Notation: Bold face = vectors and matrices

advertisement

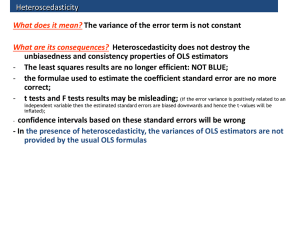

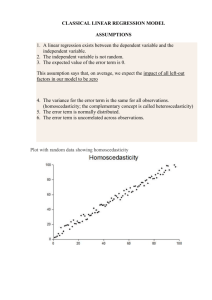

Lin Ma Olga Kerimova Tan Meng ECON4160 Seminar 2 11. 02.2009 Notation: Bold face = vectors and matrices (......)ʼ is a transposed row vector = column vector. Notation is used for easier representation. diag[..] is a matrix with zeroes everywhere except the leading diagonal. The elements on this diagonal are listed in the bracket. Exercise 7 1) Which assumptions would you make about the disturbances ut , vt and wt ? The three equations may be rewritten as follows, such that all three have Ct on the LHS and the RHSʼs are comparable. (aʼ) -- multiplying (a) by Pt (bʼ) -- (b) is unchanged (cʼ) -- multiplying (c) by Rt => utPt = vt = wtRt Thus, the assumptions on ut are sufficient for assumptions on vt and wt to follow (see below). Assumptions: E(ut|Pt,Rt) = 0; E(vt|Pt,Rt) = 0; E(wt|Pt,Rt) = 0; t = 1, ... ,n Note: since there is no intercept in (b), these zero conditional mean assumptions will not be automatically fulfilled. E(ut,us|Pt,Rt,Ps,Rs) = σ2ωts t,s = 1, ... ,n and σ2 some unknown constant E(vt,vs|Pt,Rt,Ps,Rs) = E(utPt,usPs|Pt,Rt,Ps,Rs) = PtPsE(ut,us|Pt,Rt,Ps,Rs) = PtPsσ2ωts; t,s = 1, ... ,n E(wt,ws|Pt,Rt,Ps,Rs) = E(ut(Pt/Rt),us(Ps/Rs)|Pt,Rt,Ps,Rs) = (Pt/Rt)(Ps/Rs)σ2ωts; t,s = 1, ... ,n Note: ωts,t≠s may well be non-zero (autocorrelation) and ωtt ≠1 (heteroscedasticity) Assumptions in vector form: E(u|X) = 0; E(v|X) = 0; E(w|X) = 0 E(uuʼ|X) = σ2 Ω E(vvʼ|X) = E((uP)(uP)ʼ|X) = PPʼE(uuʼ|X) = PPʼσ2 Ω E(wwʼ|X) = E(u(P/R)(u(P/R))ʼ|X) = (P/R)(P/R)ʼE(uuʼ|X) = (P/R)(P/R)ʼσ2 Ω where Ω is a nxn matrix with element (t,s) = ωts; X is a nx2 matrix with column 1 being the vector of prices (P1 P2 ... Pn)ʼ and column 2 being the vector of Income (R1 R2 ... Rn)ʼ. u, v and w are nx1 vectors of disturbances such that u = (u1 u2 ... un)ʼ and so on. P is a vector of prices, i.e. a nx1 vector contained in column 1 of X. Similarly, R is a nx1 vector of income contained in column 2 of X. P/R is a nx1 vector (P1/R1 P2/R2 ...Pn/Rn)ʼ such that Pt/Rt is row t of this vector. (P/R)(P/R)ʼ is the product of a column vector and a row vector, yielding an nxn matrix of which (Pt/Rt)(Ps/Rs) is one element (in row t and column s). Note: (uP) is not the product of vector u and vector P (that multiplication would be impossible). uPnx1 = (u1P1 u2P2 ... unPn)ʼ. Hence, uP(uP)ʼ is an nxn vector. Lin Ma Olga Kerimova Tan Meng ECON4160 Seminar 2 11. 02.2009 2) Explain how you would estimate the marginal propensity to consume, β, (i) by OLS and (ii) by GLS, in the three cases. What can you say about the properties of estimators? OLS Estimate all three equation by standard OLS - minimise sum of squared residuals. The estimates of β will differ as the residuals are assumed to be different and hence the estimated error terms differ. The estimators will be unbiased, consistent but inefficient (since the disturbances are autocorrelated, heteroscedastic or both). The OLS estimators are asymptotically normally distributed. Only if Ω = In (identity matrix), u will be well behaved (no autocorrelation and no heteroscedasticity) and, therefore, the estimator of β in (a) will be efficient as well as unbiased and consistent. The other 2 estimators (in (b) and (c)), however, will remain inefficient (due to heteroscedasticity) as for example E(vt,vs|Pt,Rt,Ps,Rs)=Pt2σ2 for t=s and 0 for t≠s. Similarly for w. GLS (Generalised Least Squares) First assume that there may be both Autocorrelation and Heteroscedasticity, i.e. a general analysis follows. In a case where E(uuʼ|X) = σ2 Ω and supposing that Ω is known, we can transform the model and estimate by GLS. If σ2Ω is positive definite, then a non-singular matrix T with element (t,s) = tts will exist such that TΩTʼ = In or equivalently Ω-1 = TʼT. Thus, we need to find the inverse of Ω and factorise it, which is possible when Ω is positive definite. Rewrite (a), (b) and (c) in matrix form for convenience: (a) y = Zβ + u where ynx1 = (C1/P1 C2/P2 ... Cn/Pn)ʼ and Z is nx2 with column 1 containing 1ʼs (for the intercept) and column 2 being an nx1 vector (R1/P1 R2/P2 .... Rn/Pn)ʼ. β is a 2x1 vector (α β)ʼ. u is an nx1 vector of disturbances (u1 u2 ... un)ʼ. (b) y = Zβ + v where ynx1 = (C1 C2 ... Cn)ʼ and Z is nx2 with column 1 being an nx1 vector (P1 P2 ....Pn)ʼ and column 2 being an nx1 vector (R1 R2 .... Rn)ʼ. β is a 2x1 vector (α β)ʼ. v is an nx1 vector of disturbances (v1 v2 ... vn)ʼ. (c) y = Zβ + w where ynx1 = (C1/R1 C2/R2 ... Cn/Rn)ʼ and Z is nx2 with column 1 being an nx1 vector (P1/R1 P2/R2 .... Pn/Rn)ʼ and column 2 containing 1ʼs (for the intercept) . β is a 2x1 vector (α β)ʼ. w is an nx1 vector of disturbances (w1 w2 ... wn)ʼ. Now transform the models by premultiplying by a transformation matrix T. (a) becomes: Ty = TZβ + Tu (equivalently y* = Z*β + u*) Then E(u*u*ʼ|Z) = E(TuuʼTʼ|Z) = Tσ2 ΩTʼ = σ2 TΩTʼ = σ2In Thus, β can now be estimated by OLS on the transformed model. (b) becomes: Ty = TZβ + Tv (equivalently y* = Z*β + v*) Here we need to find T such that TPPʼΩTʼ = In Then E(v*v*ʼ|Z) = E(TvvʼTʼ|Z) = TPPʼσ2 ΩTʼ = σ2 TPPʼΩTʼ = σ2In Thus, β can now be estimated by OLS on the transformed model. (c) becomes: Ty = TZβ + Tw (equivalently y* = Z*β + w*) Here we need to find T such that T(P/R)(P/R)ʼΩTʼ = In Then E(w*w*ʼ|Z) = E(TwwʼTʼ|Z) = T(P/R)(P/R)ʼσ2 ΩTʼ = σ2T(P/R)(P/R)ʼΩTʼ = σ2In Thus, β can now be estimated by OLS on the transformed model. The estimators are minimum variance linear unbiased estimators (MVLUE). The estimators are consistent provided that plim[(1/n)Z*ʼZ*] = Q* where Q* is a finite positive definite matrix. The estimators are also asymptotically normally distributed. Lin Ma Olga Kerimova Tan Meng ECON4160 Seminar 2 11. 02.2009 Two specific cases: Only Heteroscedasticity - weighted least squares (equation (a)) ω11 ω11 ω22 Ω ω22 ωnn ωnn Thus the transformed model y* = Z*β + u* has the following elements: yt* = yt/√ωtt; zkt* = zkt/√ωtt; ut* = ut/√ωtt. In case (b) Tnxn = diag[(1/√ωtt)Pt] for t=1, .... ,n. In case (c) Tnxn = diag[(1/√ωtt)Rt/Pt] for t=1, .... ,n. Only Autocorrelation - AR(1) Ω Then y1* = (√1-ρ2)y1; zk1* = (√1-ρ2) zk1 And for t = 2, .... ,n: yt* = yt - ρyt-1 ; zkt* = zkt - ρzk,t-1 3) In the consumption functions above we have assumed that the consumers do have money illusion, since a proportional change in Pt and Rt is assumed to leave real value of consumption, Ct /Pt , unchanged. Could you, by modifying specifications (a), (b) or (c) in suitable ways, use them as a starting point investigating econometrically whether the consumers have money illusion? not the the for One possibility is to include the price index Pt in specification in (a), which, as it stands, is in real terms only. Thus, Ct/Pt = α + βRt/Pt + δPt + ut To test for money illusion, test δ=0 vs. alternative δ≠0 by means of a simple t-test. If there is no money illusion, real consumption depends on real income only and does not respond to proportional changes in prices and income). If there is money illusion (δ≠0), a proportionate change in prices and income will change real consumption, indicating that consumers respond to nominal changes (in the price level in this case) even if in real terms nothing had changed. An even clearer way to illustrate money illusion, perhaps, is to include nominal income in (a): Ct/Pt = α + βRt/Pt + φRt + ut Lin Ma Olga Kerimova Tan Meng ECON4160 Seminar 2 11. 02.2009 Here, one would test the hypothesis φ=0 (no money illusion). As before, if there is no money illusion, a proportionate change in prices and income will leave real consumption unchanged, i.e. consumers think in real terms rather than in nominal terms. However, if the hypothesis is rejected and money illusion is present, a proportionate change in prices and nominal income will in fact change real consumption. If nominal income increases proportionately to an increase in prices, consumers not suffering from money illusion will realise that in real terms their income is the same and not change their consumption. However, consumers under money illusion, will respond to an increase in their nominal income by consuming more (real consumption increases). Real consumption will vary with nominal income. Exercise 9 (a) Describe one of more methods which you would find useful in investigating whether the disturbances u or v or w in models (a)–(c) in Exercise 7 exhibit heteroscedasticity. 1. Plot graph Plot êt² against independent variables. We can observe whether there exits an increasing or decreasing pattern. (a) êt² = [C t /P t – (C t /P t)ols]2 (b) êt² = [C t – (C t)ols]2 (c) êt² = [C t /R t – (C t /R t)ols]2 Homoscedasticity Heteroscedasticity 2. Whiteʼs test H0: σt²=σ2 for all t (no heteroscedasticity) H1: Not H0. A simple operational of Whiteʼs test is carried out by obtaining nR² in the regression of êt² on a constant and all unique variables contained in x and all the squares and cross products of the variables in x.The estimated models for the three cases, where a, b, c, d, e, and f are coefficient estimates, are: Lin Ma Olga Kerimova Tan Meng a) êt²= a + b(Rt/Pt) + c(Rt /Pt)² b) êt² = aPt + bPt² + cPtR t + dRt² + f c) êt²= a + b(Pt /Rt) + c(Pt /Rt)² ECON4160 Seminar 2 11. 02.2009 êt² = [C t /P t – (C t /P t)ols]2 êt² = [C t – (C t)ols]2 êt² = [C t /R t – (C t /R t)ols]2 Find the nR² (where n the number of observations) of each regression. The statistic is asymptotically distributed as Chi-squared with P-1 degrees of freedom, where P is the number of regressors in the equation, including the constant. (a) 3-1 = 2 d.o.f (b) 5-1 = 4 d.o.f (c) 3-1 = 2 d.o.f. Chi-squared with 5% : critical value = 5.99 Chi-squared with 5% : critical value = 9.49 Chi-squared with 5% : critical value = 5.99 Compare nR² with the relevant critical value. If nR² ≥ critical value reject hypothesis of homoscedasticity. If nR²< critical value, one canʼt reject hypothesis of homoscedasticity. 3. Breusch-Pagan Test This test requires a specific alternative hypothesis H0: σt2 = σ2 f(α0 + α′zt ), where zt is a vector of independent variables. Model is homoscedastic if α = 0. We specify the test based on: (a) zt=[1, Rt /Pt] (b) zt=[1, Pt, Rt] (c) zt=[1, Pt /Rt] By using the least squares residuals, get gt = et²/(eʼe/n)-1 and then find LM=½[gʼZ(ZʼZ)ˉ¹Zʼg], and compare the value with the critical value for the chi-squared distribution with: (a) 1 d.o.f. Chi-square with 5% : critical value = 3.84 (b) 2 d.o.f. Chi-square with 5% : critical value = 5.99 (c) 1 d.o.f. Chi-square with 5% : critical value = 3.84 Z is an n×P matrix of observations on (1, zt ). Conclude whether the null hypothesis of homoscedasticity is rejected or not. Note: the Koenker and Bassettʼs method could be much more powerful with: LM=[1/V](u - ūt)ʼZ(ZʼZ)ˉ¹Zʼ(u - ūt) where u=(e12, e22, . . . , en2) and t is an n×1 column of 1s and ū = eʼe/n. Lin Ma Olga Kerimova Tan Meng ECON4160 Seminar 2 11. 02.2009 9 (b) Describe one or more methods that you would find useful in order to investigate whether the disturbance of the model you have chosen in Exercise 7, exhibits autocorrelation. 1. Plot êt We can plot êt which could represent u t, v t, or wt. For example: positive autocorrelation negative autocorrelation 2. Durbin-Watson test Let μ t =ρμ t -1+ε t -1<ρ<1 (μ is the random disturbance, ut, vt or wt in the case) H0: ρ=0 H1: H0 is not true Find the D.W. value. Find the dL and dL with D.W. distribution according to the degrees of freedom, n, and the number of regressors excluding the intercept (check the table Greene, p. 1098). If 0<D.W.<dL If dL<D.W.<dU If dU <D.W.<4−dU If 4−dU <D.W.<4 - dL If 4−dL <D.W.<4 positive autocorrelation canʼt decide no autocorrelation canʼt decide negative autocorrelation Lin Ma Olga Kerimova Tan Meng ECON4160 Seminar 2 11. 02.2009 Note: The Durbin–Watson test is not likely to be valid when there is a lagged dependent variable in the model. The D.W. statistic will usually be biased towards no autocorrelation. However, there are other tests, such as the LM and Q tests as well as Durbinʼs h test, that can be used whether or not the regression contains a lagged dependent variable. Exercise 10 Explain the differences between the Generalized Least Squares (GLS) and the Feasible Generalized Least Squares (FGLS) methods. Explain how you would proceed to apply the latter method in a specific situation. What can you say about the properties of the FGLS method? The FGLS method is just a “little modification” on the GLS method. To obtain the FGLS estimators is to replace the covariance matrix in the GLS method by an estimated covariance matrix ΩFGLS. Generally the covariance matrix contains unknown parameters, so it is impossible to use GLS. Instead, we use FGLS. However, the FGLS method hinges on knowing the form of heteroscedasticity and/or autocorrelation, in which case it is possible to find a consistent estimator of Ω. Specific situation Assume the disturbances are heteroscedastic but non-autocorrelated. Also the disturbances satisfy the assumption that it is uncorrelated with explanatory variables. Then we do the following steps to apply the FGLS: Step1: calculate the ordinary least squares (OLS) estimators as usual. Then use the OLS estimators to compute the error terms, ei, as estimators of the residuals, ui. Step2: Use ei to construct OLS covariance matrix Ω-hat = diag[e12 e22 ... en2]. In this specific case, Ω-hat is the estimated covariance matrix ΩFGLS in FGLS method. Step3: Estimate the FGLS estimators by using ΩFGLS to replace the true covariance matrix, Ω, of the disturbances. Then we get the FGLS estimator: The above steps can be iterated to get the estimation of Ω to convergence. Properties of the FGLS estimators The GLS estimator is the minimum variance linear unbiased estimator in the generalized regression model. The FGLS estimator has the same large-sample property as its infeasible counterpart GLS estimator. This result does not depend on using an efficient estimator of Ω, but simply any consistent estimator of Ω. However, care has to be taken that the asymptotic efficiency of FGLS estimators may not carry over to small samples because of the variability introduced by the estimated Ω. So with small sample, it might not be a good choice to use FGLS.