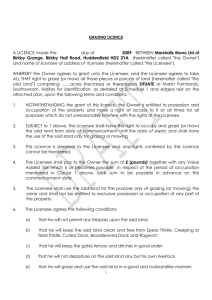

Conveyancers Act 2006 - Victorian Legislation and Parliamentary

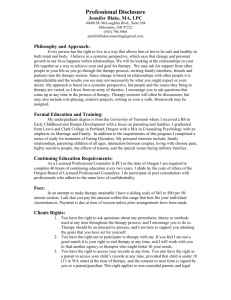

advertisement