analyse the general model in which firms are owned by shareholders with a

probability L of a liquidity shock and so early sale. A strategy for the Board of each firm

is a decision function which maps the privately known firm type and the publicly known

shareholder time horizon to a choice between developing the risky or the business-as-usual

technology. It follows that, observing the business model chosen, the market can make

inferences as to the set of types from which the firm must be drawn. This will affect the

price shareholders will receive if they sell early.

8

The Board seeks to maximise the aggregate expected value of the shareholders. The

proportion 1 − L of the shareholders will be long-term holders of the stock and see the

realised payoffs. The expectation of this payoff is R̄τ /P as the Board are aware of the

true type τ of their firm. The proportion L of shareholders will be short-term owners

and sell their holding before the business results are realised. Thus what matters to these

shareholders is the market price they receive for their stock. The value of the equity at the

point of sale (end t = 1) will be the expected payoff at t = 2 conditional on all publicly

available information. Hence if a firm of type τ develops the risky technology then the

Board’s objective function at t = 1 takes value V risk (τ, L) given by:

V risk (τ, L) = (1 − L) ·

+L

R̄τ /P

| {z }

Expected t=2 payoff

R̄

· E (τ | risky chosen)

|P

{z

}

(4)

Equity value at end t=1

The objective function (4) follows from the assumption that the Board maximises the

expected value of the shareholders who own the firm at the point of taking a business

decision. The market’s inference as to expected firm payoff depends upon the equilibrium

strategy of the Board:

Lemma 2 The Board’s strategy takes a cut-off form: if firm type is above some level

τ ∗ (L) then the Board decides to develop the risky technology; otherwise it develops the

safe technology.

The proof of Lemma 2 follows by noting that firms of higher type τ create greater

expected value for their long-term shareholders from developing the risky technology

than firms with lower type. Short-term shareholders are indifferent between all firm types

which select the same technology. This is because firm type is private information and so

not priced in until payoffs are realised. The partition of the type space then follows.

This brings us to the first main result of this analysis:

Proposition 1 In an economy/industry with a probability L of short term shareholder

ownership:

1. Short term shareholders create a bubble in the price of the input asset: P (L) > P f .

This bubble becomes more severe the larger is the probability of short-term ownership

(dP (L) /dL > 0) .

2. Inefficiently many firms develop the risky technology. This mis-allocation grows in

the probability of short-term ownership, L.

3. The input asset price is uniquely defined by:

R̄

R̄

r = q (bP ) + L 2

P

bP

9

Z

1

1 − G (τ ) dτ

τ =q(bP )

(5)

4. The ex ante cost of equity capital for a representative firm is increasing in the

probability of short-term ownership, L.

The Board of a firm are assumed in this study to seek to maximise the value of the

shareholders who own the firm at the time a business decision is being taken. Therefore,

in assessing whether to pursue a new risky technology, or adopt the business-as-usual

technology, the Board are concerned with the path of their share price as well as the net

present value maximising decision, (4). If an action can be taken which increases the

market value of the firm’s equity in the short term then this is desirable as it will increase

the payoff of short-term shareholders. As investors have asymmetric information as to the

type of the firm, the short-run share price can be increased by pooling with high quality

firms. Here this means developing the risky technology so as to alter the information

available to investors – even at the cost of some long-term value. Proposition 1 shows

that across the industry or market such behaviour has general equilibrium effects: it leads

to cross-sectional distortions in technology choices; bubbles in input asset markets; and

increases in the cost of capital.

That shareholders with short time horizons, should lead to bubbles, that is to distortions in the price of real assets, is, I believe, a new insight. This is a bubble in the technical

sense (Allen, Morris and Postlewaite (1993), and Allen and Gale (2000)), but perhaps not

in the common use of the term as this is not a repeated game in which the asset price rises

indefinitely. To understand the result suppose that there was no bubble in the price of

the input asset (e.g. sub-prime mortgages, or IT skills in a developing country) which is

therefore at its fundamental level, P f (3). Each firm which pursues the risky technology

will do so at a scale of 1/P f . Market clearing would then guarantee that the marginal

firm which develops the risky technology extracts the same expected net present value as

it would do from the business-as-usual technology. Now consider the incentives for the

Board of a firm of type just below this cut-off level. At the fundamental price P f for the

input asset the net present value of the risky technology is below that from the business

as usual option. Thus long term-shareholders would lose out slightly from a decision to

invest in the risky technology. The net present value would fall in a continuous way as

the firm type fell further from the cut-off level. However, if the firm did invest in the risky

technology, then the market would infer, mistakenly, that the firm was drawn from the

top portion of the type distribution. Hence the market value of the equity at the end of

t = 1 would jump up discontinuously. This would represent a discontinuous gain for any

shareholders who suffered a liquidity shock and sold early, and so would outweigh the loss

to the long-term shareholders.7

7

The t = 1 share price is not raised here by the absence of short-sellers (Lamont (2004)). Neither long

nor short term shareholders have privileged information at t = 1 as to whether the firm is at the top or

bottom end of the ability range which self-selects the risky technology. The share price is the expected

firm value over this firm ability range.

10

This implies that firms below the efficient cut-off type would buy the input asset at

its fundamental price. This extra demand at the fundamental price will force the price

of the input asset up. Hence a bubble is created in the input asset. As the probability

of short-term ownership in the economy grows, so the Board is willing to sacrifice more

long-run value in return for the short-run boost provided to the t = 1 market value of the

equity from pooling with the best management firms and developing the risky technology.

This increase in demand pushes the price of the input asset up yet further. So we have

the first result of Proposition 1.

The increasing mis-allocation of firms to the risky technology is then an implication of

market clearing, and only becomes apparent due to the general equilibrium nature of the

analysis. As the probability of short-term ownership grows, so the price of the input asset

rises. Other things equal therefore, the firms which invest in the risky technology now

use less of the more expensive input asset, and enter the risky technology at a smaller

scale. Market clearing for the risky asset then requires that more firms invest in the

risky technology. Thus the proportion of firms which develop the risky technology grows,

moving further away from the first-best, in the probability of short-term ownership in the

economy or industry.

The mis-allocation effect has an immediate and important further consequence on the

cost of equity capital. All investors realise that as the probability of short-term ownership

in an industry or economy increases, so more firms will be drawn into developing the

risky technology at the expense of long-run value. Hence, ex ante at the investment stage

(t = 0) , there is a greater probability that a firm will choose a business line not in its

long term interests. This is a cross-sectional mis-allocation effect which lowers the t = 0

expected value of firms. Further, there is also a second general equilibrium effect. An

increase in the probability of short-term ownership raises the price of the input asset, and

this also lowers the expected value of any firm developing the risky technology. Hence

through this channel also the representative firm sees its value decline at the financing

stage. Both of these effects lower the value of firms at t = 0. Therefore entrepreneurs must

sell a larger proportion of their firms to raise the desired dollar investment. Hence the

cost of equity capital rises with the probability of short-term ownership. This result offers

support for the policy objective suggested in both the UK and the US that shareholders

should be encouraged to be long term holders of a stock.8

Figure 2 demonstrates the input asset price bubble and cost of capital increases resulting from short-term shareholders for the case of uniformly distributed firm types. The

calculations for this numerical simulation are contained in Appendix B.

8

See footnote 1 and the discussion which refers to it.

11

Figure 2: Numerical Simulation Depicting Proposition 1

Notes: The left hand graph depicts the critical firm type, τ , for any given probability of short-term

ownership in the industry/economy. Types above the critical level develop the risky technology. The

mis-allocation of firms to technologies grows as the probability of short-term ownership increases. The

right hand panel depicts the magnitude of the growth in the price of the input asset, and in the cost of

equity capital, as a function of the probability of short-term ownership, L. The greater the probability

of short-term ownership, the greater the distortions engendered in these related markets. Calculations

underlying these simulations are contained in Appendix B.

5

Robustness to Elasticity of Supply of the Input Asset

The presence of short-term shareholders in the economy causes too many firms to invest

in the high risk technology and it causes bubbles to form in the price of inputs, distorting

input prices. In this section we explore the robustness of these effects to the elasticity of

supply of the input asset required for the high risk technology. In particular if the input

asset should be perfectly elastically supplied, its price cannot rise and so the bubble effect

cannot exist in this extreme case. This section asks whether the distortionary effect of too

many firms entering the risky technology applies irrespective of the elasticity of supply

of the input asset, and it asks whether the distortion in the price for the input asset also

always exists except in the polar case of perfect supply elasticity.

Suppose that the supply S (P ) of the input asset responds to price according to:

S (P ) := b ·

P

Pf

ζ

(6)

The supply function has a constant elasticity ζ with respect to price to facilitate the

empirical interpretation of the results. The benchmark example had inelastic supply

(ζ = 0) . The supply function (6) is normalised so that absent short-term shareholders,

and for any elasticity of supply ζ, the fundamental price of the input asset is invariant at

the level P f given by (3). To see this note that at P = P f , the supply is b. At the price P f

the critical firm type is therefore τ̂ , given by (2). Hence absent short-term shareholders,

12

and for any supply elasticity, the first best situation would have types [τ̂ , 1] entering the

risky technology. I augment (1) and restrict attention to parameters such that

b<

r r f ζ

·

P

R̄

R̄

(7)

This is sufficient to ensure existence of the equilibrium price for any given elasticity of

supply, ζ.

We can establish the price of the input asset, P, and the critical firm type, τ̃ , above

which the Board will pursue the risky technology.

Lemma 3 In an industry with elasticity of supply ζ and with L short-term shareholders,

the critical firm type, τ̃ , which just selects the risky technology satisfies

r

R̄

"

Pf

b

ζ

1

# 1+ζ

(1 − G (τ̃ ))

L

= τ̃ +

1 − G (τ̃ )

Z

1

1 − G (τ ) dτ

(8)

τ =τ̃

The critical firm type is uniquely defined and the price of input asset, P , is given implicitly

by

ζ !

P

τ̃ = q b · P

(9)

Pf

Lemma 3 allows us to establish the robustness of the mis-allocation and price distortion

results in Proposition 1 to an elastically supplied input asset:

Proposition 2 When the input asset is elastically supplied:

1. For anything less than perfectly elastic supply, ζ < ∞, the price of the input asset

grows in the proportion of short-term shareholders.

2. The extent of mis-allocation to the risky technology in any industry grows with the

elasticity of supply of the input asset: ∂ τ̃ /∂ζ < 0; and the mis-allocation grows with

the proportion of short-term shareholders, ∂ τ̃ /∂L < 0.

Irrespective of the elasticity of supply of the input asset, the input asset sees its price

distorted upwards from its fundamental level. The logic outlined in Section 4 continues

to apply: firms seek to increase their short run value by following a pooling strategy and

are willing to sacrifice some long run value to benefit shareholders who need to sell early.

The existence of a price distortion is therefore robust, though its magnitude falls as the

elasticity of supply increases.

Part 2 demonstrates that the mis-allocation result that short-term shareholder pressure

causes an excessive proportion of the firms to choose the risky technology is entirely robust

to the introduction of elastic input supply. Holding the proportion L > 0 of short-term

13

shareholders in the economy fixed, the mis-allocation of firms to the risky technology will

grow with the elasticity of supply. To see why, consider the marginal firm type which just

elects to develop the risky technology, and consider the thought experiment of increasing

the elasticity of supply of the input asset. The increased elasticity of supply must increase

the volume of the input asset on the market. If there were no change in the identity of

the marginal firm, the price of the input asset would fall to allow the extra supply to be

absorbed. The marginal firm will now however benefit from a lower input price and so

strictly benefit from developing the risky technology. This is a contradiction to the firm

being marginal, and so more firms will find it profitable to develop the risky technology

for the short run pooling value increase. Hence the mis-allocation effect is exacerbated.

6

Market Learning From Signals As To Firm Type

The information asymmetry between the firm and investors has played a key role in this

analysis. The Board see value in pooling on business-model choice with high ability firms

as this alters the information environment of investors and so the near-term share price.

In this section we explore the effect of an informative signal on firm type. We will see

that this can actually exacerbate the distortion.

Let us suppose that the firm types in the population are distribution according to

a normal distribution τ ∼ N (µ, 1/hµ ) . I ignore the restriction that τ ∈ [0, 1] and so

implicitly assume that the precision hµ is high enough that the mass outside of the unit

interval is deminimis. At the general equilibrium the introduction of some short-term

shareholders, L > 0, causes a distortion as too many firms opt for the risky technology to

benefit in the short-term from pooling. Hence firms τ ∈ [τ̃ , 1] enter the risky technology

with τ̃ < τ̂ the first best level ((2), Proposition 1). The cut-off type τ̃ is indifferent

between entering the risky technology and not implying that (4):

r−

R̄

R̄τ̃

(1 − L) = L E (τ | τ ≥ τ̃ )

P

P

(10)

Now suppose that before any investment decisions (t = 0) a signal zi is generated as

to the type of an individual firm τi , where the subscript i denotes the firm. This signal is

centered on τi but is generated with normal noise so that zi ∼ N (τi , 1/hε ) . The market

14

will update their beliefs as to the type of firm i. Bayesian updating will deliver that9

τi ∼ N

zi hε + µhµ

1

,

hε + hµ hε + hµ

(11)

The presence of the signal will alter the critical firm i type, τ̃i , which will just be indifferent

between the two technologies. The critical firm type will satisfy the analogue of (10)

using the posterior distribution of firm i types, (11). If E (τi | τi ≥ τ̃ ) is greater than

E (τ | τ ≥ τ̃ ) , then as the left hand side of (10) is strictly declining in τ̃ , we must have

τ̃i < τ̃ . In words, if the signal increases the market’s estimation of firm i’s type conditional

on that type lying above τ̃ , then a firm of type τ̃ would strictly prefer to develop the risky

technology. Hence the critical firm type falls further below the first best cut-off.

However as a signal alters both the mean and the precision of the posterior distribution,

there is no simple relationship between the signal received and the expected mean of the

posterior distribution conditional on the type lying above a given level τ̃ . To proceed

further we note that the moments of the truncated normal distribution have an explicit

characterisation (Greene (2003), Theorem 24.2):

1

ϕ (α)

zi hε + µhµ

+p

E (τi | τi ≥ τ̃ ) =

µ )−(zi hε +µhµ )

hε + hµ

hε + hµ 1 − Φ (α) α= τ̃ (hε +h√

(12)

hε +hµ

where ϕ (·) and Φ (·) are the standard normal density and cumulative distribution. The

second term is known as the inverse Mills ratio. To allow analytical analysis I borrow

from the statistics literature and use Shore (1982) to closely approximate this ratio as

ϕ (α)

=

1 − Φ (α)

(

1.4184 [Φ (α)]0.8632

α≤0

−0.1368

1.4184 [1 − Φ (α)]

Φ (α) α ≥ 0

(13)

Of particular interest is the effect that a positive signal as to the type of firm i has

on the actions of this firm. This signal may or may not be justified due to the noise. A

positive signal is one such that zi ≥ µ.

Proposition 3 Suppose that there is a positive measure of short-term shareholders, L >

0. Consider a positive signal for firm i as regards the risky technology: zi ≥ µ.

1. If the market expects most firms to invest in the risky technology, τ̃ ≤ µ, then:

(a) The existence of a weak positive signal, zi ≈ µ, reduces the distortion in firm

i’s technology choice behaviour;

9

To see this note that through Bayes’ rule:

1

1

2

2

Pr ( τi | zi ) ∝ Pr ( zi | τi ) Pr (τi ) ∝ exp − hε (zi − τi ) · exp − hµ (τi − µ)

2

2

Completing the square of this expression in τi generates the result.

15

(b) The distortion in firm i’s technology choice behaviour increases in the strength

of the signal: τ̃i falls as the signal zi increases.

2. If the market expects most firms to invest in the safe technology, µ < τ̃ then:

(a) The existence of a weak positive signal, zi ≈ µ < τ̃ can increases the distortion

in firm i’s technology choice, and will do so if the precision of the signal is

great enough;

(b) The distortion in firm i’s technology choice behaviour is not monotonic with

increases in the strength of the signal. The distortion can be increased by better

strong signals, and reduced by better weak signals.

The proof of Proposition 3 uses the statistical approximation offered by Shore (1982)

to balance the change in both the mean and the precision of the posterior distribution

from given signals. There are two basic cases studied. The first is when the market

expects most firms to invest in the risky technology. This would be the case if the safe

returns r were relatively small compared to the returns from the risky technology (R̄). In

this case a positive signal is going to move the untruncated density of firm i’s type to the

right, and increase its precision. If however the signal is weak so that zi is close to the ex

ante expected value µ, then the truncated distribution does not change its expectation a

+µhµ

. The loss of

great deal, but the precision increases pulling mass to the new mean zihhεε+h

µ

mass from the right tail of the distribution lowers the market’s expectation of the firm’s

value conditional on choosing the risky technology. Hence the benefit of pooling is less and

so the distortion created by short-term shareholders is reduced. However, as the signal

grows in strength, more mass is moved in the truncated posterior to higher values and so

the market will assign higher expected types to firm i if indeed the firm does develop the

risky technology. Hence the benefits of pooling grow, and so firm i will deviate at even

lower type values.

The second part of Proposition 3 considers the case in which the market expects the

majority of firms not to invest in the risky technology; the returns are only good enough

for the few firms most suited to it. Now the existence of a signal which is only just positive,

and certainly below the cut-off type, can increase the distortion in firm i’s behaviour. The

signal will barely raise the expected value of the untruncated ex post distribution, but it

will increase the precision of the distribution and so reduce the mass in the tails. If the

increase in the precision assigned to firm i is great enough then the reduction in tail mass

causes the density function to be flatter over the whole region of types above the cut-off

τ̃ . This implies that the reduction is relatively larger at lower types above the cut-off

than higher types, causing the expected value conditional on being above the cut-off to

rise. This therefore increases the distortion in firm i’s behaviour. However, as the signal

16

improves the expected type of the firm conditional on being above the cut-off can be

dragged down or up depending on the parameter values.

7

Shareholder Time Horizons and Pay Structure

We now explicitly consider the CEO within the firm. The Board face a standard PrincipalAgent problem. They wish the CEO to exert effort to improve the firm, and can provide

incentives to do this by giving the CEO an equity stake and so exposing him or her to

improvements in the firm’s equity value. However a tension is now created with the second

objective of respecting the interests of the proportion L of short-term shareholders who

will sell early by guaranteeing a high early share price. All shareholders contribute to the

costs of providing incentives, but if the fruits of the CEO’s efforts are not fully priced

into the early share price, not all shareholders will benefit. This section will study the

outcome of this dilemma on the structure of CEO pay.

To pursue this analysis consider a single firm of type τi , and consider a contracting

stage at t = 0 between the Board (principal) and CEO (agent). Both the CEO and

Board are aware of the firm type τi . To study contracting with a risk-averse agent I use

the standard approach of normal payoffs and CEO mean-variance utility. If the CEO’s

payment is given by the random value W then the expected utility, gross of the effort cost

is:

E (U (W )) = E (W ) − (ρ/2) var (W )

(14)

The parameter ρ is the CEO’s coefficient of absolute risk aversion. The CEO’s outside

option is normalised to utility u.

Let us suppose that at t = 0 the Board can offer a contract to the CEO with three

parameters. The Board can offer a fixed wage payment f which I allow to take positive

or negative values.10 In addition the Board can use a bonus b as a proportion of market

value of the firm at t = 1, or a deferred (vested) bonus at t = 2 as a proportion v

of realised value, or any combination. These remuneration tools are all standard. The

bonus elements agreed between the Board and the CEO at t = 0 are private information

to the contracting parties. This assumption captures that in reality the Board is not

bound by publicly stated bonus rates.11 Normalise discounting to zero. Thus if the equity

value at time t ∈ {1, 2} is denoted Xt , then the CEO receives remuneration f +bX1 +vX2 .

I assume that the CEO makes the technology decision.

In the standard effort model, the CEO can raise the expected t = 2 payoff from either

10

A negative fixed fee, f, captures settings in which the CEO must first make a payment to the firm

in return for being hired with the incentive pay schedule.

11

One case study example is provided by the CEO of BP in 2010. The share price performance over

the period 07-09 would have led to no share award according to the publicly published criteria. In the

event the CEO was awarded a substantial bonus of shares regardless. See “BP’s Hayward Given 41%

Increase,” Financial Times, March 5, 2010.

17

strategy by an amount η at a personal effort cost of κη 2 /2. Thus the t = 2 expected

payoff from the risky technology would be η + R̄τ /P while that from the business-asusual technology would be η + r. The effort component, η, is privately chosen by the CEO

and not directly observable to others. The realised returns are observed at t = 2, and I

assume they are normally distributed around their expected values η + r, η + R̄τ /P .

Define the payoff variance of the business-as-usual technology as σs2 , and that of the risky

technology as σr2 .

As in the benchmark model, outside investors do not observe the firm’s type τi , they

are aware only of its distribution: G (τi ). The probability L of short-term ownership

continues to be common knowledge. As I consider one firm, suppose the price of the

input asset is constant at P.

7.1

The Equilibrium Incentive Contract

The market at t = 1 does not observe the remuneration contract and so must infer the

likely impact of CEO effort on firm type. The expected utility of the CEO from the risky

choice is denoted U risk (η, τ ) and is given, using the mean-variance assumption, by

U

risk

(η, τ ) = f +

bX1risk

R̄τ

κ

ρ

+v η+

− η 2 − v 2 σr2

P

2

2

(15)

The expected utility to the CEO from the business-as-usual (or safe) technology choice is

U safe (η, τ ) and is given by

ρ

κ

U safe (η, τ ) = f + bX1safe + v (η + r) − η 2 − v 2 σs2

2

2

(16)

Lemma 4 The CEO will improve the firm type by an amount η ∗ :

η∗ =

v

κ

(17)

Proof. Direct optimisation of CEO utility, (15) and (16), with respect to the effort level

η.

Lemma 4 demonstrates that the CEO’s effort choice depends upon the deferred bonus,

v, but not the short-run bonus b. This is because in the model studied, before the

realisation of results at t = 2, private effort exerted to raise the expected payoffs of the

business cannot be verified by the market, and so is not fully reflected in the early share

price. This is therefore a model of long-term projects which the CEO can undertake.

These are projects where success is not immediately apparent and so is not immediately

priced into the firm’s equity value. Early bonuses do not incentivise CEO effort on such

projects concerning the long run capabilities of the firm. The utility of the contract to

the CEO will depend on the business-model choice he is incentivised to make:

18

Lemma 5 The CEO will prefer the risky to the safe technology if:

b

h

|

X1risk

−

{z

X1safe

(i)

ρ R̄τ

+ v 2 σr2 − σs2

≥v r−

P

2

}

| {z }

i

(18)

(ii)

If (18) is satisfied, the CEO will accept the contract if

f+

bX1risk

R̄τ

v2 1

2

+v

+

− ρσr ≥ u

P

2 κ

(19)

Otherwise the CEO will accept the contract if

f+

bX1safe

v2 1

2

− ρσs ≥ u

+ vr +

2 κ

(20)

Lemma 5 determines the restrictions on the contract the Board can offer which ensures

that the CEO both accepts the contract, and then selects a given technology. Equation

(18) is the CEO’s incentive compatibility constraint. If the CEO implements the risky

technology, then the share price of the firm will increase due to the pooling effect which

places the firm with high type firms. This effect is captured in bracket (i) . The CEO

internalises this jump in short-run value via his short-term bonus, b. If b is made sufficiently

large then the CEO is incentivised to select the risky technology. For high types of

firm, long term bonus alone will be sufficient to incentivise the firm to select the risky

technology. But if the firm type is low enough ((ii) positive) then a large enough short-run

bonus is required to ensure that the CEO pursues the risky technology.

Equations (19) and (20) are the participation constraint. They measure the CEO’s

utility from developing the risky and safe technology respectively. If the utility from the

contract exceeds the outside option, then it is acceptable to the CEO.

7.2

Shareholders and Endogenous Incentives

We are now in a position to explore how the Board will manage the competing pressures

of incentivising the CEO and also ensuring the share price is high for those shareholders

who need to sell early. Short-term shareholders sell at a price of X1risk if the CEO is

incentivised to pursue the risky project. This price is not affected by private changes to

the CEO contract, unless the contract should incentivise the CEO to alter technology

choice. Assuming the Board incentivise the risky technology then the objective function

is:

R̄τ

R̄τ

risk

∗

risk

risk

∗

− f + bX1 + v η +

V

(τ ) = LX1 + (1 − L) η +

P

P

subject to (18) and (19).

(21)

19

A similar objective function for the Board exists if the Board targets the business-as-usual

technology. These objective functions can be solved to yield:

Proposition 4 Consider a firm of type τ with a probability L of short-term ownership.

The optimal CEO deferred bonus rate is declining in L and given by:

(

v=

1

(1 − L) 1+κρσ

2

If Board targets risky technology

r

1

If Board targets business-as-usual technology

(1 − L) 1+κρσ

2

(22)

s

The CEO is incentivised to improve firm type by an expected amount which is declining

in L and given by:

(

∗

η =

1

(1 − L) κ(1+κρσ

2)

r

(1 − L)

1

κ(1+κρσs2 )

If Board targets risky technology

If Board targets business-as-usual technology

(23)

Proposition 4 delivers the result that the Board translate the shareholder pressure

coming from the proportion L who will sell early into reduced long term incentives, and

so a lower expected level of firm type improvement. This is irrespective of whether the

other parameters of the contract are structured to incentivise one technology choice or

another.

Deferred pay incentivises the CEO to improve the long run capabilities of the firm

(Lemma 4). But the benefits of these sorts of improvements are not fully reflected in the

short-run share price. To the extent that the Board internalise the sale price of shares at

t = 1 through the L who will suffer a liquidity shock, the Board undervalue these benefits.

This leads to the lowering of deferred payments. As deferred payments are reduced, the

CEO is less incentivised to improve the long run capabilities of the firm, and so the firm

will improve its type by less the greater the probability of short-term ownership. In the

extreme of only having short-term shareholders on the register, the CEO will receive no

long-term deferred bonus payments, and will not be incentivised to improve the long-run

capabilities of the firm at all if such efforts are not immediately priced into the short term

share price.

8

Model Robustness to Further Extensions

The model of firms selecting between competing technologies is designed to be tractable

and allow the key market pooling and profit maximisation forces which contribute to the

cost of equity and the equilibrium price of inputs to be explained. In this section we

explore a number of further extensions to the analysis undertaken.

Short-termism Differing Across Firms The model has assumed that all firms have

the same probability of short-term ownership. This simplification allows the insights

20

to be developed in a setting where firms differ only in one dimension: their type.

The results of the analysis are then immediately applicable to a comparison between

different economies or industries. It would be possible to extend the analysis to the

case of an exogenous distribution of shareholder time horizons across firms. For

any given probability of short-term ownership, L, one would have a conditional

distribution of firm types: f (L, ·) . For this conditional distribution the results of

this analysis apply: the highest types opt for the risky technology, and this set is

enlarged beyond the optimum by the presence of the L short-term shareholders.

However endogenising the shareholder time horizon is beyond the scope of this

model. This would require the relative asset prices of the firms to be endogenised

in the context of shareholders who differ in the value they attach to a given firm.12

Informed Trading In the analysis above all buyers and sellers of shares at the interim

date are uninformed as to the true type of the firm. Shareholders can only make

inferences based upon the signalling value contained within the technology choice.

The Board however are aware of the firm type, and they are also owners of some

of the shares. Let us suppose that Board members can decide to sell early to profit

from their privileged information, or that they might also be subject to liquidity

shocks requiring sale at t = 1 with some probability. Stock market rules require

Boards to disclose any sales to the market, therefore the relevant case to consider

is one in which Board members have the opportunity to publicly sell their shares

in advance of the other liquidity shock shareholders. Board members will only sell

in the absence of a liquidity shock if the sale price they receive is in excess of the

true long-run value of the firm. Hence, observing a Board member’s sale the market

will infer that a firm might be over-valued and mark down the stock price. The less

the probability of a liquidity shock for Board members, the greater the information

content of the signal in the Boards’ sale, and so the stronger is this price effect.

In the extreme case of the Board members having exactly zero probability of a

liquidity shock, then we have a ‘lemons market.’ If there is any positive probability

of a liquidity shock for Board members, then the economics described above would

apply. If Board members sell early then this contains some bad news, lowering the

share price and mitigating the ex ante reason to distort technology choice. But a

share premium would remain from the risky technology as the Board member might

be selling for exogenous (liquidity shock) reasons. Hence the economics described

remains robust to Board members trading for their own profit.

Shareholder Activism In the model presented, shareholders purely invest in the firms.

Shareholders do not actively monitor and correct management failings in the Board

12

Albagli, Hellwig and Tsyvinski (2013) develop such an asset pricing model without exploring differences in shareholders’ realised liquidity shocks.

21

(or senior management team). Consider now if some of the shareholders are activists

who can have a material impact on the behaviour of the firm. The presence of such

activist investors on a firm’s shareholder register would, in theory, alter the results

that short-term shareholders raise the cost of capital in an ambiguous way. Any

monitoring by such shareholders which improved management’s focus on the long

run would act to increase ex ante firm value and lower the cost of capital. However, if

an activist investor had a short-term focus and could alter management’s behaviour

to maximise the early path of the share price, then this would act against the

value improvements from monitoring, and so lead to negative effects on firm value.

Bebchuk, Brav and Jiang (forthcoming) offer evidence that activist shareholders

improve the long-term profitability of firms they own suggesting that the primary

effect is dominant.

9

Empirical Discussion

In this section I offer some empirical evidence that short-term ownership differs significantly between countries, and I document the empirical predictions afforded by the analysis and their relationship to the existing empirical evidence.

9.1

Evidence Of Short-Term Shareholders

Measuring the extent and indeed existence of short-termism amongst shareholders is an

ongoing topic of research. Holderness (2009) notes that most of the empirical research

on ownership focuses on blockholders and inside ownership – relatively little looks at the

full spectrum of owners. We have noted that recently, empirical research has constructed

indices of owner time-horizons, see for example Gaspar, Massa, and Matos (2005). The

study presented here considers general equilibrium effects of short-term shareholders. It

is therefore tempting to ask whether there is evidence of owner liquidity differing across

jurisdictions, as La Porta et al. (1998) suggest is likely. Gaspar et al. (2005) do not

consider such cross-sectional comparisons. The easiest data to acquire on this question

involve share turnover rates, however the existence of short-termism cannot be inferred

from a high share turnover rate. Froot, Perold and Stein (1992) note that a firm can have

a high turnover rate if a small percentage of the firm is repeatedly bought and sold, whilst

the vast majority of the firm remains under stable ownership. To address differences in the

likelihood of stable ownership, and so justify the assumptions underlying this theoretical

model, I therefore construct a bespoke dataset. I collected the shareholder register data

at multiple time periods for the largest 20 firms by market capitalization in the Germanic

civil law countries of Germany, Austria and Switzerland. In addition I constructed a

matched sample of 20 US firms which were in identical 3-digit SIC codes as their primary

22

business, and whose size was as near to the Germanic firms as possible.13 The identity

of the 20 German owned firms and their US match are provided in Appendix C. I then

derive a lower bound for the short-termism of ownership over two, four, six and eight

quarters using the following construction:

Percentage of

%

common

Minimum

%

stock

X

Short-termism =

stock owned by − held by j over

j named

over z quarters

j at Sep 2012

prior z quarters.

on shareholder

register at

Sep 2012

(24)

The database (CapitalIQ) lists the ownership data of all common stock owners with

a stake in excess of 0.1% of the firm. Definition (24) is a conservative measure of shorttermism. First (24) assumes that all unnamed owners (i.e. owners of less than 0.1 % of

the equity) are long-term as they do not count towards the short-termism measure. In

fact one would expect a proportion of these individuals to be liable to liquidity shocks.

Second, if an owner of shares should sell part of their stake over the z quarters, only

the part which is sold counts towards the short-termism measure. The remainder which

has been held over the entire z quarters finishing in Q3 2012 is assumed to be long-term

held.14

I compare civil law countries to the leading common law country as the legal differences

in shareholder protection, it is argued, might lead to differences in ownership patterns and

corporate behaviour (see La Porta, Lopez-de-Silanes, Shleifer, and Vishny (1998)). Using

the matched sample we can interrogate to what extent short-termism in share ownership

differs between Germanic civil law countries as compared to the US. Figure 3 demonstrates

that the Germanic firms enjoy lower levels of short-termism than their matched US firms.

Over 2 quarters the top 20 Germanic firms have 5.5% of short-term held common stock,

whereas the matched US sample over 2 quarters faces 9.7% of short-term held common

stock, almost double the amount. That is, over six months, 10% of the matched US firms’

equity changed hands on average, while only 5% of the equity moved over the period in the

Germanic firms. This difference has a p value of 0.011 and so is almost significant at the

1% level, and easily so at the 5% level. The significant difference remains in the extent of

short-termism over 4 quarters. The difference in short-termism remains constant at longer

time horizons, though loses significance in this small sample. The proportion of shorttermism grows as the time horizon grows: If a firm is contemplating an investment with a

two year payback period, they can expect to see around 20% of the equity change hands

before the results are fully realised. Thus there is reason to explore the effect of differing

13

This process of matching firms by industry and then market value is a standard approach. For an

early example consider Spiess and Affleck-Graves (1995).

14

Note that if owner k sells shares to j over the prior z quarters, then these shares count towards the

short-termism measure. These shares are captured exactly once in equation (24) by the increase in owner

j’s holding.

23

Figure 3: Comparison of Shareholder Short-Termism Between Germanic Civil Law countries and US (Common Law)

Notes: The graph depicts the mean short-termism amongst the top 20 firms in the Germanic civil

law countries of Germany, Switzerland and Austria. This is compared against the mean short-termism

amongst the matched panel of firms in the leading common law country (United States). Short-termism

is measured using construction (24). The data is drawn from CapitalIQ and measures short-termism

in the period ending with Q3 2012. The matching is done by 3-digit SIC, followed by firm size. **, *,

denotes that the difference in mean is significant at the 5%, 10% level; p values in parentheses. The

difference in means is plotted on the right hand axis.

investor time-horizons across economies, and indeed across industries. In particular this

analysis would suggest a stronger pressure on US firms, as opposed to Germanic ones, to

follow a new technology to benefit from the pooling effect we describe. Further, Figure 3

provides evidence consistent with the suspicion of many commentators that short-termism

is greater in the US (common law jurisdiction) than in countries such as Germany and

Switzerland (civil law).15

9.2

Empirical Predictions

The analysis of short-term shareholders yields the following three main empirical predictions:

1. Economies/industries/firms whose shareholders have shorter time horizons are sub15

See Franks, Mayer, and Rossi (2009).

24

ject to pressure to choose risky business-models only suitable for the most exceptional management teams; and prone to upwards price distortions from fundamentals (technically bubbles) in the cost of the required inputs.

This prediction follows from Proposition 1. This prediction of the model makes rigorous a great deal of anecdotal evidence and policy maker suspicion referred to in the

Introduction. As noted in the Literature Review (Section 2), there is a great deal of

empirical work which links short investor time-horizons with poor corporate performance:

Gaspar, Massa, and Matos (2005), Derrien, Kecskes, and Thesmar (2013), Polk and

Sapienza (2009), Graham, Harvey, and Rajgopal (2005). The assumptions underlying

the pressure to pool mechanism we explore here explicitly finds support in Graham et al.

(2005) who document the aversion that management have to actions which lower current

share prices, even at the cost of long term value creation.

2. In perfect capital markets, economies/industries/firms whose shareholders have short

expected time horizons face higher costs of equity capital.

This prediction follows from Proposition 1 and is robust to elastically supplied inputs

(Proposition 2). Using conference call transcripts, Brochet, Loumioti and Serafeim (2012)

document that firms with a short-term oriented investor base acquire higher betas, and

so pay higher costs of capital. Further, Attig, Guedhami and Mishra (2008) find that the

implied cost of equity capital decreases with the presence of large shareholders who are

banks, the state, or family, beyond the controlling owner. It seems likely that such blockholders are in the main long-term shareholders. Both analyses are therefore supportive

of this prediction. Cella (2012) finds that long-term investors improve firms’ investment

performance which would typically imply reduced costs of capital.

3. Economies/industries/firms whose shareholders have short time horizons have CEOs

with reduced long-term incentives.

This prediction follows from Proposition 4. Dong and Ozkan (2008) document that

long-term institutional investors lower short-term CEO pay as proxied by base salary and

cash bonus. Further, they document that long-term investors increase the sensitivity of

overall pay to realised firm performance.16 Cadman and Sunder (2010) also report that

CEO contracts when a firm is backed by a venture capital fund have short-term incentives

corresponding to the time of anticipated exit of the VC – an outcome naturally explained

by this model.

16

Dikolli, Kulp and Sedatole (2009) also argue that transient shareholders lead CEOs to be under

pressure to increase current earnings, however they report some evidence that boards try to compensate

for this with contracts which underweight quarterly earnings in favour of yearly returns.

25

10

Conclusions

A firm seeks to maximise the expected wealth of its shareholder owners at the time

a business decision is taken. As shareholders may have short expected time horizons,

because of the chance of liquidity shocks or because some shareholders only intend a

short-term investment, this implies that the Board of a firm must be concerned with the

path of the share price through time as well as with its final value. So firms will see value

in taking actions which pool them with firms of high ability and so high value. Thus a

firm which decides on a risky business model which only high ability management can

make a success of will send a signal that the management may indeed be high quality.

This pressure to choose business models so as to manipulate the market’s information

drives up the price of the input needed for the risky technology to above its fundamental

level. A bubble is created. Market clearing then implies that too many firms enter this

technology. This distortion in business-model choice results in an increased cost of equity

capital, no matter what the elasticity of supply is of the input asset. And this distortion

is not necessarily mitigated by a more precise signal of the type of any given firm. Finally

a Board will respond to the apparent interests of shareholders with short expected time

horizons by underweighting long term incentives. Doing so reduces effort on tasks which

do not have short-term price impact.

In principle, if a firm was unable to determine the time-horizon of its owners then the

negative outcomes described here would be avoided. Thus, if investors all channeled their

funds through a third party, such as a bank, then the effects described here would not

occur. Though the providers of capital may be subject to liquidity shocks, by pooling

resources into a bank those liquidity shocks would not impact corporate decision making.

The bank could structure its portfolio so as to allow the firm to invest for the long run

while also owning other short-term assets to manage the liquidity requirements of the

fundamental investors. Such a model of ownership is similar to the German and Japanese

models of corporate control (see, for example, Breally, Myers and Allen (2011)). It is well

known however that such an approach has its own disadvantages. In particular set against

the study here must be the implications of having an overly powerful group of long-term

shareholders who might be tempted to exploit the firm to the detriment of the wider

population of shareholders. Such broader issues of the perils of shareholder influence and

the implications for technology choice and CEO contracting are left to future scholarly

study.

A

Omitted Proofs

Proof of Lemma 1. Rewrite (3) as rP f = R̄q bP f . The left hand side is increasing

in P f . The right hand side is declining in P f . Hence any solution to (3) must be unique.

26

We have limP f →0 R̄q bP f = R̄ > rP f P f =0 and limP f →1/b R̄q bP f = 0 < rP f P f =1/b

hence a fundamental price exists by the Intermediate Value Theorem.

Proof of Lemma 2. Suppose otherwise that the Board’s strategy was not a cut-off

type of this form. Then there must exist two firm types τ1 < τ2 such that a firm of type

τ1 would strictly prefer to develop the risky technology whilst the firm with higher type

τ2 would strictly prefer to develop the business-as-usual technology. Hence we would have

V risk (τ1 , L) > r > V risk (τ2 , L)

(25)

∂

V risk (τ, L) = (1 − L) R̄/P > 0 as L < 1. A contradiction to (25).

However, from (4), ∂τ