A Tax Policy Analysis of Treatment of Tax Malpractice Recoveries

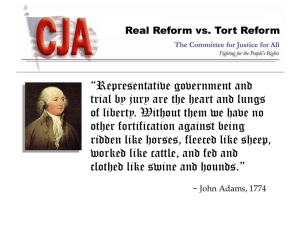

advertisement

Policy Analysis of Tax Malpractice Recovery

May 27, 2008

By Finis Cowan III

Copyright © 2008 by the author.

(713) 582-6066

finis@finiscowan.com

The author is a Tax LLM student at the University or Houston Law Center, a 1985

graduate of Baylor Law School and a partner with the firm of Forrest & Kelly LLP.

The author expresses his thanks to Professor Ira Sheperd and

classmate, Terrence Botha, for their thoughtful input.

Table of Contents

I.

Questions and Principles………………………………………..3

II.

Are Tax Malpractice Recoveries Income?..................................8

III.

IRS Treatment…………………………………………………10

IV.

If Tax Malpractice Recoveries Are Income, How Are They

Taxed?........................................................................................33

V.

Can Clients Recover the Extra Tax (“Gross-Up”

Damages) Caused By Tax Malpractice?....................................35

VI.

Parallelism Is Trumped By Administrative Enforcement

Policy and Third Party Involvement…………………………..39

2

I. Questions and Principles

This paper analyzes the tax policy issues involved when taxpayers recover

compensation for tax malpractice.1 Malpractice recoveries raise a number of tax policy

issues:

Should malpractice recoveries be treated as taxable income?2

Should the tax treatment depend on the nature and the consequences of the

malpractice?3

Should taxability differ depending on whether the malpractice was (A)

negligent advice or return preparation that cost the taxpayer additional taxes or

(B) conduct that did not cause the taxpayer to pay more than the “proper

minimum tax” under the “nontax” facts?4

Should it matter whether the practitioner promised tax benefits to which the

taxpayer never had a legitimate right?5

Since tax malpractice includes claims against a number of disciplines, this paper uses “practitioner” to

describe any potential defendant in a tax malpractice case.

1

It is this paper’s contention that malpractice recoveries in which the taxpayer suffers a loss by incurring

costs that she would not have incurred but for the malpractice should not be taxable income.

2

The IRS’ 1997-98 “proper” tax PLRs, discussed infra at p. 12, attempt to distinguish taxability of recovery

for negligent return preparation and negligence which goes to the underlying transaction or “non-tax” facts.

This paper contends that the PLRs do not adequately justify such a distinction.

3

4

The quoted terms are from the PLRs discussed, infra at p. 19.

“In these ‘pie-in-the-sky’ situations the courts seem to measure damages by the difference between the

taxes actually incurred minus what taxes could have been payable with optimal advice. They do not factor

into this calculation the tax results promised by the tax advisor.” Jacob L. Todres, Tax Malpractice Damages:

A Comprehensive Review of the Elements and the Issues, The Tax Lawyer, Vol. 61, Spring 2008, at 100-101.

Also see Ducote Jax Holdings LLC et al. v. William E. Bradley, No. 04-1943, 2007 U.S. Dist. LEXIS 490088

(E.D. La. 2007) (successful prosecution of RICO violations in tax shelter case based on misrepresentation of

legality of tax strategies).

5

3

Should malpractice recovery be treated as ordinary income or a return of

capital?

What role should tax policy play in whether and how to tax such recoveries?

What is the “incidence” of the tax, i.e., who actually bears the tax burden and

should this have any significance to tax policy?6

Should recovery be permitted for losses incurred when an IRS controversy is

triggered by malpractice, i.e., “audit damages”?

Is the origin of the claim the malpractice claim, the “non-tax facts” or the

underlying tax benefit the taxpayer lost because of the malpractice?

Prolific tax article author, Robert W. Wood,7 notes a surprising paucity of

authority8 on tax treatment of legal malpractice recovery. Wood notes the following

general principles:

1. Litigation recoveries should be taxed according to the origin, nature and

taxability of the underlying claim.9

6

Since the taxation of malpractice recoveries is not likely to have an unduly negative effect on productivity

or the economy, incidence alone should probably not be a significant factor in determining the tax treatment.

However, as long as the Alternative Minimum Tax presents a serious risk to plaintiffs with modest recoveries

and large contingent attorneys’ fees, taxation of recoveries to plaintiffs can impact with such plaintiffs’ right

to pursue their rights through malpractice litigation.

7

Wood, Tax Treatment of Legal Malpractice Recoveries, February 12, 2007, Tax Notes p. 665 (references to

“Wood” in this paper refer to this article except where otherwise noted).

8

The article containing the most elaborate policy analyses in this area is by Jeffrey H. Kahn, The Mirage of

Equivalence and the Ethereal Principles of Parallelism and Horizontal Equity, 2005, bepress Legal Series,

Paper 715, 57 HASTINGS L.J. 645 (2006). This paper is also indebted to thoughtful papers authored by

Professors Lawrence Zelenak, Anthony E. Rebollo and Jacob L. Todres. See Zelenak, The Taxation of Tax

Indemnity Payments: Recovery of Capital and The Contours of Gross Income, 46 Tax L. Rev. 381, 386-87

(1991); Anthony E. Rebollo, Journal of Taxation *353, June 2006, Responding To 'Gross-Up' Claims In Tax

Malpractice Cases; and Todres, Tax Malpractice Damages, supra at n. 5.

9

Wood, p. 665 n. 1, supra n. 7, cites the leading cases for the origin of the claim doctrine: United States v.

Gilmore, 372 U.S. 39, 49 (1963) (payment received as a substitute for something that would have been an

gross income is taxable compensation); Hort v. Commissioner, 313 U.S. 28 (1941) (consideration for the

4

2. There is no income from simply being restored to the position a taxpayer would

have occupied were it not for the malpractice.10

3. The preceding exclusion does not generally apply to recovery for interest, delay

damages, punitive damages or penalties.11

Other relevant principles include:

4. A return of capital is not included in income.12 In other words,

(T)here are strong reasons not to tax someone on the

recovery of his own money because the taxpayer has not

realized a gain in any meaningful sense. The entire system of

utilizing basis to determine gain rests on the notion that one

should not be taxed on the recovery of one’s own money. 13

An exception to that policy occurs when the tax benefit rule

applies to a recovery because the taxpayer had previously

taken a deduction that provided him with a tax benefit . . .

The reason for this exception is to prevent the taxpayer from

retaining a tax benefit for an expenditure which he

subsequently recovered. The policy of preventing a

taxpayer from retaining a deduction for which he is no longer

entitled outweighs the policy of not taxing a return of

capital.14

cancellation of a lease was essentially a substitute for rental payments and therefore taxable income rather

than a nontaxable return of capital).

10

Wood, p. 665, supra n. 7,

See Todres, pp. 10 – 40, supra, n. 5; Rev. Rul. 57-47 (interest on the amount deemed overpaid); IRC §

162(f) (penalties); Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955) (punitive damages are

includible in gross income because they are not a substitute for any amounts lost by the plaintiff or a

substitute for any injury to the plaintiff or plaintiff's property); BNA Tax Management Portfolios, U.S.

Income Series Income, Deductions, Credits and Computation of Tax, 501-3rd 2008 FN2878: “See PLR

9728052; PLR 7749029 (indemnification payment for additional income taxes and related underpayment

penalties and interest, owed due to attorney's erroneous counsel, must be included in income).”

11

12

Milenbach v. Comm'n, 318 F.3d 924, 933 (9th Cir. 2003); Raytheon Prod. Corp. v. Comm'n, 144 F.2d

110, 113-14 (1st Cir.1944) ("in lieu of what were the damages awarded.")

13

Kahn, pp. 17-18, supra, n. 8.

14

Id. at 18, n. 35.

5

5. The tax benefit rule requires taxpayers who enjoyed a tax deduction for the

amount later recovered (e.g. business taxpayers who deducted the interest and

fees later recovered) to include such recoveries in their income.15

6. Payment of taxes by a third party is income to the taxpayer.16

7. Ordinarily the payment of federal income taxes cannot be properly

characterized as a loss.17

8. For tax purposes, the ordinary rule is that a loss deduction may not be taken in

the absence of actual economic loss.18

9. Tax fairness requires that like-situated taxpayers should be taxed the same

(horizontal equity) and differently situated taxpayers should be taxed differently

(vertical equity).19

15

E.g., Rev. Rul. 57-47 distinguished tax free return of capital from recovery attributable to lost earnings on

the excess taxes that would have been taxable and the tax deductible fee. Cf. IRC § 111(a), which “provides

that gross income does not include the recovery of an amount deducted in an earlier year to the extent the

earlier deduction did not produce a tax benefit. In situations covered by § 111(a), Congress has determined

that a given type of expense or loss should be deductible, but the taxpayer's particular circumstances

precluded a benefit from the deduction.” Zelenak at 387, supra, n. 8. “Outside of §111, the nonstatutory tax

benefit doctrine probably still has vitality.” Wood, 38th Annual Employment Law Conf. p. 12, citing Dobson

v. Commissioner, 320 U.S. 489 (1943).

Also see Wood, p. 666 supra, n. 5, “That ‘did not and could not’ standard (from Clark v. Commissioner,

40 BTA 333, 335 (1935)) suggests that a tough tax benefit theory should apply to such analyses. It suggests that

there is a requirement that the plaintiff not only not have claimed a tax deduction for the loss, but also that he not

have been able to do so.”

Also see Gregg D. Polsky, The Contingent Attorney's Fee Tax Trap: Ethical, Fiduciary Duty, And

Malpractice Implications, 23 Va. Tax Rev. 615, at 634-35 (Winter 2004) (“a fiduciary duty/malpractice

plaintiff could argue that the damages she received represent a refund of attorney's fees previously paid and,

as a result, that the damages are excluded from gross income pursuant to the exclusionary component of the

tax benefit rule in section 111(a).”

Section 1.61-14(a) of the Income Tax Regulations provides that another’s payment of a taxpayer’s income

tax constitutes gross income to the taxpayer, unless otherwise excluded. Also see Old Colony Trust Co. v.

Commissioner, 279 U.S. 716 (1929).

16

17

Zelenak, p. 397-98, supra, n. 8, citing Old Colony Trust Co., 279 U.S. 716 (1929).

18

Centex Corp. v. U.S., 395 F.3d 1283, 1293 (C.A. Fed., 2005).

6

Wood posits that tax treatment of malpractice recoveries “should be based on the

item the plaintiff would have received but for the attorney’s malpractice. That, after all, is

the sine qua non of the origin of the claim doctrine.”20

The IRS’ views on this subject have been inconsistent and widely criticized.21 Its

recent general view of litigation recoveries does conform to the origin of claim doctrine:

Whether the proceeds received in a lawsuit or the settlement thereof

constitute income under section 61 depends on the nature of the claim

and the actual basis for recovery. Rev. Rul. 81-277, 1981-2 C.B. 14. If

the recovery represents damages for lost profits, it is taxed as ordinary

income; similarly, replacement of lost capital is treated as a nontaxable

return of capital. Id. at 15, citing Freeman v. Commissioner, 33 T.C.

323 (1959); see also Estate of Taracido v. Commissioner, 72 T.C.

1014, 1023 (1979). Payments by one causing a loss that do no more

than restore a taxpayer to the position he or she was in before the loss

was incurred are not includible in income because there is no

economic gain.22

19

Federal Income Tax: Doctrine Structure and Policy, Third Edition, Dodge, Fleming, and Geier, 2004, p.

122. Also see Kahn, pp. 6 and 12, supra, n. 8 and authorities cited therein. “Horizontal equity requires that

persons in like net income positions pay the same amount of income tax . . . The goal of differently taxing

individuals with disparate net income is referred to as vertical equity. William Andrews, Basic Federal

Income Taxation 7-8 (5th ed. 1999). The goal of vertical equity generally includes a requirement that there be

an ‘appropriate’ difference in taxation. Also see Paul R. McDaniel & James R. Repetti, Horizontal and

Vertical Equity: The Musgrave/Kaplow Exchange, 1 Fla. Tax Rev. 607, 607 (1993).”

20

Wood, p. 667 supra, n. 5.

Kahn, p. 48, supra, n. 8 (describes the reasoning of PLR 9743035’s attempt to distinguish

Clark v. Commissioner, supra, based on whether taxpayers incurred more than their “proper”

tax. as “weak, at best.”). Rebollo at 358, supra, n. 8 describes the “proper” tax PLRs as

“wrong. “Silly” is the conclusion of Maule, 502-2nd T.M. (BNA), Gross Income: Tax

Benefit, Claim of Right and Assignment of Income, page A-5 (specifically referring to Ltr.

Ruls. 9743034 and 9743035 ); James P. Dawson, Fox Rothschild LLP Tax Litigation Blog,

July 15, 2007 (“(G)uidance needs to be issued by the IRS keeping in mind not its position but

the position of the Court’s (referring to Centex Corp. v. U.S., 55 Fed. Cl. 381, 389 (2003),

aff'd 395 F.3d 1283 (Fed. Cir. 2005)) as to the underlying cause of action. If the IRS looks at

the underlying cause of action(s) then the conclusion should be for non-inclusion.”)

21

PLR 200328033. Although this PLR is not based a tax malpractice case, it says, “The tax indemnity

payment that A received in this case is indistinguishable from the (malpractice) indemnity payments in Clark

and Rev. Rul. 57-47.”

22

7

II.

Are Tax Malpractice Recoveries Income?

"Gross income" is broadly defined, for purpose of federal income taxation, as "all

income from whatever source derived." 26 U.S.C. § 61(a). The Supreme Court has

broadened its interpretation from "the gain derived from capital, from labor, or from both

combined," as established in 1920 in Eisner, to a more all-encompassing standard,

including "all economic gains not otherwise exempted."23 In general, gross income refers

to inflows, i.e., realized accessions to wealth.24

Any receipt of funds or other accessions to wealth received by a

taxpayer is presumed to be gross income unless the taxpayer can

demonstrate that the funds or accessions fit into one of the exclusions

provided by other sections of the Code. Commissioner v. Glenshaw

Glass Co., 348 U.S. 426, 430-31 (1955). However, the receipt

constituting a return of basis is generally not classified as income

within the meaning of section 61 because it is not an accession to

wealth. For payments received in settlement of a lawsuit, payments by

the one causing a loss that do no more than restore a taxpayer to the

position he or she was in before the loss was incurred are not

includible in gross income because there is no economic gain to the

recipient. See Raytheon Products Corp. v. Commissioner, 144 F.2d

110 (1st. Cir. 1944)(stating if a recovery is treated as a replacement of

capital, the damages received from the lawsuit are treated as a return

of capital and are taxable only to the extent that the damages exceed

the basis of the property replaced).25

23

Murphy v. IRS, 362 F. Supp. 206, 218 (D.C. 2005) citing Eisner v. Macomber, 252 U.S. 189, 207, 40 S.Ct.

189, 64 L.Ed. 521 (1920); Commissioner v. Banks, 543 U.S. 426, 25 S.Ct. 826, 160 L.Ed.2d 859 (2005).

Dodge, Fleming, and Geier, p. 244 and Kahn, p. 21, fn. 43, supra, n. 8: “The Haig-Simons definition of

income is the most commonly cited definition for tax policy purposes. It defines income for a period as the

sum of the increase in wealth accumulated by the person plus the market value of the person’s personal

consumption. See Henry C. Simons, Personal Income Taxation 50 (Univ. of Chi. Press 1980) (1938)”

24

25

GL-132608-04, *3-4, (1980) analyzing whether damages from a class action lawsuit against an insurer are

includible in the taxpayers’ income and concluding that they are not includible to the extent of the taxpayer’s

basis in the insurance policy because a return of basis is not generally classified as income within the

meaning of section 61.

8

The IRC § 104 statutory exclusion of compensation for “personal physical injuries,”

while inapplicable to tax malpractice, most closely approaches the normative rationale of

excluding from income compensation for loss of a non-taxable right or benefit, i.e., making

an injured party as whole as possible and restoring her pre-loss condition to the extent

possible with monetary compensation.

Clark v. Commissioner26 is the seminal case for nontaxability of malpractice

recovery. It held that a tax lawyer’s malpractice settlement payment was not includible in

his client’s gross income because it was compensation for a loss that impaired the client’s

capital. 27 Clark cited a variety of cases for the theory that “recoupment on account of such

losses is not income since it is not ‘derived from capital, from labor or from both

combined.’"28 The client did not, and could not, deduct the loss and was merely being

made whole.

The BTA29 disposed of the IRS’ argument that a third party’s payment of taxes is

income to the taxpayer by recognizing that the lawyer’s payment was compensation for a

loss and not payment of Clark’s taxes.30 Clark’s loss was caused by negligent advice and

return preparation that resulted in a tax that the client would otherwise not have incurred,

i.e., could have legally avoided.

40 B.T.A. 333, 1939 WL 11, 1939 BTA LEXIS 864, (B.T.A. Jul 27, 1939). Wood notes, “It is a testament

to the lack of authority in this area that Clark is still a leading (and nearly the only!) case nearly 70 years

later.” Wood, p. 665 fn. 7, supra, n. 5.

26

The practitioner’s error of advising the taxpayer to file a separate tax return instead of a joint return

impaired the utility of a capital loss deduction.

27

28

40 B.T.A. at 335, 1939 WL at **5, citing Merchants Loan & Trust Co. v. Smietanka, 255 U.S.

509; United States v. Safety Car Heating & Lighting Co., 297 U.S. 88.

29

The Tax Court was formerly known as the Board of Tax Appeals.

30

40 B.T.A. at 335, 1939 WL at **4, 5.

9

A 1971 IRS General Counsel’s Memorandum says that return of capital is the

“clearest” example that not all receipts are income and noted analogous treatment for tax

malpractice damages:

(T)he courts and the Service have held certain payments to be excludable

from gross income, where the payments, often called damages,

compensate a taxpayer for the loss of something that would not itself have

been includible in his gross income. Mr. Justice Frankfurter, in his

concurring opinion in United States v. Kaiser, 363 U.S. 299 (1960), says

at page 311:

The principle at work here is that payment which compensates for a loss

of something which would not itself have been an item of gross income is

not a taxable payment.31

In Concord Instruments Corp. v. Commissioner, T.C. Memo 1994-248, the Tax

Court held that a taxpayer was entitled to exclude from income a malpractice insurance

recovery paid to compensate the taxpayer for a failure by his tax counsel to timely appeal

an adverse court decision. The Court held that the recovery was designed to compensate

the petitioner for a loss of capital, and thus, did not constitute income. The Court cited Rev.

Rul. 81-277, 1981-2 C.B. 14, where the Service indicated that, "Payments by one causing a

loss that do no more that restore a taxpayer to the position he or she was in before the loss

was incurred are not includible in income."32

III. IRS Treatment

After nearly two decades of nonacquiescence to the Clark nontaxability rule, the

31

32

G.C.M. 35164.

See fn. 19 to Concord Instruments Corp.

10

IRS in Rev. Rul. 57-47, C.B. 1957-1, 4, 23, ruled that tax malpractice recoveries are not

taxable:

(A) tax consultant made an error in preparing and filing a taxpayer’s

individual income tax return. That error caused the taxpayer to pay

more than her minimum proper income tax liability . . . the

reimbursement of the additional tax paid earlier is not includible in

the taxpayer’s income.33

The portion of the recovery attributable to lost earnings on the excess taxes that would have

been taxable and the tax deductible fee was not excluded under the tax benefit rule.34

In GCM 35164 (1972) the IRS again determined that a recovery of reimbursement

for tax malpractice that resulted in the overpayment of taxes was not subject to tax under

the return of capital theory followed in Clark.. The malpractice was failing to qualify the

taxpayer as an electing small business corporation but that difference was deemed not

sufficient to distinguish the case from Rev. Rul. 57-47 and Clark.

In the 1990s, the IRS cast doubt on the scope35 and validity of the Clark non-

33

PLR 200328033. The nature of the negligence and additional tax it caused were not disclosed in Rev. Rul.

57-47. As contrasted with private letter rulings, Revenue Rulings are affirmative statements of the position of

the IRS that may be relied on by taxpayers. Reg. 601.601(d)(2)(v)(e).

IRS Private Letter Rulings do not constitute authority, may not be used or cited as precedent and can

not bind courts. IRC Section 6110(k)(3); See Hanover Bank v. Commissioner, 369 U.S. 672, 686 (1962);

Snap-On Tools, Inc. v. United States, 26 Cl. Ct. 1045, 1060 (1992), aff’d, 26 F.3d 137 (Fed. Cir. 1994).

“Despite all their shortcomings, tax lawyers still look to private letter rulings for the IRS’ general position on

matters.” Wood, The Bottom Line: Tax Issues In Employment Cases, 2005 p. 5.

Rev. Proc. 2007-1 says a letter ruling “is a written determination issued to a taxpayer by an

Associate office in response to a written inquiry from an individual or an organization about its status for tax

purposes or the tax effects of its acts or transactions, prior to the filing of returns or reports that are required

by the revenue laws. A letter ruling interprets and applies the tax laws to the taxpayer’s specific set of facts

and is given when appropriate in the interest of sound tax administration. A letter ruling includes the written

permission or denial of permission by an Associate office to a request for a change in a taxpayer’s accounting

method or accounting period. Once issued, a letter ruling may be revoked or modified for any number of

reasons, as explained in section 11 (section 9.19 for a change in accounting method letter ruling) of this

revenue procedure, unless it is accompanied by a “closing agreement.”

34

Accord General Counsel Memorandum 35164 (1971) finding recovery of malpractice damages for failure

to elect "S" corporation status not taxable. The ruling looked to the character of the income that would have

been received had no malpractice occurred.

35

Wood, p. 666 supra, n. 5 (The IRS tried “to limit the breadth of the Clark holding” in these rulings.)

11

taxability rule in a series of private letter rulings. “In the end, the IRS distinguished Clark

(as well as Rev. Rul. 57- 47) in each of the fact patterns at issue, and therefore held that the

various tax-based recoveries considered in the rulings were subject to tax.”36

It is difficult, if not impossible, to reconcile Clark and Rev. Rul. 57- 47 with these

rulings. Wood’s distillation of the rulings is that they “suggest that an exclusion from

income is appropriate only when the taxpayer pays more than his ‘proper’ minimum

federal income tax liability based on the underlying transaction.”37 He articulates the

taxpayers’ expected response, “but for the accountant’s error, the . . . transaction would

have . . . been nontaxable. That is arguably not a question of whether the taxpayer owed the

correct amount of tax, but whether the transaction is taxable at all.”38

The consensus of commentators is that the Clark reasoning should have controlled

the PLRs and required a different, nontaxable outcome. The negligent practitioners were

“simply repaying the taxpayer for lost capital based on the accountant’s error. This should

be treated similarly to payments made for causing damage to property . . . the replacement

of dollars is equivalent to a replacement of basis, both of which represent a return of

capital.”39

IRS’ “Minimum Proper Tax” Rationale

Four of the PLRs were to investment funds that failed to qualify as regulated

investment companies (“RIC”) due to their CPAs’ negligence. LTR 9211015 and LTR

36

Rebollo, supra, at 357, supra, n. 8.

37

Wood, p. 670, supra, n. 5.

38

Id.

39

Kahn, p. 48, supra, n. 8.

12

9211029 followed the holding and reasoning of Clark and Rev. Rul. 57-47 by holding that

malpractice recoveries are a nontaxable return of capital. LTR 9743035 and LTR 9743034

revoked the earlier PLRs because they were no longer “in accord with the current views of

the Service.” The later rulings attempted to distinguish Clark and Rev. Rul. 57-47 because

in those cases the:

preparers' errors in filing returns or claiming refunds caused the taxpayers to

pay more than their minimum proper federal income tax liabilities based on

the underlying transactions for the years in question. In this case, however,

the CPA firm's error altered the underlying entity status of Fund. Fund

incurred the minimum proper federal income liability as a subchapter C

corporation during the period it did not qualify as a RIC. The CPA firm's

reimbursement, unlike the reimbursements in Clark and Rev. Rul. 57-47,

was not made to compensate Fund for a tax liability in excess of Fund's

proper federal tax liability for the tax years relating to the firm's negligence.

Instead, the reimbursement was a payment of Fund's proper tax

liability.40 (emphasis added).

The distinction is difficult to understand and as Wood notes “difficult to apply.”41 These

later rulings have a number of significant flaws:

In the first place, the 1997 PLR conclusion that Clark paid more than his proper tax

glosses over the most critical, undisputed fact in the case. Clark’s irrevocable joint filing

status election that was so important to the IRS in 1939 is treated as if it was insignificant

in 1997. The IRS’ reasoning in 1997 implies that it collected an improper tax from Clark.

On the contrary, Clark paid the “proper” amount of tax computed for one filing a

joint tax return, a circumstance caused by his negligent tax practitioner. Both Clark and the

investment funds’ undesirable tax status was caused by their negligent tax practitioners.

The crux of both malpractice claims was that the practitioners’ negligence caused the

40

LTR 9743035.

41

Wood, p. 666, supra, n. 5.

13

taxpayers to incur additional “proper” tax that they otherwise would not have incurred.

Payment of more than their proper tax liability would have negated their malpractice

causation claims.

There is no indication in Rev. Ruling 57-47 that the taxpayer did not pay more than

the proper tax under the circumstances created by her negligent tax practitioner.

That the malpractice recovery “was not made to compensate Fund for a tax liability

in excess of Fund's proper federal tax liability” contradicts the factual description of the

PLRs and ignores the measure of damages used, “The reimbursement restored Fund to the

position it was in before the loss was incurred . . .”42

Whether this blatant misinterpretation of the basis of the parties’ settlement would

survive widespread objective judicial scrutiny seems unlikely. At least one court has

rejected the IRS’ “current view” in a non-malpractice context, Centex Corp. v. U.S., 55

Fed. Cl. 381, 389 (2003), aff'd 395 F.3d 1283 (Fed. Cir. 2005): “The judgment is not a

replacement of lost income. Instead, plaintiffs are receiving monies already subject to tax

once before.”

Centex at bottom involves a situation where a taxpayer paid the

correct amount of tax and then later received an

indemnification payment for a portion of that tax, and it was

the Government that argued for the application of Clark (to

successfully avoid plaintiff’s gross-up damages claim for

additional taxes). This certainly seems inconsistent with the

position the IRS has taken in its post-1991 letter rulings. Of

course, it is unclear whether the Department of Justice

consulted the IRS before advancing its Clark argument. 43

42

LTR 9211015.

43

Richard A. Wolfe, Tax Indemnity Insurance: A Valuable and Evolving Tool For Managing Tax Risks, pp.

32-33, The Tax Club, 2003.

14

The 1997 PLRs unequivocally ignore the principled reasons given in the 1992

PLRs:

A. If reimbursement is a replacement of capital, it is not includible in gross

income.

B. Payment by the one causing a loss that does no more than restore a taxpayer

to the position he or she was in before the loss was incurred is not includible

in gross income because there is no economic gain.

C. But for the preparer's error, the taxpayer would not have incurred the losses

for which it received reimbursement.

Finally, the emphasized 1997 language that the reimbursement was a tax payment is

directly contrary to the Clark interpretation.44

If LTR 9743034-35 were isolated rulings, perhaps they could be explained as

arising from a unique situation involving tax practitioners’ failures to ensure their client’s

underlying transactions complied with tax law. Instead, the uncertainty raised by 974303435 is exacerbated by two other malpractice PLRs and a Nondocketed Service Advice

Review (“NSAR”) which also followed the “proper” tax concept.45 The IRS again

concluded that these taxpayers, unlike Clark, did not pay more than their minimum proper

federal income tax liability. The “proper” tax PLRs and NSAR do not adequately explain

how the reimbursement was not a return of capital or how they differed from earlier,

40 BTA at 335 (Clark “paid his own taxes.”) But see Zelenak, 46 Tax L. Rev. at 383, supra, n. 8 (“By

itself, this is an absurd basis for distinguishing Old Colony. It suggests that the president of Old Colony

would not have been taxed if he initially had paid his own taxes on his salary, and his employer then had

reimbursed him for those taxes, despite the fact that the economic substance of that arrangement is identical

to the arrangement the Supreme Court held taxable in Old Colony.”) See Old Colony Trust Co. v.

Commissioner, 279 U.S. 716 (1929).

44

45

See LTR 9728052, LTR 9833007.

15

nontaxable settlements in Clark and Rev. Ruling 57-47. None of the later rulings provide

an adequate reason for distinguishing between (1) errors in filing returns or claiming

refunds which caused taxpayers to pay more than their minimum proper federal income tax

liabilities based on the underlying transactions and (2) errors which alter the taxpayer’s

underlying tax entity status. Nor is any explanation provided to distinguish “proper” from

“improper” tax liability.

In LTR 9728052, Doc 97-20252, 97 TNT 134-27, a defective alimony agreement to

pay the taxpayer’s ex-spouse’s estate disqualified an alimony deduction.46 The negligent

lawyer reimbursed the taxpayer for the extra taxes incurred as a result of the defective

agreement. The IRS ruled that the reimbursement was income to the taxpayer even though

it was compensation for negligence that cost the taxpayer readily avoidable taxes, just as in

Clark, was not derived from his capital or labor and (as the Clark and Concorde courts had

ruled) did not result in economic gain.47 The IRS’ stated reason for the distinction was that

the negligence “related to the underlying transaction, that is, the terms of the Agreement.”

LTR 9833007, Doc 98-25747, 98 TNT 158-12, involved a lottery winner whose tax

practitioner failed to advise the client as to certain deductions. This omission resulted in

more tax than otherwise would have been owed. The practitioner’s malpractice carrier

reimbursed the client for the additional taxes. Again, the IRS failed to follow Clark,

Kahn’s conclusion (Kahn, p. 51, supra, n. 8) that the amount of the damage in PLR 9728052 would be

“difficult, if not impossible,” to ascertain appears exaggerated. The calculation of such alimony provisions

typically includes a premium for the recipient’s tax at a lower tax rate than the payor’s anticipated rate.

Expert testimony would be expected, and would likely be contested, but proving such damages should not

have been significantly more difficult than in the lottery or RIC malpractice PLRs. Kahn is certainly correct

that (A) any unpaid alimony premium should have reduced the damages and (B) since the proof was

sufficient to justify an arms length settlement, the challenge of proving the taxpayer’s damages was overcome

and should have been no reason for the IRS to tax the reimbursement.

46

“This principle should apply with respect to errors in any type of agreement (not just divorce agreements)

that result in additional taxes, interest and penalties for which the taxpayer is indemnified. Under the ruling,

all such indemnification payments would be gross income to the taxpayer receiving them.” Federal Tax

Coordinator, Second Edition, J-5800, see language following reference to FN39.1.

47

16

Concorde and Rev. Ruling 57-47 and employed the questionable reasoning that additional

federal taxes were not caused by an error on the return itself. Instead, the negligence was

the failure to provide competent advice that would have reduced the tax liability. The

Service ignored that the Clark malpractice also involved negligent advice.48 Again, the

Service’s excuse was that unlike Clark, this taxpayer supposedly did not pay more than his

minimum proper tax.

Wood’s analysis of the IRS’s position post-Clark is that,

(T)he view that legal malpractice is nontaxable as a recovery of capital

appears to be quite narrow. At least one reading of the ‘‘authority’’

following Clark (bearing in mind that private letter rulings do not

constitute authority) is that it is limited to indemnification for negligent

tax advice. I believe that reading is too narrow.49

Still, the rulings say what they say, and extend tax relief only when

the claimant paid more than his ‘‘proper’’ minimum federal income tax

liability, and when the nature of the indemnification is related to the

underlying claim. When the IRS has declined to follow Clark, its

determination was based on the underlying nature of the transaction

giving rise to the discrepancy.50

What is an “improper” tax? Presumably, the IRS meant that the taxes in Clark and

Rev. Ruling 57-47 would not have been owed under the substance of the underlying facts,

i.e., if the form errors caused by negligence are disregarded. This is hardly a useful or

satisfying definition. Since all of the excess taxes involved were caused by negligence of

tax practitioners, that cannot be the distinguishing feature of an “improper” tax. Since none

of the errors could have been corrected by an amended return if the errors had been caught

48

40 BTA at 333.

49

The view on advice became even narrower in 2001 NSAR, infra, p. 23.

50

Wood, p. 667, supra, n. 8.

17

before expiration of the IRS statute of limitations, that misfortune cannot be the

distinguishing feature of an “improper” tax either.

The only malpractice situation in which the “proper tax” concept makes sense to

this writer is if the errant practitioner had promised “pie-in-the-sky” tax results for which a

taxpayer somehow obtained recovery of compensatory damages.51 The difference between

the higher proper tax and the improperly promised lower tax in such a situation would be

an accretion of wealth.52

This paper submits that the IRS’ “proper” tax concept should not be applied to a

malpractice case in which the tax exceeds what it should have been absent the malpractice,

regardless of the nature of the malpractice. Aside from causing the taxpayer’s loss, the

nature of the practitioner’s conduct is irrelevant to whether the reimbursement for

additional taxes is an accretion of wealth. No IRS pronouncement has articulated why the

nature of the malpractice is relevant beyond stating ipso facto that some malpractice is

distinguishable.

The following discussion demonstrates how the IRS adopted Professor Lawrence

Zelenak’s “proper” tax concept from his analysis of tax indemnity agreements.

A tax indemnity agreement is a guarantee of the tax treatment that a

taxpayer will have in a transaction and an agreement to indemnify the

taxpayer for any additional taxes incurred if the actual tax treatment is

different from the one that was promised.”53

This would not be consistent with the requirement that malpractice cause the excess tax. See Zelenak’s

example involving reimbursement for promised tax benefits which demonstrates that such a taxpayer suffered

no loss as had Clark, p. 397, supra, n. 8.

51

52

Zelenak, p. 397, supra, n. 8.

Kahn, p. 52, supra, n. 8. Also see Richard A. Wolfe, p. 22, supra, n. 42 (“Insurers that issue TIIPs actually

strengthen the integrity of our tax system . . . if a company is contemplating pursuing a particular tax plan,

and the CFO of the company tries to obtain a TIIP but cannot do so because the plan is too aggressive, the

company may be deterred from pursuing the plan . . . The recently issued tax shelter disclosure regulations

under section 6011 indicate the IRS recognizes that TIIPs do not help facilitate tax shelters . . . the TIIP

53

18

Despite Zelenak’s careful distinction between asset sale tax indemnity agreements

and malpractice,54 the IRS misapplied the “proper” tax concept to tax malpractice cases

involving actual losses. In other words, the IRS hijacked the “proper” tax argument that

was asserted solely against its rulings on the tax indemnity agreement cases and misused it

as a vehicle to tax a variety of distinguishable malpractice recoveries. The IRS’ assertion

of this argument out of its intended context violates the origin of the claim doctrine and the

accretion concept of income. By definition, ignoring such fundamental principles leads to

“unprincipled”55 result-oriented reasoning.

Anthony E. Rebollo agrees that “the reasons given by the Service for 'changing

directions' sound similar to” Zelenak’s analysis.56

Zelenak's law review article distinguished the fact patterns in the two

(indemnity agreement) letter rulings from the facts in Clark as

follows. In the letter rulings, the 'nontax facts' of the underlying

transactions dictated that the tax paid by the taxpayers was 'only the

correct tax, in the sense that they could not have paid any less tax

based on the underlying facts as they actually existed.' The Clarks,

on the other hand, 'could have paid less tax without any change in

the nontax facts of their situation, if their preparer had simply made

a different tax election.'57

underwriting process provides an informed assessment of complex tax risks by a sophisticated, neutral third

party -- a party with a strong economic incentive to confirm that the tax risk being insured conforms to the tax

laws.”

Zelenak, p. 399, supra, n. 8 (“By contrast, the payment from the negligent return preparer in Clark was

not in connection with an asset sale, so that treating that payment as nontaxable did not have the effect of

creating a form of tax-favored investment income not authorized by statute.

54

55

See Joseph M. Dodge, The Netting Of Costs Against Income Receipts (Including Damage Recoveries)

Produced By Such Costs, Without Barring Congress From Disallowing Such Costs, 27 Va. Tax Rev. 297,

313 (Fall 2007)

Rebollo, p. 358, n. 7 and 17, supra, n. 8, “See Letter Rulings, 'IRS Makes Clear Which Tax Indemnity

Payments are Taxable,' ('In separating itself from the prior authority that called for excluding the indemnity

amounts from income, it seems apparent that the Service has read articles such as Zelenak, 'The Taxation of

Indemnity Payments: Recovery of Capital and the Contours of Gross Income,' 46 Tax L. Rev. 381 (1991)').

56

57

Rebollo, p. 359, supra, n. 8.

19

Professor Rebollo is correct that, as applied to malpractice cases, the “proper” tax

argument ignores that the taxpayers could have paid less taxes but for the nontax facts

caused by the malpractice. Rebollo’s “problem with sorting out 'tax facts' from 'nontax

facts,' is that it will depend on one's perspective and how those terms are defined. But if the

propriety of a gross-up (i.e., recovery of the tax) turns on whether the claimant would have

been required to pay the underlying taxes in any event, then the amounts comprising the

indemnity payment may not constitute actionable damages in the first place.”58 Another

way of putting this is that the IRS’ stated reasoning for taxing these malpractice settlements

is oblivious to the tort requirement of proximate cause.

Professor Rebollo is also correct that the definition of “nontax facts” is unclear.

Presumably, he meant the non-malpractice-caused facts and non-indemnity-agreementinduced facts under which the taxpayers would owe the lowest possible tax.

Clark’s nontax facts were presumably that he was married and had capital losses.59

Clark could have properly paid less taxes based on these nontax facts. This is clear enough

until Zelenak adds that, “the tax liability determined on audit is the correct liability based

on the nontax facts.”60 Would not an audit of Clark have resulted in more liability than he

owed on the nontax facts, i.e., include tax caused by malpractice?

The nontax facts “as they actually existed” referred to by Zelenak with regard to

indemnity agreement letter PLR 8748072 were that the mortgage backed certificates did

not meet the requirements of IRC § 936 as represented.61 Similarly, the nontax fact in his

58

Id.

Zelenak, p. 397, supra, n. 8 (Clark “could have paid less tax without any change in the nontax facts of

their situation, if their preparer had simply made a different tax election”).

59

60

Id. fn. 81 of Zelenak’s article.

20

would-be-tax-favored-bond example were their failure to comply with IRC § 103.62 Why

noncompliance with the IRC is considered a “non-tax” fact is unclear but it is clear that the

taxpayers “could not have paid any less tax based on” these “nontax” facts.”63

The critical difference seems to be the actual cause of the tax that was reimbursed:

was the tax already owed or was the tax caused by malpractice?64

The “proper” tax malpractice PLRS and NSAR ignore this difference. The PLRs

do not mention nontax facts. The NSAR’s reference erroneously implies that Zelenak

advocated taxing malpractice recoveries:

He (Zelenak) concluded that if a taxpayer's tax liability, based on the

actual facts, was as low as legally possible, none of the tax he or she pays

should be classified as an “excess tax” which effectively invaded the

taxpayer's capital.65 Thus, any indemnification received as a result of

erroneous advice regarding the tax consequences of the transaction giving

rise to the liability could not constitute a return of capital.

The concept of nontax facts (i.e. facts not caused by the practitioner under which

the taxpayer owed the minimum tax) in them is also unclear because of the IRS’ chronic

mischaracterizations of causation.66 Presumably, the IRS would say such “nontax” facts

were the tax data of the alimony payer before alimony, the would-be RICs under

61

Zelenak, p. 398, supra, n. 8.

62

Id. p. 399.

63

Id.

64

“Non-malpractice facts” and “non-indemnity-agreement facts” would be more precise and useful terms.

This statement is a fair statement of Zelenak’s position on tax indemnity agreements but not on

malpractice.

65

E.g., 2001 IRS NSAR 0056: “in those PLRs the Service concluded the taxes the taxpayer was legally

obligated to pay were a consequence of the transaction he or she entered into, and not a result a result of any

mistake the tax advisor made.” In other words, the malpractice settlement was unfounded in the view of the

IRS.

66

21

subchapter C and the lottery winner and would be tax-free acquiring corporation with the

bad tax advice inflicted on them.67

While Zelenak’s article explains the difference between a “proper” tax and paying

more than a “proper” tax, the PLRs it spawned add no light as to why recovery for one is

deemed income and one is not in malpractice cases. The “nontax facts” of the PLRs did

not change the nature of the reimbursements to the taxpayers and could not logically

change the reimbursements into accretion of wealth.

Zelenak’s article concluded that while Clark “probably is correct,” tax indemnity

agreements “present issues not raised by Clark, and that extension of the Clark rationale to

such payments is not appropriate.”68 Zelenak’s article logically demonstrates how tax

indemnity agreement payments do not result in a loss. The IRS properly followed it in

revoking its indemnity agreement PLRs.69

However, the IRS’s implicit rejection of

Zelenak’s distinction between tax indemnity agreements and malpractice is the source of

the “proper” tax confusion under examination here.

The foundation of Zelenak’s argument is his reconciliation of Clark and Old

Colony Trust Co. v. Commissioner,70 in which an employer’s payment of its employee’s

67

2001 IRS NSAR 0056: (“if the facts developed in this case indicate that the recovery is being received on

account of erroneous tax advice indicating that the transaction in which *** acquire *** was nontaxable, we

believe the tax indemnification payment made on account of that erroneous advice will constitute taxable

income.”)

Zelenak, p. 382, 385, supra, n. 8 (The arguments against Clark are: “(1) that Clark is inconsistent with the

holding of Old Colony; (2) that allowing a tax-free recovery of a nondeductible loss is inconsistent with the

congressional decision that the loss should be non deductible; (3) that allowing a tax-free recovery of a

nondeductible loss results in inconsistent treatment of similarly situated taxpayers; and (4) that Clark is at

odds with fundamental principles of annual accounting in general, and with the Supreme Court's opinion in

Burnet v. Sanford & Brooks Co. (282 U.S. 359 (1931)) in particular. (Zelenak) concludes that none of these

arguments is persuasive and that the (Clark) case was decided correctly.” See Old Colony Trust Co. v.

Commissioner, 279 U.S. 716 (1929).

68

69

See PLRs 9226033, 9226032 and 9120014.

70

279 U.S. 716 (1929).

22

taxes was held to be income to the employee. Zelenak perceptively distinguished the two

cases based on the BTA’s finding of Clark’s loss.71 The cause of the excess tax is the

distinguishing feature:

What then justifies treating the taxes in Clark as a loss, even though it is clear from

Old Colony that payments of federal income tax ordinarily cannot be so treated?

The answer must be that the Board in Clark implicitly drew a distinction between

(1) taxes that were clearly and unavoidably owed given the taxpayer's economic

situation (such as taxes on salary), which cannot be characterized as a loss, and (2)

excess taxes that were not necessarily owed given the taxpayer's economic

situation, but were paid through a mistake of some sort, which can be characterized

as a loss because of the mistake.72

The 1997-98 “proper” tax PLRs ignore this crucial distinction in order to treat taxpayers in

the second (nontaxable) situation as if they were in the first (taxable) situation. Those

PLRs twist the following argument of Zelenak by making an opposite, even more

hypertechnical, form of it to argue that Clark paid more than the “proper” tax:

(O)ne could argue that in Clark there was no mistake and no excess tax, because

the Clarks in fact paid the proper amount of tax, given the election to file a joint

return. If one accepts the argument that the Clarks simply paid the proper amount

of tax, Clark becomes indistinguishable from Old Colony, and the recovery should

be taxable. That argument seems hypertechnical, however, given that the Clarks

could have paid a smaller amount of taxes based on exactly the same economic

facts, but for the ill-advised election which had no effect other than to increase

unnecessarily their tax liability.73

Although this implies that Clark paid more than tax than he should have; Zelenak’s

main point was that since the tax indemnity agreement recipients did not pay more than

their proper tax, they, unlike Clark, did not suffer a loss.74

71

40 B.T.A. at 333 (“to compensate him for a loss suffered on account of erroneous advice”).

72

Zelenak, p. 386, supra, n. 8.

73

Id.

74

Id. at 398.

23

As noted above, the IRS properly adopted the following Zelenak argument

supporting taxation of tax indemnity agreements: “If the taxpayer could not have paid any

less tax based on the actual nontax facts, there is no loss which can be recovered tax

free.”75 That seems like a perfectly valid and workable rule for both malpractice and tax

indemnity agreements. Unfortunately, the IRS misapplied it to malpractice cases by

mischaracterizing facts and ignoring the bases of the malpractice recoveries.

The lottery winner could have paid less tax had he been properly advised. The

alimony payer could have paid less taxes had his lawyer properly drafted his agreement.

The would-be RIC could have paid less tax had its CPA ensured it complied with

investment requirements. The IRS’ view of the factual bases of these malpractice

recoveries either fails to comprehend the fundamentals of tort compensation or deliberately

distorts the facts.

The IRS’ application of this “proper” tax concept out of its intended context

explains why the phrase “proper” tax makes so little sense in malpractice cases. In the

parlance of Daubert reliability of methodology, the IRS’ 1990s malpractice PLRs are

guilty of an analytical gap by utilizing an inapplicable, irrelevant principle and by ignoring

the fundamental accretion and return of capital principles of defining income. The

“proper” tax concept does not logically “fit” the malpractice cases to which it was applied.

The 2001 NSAR76 cited above by Rebollo confirms the IRS’ misapplication of

Zelenak’s tax reimbursement agreement “proper” tax concept to malpractice cases in a

75

Id. at 399.

2001 IRS NSAR 0056, 2001 WL 34056101. “In accordance with I.R.C. § 6110(k)(3), this Chief Counsel

Advice should not be cited as precedent.”

76

24

less than forthright manner. The NSAR held that taxable income includes malpractice

insurance reimbursement for claims that: (a) a tax advisor failed to advise of the correct

tax consequences of an attempted tax-free merger transaction that turned out not to be taxfree or (b) the advice provided regarding the tax consequences of the transaction was

incorrect. The taxpayer contended that the reimbursement should not be taxable income,

citing Rev. Rul. 57-47, 1957-1 C.B. 23; Concord Instruments Corp. v. Commissioner,

supra, and, Clark v. Commissioner, supra. The 2001 NSAR attempts to distinguish those

authorities based on the nature of the advice and the negligence:

(B)ad advice received by the taxpayer did not address how to structure a

transaction in order to minimize its tax consequences, but rather addressed

how to report the tax consequences of a transaction that was already

completed. That bad advice caused the relevant taxpayer to pay more tax

than he would legally have been required to pay, had he reported the

relevant transaction appropriately. And in Concord Instruments Corp.,

supra, the recovery was received in connection with a procedural mistake an

adviser made, and not as a result of mistaken substantive tax advice.

In the instant case, (the taxpayer) entered into a transaction whose tax

consequences were fixed, although possibly unexpected as a result of

erroneous tax advice that it apparently received.

The NSAR ignores that Clark’s joint return election was also irrevocably

fixed and that his loss was also a direct result of negligent advice.77 Again, this

attempted distinction is a non sequitur because the nature of the negligence does not

affect the nature of the reimbursement or transform it into income.

The 2001 NSAR cited Lawrence Zelenak’s article78 as “the leading analysis of the

tax consequences of receiving payments intended to indemnify a person for additional

77

40 BTA at 333.

78

The Taxation of Tax Indemnity Payments: Recovery of Capital and the Contours of Gross Income, 46 Tax

Law Review 381 (Spring 1991)

25

taxes incurred after the receipt of erroneous tax advice.” The NSAR revealed that Zelenak

“articulated the fundamental theory upon which the Service relied in a number of PLRs in

which it concluded that damages received for erroneous tax advice constituted income, i.e.,

that a tax indemnity payment should be considered to be income where the taxes that the

relevant taxpayer paid were the correct taxes due on the underlying transaction.”

The NSAR failed to disclose that the IRS’ “current view” of taxability of

malpractice recoveries was diametrically opposed to Zelenak’s conclusion as to the correct

result in malpractice cases, i.e., nontaxability:

Clearly there is a loss creating mistake if a taxpayer incorrectly calculates

his tax liability as being higher than it really is. It is universally agreed that a

refund resulting from such a mistake is not taxable. If no refund is

available because the statute of limitations has run, but the taxpayer

recovers an equivalent amount from his negligent return preparer, it is

equally clear that there has been a loss-creating mistake and that the

recovery is free of tax.79 (emphasis added)

Nowhere has the IRS acknowledged Zelenak’s explicit distinction between malpractice and

tax indemnity agreements: “there are crucial differences between the Clark situation and

the situations described in the (tax indemnity agreement) letter rulings . . . By contrast, the

payment from the negligent return preparer in Clark was not in connection with an asset

sale, so that treating that payment as nontaxable did not have the effect of creating a form

of tax-favored investment income not authorized by statute.”80

Immediately following the NSAR’s reference to a malpractice PLR, the NSAR

cited the tax indemnity agreement PLR 8748072 (that Zelenak distinguished from

malpractice) without noting Zelenak’s distinction between the two. The only similarity

79

Zelenak, p. 386, supra, n. 8.

80

Id., pp. 397, 399.

26

noted by the NSAR between the two cases was that they both involved additional taxes

caused by disqualifying asset holdings. The NSAR ignores Zelenak’s most fundamental

point, the critical difference that in the malpractice case, the reimbursement is for a true

loss while tax indemnity agreements do not involve a loss.

“To resolve whether two persons or circumstances are to be treated the same by the

tax law, it is necessary to determine whether the differences that exist are relevant for that

purpose.”81 The IRS has not demonstrated the purported relevance of the difference

between Clark’s negligent advice and return preparation and the advice in the PLR cases.

Note that the Service maintains that the exclusion of a

reimbursement depends on the nature of the bad advice. In Clark,

the exclusion was allowed when the advisor made an error in

advising his client and his wife to file a joint return rather than

separate returns. The Service distinguishes bad advice on a return

that causes the taxpayer to pay more than his minimum tax liability

from advice on a taxpayer’s underlying transactions that fails to

minimize the taxpayer’s liability. The Service has not allowed the

exclusion when the advisor’s error pertains to failure to advise a

client to take an action that would have resulted in lower federal

tax liability. See, e.g., P.L.R. 2003-28-033 (July 11, 2003).82

As further proof of its deficient analysis, the NSAR mischaracterizes PLR 9833007

as involving a “tax indemnity” case. 9833007 was actually a malpractice case not

involving a tax indemnity agreement, a type of case that Zelenak took pains to distinguish.

The 2001 NSAR seems like the result of the childhood “telephone” game where a

series of people whisper a message one to another to see how distorted the ultimate

message becomes. The NSAR writer could not have made a careful reading of Zelenak’s

81

Kahn, p. 94, n. 8, supra, n. 8.

82

Sophia Hudson, An Argument For Untidiness: Non-Parallel Treatment OF Exclusions and Deductions In

Federal Income Taxation, 32 Michigan Tax Lawyer, Fn. 5 at p. 35 – Winter 2006.

27

article and honestly concluded that Zelenak supported taxation of malpractice recovery.

Not that the IRS is bound by Zelenak’s opinions but in an age of increasing duties to “the

system,” intellectual honesty would indicate acknowledging a source’s primary distinction,

contrary conclusion and recognition of the difference in economic substance of the two

situations. The IRS’ failure to do so has resulted in its inconsistent application of the law

and unnecessary confusion.

Another indication of the IRS’ disregard of the substance of the underlying

transactions is that the NSAR perpetuates the errant PLRs’ decidedly different view of

proximate causation than did the taxpayers in the PLR malpractice cases. The basis for one

of the malpractice settlements was initially described as follows:

A is now negotiating with his attorney's malpractice insurer for an

indemnification payment. This payment will recompense A for the

additional federal income taxes . . .83

Compare that initial description with the IRS’ “current view”:

(T)he taxes the taxpayer was legally obligated to pay were a consequence of

the transaction he or she entered into, and not a result a result of any mistake

the tax advisor made.84

No court could legitimately award additional taxes as malpractice damages if this

were its finding. In effect, the IRS has indicated that it will reject the courts’ and parties’

arms length, objective conclusions that the malpractice caused the excess taxes and

substitute its own inaccurate and uninformed conclusion as to causation.

The “proper” tax rulings do not clarify the supposed significance of the distinctions

among different types of negligent advice and negligent return preparation. Nor do they

83

LTR 9728052.

84

2001 IRS NSAR 0056, 2001 WL 34056101. Also see PLR 9743035 and PLR 9833007.

28

explain why compensation for a loss caused by negligent advice may be income but

compensation for a loss caused by negligent return preparation is not income. If this

distinction continues as standard IRS practice, malpractice plaintiffs’ counsel would be

expected to frame their complaints as negligent return preparation whenever possible and

avoid pleading negligent advice as to prospective transactions.85 It is hard not to see the

“advice” distinction as unfair, arbitrary, and artificial.

Rebollo points out that plaintiffs in tax malpractice cases seeking to recover

damages for additional tax should be expected to rely on this “series of private letter

rulings issued in the 1990s, where the IRS 'changed directions,' ultimately concluding that

certain tax-based recoveries would be subject to tax, which arguably would support

requests for gross-ups” i.e., to award additional taxes caused by the malpractice.86

There are potentially serious administrative difficulties with the IRS and tax courts

second guessing and re-litigating parties’ and courts’ handling of what are often complex

underlying malpractice cases. A prime example is the “proper” tax PLRs’ chronic

mischaracterization of the reasons for the malpractice settlements. In addition, plaintiffs in

malpractice cases generally have to prove they would have prevailed in the underlying

“case within” the malpractice case to prove proximate causation. These practical

difficulties and judicial and administrative economy favor not having to (A) retry the

underlying cases or (B) rely on artfully selective drafting of underlying pleadings and

agreements to determine taxability. A better administrative rule would be to limit

application of the “proper” tax concept to taxing recoveries for asset sale tax indemnity

“(A) creatively and properly worded complaint can affect whether the amount received is determined to be

excludable from gross income.” Wood, p. 671 supra, n. 5, citing Getty v. Commissioner, 913 F.2d 1486 (9th

Cir. 1990).

85

86

Rebollo, at 356, supra, n. 8.

29

agreements, and sale of tax benefits and pie-in-the-sky misrepresentation cases. Taxpayers

whose tax is “exactly what it should have been,” based on the substantive facts of their

situation did not suffer a loss.87

(A) sham transaction cannot turn the tax on unrelated income into a

loss, so as to exempt the reimbursement of that tax from Old Colony

doctrine. If it could, the integrity of Old Colony would be at the

mercy of every sham transaction and every abusive tax shelter. If the

payment of the taxes one properly owes can be characterized as a

loss-thus making the recovery of that payment tax free-because one

might have reduced one's tax liability by making a legitimate tax

shelter investment, then the Supreme Court might as well overrule

Old Colony.88

The “proper minimum tax” PLRs and NCAR ignore the central reasoning in Clark

and Rev. Ruling 57-57, that reimbursement was for the taxpayers’ lost capital based on the

accountant’s error89 and the origin of claim doctrine. They also ignore the reality of the

losses incurred by the taxpayers.

“(I)t is difficult to see why Clark is distinguishable from the PLR cases where the

underlying tax-based damages could have been avoided or eliminated if proper advice had

been given.”90 In fact, since Clark was based in part on negligent advice,91 they are not

logically distinguishable. It is hard to see a difference, from the taxpayer’s perspective,

between bad advice to file a joint tax return and bad advice that alimony would be

deductible. In both situations, the practitioners’ mistakes cost the taxpayers additional tax

87

Zelenak, p. 402, supra, n. 8.

88

Id., p. 402, where Zelenak also explains why recipients of tax indemnity agreements should be allowed to

reduce their gain by their basis.

89

Kahn, p. 48, supra, n. 8.

90

Rebollo, p. 359, supra, n. 8.

91

40 B.T.A. at 333

30

that they would not have owed had the advice been competent. The taxpayers in the 199798 PLRs experienced no more accretion of income than Clark yet were taxed on their

recovery. Clark was made whole while the other taxpayers were not. The rulings do not

explain why these similarly situated taxpayers should be treated differently. The rulings

violate the policy principle of horizontal equity, that like-situated taxpayers should be taxed

the same, without any justification. The rulings also ignore the prevailing net accretion

definition of income92 and the Schanz-Haig-Simons concept of income as encompassing

“the change in the value of the store of property rights.”93 The rulings fail to adequately

articulate any “difference principle” or way of telling whether such taxpayers are alike or

different, and, if different, by what degree they are different.

Why shouldn’t all taxpayers forced to incur additional taxes because of their tax

practitioners’ fault, be allowed to exclude compensation for such loss from their taxable

income? Why should the difference in tax treatment be based on something largely out of

the taxpayer’s control such as the nature of the practitioner’s negligence, whether it is in

filling out a form, selection of language to use in an alimony agreement or advice on tax

planning? What does the fact that the practitioner’s negligence “related to the underlying

transaction and the terms of the agreement” have to do with whether the taxpayer enjoyed

an increase or accretion of wealth between the time that the unexpected tax was incurred

and when the taxpayer received compensation?

Zelenak offers a policy reason as to why tax indemnity agreement reimbursements

should be taxable: “it permits private parties to manufacture a ‘loss’ out of nothing, with

92

Jos.T. Sneed, The Criteria of Federal Income Tax Policy, p. 579 and note 45, Cf. Musgrave, The Theory of

Public Finance (1959) note 27, at 165.

93

Henry Simons, Personal Income Taxation (1938).

31

no regard to the actual nature of the asset in question, through the simple means of a

misrepresentation by the seller.” It is conceivable that such a conspiracy could occur in

the context of a property transaction in which the parties were cooperative enough to plan

a tax avoidance scheme but Zelenak concedes that it is hard to see such a risk occurring in

malpractice cases: “By contrast, the payment from the negligent return preparer in Clark

was not in connection with an asset sale, so that treating that payment as nontaxable did

not have the effect of creating a form of tax-favored investment income not authorized by

statute.”94

Kahn argues that the IRS should respect the amount of malpractice settlements

since the taxpayers and the malpractice carriers negotiate them at arms length, 95 i.e. the

carrier’s lack of incentive to overpay is indicia of reliability.96

There is no risk of collusion in this circumstance, and the bona fides

of such an agreement are beyond question, since the insurer has no

extrinsic motives (such as silencing the bad publicity that a dispute

would bring to the attorney) for settling the issue. Even if the

payment were made directly by the attorney, the possibility of

collusion or ulterior motive is not significant enough to change the

tax result.97

A Return To Clark?

94

Zelenak, p. 399, supra, n. 8.

95

Kahn, p. 48, supra, n. 8.

96

Also see Leandra Lederman, Statutory Speed Bumps: The Roles Third Parties Play In Tax Compliance, 60

Stan. L. Rev. 695, *695-96 (Dec. 2007)(“by harnessing the structural incentives of third parties . . . the

government can afford to free ride on the incentives of a third party in contexts in which the transfer of funds

from the third party to the taxpayer is a zero-sum game” i.e. where the third party has no incentive to collude

with the taxpayer.)

97

Kahn, p. 52, supra, n. 8.

32

The new millennium, and possibly the negative publicity concerning the IRS in the

1990s,98 resulted in an analogous pro-taxpayer private letter ruling. In LTR 200328033,

Doc 2003-16433, 2003 TNT 134-9, quoted above, the IRS ruled that a settlement was not

taxable when the taxpayer’s former employer’s error resulted in nontaxable disability

benefits being taxed. The IRS recognized and applied the Clark rule that the tax indemnity

payment the taxpayer received was compensation for the loss of capital suffered by

payment of taxes and indistinguishable from the reimbursement received by the taxpayer in

Clark. Without elaborating on the enigmatic “proper” tax, the IRS determined that the

taxpayer did not pay “more than his minimum proper federal tax.” Time will tell whether

this return to the principled reasoning of Clark and Rev. Ruling 57-47 is an aberration or

the IRS’ ultimate position.

IV.

If Tax Malpractice Recoveries Are Income, How Are They Taxed?

The origin of claim doctrine should determine the treatment, but again, the IRS

private letter rulings’ disregard of the return-of-capital and origin of claim doctrines raise

considerable uncertainty.

Tax malpractice claims typically include negligence, negligent misrepresentation,

breach of contract, breach of fiduciary duty and fraud. “There has been a good deal of

controversy over the tax treatment of fraud, misrepresentation and breach of fiduciary duty

claims.”99 Courts have generally treated recovery in fraud and breach of fiduciary cases as

98

E.g., October 13, 1997, The Washington Times, IRS Fights To Keep Up Morale Under Torrent Of Bad

Publicity, Senate hearings “featured tearful taxpayers testifying about IRS abuse, with the horror stories

confirmed by disguised IRS agents.”; Los Angeles Times, March 25, 1995 headline, ”Taxing Times: IRS

Reputedly Inefficient, Reckless, Spiteful Bureaucracy.”

99

Wood, The Bottom Line: Tax Issues In Employment Cases, 2005 p. 11.

33

ordinary income.100 Wood argues that such recoveries “may be capital gain, or even may

be a non-taxable return basis.”101

What if the malpractice caused the taxpayer to liquidate assets to pay the taxes and

penalties? “(I)n order to avoid a lost profits determination (with its ordinary income

consequences), it will be necessary to prove that the injury was related to a capital asset

and that the taxpayer had basis in that asset.”102

The basic direct or "core" damages for tax malpractice103 “typically involve four

types of injuries: additional taxes, interest paid the taxing authority, penalties104 and

corrective costs. Three different views have developed concerning the recoverability of

interest.105 The other core damages are normally recoverable.”106

100

Id. citing Griffiths v. Helvering, 308 U.S. 355 (1939) and Arcadia Refining Co. v. Commissioner, 118

F.2d 1010 (5th Cir. 1941).

Id. citing Dobson v. Commissioner, 320 U.S. 489 (1943), reh’g denied, 321 U.S. 231 (1944). “In Dobson,

the Supreme Court held that a taxpayer realized no income on recovering damages in settlement of a fraud

action against a seller of securities. The taxpayer had sold the securities at a loss, but realized no tax benefit

(owing to no taxable income). When he received a settlement, it was a recovery of his original investment.”

Also see Boehm v. Commissioner, 146 F.2d 553 (2d Cir. 1945), aff’d on other grounds, 326 U.S. 287 (1945)

(where a taxpayer sued because his stock had become worthless, this was deemed a recovery of capital (or his

original investment)).

101

102

Wood, The Bottom Line: Tax Issues In Employment Cases, 2005 p. 12 citing Biocraft Laboratories, Inc.

v. Commissioner, T.C. Memo 1980-268 (1980). See also H. Doud v. Commissioner, T.C. Memo 1982-156

(1982).

103

Todres, p. 10, supra, n. 5.

Id. at 39. “If the injured taxpayer is to be made whole, such penalties need to be recovered. . . . Unlike the

situation with interest imposed on an injured taxpayer where the taxpayer has had the benefit of having

money not belonging to him for a period of time . . . the incurrence of a penalty is simply damages flowing

directly from the tax advisor’s negligence, and the recovery of such amounts is not controversial.”

104

Id. at 11. “one approach (‘probably the majority view’ p. 27) permits the recovery of such interest from

the defendant, one approach denies any recovery of such interest (to prevent a windfall or because it is

speculative) and a third approach stands in between these two extremes and permits recovery of some

interest, but only to the extent the interest paid by the plaintiff to the government exceeds the interest earned

by the plaintiff on the tax underpayment.” Id. at 27 et. seq. for detailed discussion. See Streber v. Hunter,

221 F. 3d 701 (5th Cir. [Tex.] 2000) for application of third, net “interest differential” approach.

105

34

There should be no recovery for taxes that the taxpayer would have owed regardless

of the malpractice.

Although Zelenak makes a cogent argument that proceeds from tax indemnity

agreements should be “fully taxable,”107 his two references to allowing credit for the

taxpayer’s basis108 leave it unclear whether his preferred treatment is to tax them as

ordinary income (as he apparently persuaded the IRS to do), or as the IRS originally treated

them, a return of capital. This writer’s interpretation and recommendation is that they be

treated as a return of capital but that that the recipient only be allowed to offset as basis the

cost of the indemnity agreement, or the fee to the tax shelter promoter, and not any taxes

that she hoped to avoid.

V.

Can Clients Recover the Extra Tax (“Gross-Up”

Damages) Caused By Tax Malpractice?

If malpractice recovery is includible in the gross income of the plaintiff, should the

amount of the claim be increased (“grossed-up”) to offset the tax? Wood’s 2007 articles109

on this remedies question describe the uncertainty of the answer as “maddening.” He

discerns that the “current trend of case law suggests that tax gross-up claims and discount

requests (from damage awards for tax benefits conferred) are more favored today than they

were in the past” but that courts are “usually unsympathetic to such claims.”110 Todres

106

Id.

107

Zelenak, p. 398, supra, n. 8.

Id., pp. 400 (treating the “the payment as an adjustment of the purchase price . . . would be recovery of

capital treatment, but not in the same sense as Clark. Here, the recovered capital would be part of the cost of

the investment, not amounts paid in tax . . . ) and 402, where he recommends that the recipient be allowed to

recover his basis paid for the contract, but not for any tax he paid.

108

109

Taxes As an Element of Damages, 29 Civil Litigation Rptr. 177, Oct. 2007 and Damages for Tax

Consequences, Tax Notes 475, Aug. 2007.

110

29 Civil Litigation Rptr. at 178.

35

reports that “most states allow recovery of the additional taxes caused by the malpractice,”111

but he also concludes that “whether the basic damage award should be grossed-up so that an

injured plaintiff should be made whole on an after-tax basis” is one of the “most salient”

unresolved tax malpractice issues.112

Which of these accomplished writers’ seemingly divergent conclusions is more

accurate? Does the divergence mean that allowing recovery of additional taxes caused by

malpractice113 is a separate issue than the mathematical “gross-up” methodology used to